Chapter 1

Address heightened investor expectations

Capitalize on ESG investing and stewardship trends.

A sustainable investing surge is underway. Driven by many factors, such as investor demand and increasing recognition that ESG factors can be financially beneficial, ESG investing strategies have gone from niche to mainstream to now transforming the flow of capital. In 2020, ESG investing strategies surpassed $1 trillion for the first time on record after net inflows of $71.1 billion in the wake of the pandemic.1 Significant growth in ESG-branded funds and indexes points to continued momentum.2

Investors are also raising the stakes when it comes to ESG stewardship. The high-profile ESG engagement priorities of BlackRock and State Street, as well as the over 3,000 investor signatories to the Principles for Responsible Investment, underscore the strength and breadth of investor commitment in this area, as do related proxy voting and activism trends.3

This year saw a record number of shareholder proposals on environmental and social topics secure majority support, as well as an uptick in the incorporation of ESG factors into activist hedge fund strategies.4 Companies that are signatories to the Business Roundtable’s Statement on the Purpose of a Corporation are under particular scrutiny from investors and other stakeholders regarding how they are implementing that commitment.

It is essential for boards to understand how evolving ESG investing and stewardship trends are impacting access to capital and relationships with investors. They should be sufficiently informed to confirm whether the company is effectively capitalizing on these trends to attract long-term investors and secure shareholder support.

How we see it

We believe capital will increasingly shift to organizations that create value in the long term, across a broader group of stakeholders. Long-term-value creation requires a strategy that is inclusive of stakeholders, business capabilities for successful execution and demonstrated impact in the market through measurement, reporting and a cohesive narrative.

