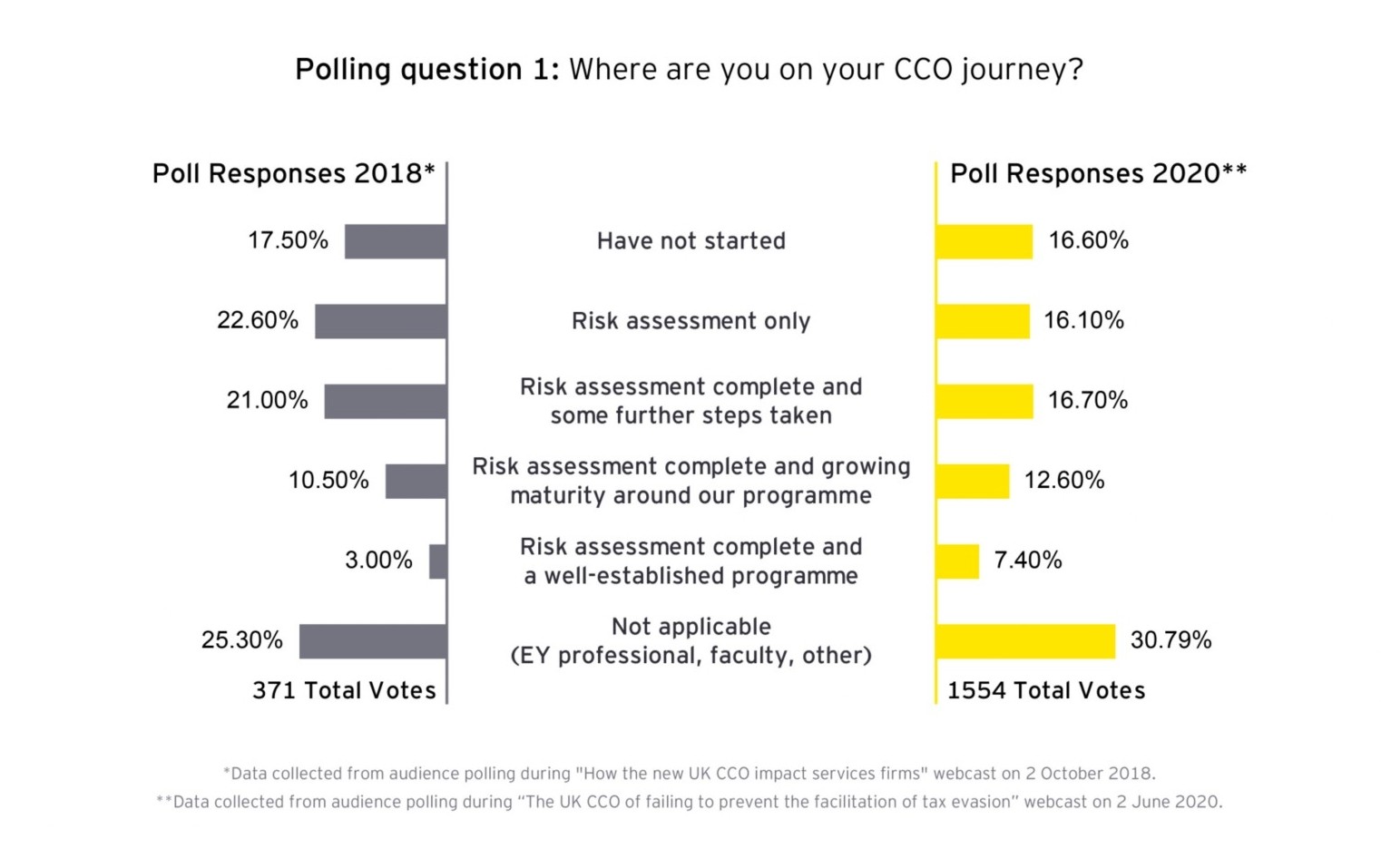

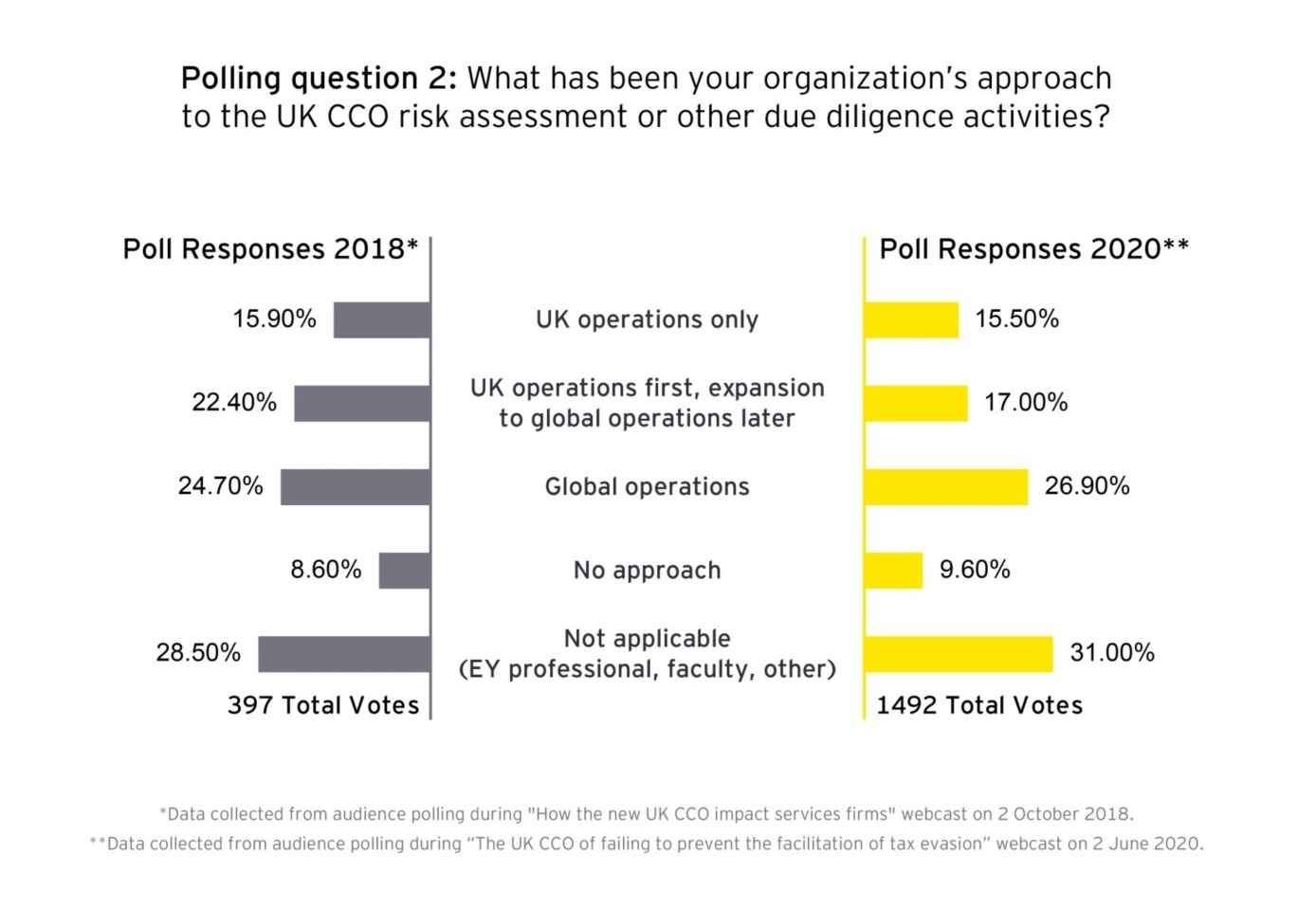

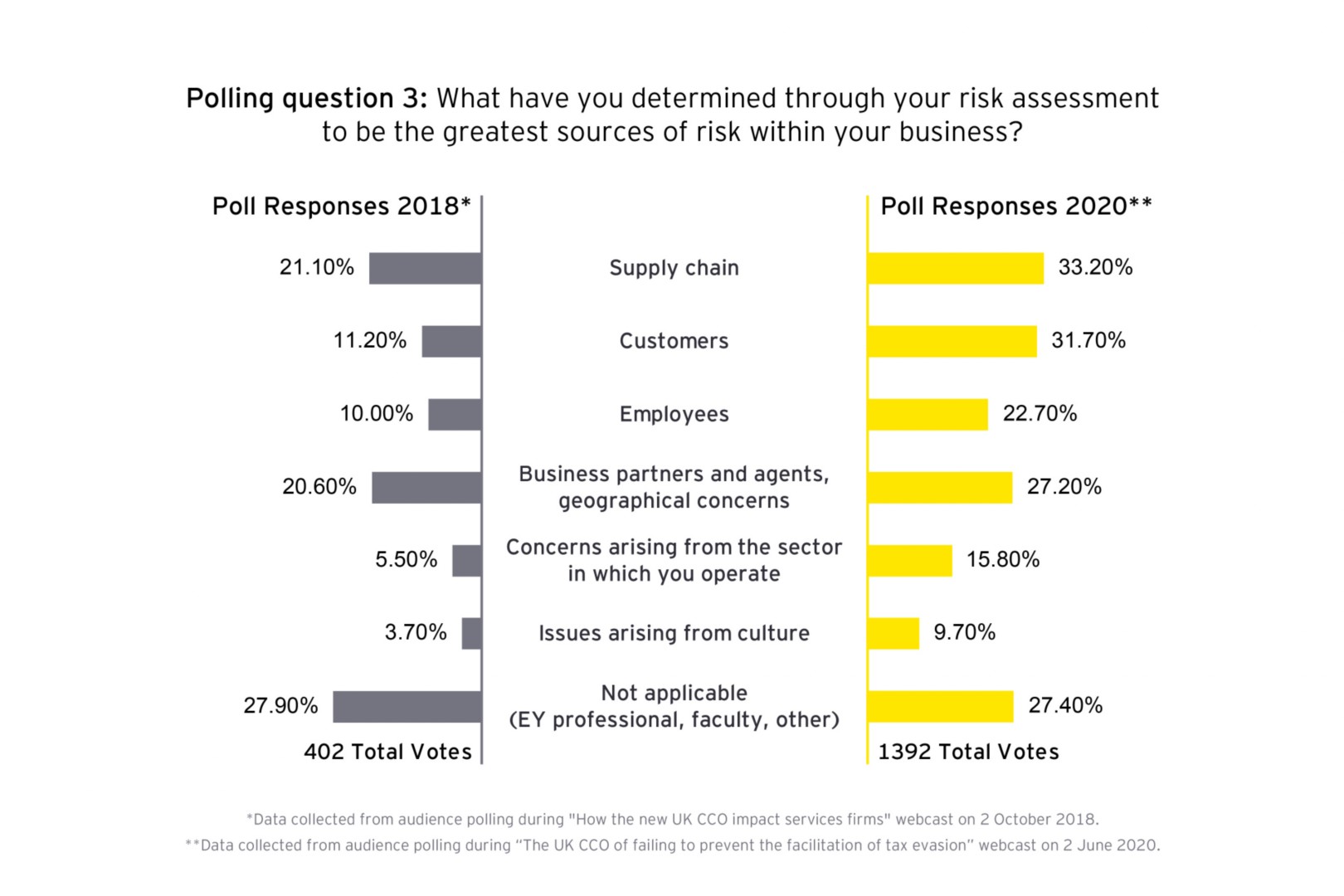

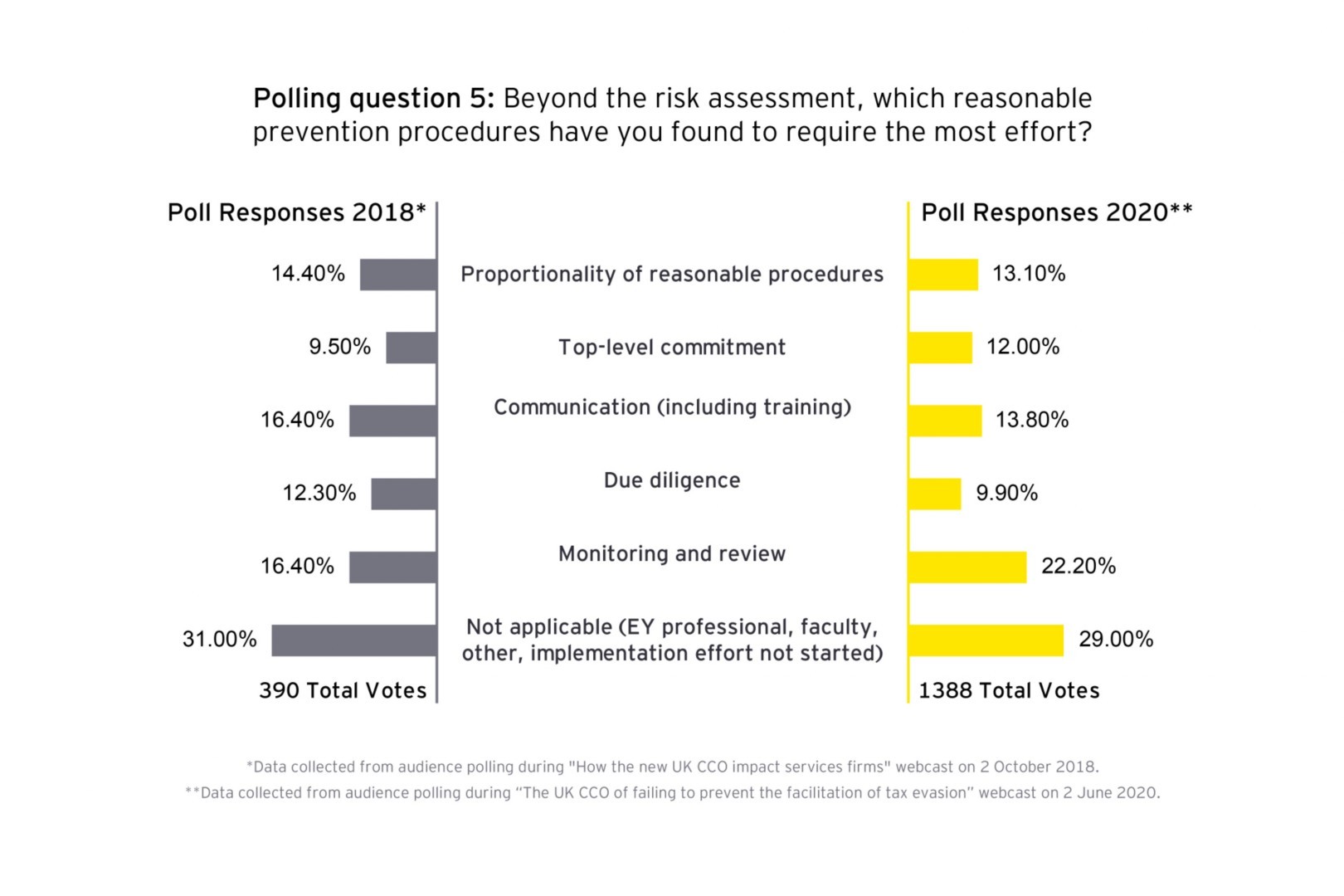

As our webcast poll results highlight, there are still businesses who have not fully implemented reasonable procedures and who are open to risk.

As the HMRC investigations progress, the bar will continue to be raised. Employee communications and training is hugely important. It is timely to reflect on the US Department of Justice (DoJ) guidelines released in June 2020 which highlights the direction of travel we have seen with bribery and corruption enforcement authorities take. It