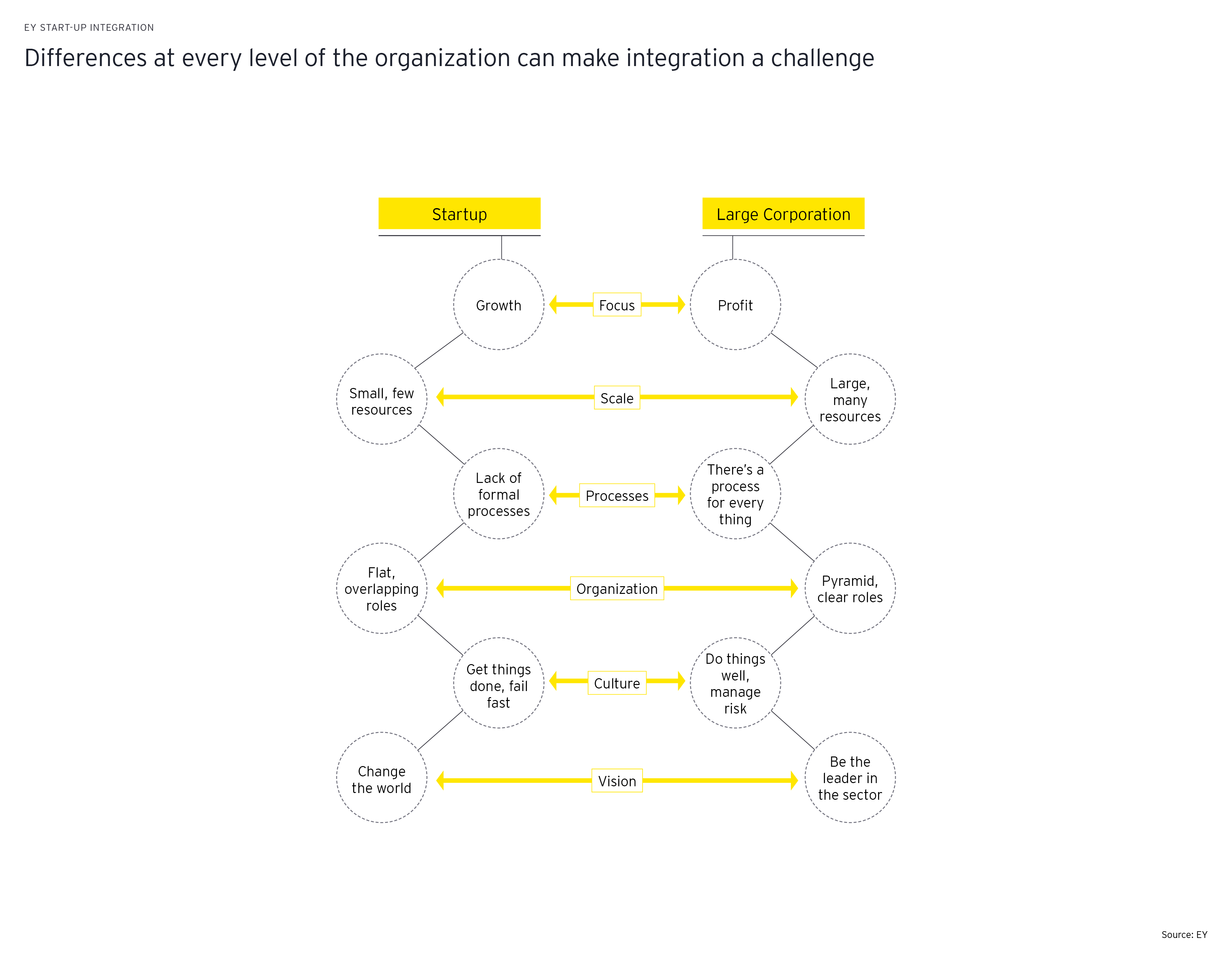

Smaller, less mature targets can feel stifled by the demands of a large organization, especially if they are not adequately considered during negotiations. Both parties can benefit from the support of an external advisor like EY to navigate potential sticking points.