Adapt to significant changes in business context

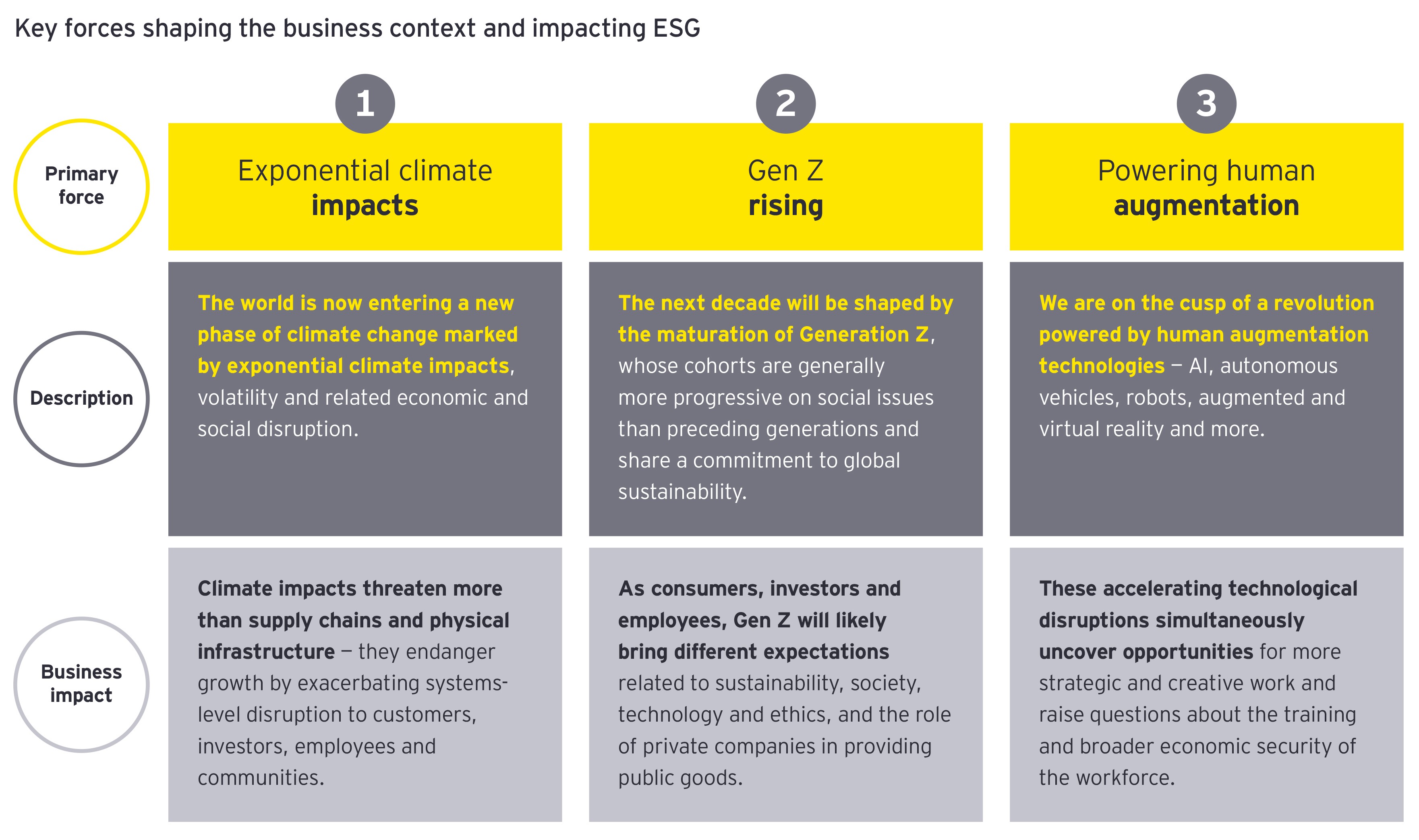

Today’s ESG-oriented investing trends are forward-looking and anticipate profound shifts in the business environment over the long term. Key forces and megatrends that are shaping tomorrow’s business environment, such as exponential climate impacts, the rise of Gen Z, and powering human augmentation, will further sharpen the focus on corporate purpose and the interdependence of long-term financial value and social and environmental factors.5

Maximizing value over the long term can only be accomplished by considering certain stakeholders, including employees, customers, suppliers, community stakeholders and investors. By understanding and adapting to this emerging business context, directors are better positioned to challenge the status quo and support future strategies.

Chapter 2

The ESG ecosystem and developments impacting stakeholder expectations

Know the key players shaping the ESG ecosystem and how your company is viewed.

