EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Tax Alert 2025 No. 04, 22 January 2025

The Canada Border Services Agency (CBSA) released the January 2025 update of its trade compliance verification priorities list, emphasizing continued efforts to ensure proper compliance with Canadian trade laws.1

The CBSA continues to focus on tariff classification, valuation and origin as key areas of compliance verification, with new product categories and compliance strategies introduced in this update.

Background

To maintain trade compliance, the CBSA requires importers to:

- Classify commercial goods under the appropriate tariff classification;

- Accurately declare the origin and value of goods; and

- Pay the appropriate duties and taxes on imported goods.

The CBSA conducts trade compliance verifications to assess adherence to customs legislation and ensure accurate reporting.

Verification and compliance priorities

The CBSA uses a risk-based, evergreen process to determine verification priorities, introducing new targets throughout the year while retaining some from previous cycles.

New compliance priorities (January 2025)

The CBSA has identified new compliance priorities including:

- Tariff rate quota and classification of frozen desserts containing 5% dairy;

- Tariff classification of gloves (Round 3);

- GST and excise duties on vaping products and exemption codes;

- Origin verifications under the Canada-European Union Comprehensive Economic and Trade Agreement and the Canada-United Kingdom Trade Continuity Agreement;

- Duties Relief Program verifications; and

- China Surtax Orders for electric vehicles and steel products.

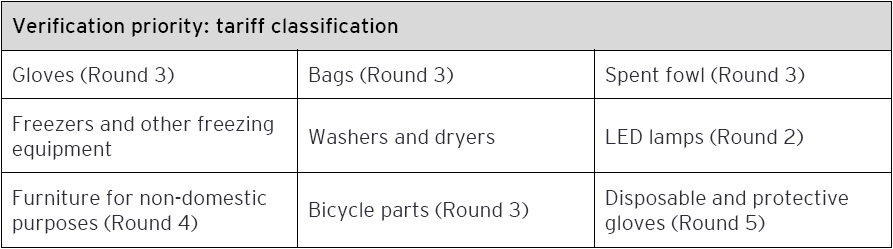

Verification priority: tariff classification

Verification priority: valuation

- Apparel, Round 4 (Harmonized System Number(s): Chapters 61 and 62)

- The CBSA has identified a risk that importers of apparel may not be in compliance with valuation requirements under the Customs Act.

Verification priority: origin

- Bedding and drapery, Round 3 (Harmonized System Number(s): Headings 63.01, 63.02 and 63.03)

- The CBSA has identified a risk that bedding and drapery imports made in Canada-United States-Mexico Agreement (CUSMA) countries do not qualify for CUSMA preferential tariff treatment due to non-qualifying inputs used in the production of the imported goods.

Compliance tools used by the CBSA

The CBSA may also use the following instruments to administer and enforce compliance with the Customs Act:

- The CBSA Assessment Revenue Management (CARM) system, which is used to validate duties and taxes while addressing non-compliance.

- Three compliance intervention tools, as described below, offer a more efficient, targeted approach for specific import transactions compared to traditional verifications and promote voluntary compliance.

- Trade advisory notices (TAN): Notices prompting importers to review declarations for potential non-compliance; no monetary assessment is issued as a result of a TAN.

- Compliance validation letters (CVL): Letters requesting further information where non-compliance is suspected.

- Directed compliance letters (DCL): Formal notifications of non-compliance with monetary assessments.

Most-Favoured-Nation (MFN) tariff withdrawal for Russia and Belarus

Effective 2 March 2022, Canada withdrew the MFN tariff treatment from goods originating in Russia and Belarus. These goods are now subject to a General Tariff rate of 35%.

The list of goods being monitored and risk-assessed includes, but is not limited to:

- Products of iron or steel;

- Fertilizer;

- Petroleum;

- Non-ferrous metals; and

- Tires.

These goods must be accounted for under the General Tariff rate of 35% unless in transit on or before 2 March 2022.

Takeaways for importers

Importers should ensure proactive compliance strategies are in place, including proper documentation and ongoing review of classification, valuation and origin data.

CBSA verifications can be time-consuming and costly for importers. Companies must be proactive and adopt an informed compliance mindset. Best practices for companies include implementing programs, frameworks and methodologies to help maintain and continuously improve their customs and trade compliance management profile.

Learn more

For more information, please contact one of the following EY Global Trade professionals:

EY Global Trade

Sylvain Golsse, Partner

+1 416 932 5165 | sylvain.golsse@ca.ey.com

Kristian Kot

+1 250 294 8384 | kristian.kot@ca.ey.com

Joanna Liang

+1 416 943 5512 | joanna.liang1@ca.ey.com

Denis Chrissikos

+1 514 879 8153 | denis.chrissikos@ca.ey.com

EY Law LLP

Helen Byon, Partner

+1 613 598 0418 | helen.byon@ca.ey.com

_______________

- Trade compliance verification (cbsa-asfc.gc.ca).

Download this tax alert

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.