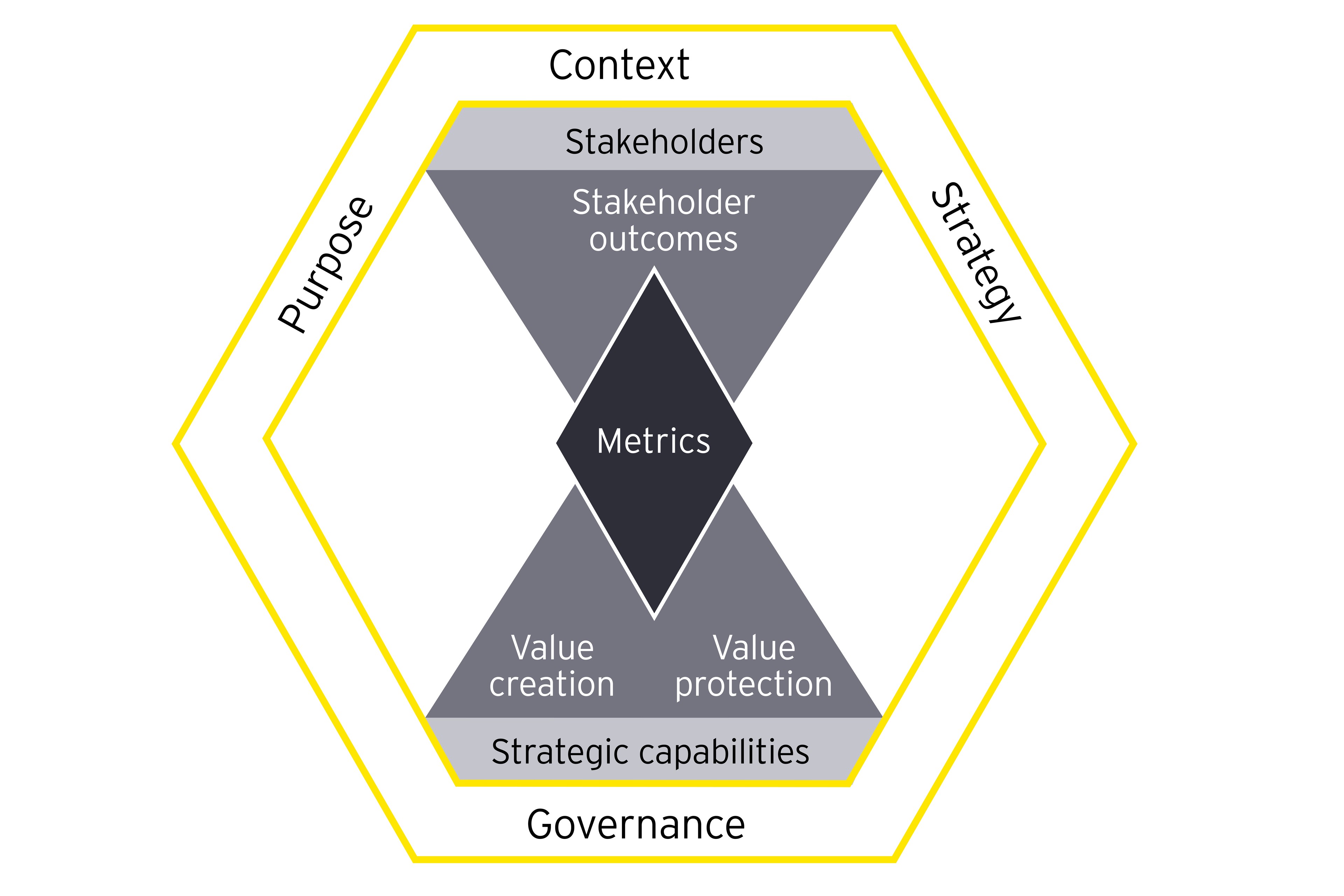

Long Term Value Framework

Working with the Coalition for Inclusive Capitalism, EY has helped develop a new reporting framework for demonstrating long-term value creation for all stakeholders.

This framework provides an approach companies can take to identify and evaluate company-specific key value drivers and develop non-financial metrics which can help clarify value and value creation.

To rebuild stakeholder trust, business leaders need to transform their company’s reporting functions to ensure:

- That they have the right people and capabilities to successfully integrate (and make sense of) financial and non-financial information.

- That they have the right technology in place to measure what they want to report against – technology and data advances will enable many traditional finance processes to be automated, so CFOs can focus on making sense of non-financial data.

- That the right governance and culture is in place, and that finance functions assess and report on it.

Get in touch to better understand how you can identify which stakeholder groups you want to address in your corporate reporting; how to put the systems, processes and mechanisms in place to measure what needs to be measured; and how to use your corporate reporting to really demonstrate the value your business generates.

Summary

CFOs are often the ones under pressure to help rebuild trust and ensure that corporate reporting is fit for the future. Organisational transformation includes investing in employees, dealing fairly and ethically with suppliers, and supporting the communities in which they work. We can help you measure aspects of innovation, trust, culture, sustainability, and more.