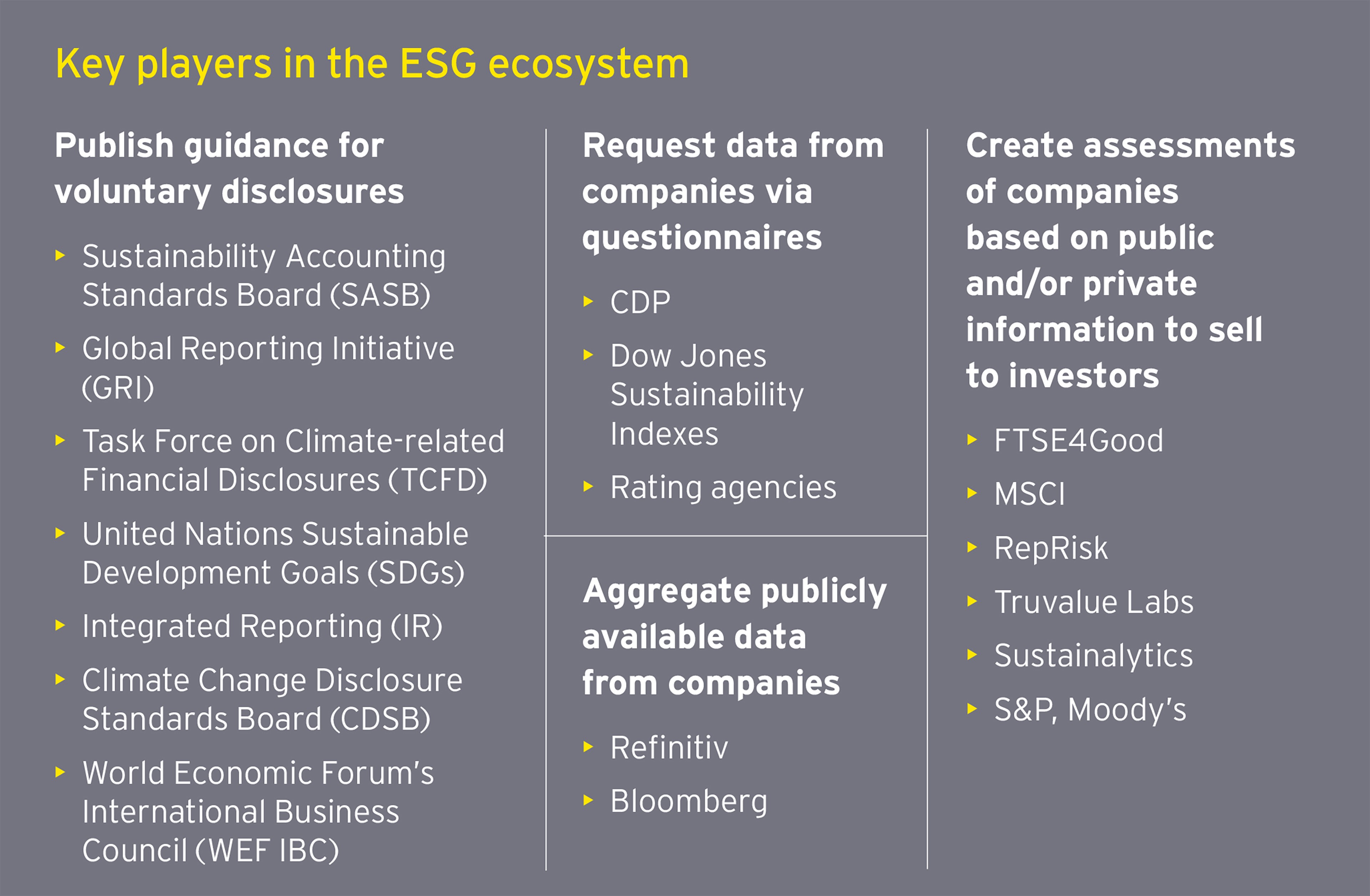

Enabling today’s rapidly evolving ESG investing trends is an ever-expanding ESG ecosystem. Key players shaping this ecosystem include corporate reporting standard-setters that provide guidance for ESG disclosures; data aggregators that structure publicly available data or that request data from companies via questionnaires; rating agencies that create assessments of companies based on public and/or private information to sell to investors; and increasingly in many jurisdictions, regulators.

Depending on the identification of the priority stakeholders and ESG issues, some or many of these organizations could be significant in communicating the company’s narrative. Knowing this ecosystem and how the company is viewed should be part of the board’s oversight of strategic decision-making and communications.

Keep pace with market-driven and regulatory developments

Recent market-driven and regulatory developments are further accelerating standardized ESG reporting and impacting the expectations of stakeholders, particularly investors, subjecting the ecosystem above to ongoing disruption. By staying up-to-date on these and related developments, boards can help their companies keep pace with market trends and stakeholder expectations and potentially get ahead of regulation.

Chapter 3

Guide ESG strategy development that drives stakeholder engagement and value

Know what matters and oversee a materiality assessment.

