Chapter 1

Workforce issues take center stage

Investor focus on human capital has intensified. Companies are responding.

Investor focus on human capital was magnified this season as the pandemic made workforce health, safety, well-being and compensation central to many companies’ ability to survive and thrive in the face of uncertainty. Further, as racial justice becomes a national focus, workforce diversity and related diversity and inclusion policies and practices are coming under closer scrutiny.

Investors’ prioritization of workforce issues manifested in a number of ways, from publicly-declared stewardship goals to high-profile letter campaigns to record-level support of related shareholder proposals2.

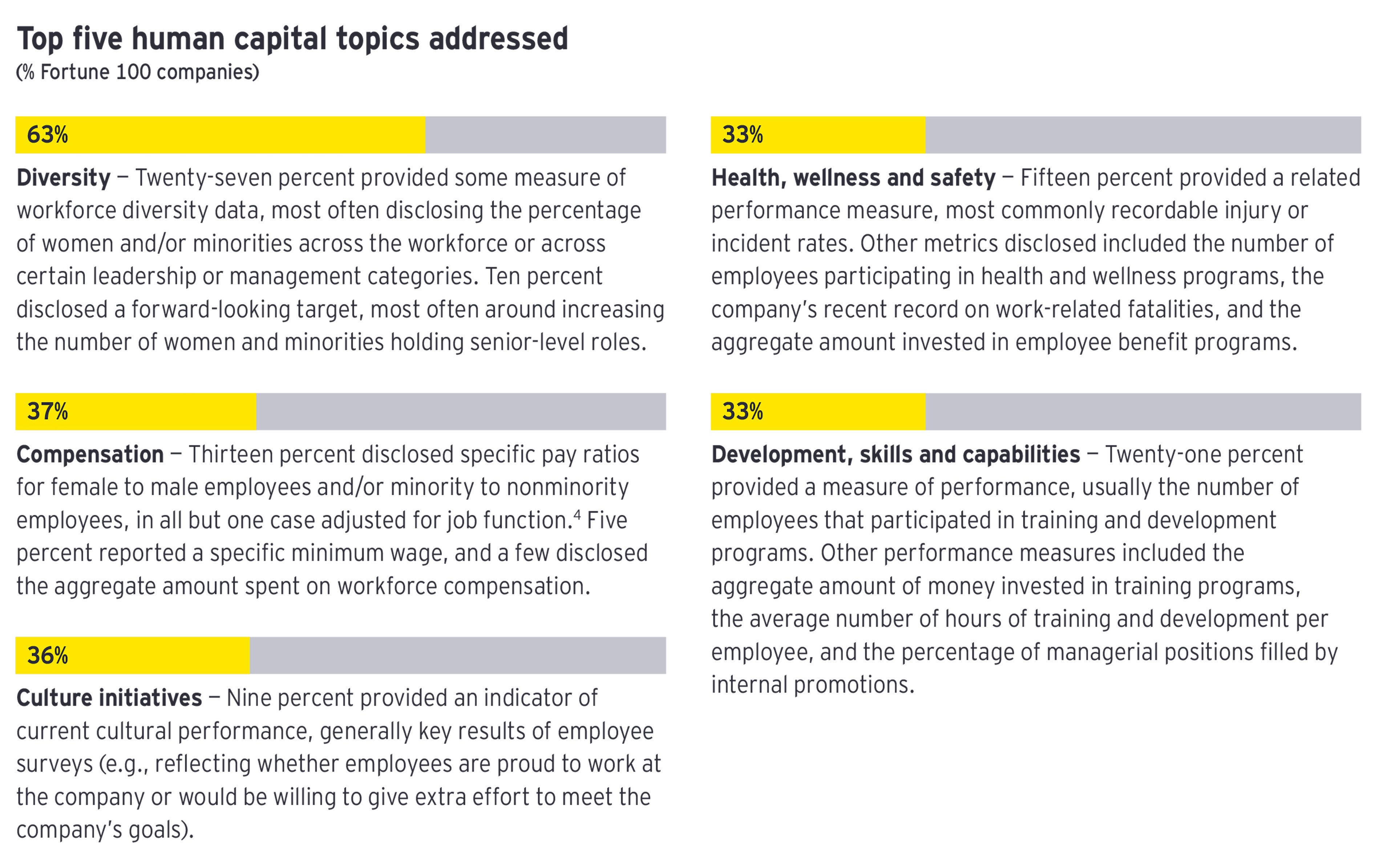

This year’s proxy disclosures demonstrate that many companies are paying attention: the percentage of Fortune 100 companies that voluntarily highlighted human capital initiatives and commitments more than doubled over the past three years, rising from 32% in 2017 to 77% in 2020. Similarly, the percentage of companies that explicitly assigned board or committee oversight of human capital jumped from 28% in 2017 to 69% in 2020, with those responsibilities generally assigned to compensation committees.

