The US market will continue to attract inbound investments as foreign institutions look for a less regulated point of entry.

Construction equipment

Spending on construction equipment hit an all-time high in 2017, primarily as a result of increased spending in the private residential construction space. We expect spending to increase into 2019 as billions of dollars in aid are allocated to rebuild infrastructure and housing in areas of the country that were affected by natural disasters, such as Hurricane Harvey in Texas.

If the discussions regarding a multibillion-dollar infrastructure bill are successful, this could lead to a significant increase in demand for equipment financing in the near term and drive M&A in the sector.

Railcar

The railcar equipment leasing industry experienced headwinds during 2017 with demand remaining below replacement levels, resulting in an oversupply of railcar equipment. M&A is expected to remain muted until the cyclical downturn passes. Opportunities exist, but only if sellers are willing to be opportunistic and patient.

Summary

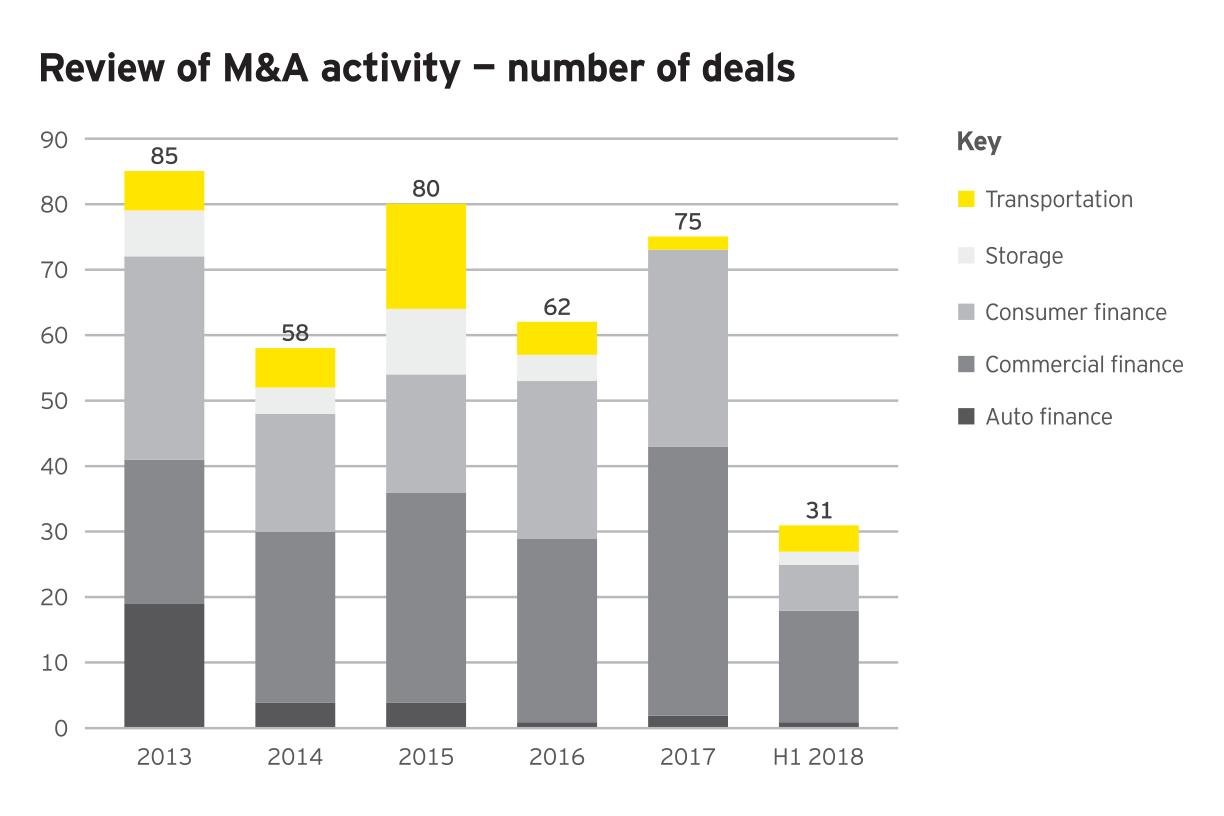

We expect to see an active M&A market within specialty finance as strategic and PE acquirers compete in a high valuation environment for high-yield opportunities.