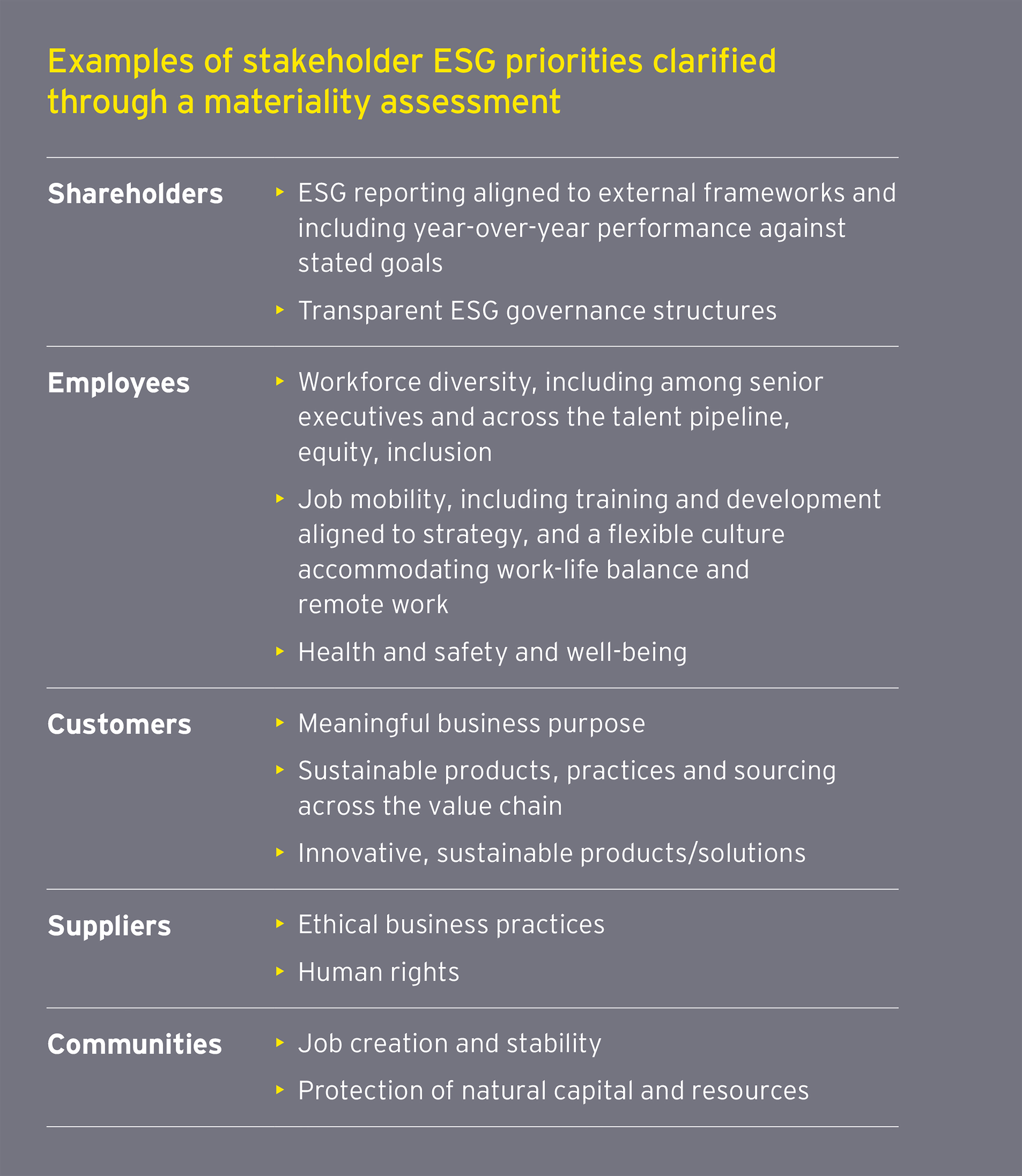

A fundamental step in ESG strategy development is a sustainability materiality assessment. A materiality assessment involves engaging with a company’s most important stakeholders to identify and prioritize ESG topics that are most relevant to the business and where the company can make the most meaningful impact. This is a critical early step as it helps filter the excessive number of ESG issues into a more manageable set upon which to focus.

In this context, the term “materiality” does not reference any particular regulatory definition; it applies more broadly to topics that can have different levels of relevance depending on the stakeholder. Overseeing the materiality assessment helps boards understand and help efficiently drive the social and environmental issues that intersect most directly with the business.

