Chapter 1

Trading Multiples Switzerland

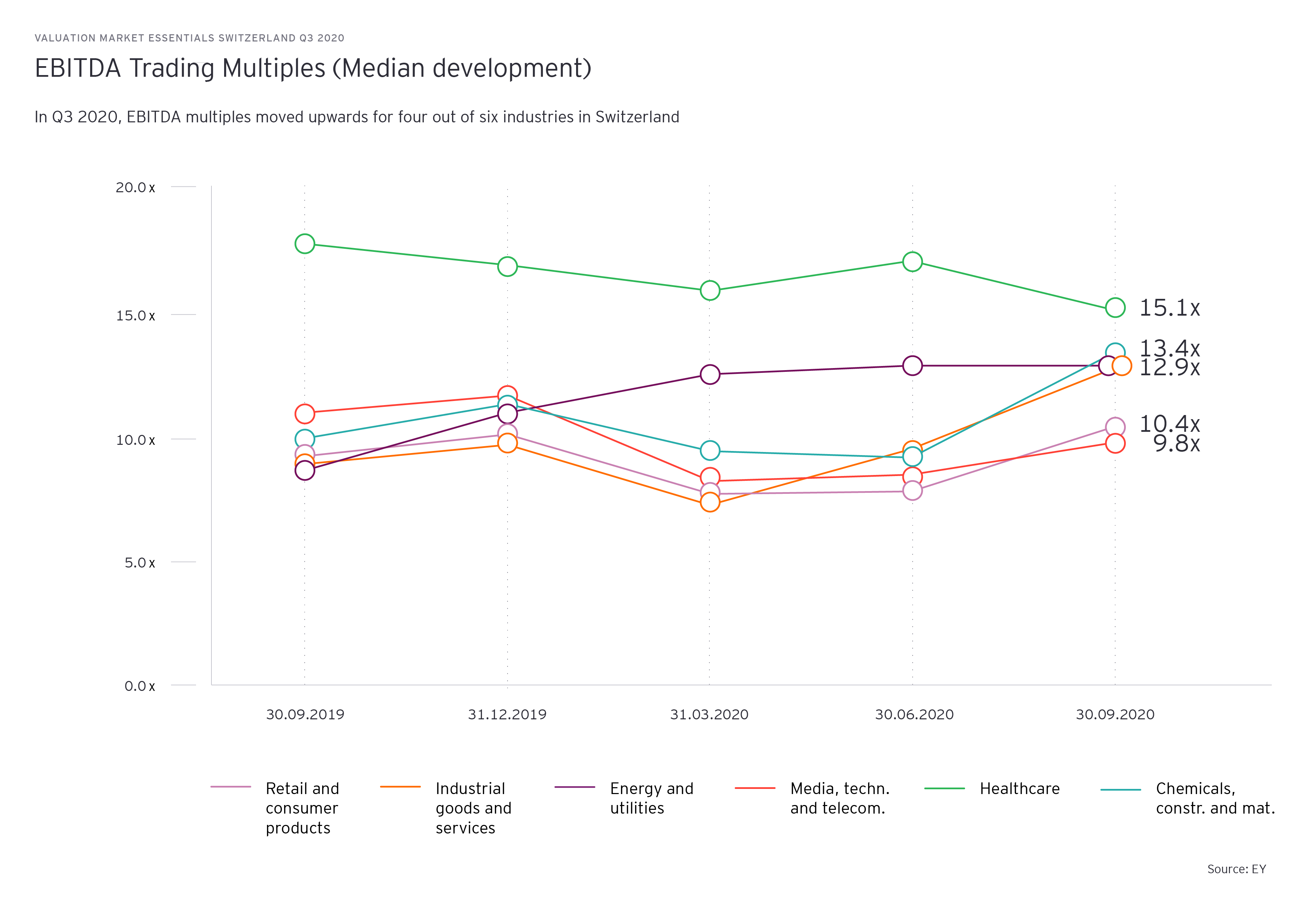

Trading EBITDA multiples witnessed upward movement in Q3 2020

While in Q1 2020, a strong decline in trading EBITDA multiples was observed driven by the crash in the stock market, followed by a moderate increase in Q2 2020 for some of the industries, a sharp upward turn in trading EBITDA multiples can be observed for four out of six industries in Q3 2020, even boosting multiples to the record levels.

