Meanwhile, such major jurisdictions as India and the Gulf Cooperation Council of six Middle Eastern states are now introducing VAT-type taxation for the first time, using systems that are highly automated from the start. Usually, tax administrations’ new systems and procedures tend to evolve (though not always linearly) through five levels, as described in our framework, below:

- E-filing requirements for traditional tax returns and forms

- E-accounting, with businesses required to digitally submit source data such as invoices — often in real time or close to it

- E-matching, when administrations map data across tax types and, potentially, across buyers and sellers

- E-audit, which is digitally-enabled tax auditing — often with a limited window for businesses to respond.

- E-assessment, in which tax administrations forgo tax filings altogether. Instead, they analyze the data businesses have transmitted, determine the tax rate and take the money out of corporate bank accounts, unless their findings are contested.

Some of the world’s largest economies, such as Japan, the UK and the US, still rank on the first level of this scale, according to Carolyn Bailey, EY Americas Digital Tax Administration Services Leader. Thirty-plus countries around the world are at level two, she says. Brazil, Mexico and Russia have reached level four. Many more administrations are likely to move from level 1–2 to level 4–5 within 5 to 10 years, with advances such as blockchain, says Bailey.

Troublesome transition

To date, however, the transition has proved difficult for businesses. One issue is timing. As governments speed their collection of tax information and cross-check that data between buyers and sellers, mismatches can occur — for example, if one side of a transaction books an invoice in May and the other books it in June.

“Siemens has more than 600 litigation cases in Brazil alone, and most are related to automated assessments,” says Christian Kaeser, Chairman of the Tax Commission of the International Chamber of Commerce (ICC) and Global Head of Tax at Siemens AG, in Munich, Germany. Other businesses are in the same situation in Brazil, says Kaeser, who expects to see similar patterns — to a greater or lesser extent — in other jurisdictions that automate their indirect tax systems.

“There will always be cases where the timing will not match 100% in any given period,” says Kaeser. “And the shorter the period of time, the greater the chance of a timing mismatch.” When mismatches result in official notices from tax authorities, businesses find themselves having to explain and litigate over and over. “That is simply multiplying the workload for us,” he says.

Kaeser expects the situation to improve as, for example, tax administrations’ algorithms adapt. “Logically, the systems will get better, but don’t ask how long it will take,” he says.

Some businesses that have filed for refunds in Mexico have faced another challenge. Better-equipped tax authorities have applied greater scrutiny, causing delays and tying up cash flow, according to Teresa Rodríguez, Indirect Tax Partner at Mancera, SC, an EY affiliate in Mexico City.

Other issues include continual changes in tax rules and inconsistency from one jurisdiction to the next. There is even a lack of consistency in the way jurisdictions are implementing standards — for example, the OECD’s Standard Audit File — Tax (SAF-T) for the export of accounting records in a commonly readable format.

“They’re supposed to all follow one framework, but each one makes it just different enough to drive you nuts,” says Bailey, citing governments’ varying data requirements, scope and frequencies.

Inconsistency doesn’t only add administrative costs, but it also increases the risk of errors and of double taxation, says Kaeser. These and other transitional issues are among the topics being addressed in a new working group of the ICC’s Commission on Taxation.

“The bigger your business, the more systems you have, the more procurement and accounts payable platforms, the more difficult the task of complying,” says Adrian Hextall, Director, Financial Services, Tax Technology & Transformation at EY UK, in London.

Getting businesses on board

For their part, tax authorities realize the challenges taxpayers face. “The tax administration in Mexico doesn’t expect 100% compliance right now from taxpayers because it’s a transitional period,” says Rodríguez. “But they expect taxpayers to accept and incorporate these changes, rather than fight them.”

Governments also point to the benefits businesses can ultimately realize. In Mexico, for example, the tax administration will reward compliant businesses by reducing the standard time it takes for them to receive VAT refunds (from 4 to 6 months down to 5 days), says Rodríguez.