Guide an ESG strategy

Once ESG priorities are defined, then the board should help guide the design of an ESG strategy that strengthens current business initiatives and addresses gaps related to those priorities. With the materiality assessment as the foundation, companies should allocate resources to ESG initiatives that are aligned to the highest priorities and drive long-term business value.

Strategic ESG priorities should be limited in number, focused on the midterm (i.e., bridge long-term aspirations and short-term objectives) and evaluated using scenario planning tools. They should also pull toward the future, address critical opportunities and vulnerabilities and provide concrete guidance that aligns the organization to execute effectively against these priorities.

Oversee ESG goal setting and metrics

It is important for boards to oversee ESG goal setting and the identification of relevant metrics to measure, manage and communicate progress. Suitable criteria for metrics should be defined considering objectivity, reliability and consistency and should leverage external reporting frameworks and science-based goals. Goals should be quantified and have a set time frame with year-over-year progress communicated externally.

The role of the board, particularly the compensation committee, is to consider whether executive pay should be aligned to key ESG goals to incentivize management. Given increasing stakeholder scrutiny of such pay alignment, the compensation committee should be able to provide a clear rationale for how ESG goals are incorporated to the executive pay program, or, if they are not incorporated, why. These measures should also be sufficiently specific.

Provide for transparent ESG governance structures

While organizational and board structures vary across companies, strong governance is fundamental to success. At the board level, oversight structures may provide for the full board overseeing ESG integration into strategy and enterprise risk management (ERM); the audit committee overseeing ESG disclosure processes and controls and obtaining internal and external assurance over ESG reporting; the compensation committee overseeing the alignment of ESG goals to executive pay; and the nominating and governance committee overseeing ESG governance, stakeholder expectations and related board expertise.

Some boards may choose to create a separate sustainability committee or an environmental, health and safety committee to explicitly focus on ESG risks and opportunities. The most effective structure may change based on the company’s circumstances and the advancement of its sustainability journey.

Whatever structure the board chooses for oversight, those responsibilities should be incorporated into board and committee charters and policies, and they should be disclosed. Communicating the board’s processes and structures for governing ESG — as well as the experiences, activities and education that enhances the board’s competencies in this area — is vital to building stakeholder confidence in the board’s leadership and oversight.

Chapter 4

Support the integration of ESG with broader strategy and ERM

An integrated ESG strategy includes considerations related to capital allocation, supply chain management, marketing, partner choice and investments.