is therefore indicative of where CCO may go, taking a much harder line regarding behaviors and effectiveness of control measures. The DoJ asks for an impact assessment on how training has impacted on employee behavior or operations, which policies are attracting more attention from employees, and testing whistleblowing hotline awareness and whether employees feel comfortable using it.

People can be a key control in identifying facilitation risks in the business. By developing policies which speak to the roles of your people and the risks they could face, having a clear commitment from the top of the organization, bringing this all to life with tailored training, and both encouraging the reporting of risks through a whistleblowing line and fully investigating the risks, many businesses can go a long way to creating an effective control environment.

Data analytics also have an increasing role to play with some of our clients building interactive dashboards pulling on expanded data streams to drive real insights into compliance behaviour. We have recently worked on pre and post COVID-19 analysis implementing control environment for a global beverage business. Many things have changed in recent months and new red flags identified. The results are now helping the Compliance team focus their efforts and prompting questions into the business.

For the Financial Services and regulated sectors, it’s important to recognise that there are added control environments in place, other control legislation and responsibilities, plus additional client and transaction monitoring. Good data management is critical – are you able to identify cases of potential tax evasion through data analytics?

HMRC has emphasised on many occasions the importance of self-reporting as evidencing that reasonable procedures are operating. A dedicated portal has been created to report instances of the facilitation of tax evasion, more detail on which can be found here.