The Energy Superpower advantage

To quantify opportunities for Australia, EY modelled two scenarios: Energy Superpower and Lost Opportunity. Both scenarios assume a world on track to reach net zero emissions, globally, by around 2070.

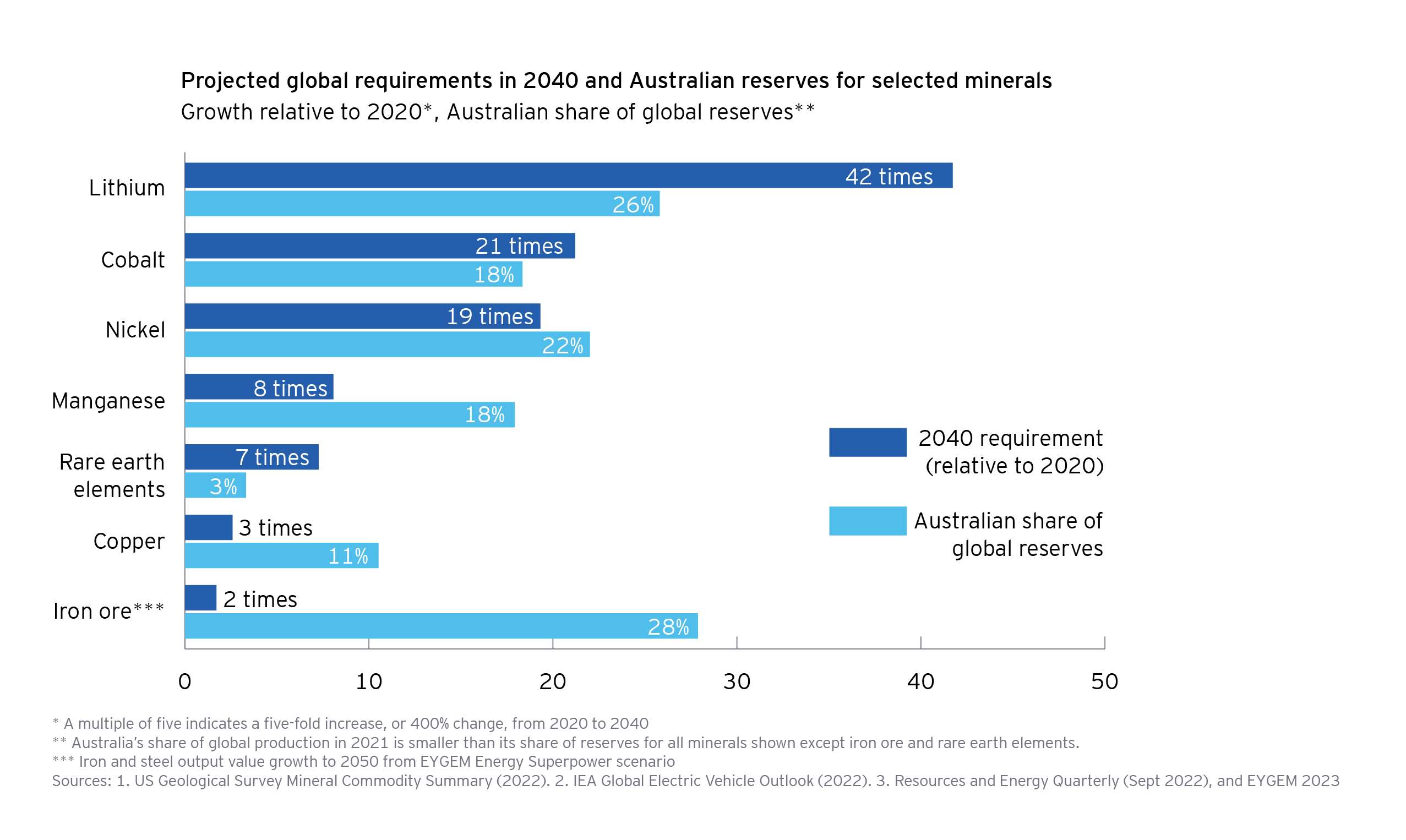

In the Energy Superpower scenario, Australia rolls out cost-competitive firmed renewable energy at scale to grow its share of global materials- and energy-intensive production – particularly in iron and steel. New energy generation and storage is positioned close to raw materials for primary ore processing and early-stage metal-making. Australia creates flexible and efficient industrial ecologies that service key destination markets, particularly in Asia.