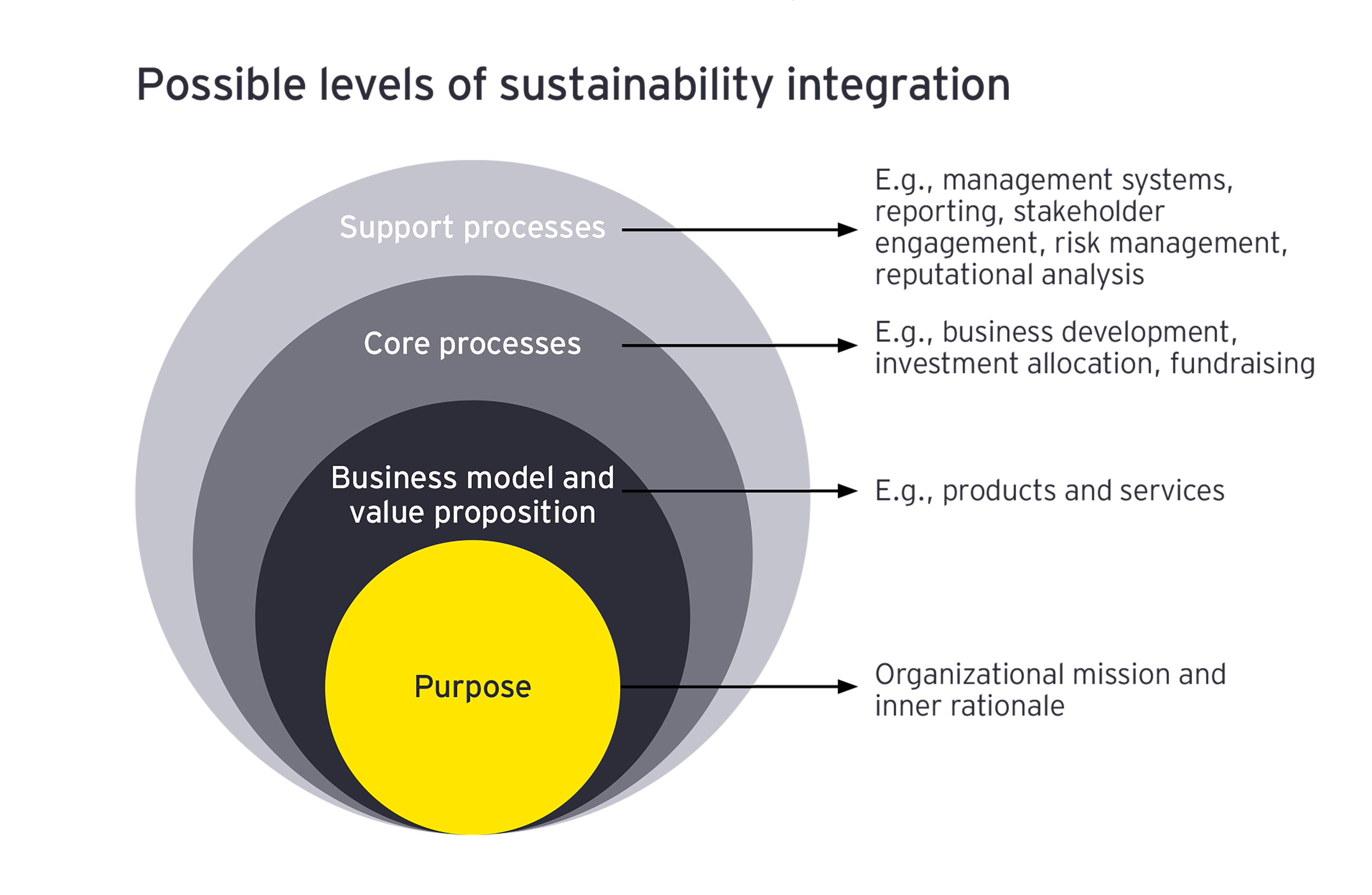

Integrating ESG into broader business strategy can enhance performance and further differentiate the company from its competitors. It involves rethinking and redefining the strategy and operational processes with an ESG lens to enhance competitiveness and sustain lasting profitability. The potential value of an integrated ESG strategy includes:

- Highlighting the sustainability of the company’s business model over the long term with consideration given to material ESG opportunities and risks

- Market differentiation through strategic positioning in terms of sustainability

- Innovation of products, services and processes with sustainability attributes to capture larger market share and address unmet stakeholder needs

- Enhanced brand and reputation among consumers, employees and investors who are increasingly environmentally and socially conscious

- Better relationships with stakeholders, who can obtain a better understanding of the organization’s overall commitments and actions

An integrated ESG strategy also includes considerations related to capital allocation, supply chain management, marketing, partner choice and investments — many of which create ESG risks and opportunities that can impact the business. Ultimately the board can help management move beyond viewing ESG as a compliance exercise to integrating ESG into a purpose-driven strategy that will drive competitiveness across multiple dimensions.6

Mitigate accelerating sustainability risks through ESG integration into ERM

ESG-related risks are among the most significant risks facing businesses today. According to the World Economic Forum’s Global Risks Report 2020, the top five risks in terms of likelihood are all environmental risks (extreme weather, climate action failure, natural disasters, biodiversity loss and human-made environmental disasters), and three of the top five risks by impact are also environmental (climate action failure, biodiversity loss and extreme weather).7 Integrating ESG risks consistently through existing ERM governance practices and processes can help risk management and sustainability practitioners navigate these accelerating ESG-related risks.