Although the LTM financials as of June 2020 considering first impacts from COVID-19 are now available and negative performance might lead to investors correcting their expectations downwards, this seems not to be the case. Instead, share prices of most of the companies have improved since Q2 2020, which can be explained by investors’ optimistic expectations of improving market conditions and financial performance after recovery. These growing expectations of companies’ improving future performance result in a higher proportion of future growth value as part of the enterprise value of a company, while the current operations value, which is mainly impacted by the pandemic, seems to be a less valued component of a company’s total value.

Chapter 2

Transactions Europe

European M&A activity regained buoyancy in Q3 2020

Following months of subdued transaction activity, the European M&A market witnessed widespread recovery in Q3 2020, although the activity in four out of six industries was still below pre-COVID levels in Q3 and Q4 of 2019. The total number of transactions (M&A transactions, which were announced or announced & closed in the same quarter and have published at least one multiple) across the six industries increased to 182 during Q3 2020. As compared to 124 deals in Q2 2020, this is an increase of 47%. The activity improved also as compared to 173 transactions recorded in Q1 2020, however, it is still below 234 transactions in Q4 2019.

While the number of transactions increased for all industries except for Energy & Utilities in Q3, the highest increase was observed in the industries chemicals, construction and materials, which also leads the chart with total 60 deals, followed by healthcare as well as media, technology and telecommunication showing growth rates of 90% and 50%.

According to the recent Mergermarket report on deal drivers, the large uptick in the M&A activity was mainly due to the pent-up demand for M&A ever since the lockdowns started. As soon as lockdowns were lifted across Europe, the M&A activity regained buoyancy. However, while a second wave of pandemic is coming with an accelerating speed and further business restricting measures and lockdowns are not excluded, the M&A market reaction is very uncertain to predict.

The top countries in terms of target company location were UK (17%), followed by France, Germany, Italy (8-10% each).

Chapter 3

Selected cost of capital and terminal value parameters

Development of certain cost of capital and terminal value parameters amidst recovering economic and business environment

Unlevered beta

Since beginning of the year, the median unlevered betas across all industries are following an upward trend given an increased volatility in the stock market. As a component of cost of capital, increased betas lead to increased cost of capital providing an indication of higher levels of systematic risk and therefore lowering valuations (all else held equal).

Debt to total capital ratio

In Q3 2020, the median debt to total capital ratio continued the declining trend for 4 of the 6 industries, mainly driven by a positive development of market capitalizations for the majority of SMI companies. However, the underlying debt level is still based on pre-COVID 2019 financials and does not yet consider any new debt resulting from government survival packages.