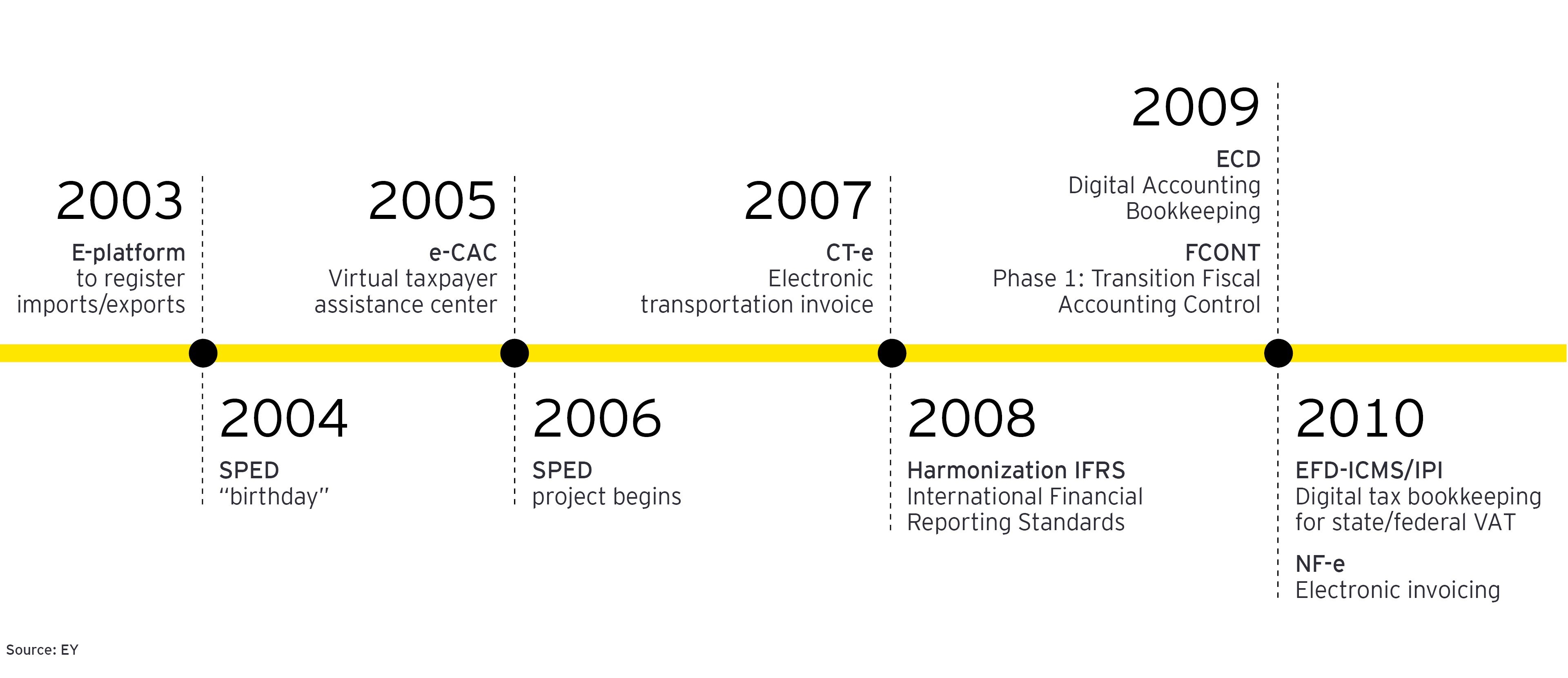

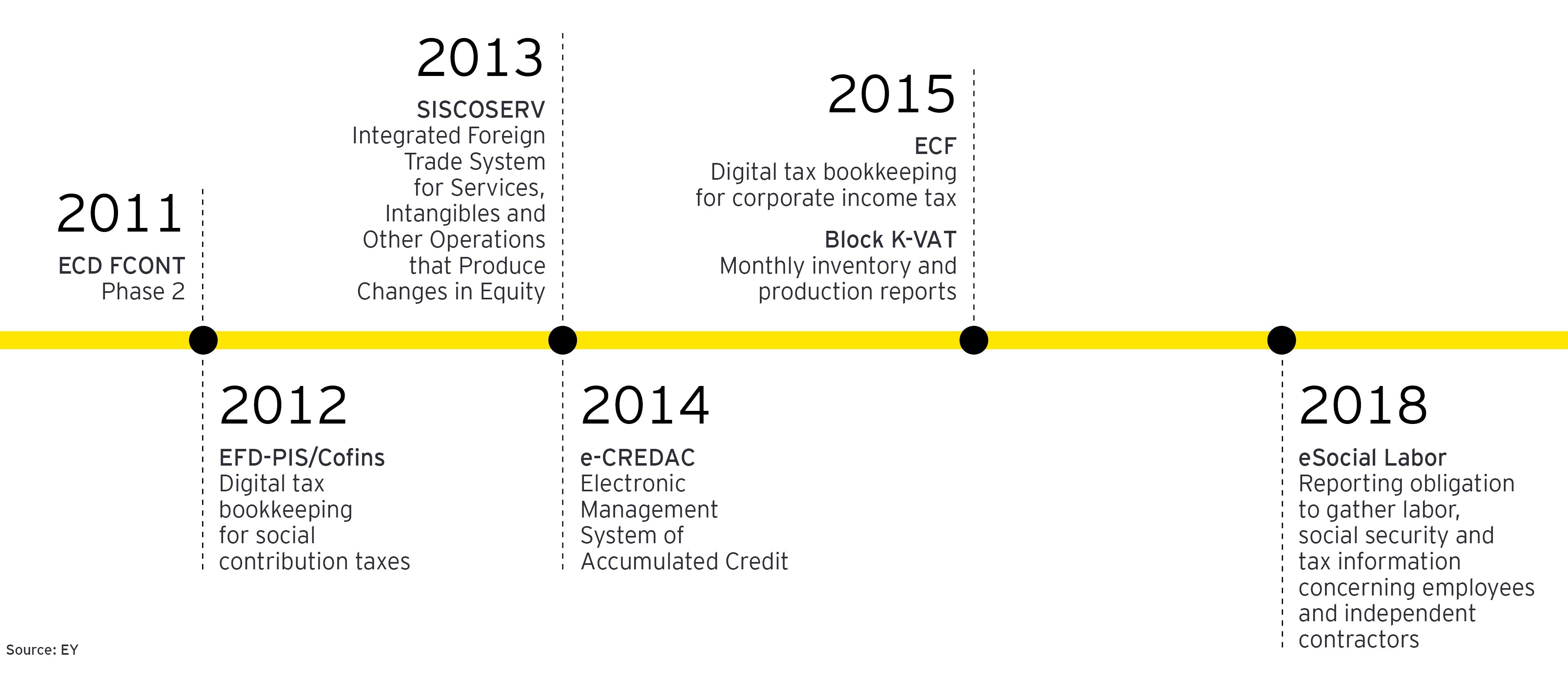

In Brazil, many regular information reporting requirements have been discontinued, says Altemir Linhares de Melo, Advisor to the Cabinet of the Federal Revenue of Brazil. “This means reducing the costs and time to comply with ancillary obligations, significantly improving the country’s business environment and, consequently, increasing the competitiveness of Brazilian companies,” says Linhares de Melo.

Over time, technology should help tax administrations conduct shorter, more focused audits, says Rodríguez. There will be fewer “fishing expeditions,” she says, which should translate into efficiencies for both the tax authority and taxpayer.