In collaboration with the Committee of Sponsoring Organizations of the Treadway Commissions (COSO) and the World Business Council for Sustainable Development, the global EY organization supported the development of guidance Enterprise Risk Management: Applying enterprise risk management to environmental, social and governance-related risks. It offers information and leading practices to organizations seeking to integrate ESG risks into ERM structures and processes utilizing the principles in COSO’s ERM framework.8

By challenging how sustainability risks align with enterprise risk management priorities, boards can help increase the consistency and cohesiveness of sustainability-related risk management. ESG integration into ERM also helps to improve decision-making and resource allocation, reduce disruptions to strategy and operations, minimize financial impacts and improve stakeholder confidence.

Chapter 5

Consider how the company tells its ESG story

Key factors for Boards to consider as they oversee ESG disclosures.

ESG communications and reporting provide stakeholders a broader view into how the company is delivering and protecting value. Further, ESG disclosures provide a forward-looking view and insights into how the company is building resilience and strengthening its competitive positioning. As boards oversee ESG disclosures, they should consider the following key factors.

- Disclosures should align to investor expectations and needs. By aligning reporting to external frameworks, companies can determine whether they are providing the comparable, decision-useful ESG data investors seek.

- Robust disclosure processes and controls must underpin ESG reporting. Companies should have rigorous disclosure processes and controls in place, including those related to data quality. Involving internal audit and obtaining internal and external assurance provides credible, quality ESG data to the marketplace and builds stakeholder confidence in the reliability of this information.

- Unified narrative should be used across reporting domains. While different company communications will target different audiences and have different objectives, all communications should articulate a clear, consistent long-term strategy for value creation.

- Companies should consider whether to integrate material ESG metrics into regulatory filings. Sustainability factors reasonably likely to materially affect the financial condition or operating performance of a company are of particular interest to investors, and when financially material or present a material risk factor, may be required to be disclosed.

The path forward: creating and communicating long-term value

As ESG investing, strategy and communication evolve, material ESG factors will become further integrated into business fundamentals and serve a critical role in how long-term value is created and reported. As the shape of business value continues to change, boards should recognize and prioritize ESG as a business imperative and create transparent governance structures and disclosures to help advance the company’s strategic journey.

By understanding the ESG landscape, overseeing the integration of ESG factors into strategy and ERM, and monitoring how related performance is communicated, boards can enhance their companies’ ability to further create long-term societal, environmental and financial value.

Questions for the board to consider

- Does the company have clear governance structures and processes around ESG at the senior executive and board levels? How is this communicated to stakeholders?

- How is the board keeping pace with market-driven and regulatory developments related to ESG and getting insights into next-generation sustainability risks and opportunities relative to the business? And what experiences, activities and education are enhancing the board’s related competencies?

- Does the board know how key investors view the company’s ESG practices and performance, and how the company is impacted by current ESG investing and stewardship trends?

- How is the company’s strategy and enterprise risk management meeting the needs of key stakeholders, addressing financially material environmental and social factors and driving competitive advantage?

- Does the company have a consistent stakeholder value narrative that is linked to strategy, supported by relevant metrics and tied to key performance outcomes?

- Is the company doing scenario planning to test the sustainability of its business model against accelerating ESG risks and opportunities? How is its capital allocation process informed by ESG considerations?

- Does the company have clear ESG commitments and targets that are communicated both internally and externally? How do these targets align with industry leaders and peer companies, and how does the executive compensation program help drive strategic ESG outcomes?

- Is the company taking the same approach to nonfinancial data as it is to financial data in terms of disclosure processes, controls and obtaining external assurance?

Summary

To sustain and thrive in this new era of accelerating transformation and stakeholder capitalism, companies should embrace ESG as a strategic business imperative. This article explores five ways boards can enhance their oversight of ESG and better position the company to unlock value.