Engage with tax authorities early to highlight areas of uncertainty arising from increasing online transactions and help shape new laws.

Not so simple

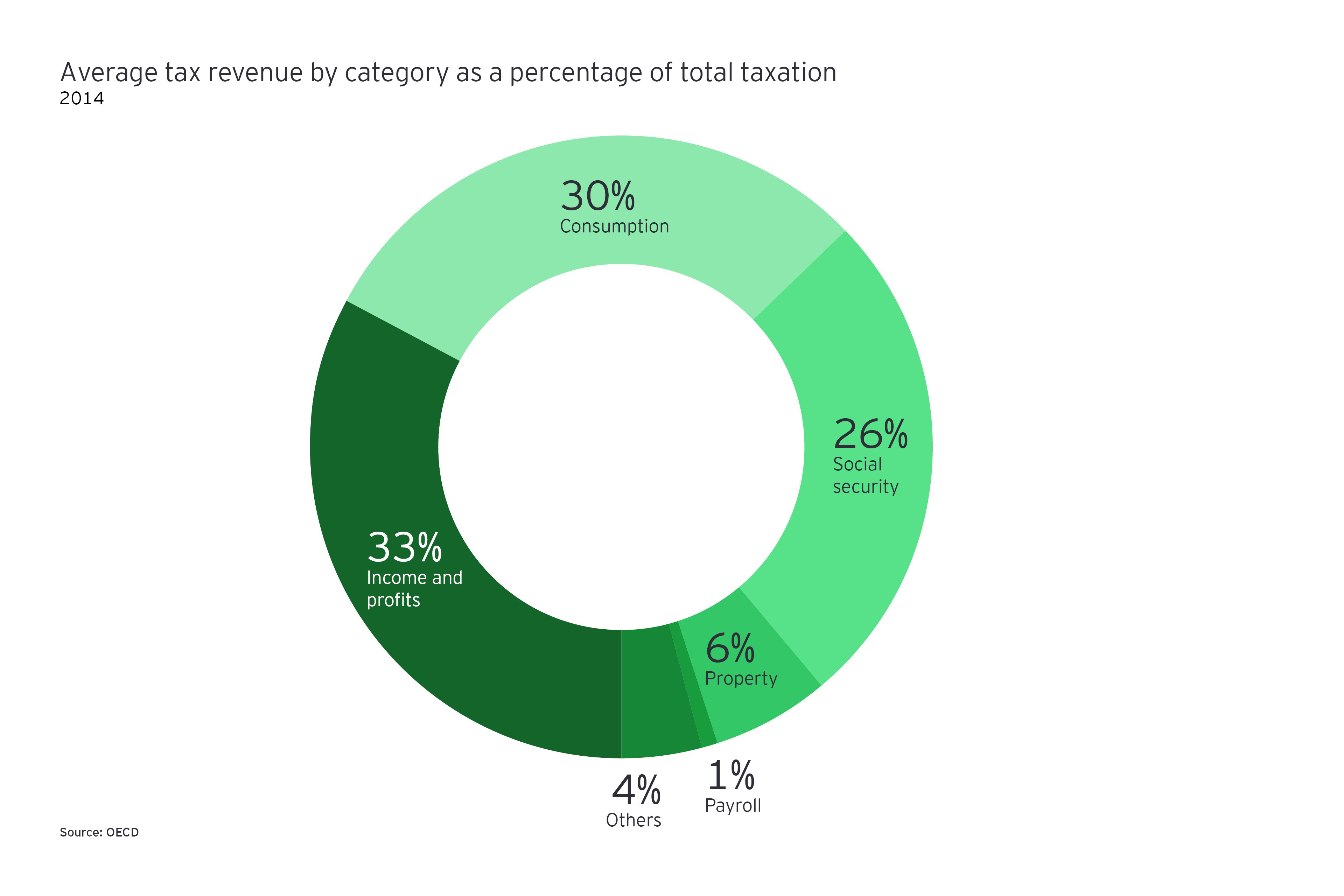

There is much at stake for governments and taxpayers alike. Consumption taxes today on average generate 30% of the national tax take for member states of the Organisation for Economic Co-operation and Development (OECD), according to the OECD’s Consumption Tax Trends 2016. That’s as much as personal and corporate income taxes combined, and ahead of social security taxes (26%).

One of the reasons why there is a strong appeal for governments around indirect taxes is that they are consumption based and therefore a consistent source of revenue.

Consumption taxes have spread quickly around the world. Invented in Germany and first introduced in France in 1954, VAT is today levied in 167 countries from Albania to Zimbabwe. The US is the only OECD member that doesn’t have a federal sales tax. But 45 of the 50 states, and thousands of local jurisdictions, impose sales taxes, generally collected by retailers and service providers and remitted to the state.

However, the line between taxable and non-taxable items may not always be clear and their treatment may vary from country to country, according to University of Sydney Law Professor Rebecca Millar. Examples include complex multi-party arrangements such as loyalty programs and third-party warranties, she says.

Multi-jurisdictional and digital transactions only add to the increasing complexity of consumption taxes. “The suggestion that VAT is a simple tax fails to take account of the complexity of real-world transactions,” says Millar.

