Chapter 1

Staying relevant in a changing world

Data-driven insights can help finance functions provide better support.

Gone are the days when traditional financial reporting, such as the profit and loss statement, balance sheet, cash flow and simple variance analysis are enough. Business leaders are now looking for in-depth insights that allow them to connect business activity to long-term value, model scenarios in real-time and efficiently allocate resources. If finance functions do not step up to the plate, then other functions will step into the void and risk weakening the central role of the finance function in the modern enterprise.

At the same time, many Chief Financial Officers (CFOs) are under pressure to reduce costs and increase efficiency. This means that any additional spending to help finance functions develop their capabilities must be clearly justified by the tangible value it adds to the business.

Related article

DNA of the CFO insight

89%of CFOs anticipate that they will have significant involvement in their organisations’ strategic decisions. (1)

External pressures are also mounting, adding to the CFO and business workload. COVID-19 and Brexit have clearly presented major challenges, but there are many other pressing developments on the horizon such as digitalisation, rising customer expectations and the increased stakeholder focus on environmental, social and governance (ESG) factors.

Businesses must manage these pressures and understand how their activities impact value in these areas. To achieve this, the CFO must play an increasing role in helping businesses to optimise actions and investments internally in order to drive outcomes externally.

Chapter 2

Defining and delivering value

As value definitions broaden, finance functions can have a greater role to play.

The finance function of the future will spend significantly more time working across their business, connecting operational KPIs to financial metrics and, in turn, value. This will help them deliver greater insight and thereby support better-informed decision making.

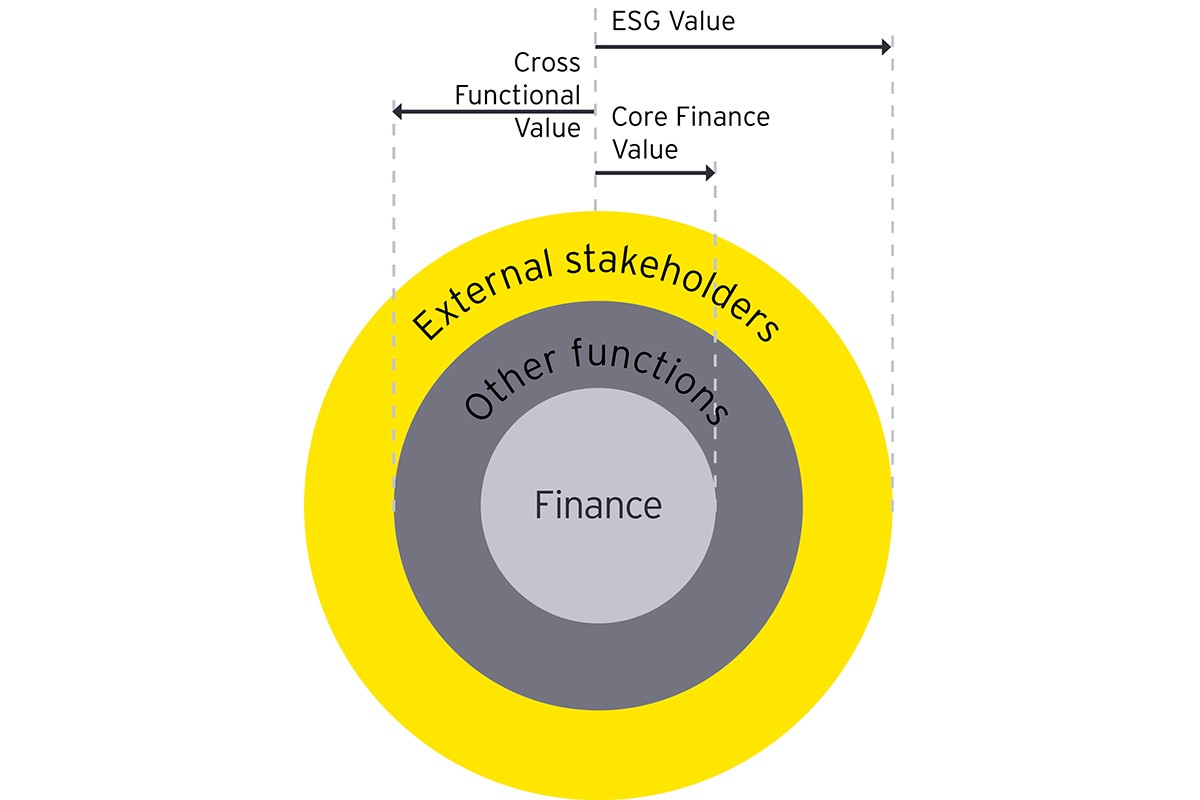

Below we identify the three key areas of business value and how finance functions must adapt in order to deliver next-generation insight:

