Extracting the gold from green

To understand how real estate companies and corporate occupiers could create new value from the net zero transition, we surveyed executives who lead some of Australia’s largest property companies and who occupy some of the country’s largest corporate tenancies.

Every corporate tenant we surveyed had set net zero or greenhouse gas emissions reduction targets, as well as 86% of property companies.

Within property companies, our survey uncovered two ‘archetypes’. One subset of companies is compliance-oriented and stepping up their ESG efforts to stay on the right side of regulation. The compliance-oriented companies are investing in green buildings to minimise downside risk and reduce costs. They are less motivated by new opportunities hidden within the net zero transition.

The other subset sees sustainability as a brand booster and a way to communicate and connect with their customers. These brand-oriented companies are willing to take risks with green buildings to win new business and customers. But they see new standards and regulations as a chance to showcase their leadership, rather than an opportunity to drive down costs.

None of the real estate companies we surveyed had aligned the two objectives. A net zero strategy, executed well, can achieve both ambitions and also create new value simultaneously.

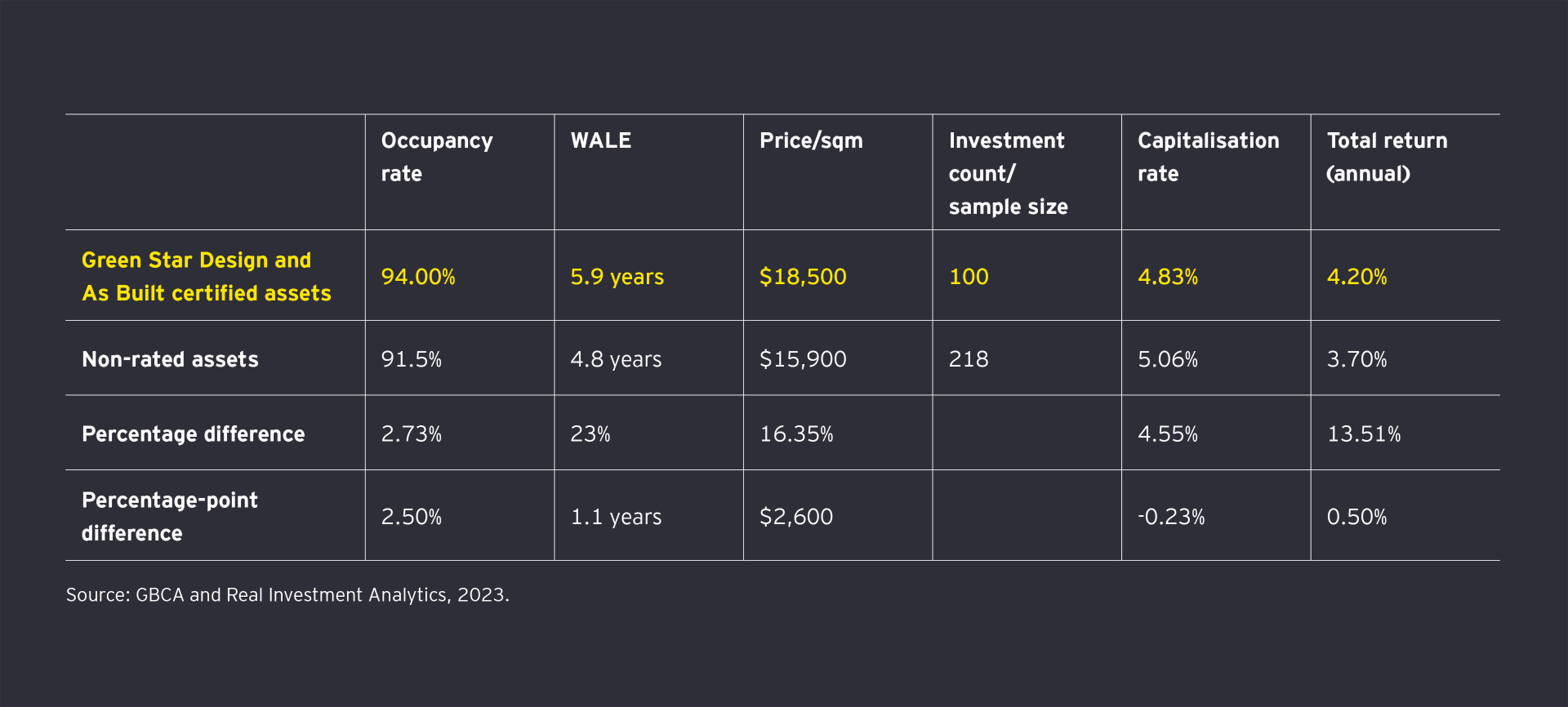

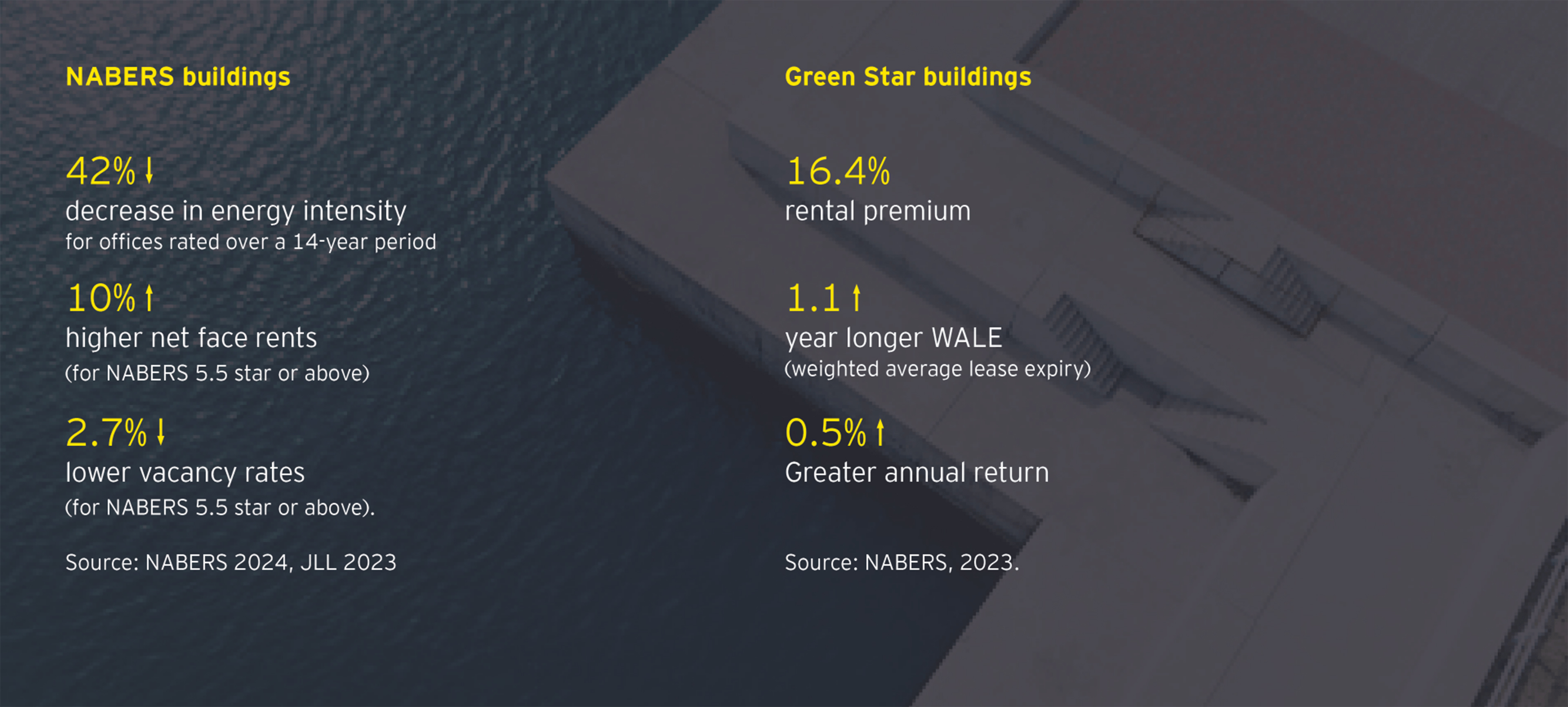

For instance, our survey found 92% of corporate tenants are more likely to stay in a property if it has strong green credentials, and they are more likely to pay a green premium. This aligns with observed market data.