What does this mean for you?

The outcomes of the Brydon review into the quality and effectiveness of audit, the Kingman review on the future regulation of financial reporting and Competition and Markets Authority (CMA) review are not yet finalised (June 2020), but they will almost certainly result in a package of reforms that will change UK corporate reporting forever.

At the heart of these changes is an ambition to ensure that the UK continues to be a world leader in auditing. Brydon’s 64 recommendations impact a variety of parties and take a strong stance on directors’ responsibilities, strengthening internal controls over financial reporting (ICFR) and the prevention and detection of fraud. Alternative Performance Measures (APMs) and certain Key Performance Indicators (KPIs) will likely have to be audited in future and that will mean companies need robust definitions, data, processes and controls to support the new KPIs. In future, CEOs and CFOs may have to vouch for the effectiveness of these internal controls and, if any weaknesses emerge, they may be held accountable.

But with these new responsibilities come opportunities. When a company understands clearly how it creates value and underpins this with robust KPIs, it can communicate with confidence. When a company also identifies the risks and controls that underpin the KPI reporting process that confidence is further enhanced. Academic studies show that companies with robust internal controls over financial reporting are rewarded with lower costs of capital and higher share prices.

Assessing your current reporting framework

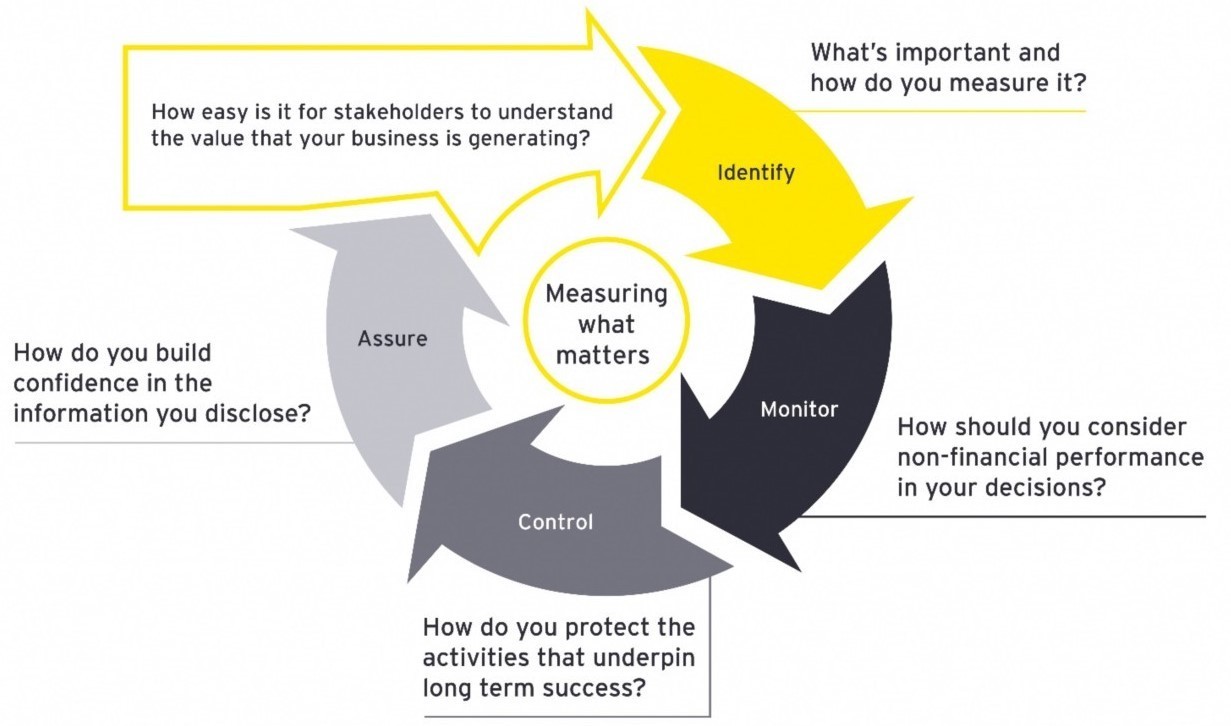

An effective reporting framework should address the issues that are fundamental to a business – from how it creates value to how that is measured and how confident CFOs are that the metrics are reliable.