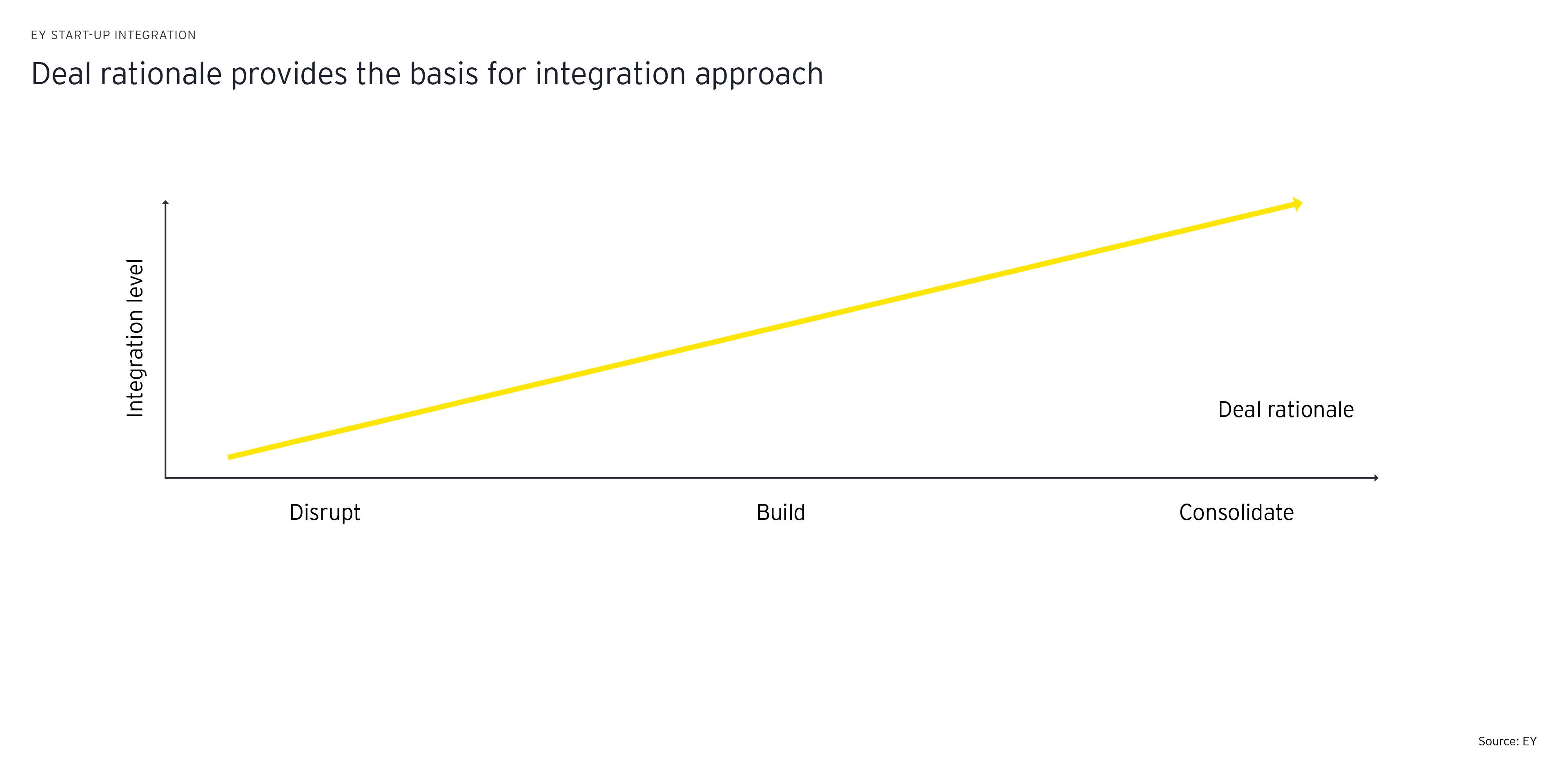

Whatever the deal rationale, buyers should translate the objectives into quantifiable targets. They should seek to understand what levels of autonomy and integration are needed to achieve desired outcomes: for example, what level of IT rollout is needed to enable the sales team to include the target’s portfolio in their offer? Which processes – like compliance – should be prioritized now and which can be addressed further down the line? Are key people at the startup a help or a hindrance? In other words, do the benefits of innovation, cultural consistency and stability at the target outweigh the risk of resistance to change? Ideally, these are considerations that will already be made pre-acquisition, and certainly during negotiations, where target and buyer may discover that an exit package for figureheads is the best approach to support integration. Regardless of the decision, the acquirer should be transparent about the benefits but also the needs and constraints of being part of a large, often listed, company.