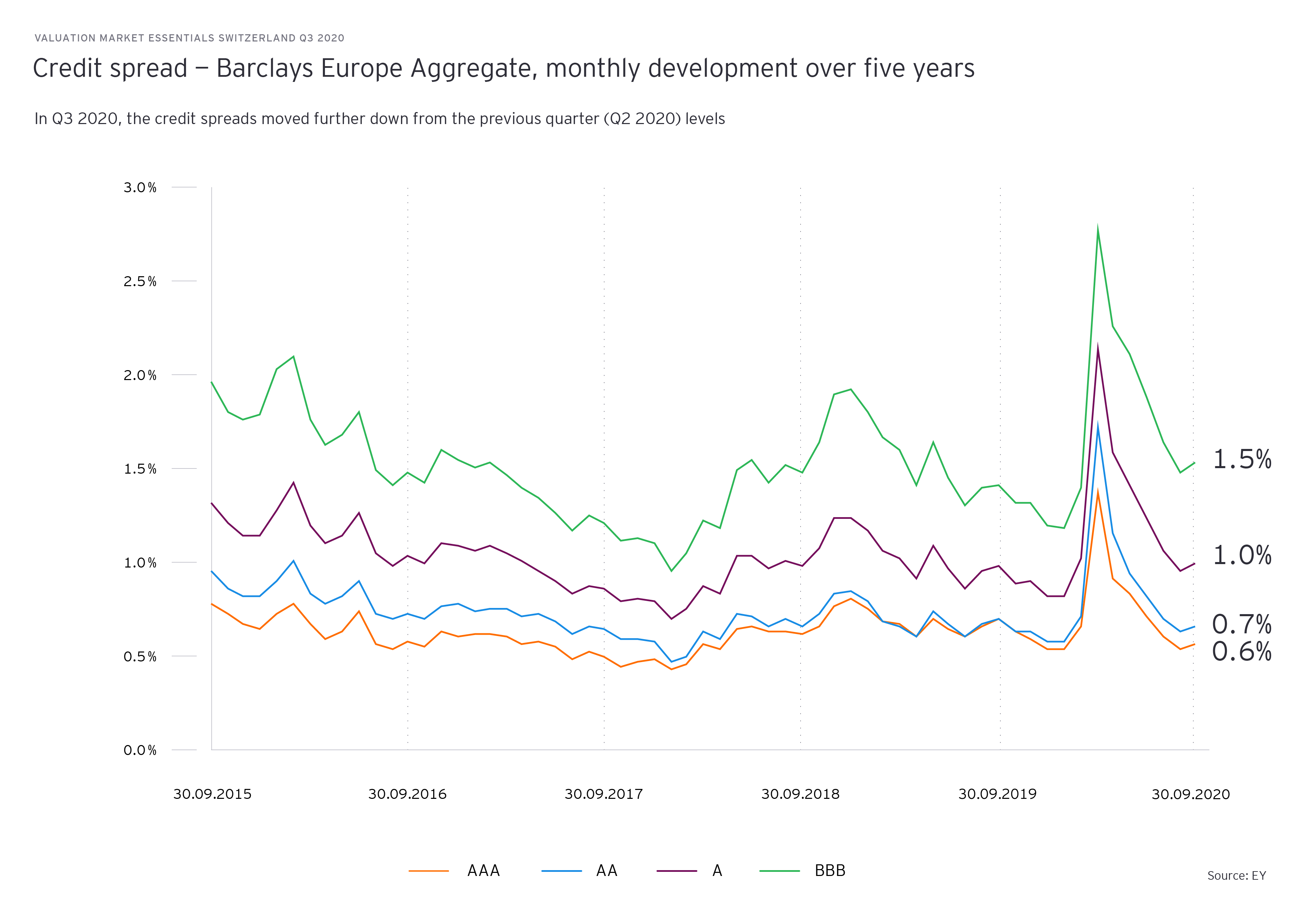

Credit Spread

The European credit spreads (Barclays Europe Aggregate) continued their downward trajectory during Q3 2020 after breaching record highs in March 2020, which can be attributed to expected recovery across Continental Europe as economies lifted lockdowns and economic freeze-outs and business activity picked up again reducing risks of default.

GDP growth

Driven by industrial activity that picked-up during the past three months, GDP growth expectations were slightly corrected upwards in Q3 2020 as compared to projections in the previous quarter. However, the GDP projections for 2020 remain as before negative for Switzerland, Germany, USA, emerging markets and globally in average. For Switzerland the short-term projected GDP growth for 2020 was slightly adjusted upwards from -6.4% as of Q2 to -4.6% as of Q3 2020, while the 10-year average (geometric mean) remained almost unchanged at 2.2% due to a recovery expected in the following years.

