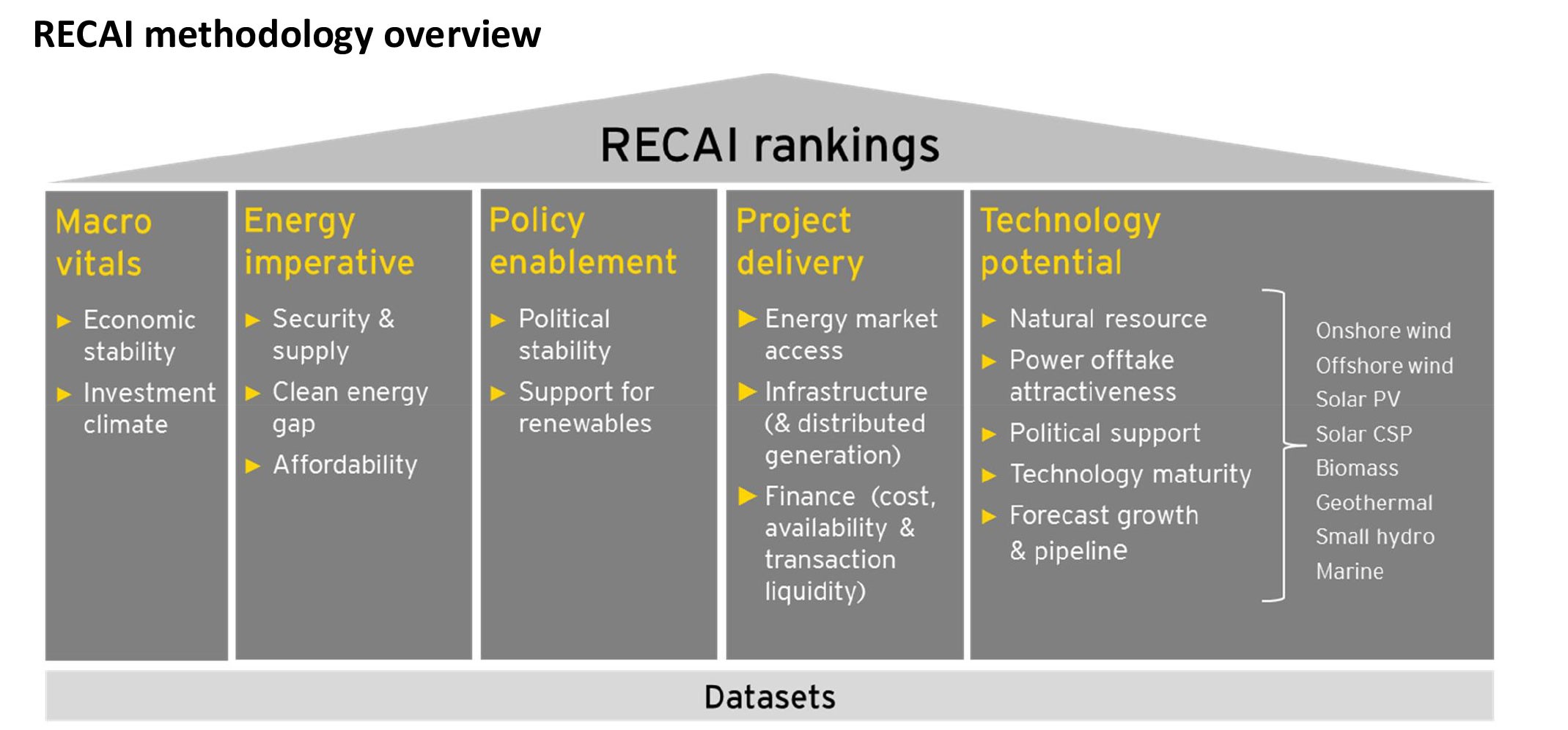

The new methodology has redefined and reprioritized the parameters impacting energy imperative as a critical factor driving long term supply and demand dynamics. This is important both at a macro level (i.e. sheer need for power, whether due to demand, security or diversity) and more specifically for renewables, including the extent to which other “cleaner” sources are being prioritized (e.g. nuclear and natural gas). Affordability remains key, so this parameter also reflects the extent to which electricity costs impact the case for renewables.

Notwithstanding renewables’ increasing cost-competitiveness, policy enablement continues to have a significant impact on market attractiveness. However, the revised index puts greater emphasis on the degree of visibility over a country’s long-term energy strategy and the level of policy stability underpinning this, in addition to the specific support mechanisms designed to achieve it.

The project delivery parameters focus on energy market access, infrastructure and finance as indicators of the ability to get deals done. They try to address a number of critical questions, including:

- How competitive is the energy market?

- What are the routes to market for the sale of renewable electricity and securing long-term contracts?

- Can projects be connected, and/or exploit opportunities that circumvent the need for grid access (e.g., distributed generation, storage)?

- Can projects secure financing?

- Is there a sufficiently liquid market for different investors to enter or exit renewables opportunities?

At a technology potential level, power offtake and incentive regimes remain important parameters alongside the strength of natural resource and capacity forecasts. However, we have reassessed and reweighted the various mechanisms (e.g., feed-in tariffs, premium tariffs, auctions, green certificates) to take account of the increasingly complex tradeoffs between price, volume and policy risks.

Technology weightings continue to be based on current and projected investment volumes. This means that solar in particular is continuing to increase in importance as a proportion of the overall weighting, even taking into account the higher $/MW value of some other technologies. This also reflects the fact that solar typically creates a broader range of opportunities, given its flexibility and scalability across a range of applications and a growing number of markets globally.