- Core financial value – The traditional view of the business centred on the key financial statements and associated KPIs. Getting this right is non-negotiable for the finance function but could it be done more efficiently? Can information be supplied in more detail, more quickly, or more accurately? Is there an appetite for finance and the wider business to move to self-service reporting and free up the teams to provide insight in other areas?

- Enterprise-wide value – In the future, finance will increasingly be asked to use its connections across the business to understand how operational metrics are driving value. By working across commercial, the supply chain and production and getting closer to its consumer and customers, is the team best placed to define the internal and external drivers of value and lead on measurement and optimisation?

- ESG value – A wider range of stakeholders are increasingly looking for businesses to deliver more than financial profit, with contribution to society growing in focus. What is the finance function’s role in the difficult task of measuring non-financials and tracking progress against intangible targets?

Related article

DNA of the CFO insight

81%of CFOs see themselves as the stewards of long-term value. (1)

Insights from the finance function of the future

Chapter 3

Putting the tools in place

With the right capabilities, finance leaders can play an increasingly important role.

The finance function can have a much bigger part to play in driving strategy, evaluating business options and guiding the allocation of resources across the business. But to do so it will need to have the right tools to assess, measure and optimise decision making.

With new tools such as EY’s Digital Performance Management Framework (2) , finance functions will be ideally placed to decide what should be prioritised to drive value. They can do this by better understanding how the internal levers within an organisation connect to the desired strategic outcomes and, by studying cause and effect, optimise decision making.

But to achieve this outcome, three key enablers will need to be considered:

- Capabilities and behaviours – Finance functions are made up of financially literate and commercially astute individuals who are integrally connected to the wider business. How can organisations not only provide them with new technical skills, but also shift mindsets to embrace agile working and gain the confidence to experiment?

- Process and data – As finance functions pivot away from traditional reporting, data will be key. How can organisations cleanse and marshal internal and external data, while also applying governance and structure?

- Technology – From data lakes to AI and machine learning algorithms, choosing the correct technology to capture, clean, store and analyse data will be key to success. How can organisations decide whether to adapt existing systems or, effectively, start from a blank piece of paper?

DNA of the CFO insight

81%of CFO’s believe there is significant business value not measured or communicated by financial KPIs. (1)

Chapter 4

The future finance function

A shift from backward-looking reporting to horizon scanning means that finance can lead the way.