Chapter 2

Companies enhance environmental governance and communications

Companies address growing investor focus on climate change and other environmental topics.

While COVID-19 has pulled workforce and community health issues to the fore, addressing systemic climate risk and pressing companies for increased transparency and progress around environmental risks and opportunities remains an investor priority. Votes on environmental shareholder proposals this season reflect this conviction. Among the shareholder proposal topics securing majority support in 2020 are the alignment of company strategy and operations with the Paris Agreement’s goal of maintaining global temperature increases well below 2 degrees Celsius; public health risks of expanding petrochemical operations in areas increasingly prone to climate change-induced storms, flooding and sea level rise; alignment of corporate lobbying with the Paris Agreement; and sustainability reporting describing company ESG performance.

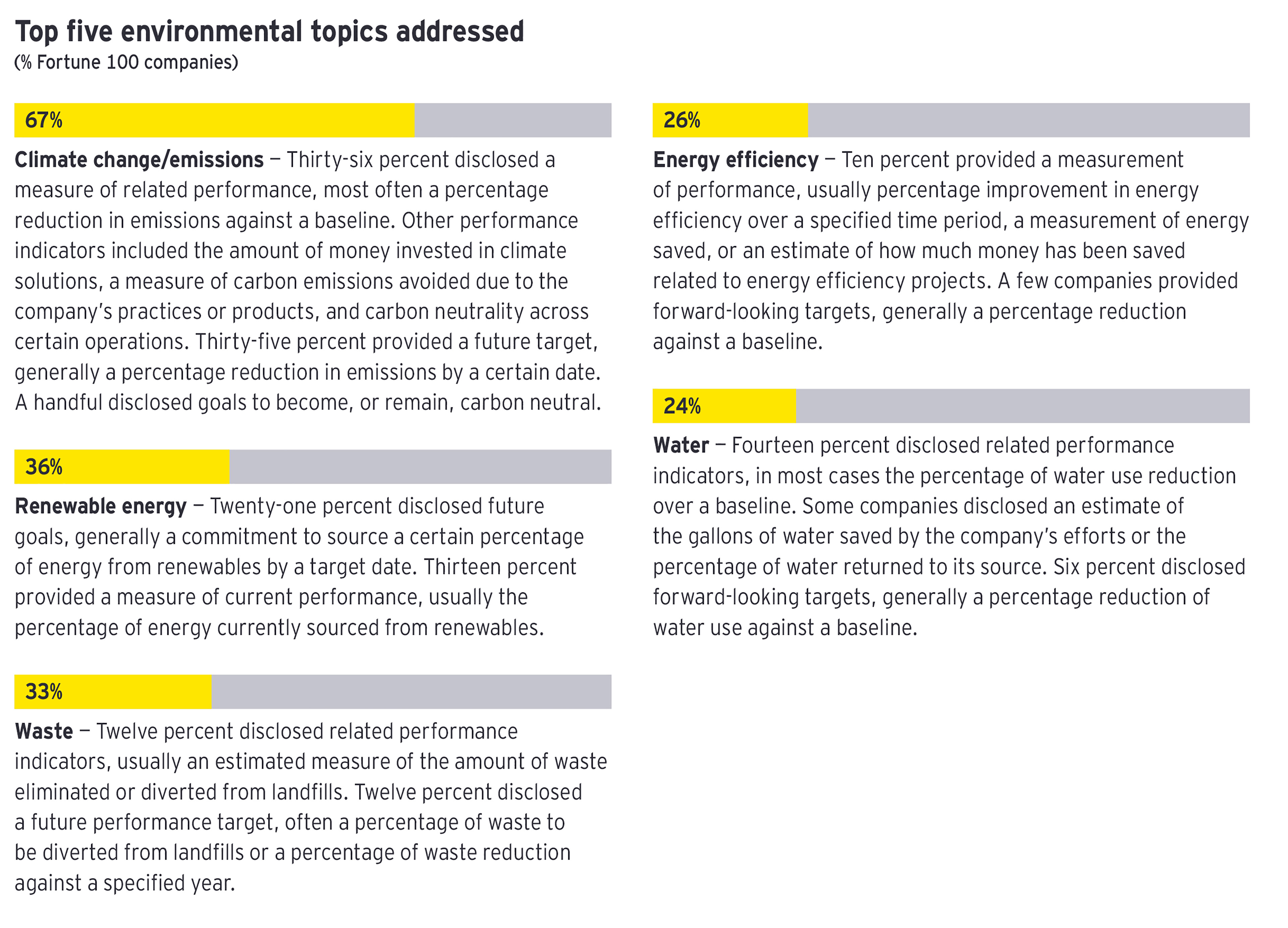

As investors double down on sustainability, companies are enhancing their environmental governance and communications. The percentage of Fortune 100 companies voluntarily highlighting environmental sustainability initiatives and commitments more than doubled over the past three years, jumping from 37% in 2017 to 77% in 2020. Similarly, there has been a significant increase in proxy disclosures assigning board or committee oversight of sustainability, rising from 65% of companies in 2017 to 81% in 2020, with those responsibilities usually assigned to the nominating and governance committee.