Going on the offensive

Improving collection rates for indirect taxes has become the goal of governments everywhere. After all, a decline in these taxes can threaten the ability of the state to pay its bills or keep up interest payments on its loans.

An EY report on managing indirect tax controversy in 2015 found that 56 countries (out of 82) are sharing information on VAT/GST with different domestic government departments, while 51 countries are sharing VAT/GST information with other countries in an effort to improve compliance and identify risk.

One of the most striking examples to stamp out VAT/GST evasion and fraud was launched in Portugal. The tax authority set up a central VAT monitoring database connected to the systems of all companies achieving sales of more than €100,000 a year. The system quickly detected 128,000 companies with irregularities, and total tax revenue surged 13% in 2013. In the restaurant sector, VAT increased 140% in the period 2011–13.

Golden tax

Similar real-time system link-ups to tackle fraud have been rolled out in Brazil and China. In the latter country, for example, vendors are obliged to enter transaction details into the Jinshui, or Golden Tax software system, to issue a VAT invoice. “China used to have an issue with VAT fraud,” says Ball. “So they implemented the Golden Tax software system.”

In Asia, tariffs and excise duties often remain important components of state revenues, with a focus on audits and enforcement activities.

The challenges of an audit can be compounded by some revenue authority schemes that provide incentives for officials to maximize assessments, says Ball. However, soaring use of data and data analytics, both by authorities and businesses, is changing the way that audits and enforcement will happen, says Ball.

“That’s a tidal wave that’s sweeping through the countries of this region,” says Ball. “I think it’s going to be increasingly used by reformists to address issues of collection efficiency and corruption within the collection agencies.”

Digital drain

But even as governments focus on resolving longstanding indirect tax issues, the digital economy has raised a slew of new, especially cross-border challenges. Mike Semes, EY’s Pennsylvania-based National Director State and Local Tax Controversy Services, says a large proportion of future controversies will arise from the digital economy.

“Our clients want to know what the rules are, so that they can play by the rules,” says Semes. “Further, it is extremely difficult for state laws and regulations to keep up with the pace at which business is changing.”

Semes says online retailing poses enormous tax administration tests. For example, when an online retailer doesn’t charge sales tax to a customer from another US state or country, the customer is obliged to remit the tax, but few, if any, customers do so. As a result, governments are taking a big hit on tax revenues.

Governments must also work to create a consensus on how to address the services side of indirect taxation, which is increasingly the heart of the cross-border economy, says Itai Grinberg, Professor of Law at Georgetown University in Washington, DC.

These issues will become increasingly important going forward as countries rely more on indirect taxes and reduce their reliance on direct taxes, according to Grinberg. “The question is whether that attention is coordinated in a way that prevents cross-border services from being overtaxed on the indirect side,” Grinberg says. “That is probably one of the next serious questions that will arise, both for indirect taxation and for international tax globally.”

On the hook

Since going after individuals is administratively unfeasible, many US states have now adopted what they call a bright-line nexus call to define the responsibilities of online vendors. Even if a company has no physical operations in a particular state, it is liable for collecting and paying sales taxes if the company’s in-state revenues exceed US$500,000. The bright-line threshold exempts small businesses that would otherwise face disproportionate costs from collecting VAT on cross-border transactions.

The European Commission, which supervises tax collection in Europe, has reached similar, albeit stricter, conclusions. In January 2015, the EU shifted to a destination basis for VAT collection for broadcasting, electronic services and telecommunications within Europe. Now the supplier has to collect VAT at the rate of the state where the customer lives, and remit the tax to the government there via the so-called Mini One Stop Shop run by national tax authorities.

This initiative failed to resolve controversy, however, because turnover thresholds at which vendors were required to register for VAT vary from country to country, and EU rules made cross-border online vendors liable for VAT no matter how small their sales. Small sellers of online services, including designers, authors and musicians, voiced concerns about the administrative and financial burdens.

‘Level the playing field’

In December 2016, the Commission adopted its VAT Digital Single Market Package, which seeks to make it easier for e-commerce businesses to comply with VAT regulations. Given that EU businesses are reckoned to incur VAT compliance costs averaging €8,000 a year in each state where they operate, the change is expected to save firms €2.3 billion a year. This should counter intensifying controversy and help innovative start-ups challenge the dominance of existing online platforms.

Australia’s revenue lawmakers have wrestled with similar issues. In 2017, Australia will reduce the AU$1,000 limit under which one can personally import items GST-free, a step that should help “level the playing field between Australian retailers and online sellers,” according to Howard Adams, EY Asia Pacific Law Leader. But this is only a first step in reducing VAT controversy, he says. “No doubt there will be more changes as the tax system tries to keep up with the digital revolution.”

Key action points

- Track legal rulings on VAT liabilities and nexus in jurisdictions where you are present and verify that you are conforming to emerging obligations

- Prepare now to implement new laws and directives on VAT being introduced in the European Union and elsewhere in a drive to tax the digital economy

- Engage with tax authorities early to highlight areas of uncertainty arising from increasing online transactions and help shape new laws

This article was originally published in Tax Insights on 27 Feb 2017.

Summary

When it comes to indirect taxes, the challenges and risks of controversy are many. They include complex legislation and different compliance obligations from country to country, and changing business models. As a result, C-level executives are making these risks a higher priority on their corporate agendas.