In the Lost Opportunity Scenario, policy settings and business strategies do not support the required development of cost-competitive renewables, or wider low-carbon innovations, making investment less attractive. In this scenario, Australia falls behind countries and regions that have coordinated new energy strategies. Instead of becoming an energy superpower, our market share falls and our future opportunities fade.

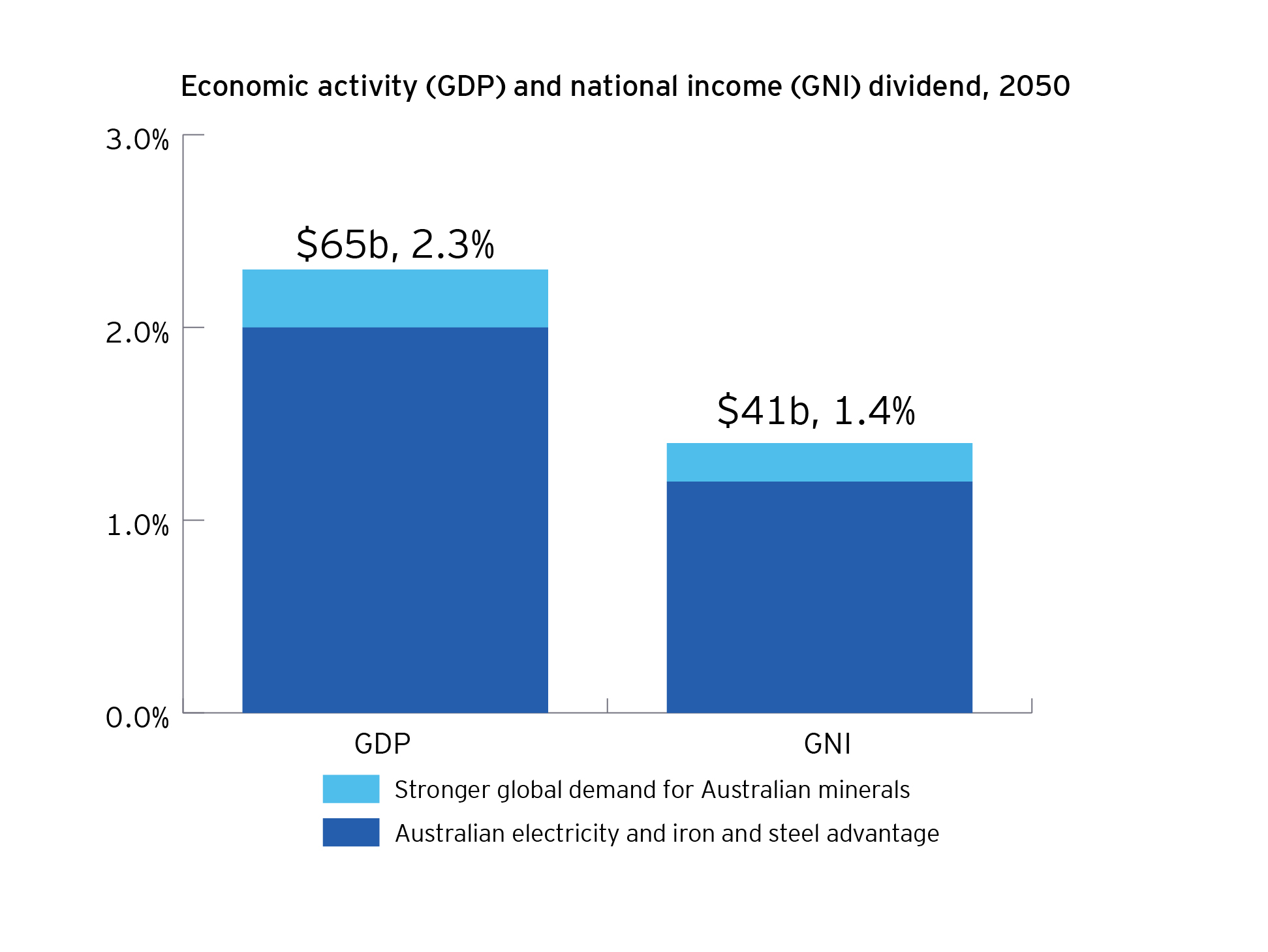

A $65 billion economic dividend

We find the energy superpower dividend adds around AUD$40 billion to national income, equal to $1,100 per person, and around $65 billion to the value of economic activity (GDP) by 2050 (in real 2021 dollars). This represents a 1.4% boost to national income and a 2.3% boost to GDP, relative to the Lost Opportunity scenario.