Chapter 4

Banking and Insurance Sector

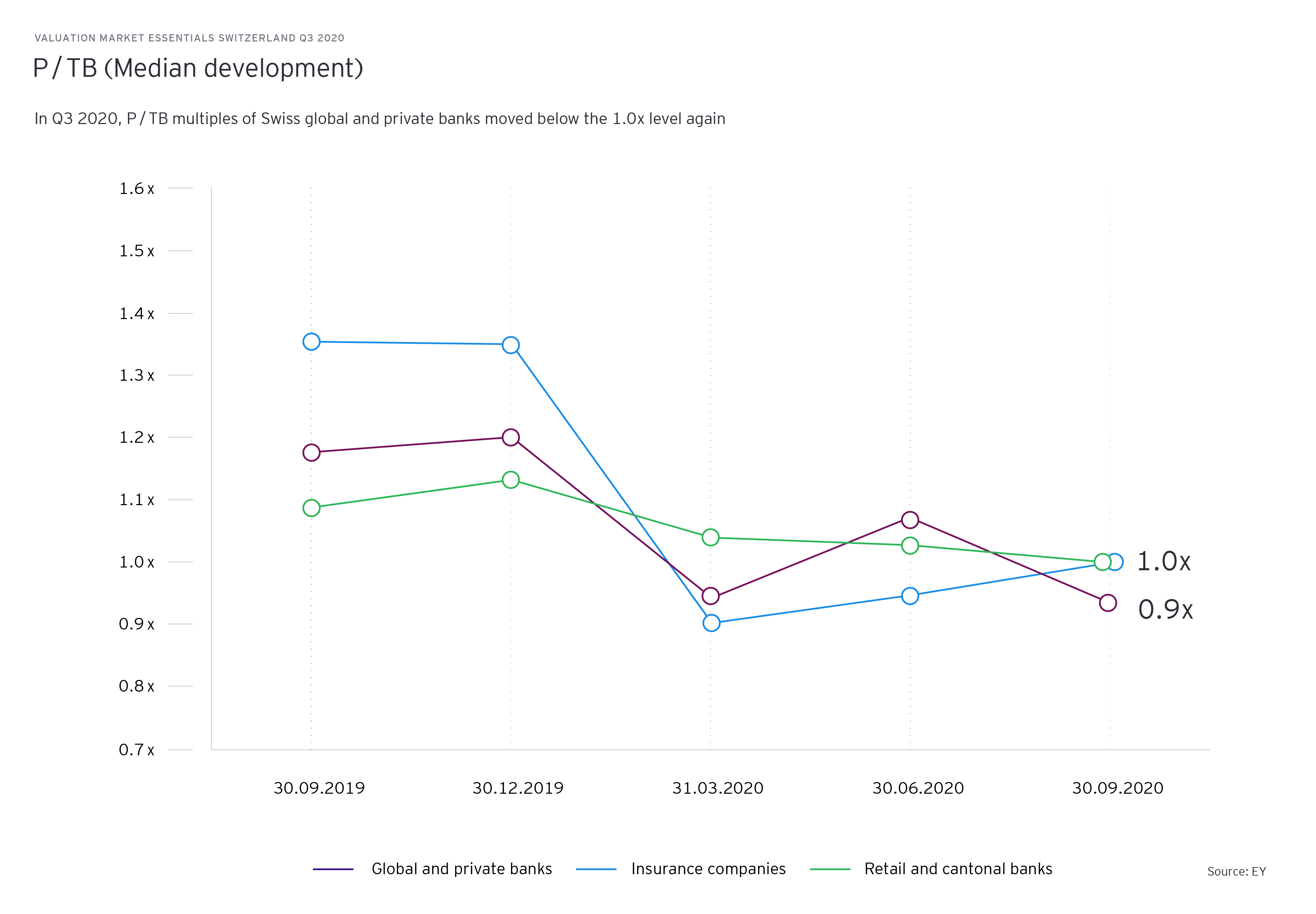

COVID-19 continues to leave its effects on the banking sector

Banking and Insurance industry witnessed contrary valuation trends during Q3 2020. While the median P/TB multiple for insurance companies increased from 0.9x in Q2 2020 to 1.0x during Q3 2020, the median P/TB multiple for the global and private banks on the other hand, decreased from 1.1x to 0.9x during the same period. The decrease in banking sector multiples was mainly due to shrinking of their market capitalization values as the sector continues to suffer from the overhang of the COVID-19 crisis.

Our Valuation, Modeling & Economics Team is here to support you with Liquidity Planning, Portfolio Analysis, Scenario Planning and other services to help you prioritizing and navigating through the economic turbulences!

Summary

While Q3 2020 shows some signs of recovery, the uncertainty about the direction and speed, in which the markets will develop especially considering a second wave of the pandemic, remains of the biggest challenge. Corporate finance practices must be prepared for the diverse (recovery) scenarios, multiple valuation methods or more advanced statistical modeling that may arise out of the volatile waters we are sailing through.

Acknowledgements

We thank Elizaveta Leontyeva for her valuable contribution to this article.