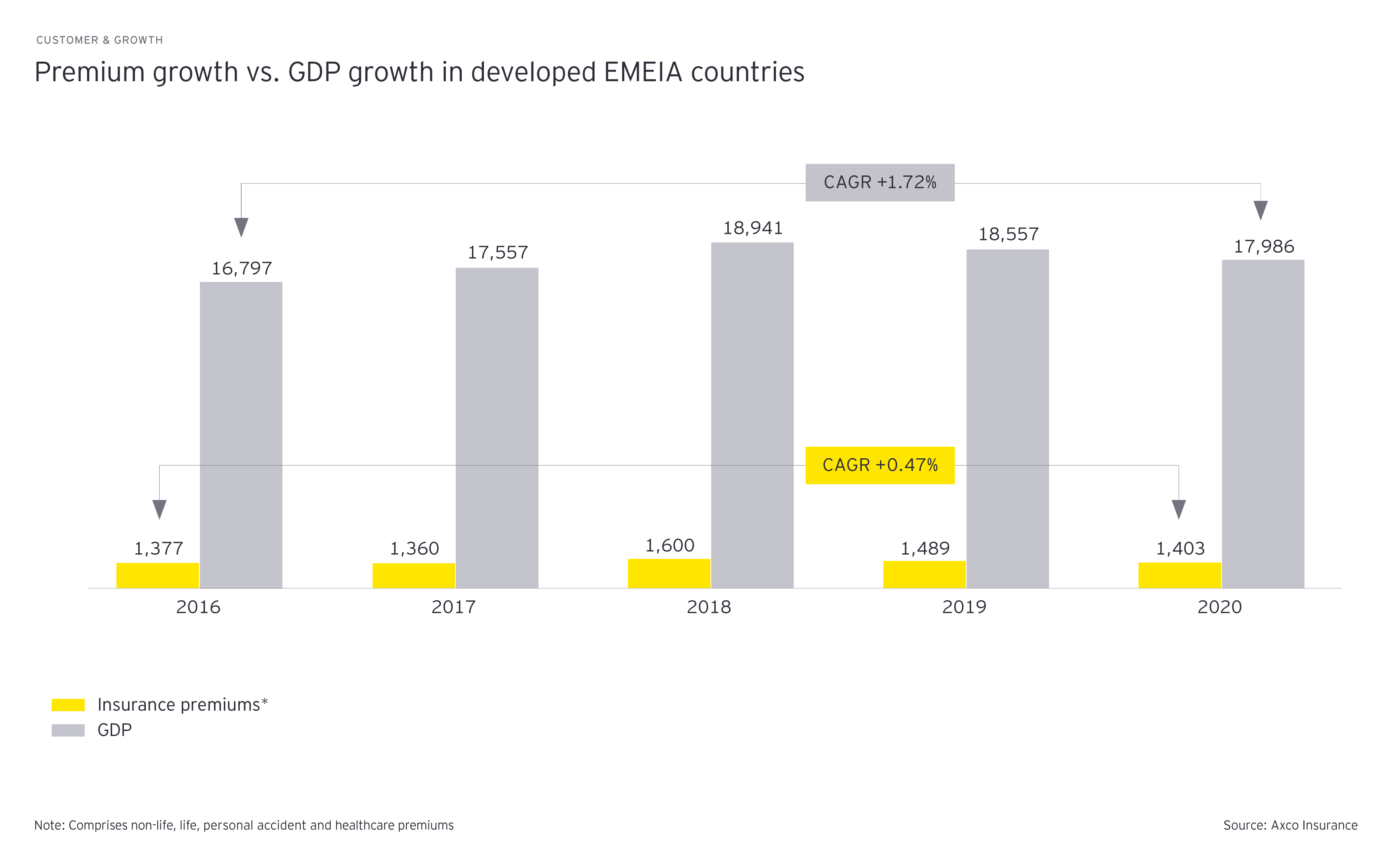

In fact, the insurance market is performing clearly below GDP growth in developed EMEIA countries, bringing to light an underserved potential. Insurers need to reimagine their business models and become truly customer-centric if they are to achieve profitable growth in the future.

Customer-centric business models

In a first step, insurers should challenge what they mean by customer-centricity. Contrary to traditionally held beliefs, it’s not about owning the customer relationship but about solving problems for customers with the highest level of convenience, with or without being seen. We propose four customer-centric business models that enable insurers to play to their own strengths and harness individual core competences to best serve the customer. Each business model comes with specific challenges, as summarized in the descriptions below:

The right approach will depend on the core competences of the specific insurer. Some players may also pursue multiple business models simultaneously for different lines of business, customer segments or other areas. At the heart of this concept is the idea of customer-centricity: putting customer needs, not visibility, first.

Transformation journey

As the transformation process involves considerable realignment, organizations may take sideways steps through the business models before reaching their preferred customer-centric approach, e.g., from collaborator to integrator or orchestrator. Incremental change is also helpful for insurers feeling overwhelmed by the scale of change needed to realign the business model and move toward customer-centricity. Breaking the journey into the individual steps described below can make it more manageable and allow small shifts to grow into sustainable transformation.

1. Plan the planting

To choose the right business model for an individual insurer, the company needs to understand its true core competences and take on a role that is most closely associated with it.

2. Prepare the soil

Before starting the transformation process, business areas that do not support the identified business model need to be divested.

3. Sow the seed

Released resources should be invested in dedicated ventures/areas to increase the probability of success and speed up the transformation process.

4. Grow the crop

As soon as first areas reach the harvest zone, achieved profits can be reinvested in the overall transformation.

5. Reap the harvest, and repeat

Transformation is not a one-off journey, but a continuous process. The more iterations, the better the harvest.

Summary

We believe the insurance industry is well placed to achieve profitable growth in the future. To realize the potential, insurers need to start now to take a longer-term view of their business and reimagine customer-centricity as the first step in a sustainable transformation.

We thank Tobias Binkert and Doina Emilian for their valuable contribution to this article.