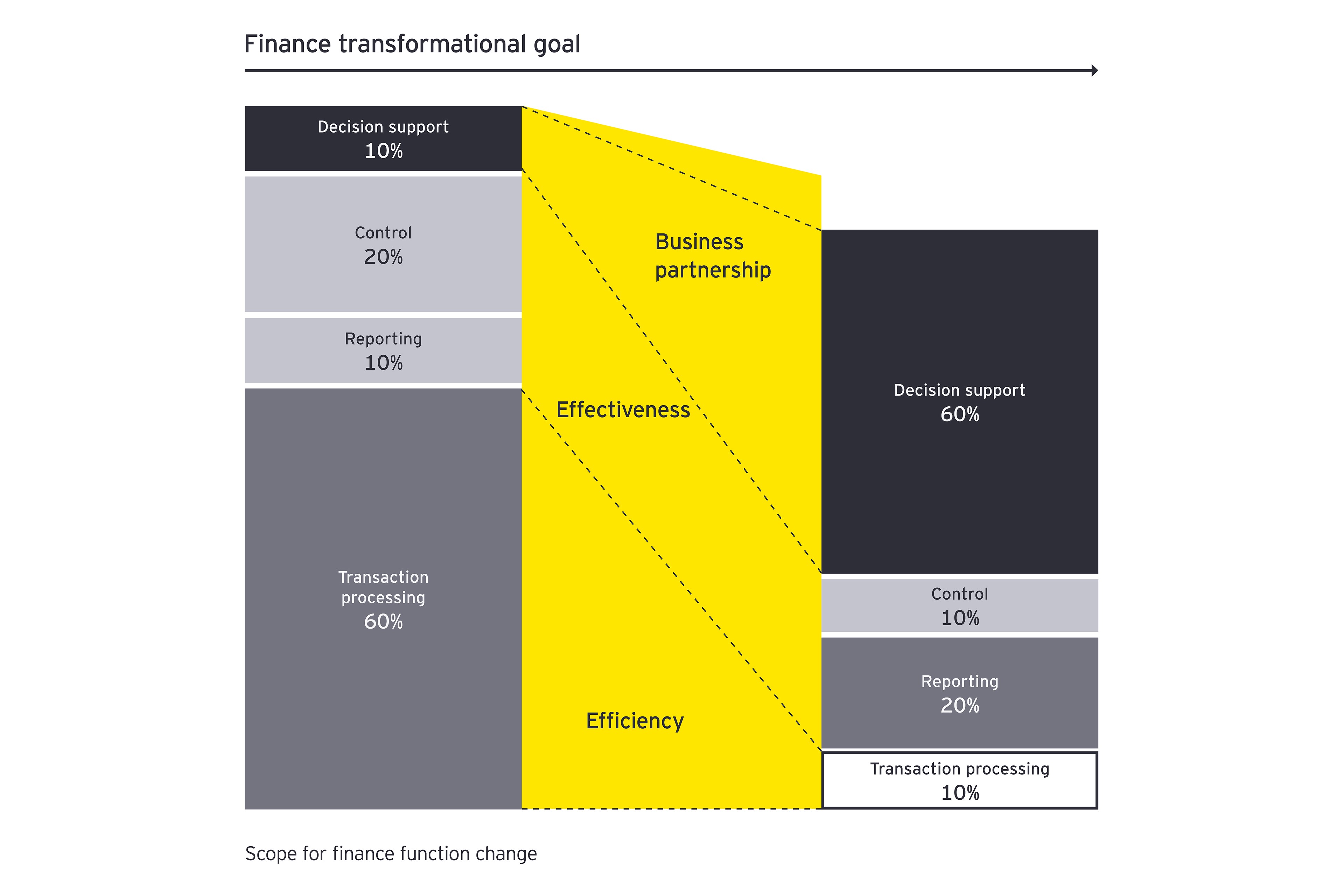

The modern finance function will maintain controlled and effective financial reporting, but also create a framework for explorative, cross-functional insight.

As automation continues to take hold of the finance function, we expect to see a shift in the activities it performs. Moving away from reactive responses, transactional activities and backward-looking analysis, the finance function will become collaborative, forward-looking and insight driven. Breaking free of traditional boundaries, it will spread its influence throughout the organisation with a network of finance business partners.

Working in an integrated and collaborative way, these finance business partners will be at the heart of operational decision making, providing what-if analysis and scenario modelling.

Embracing data and technology

Finance functions will harness advancements in technology and data to help drive effective decision making across the business. Data will be sourced from multiple sources and stored cost-effectively, using cloud technologies to provide the flexibility for rapid scalability.

Advanced analytics techniques will be used to optimise relationships between a growing number of datasets and make insight more valuable and easily accessible. Machine learning and artificial intelligence can then be applied to identify historic performance correlation, capitalise on future opportunities and manage risks in a way that would not be possible using human interpretation alone.

DNA of the CFO insight

77%of CFOs believe finance will be involved with nonfinancial reporting. (1)

Shifting to become the finance function of the future

To make this shift happen, CFOs should think beyond the constraints of today to set their sights on the future. Finance is uniquely placed to bring together core financial data, business data and external data to identify and optimise the drivers of value in terms of core financial metrics, the whole business and its stakeholders.

Ultimately, the best way to garner support from the business is to demonstrate the value that data, insight and business partnering brings.

Summary

Finance leaders will have an increasingly important role to play in the future if they can build data capabilities and use them to deliver greater insight and value. But a failure to adapt could see them lose relevance.