Chapter 3

Board diversity and related disclosures advance

The pressure on boards to diversify across a number of dimensions, but particularly gender and race, continues to grow.

Board diversity was the second-highest 2020 engagement priority investors shared with us this fall, with those investors citing diversity as foundational to enhancing board perspectives, deliberations and decision-making.

All-male boards nearly extinct — number of women on boards rising

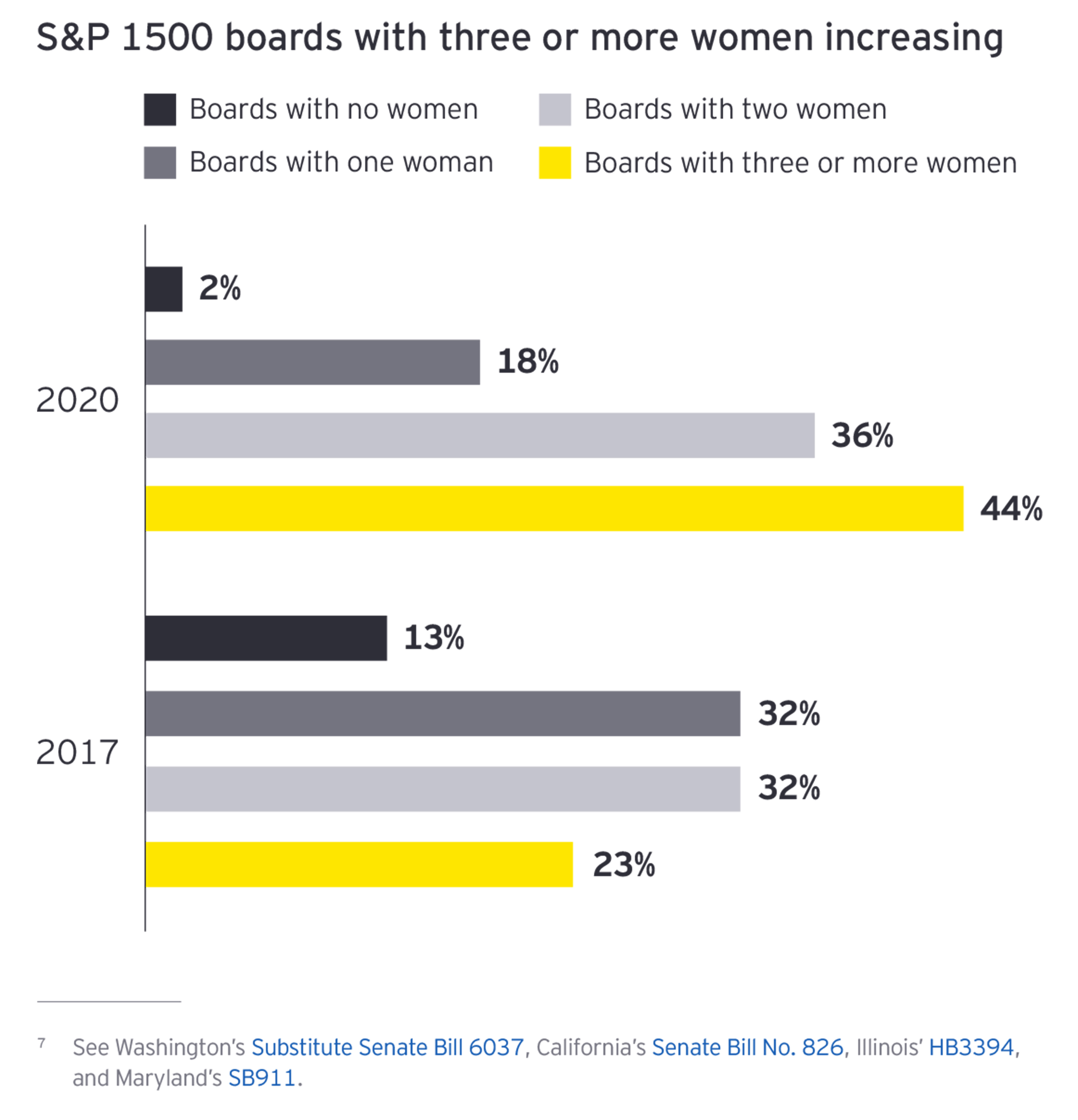

Close to half of the boards of S&P 1500 companies now have three or more women, almost doubling the percentage that did so three years ago. At the same time, all-male boards have nearly disappeared. A more dramatic shift is underway across the S&P 500, where all boards now have at least one woman and two-thirds have at least three women.

In addition, the percentage of women-held directorships across the S&P 1500 has continued to increase by at least 2 percentage points annually since 2018, reaching 26% this year. Prior to 2018, that rate had increased just 1 percentage point each year.

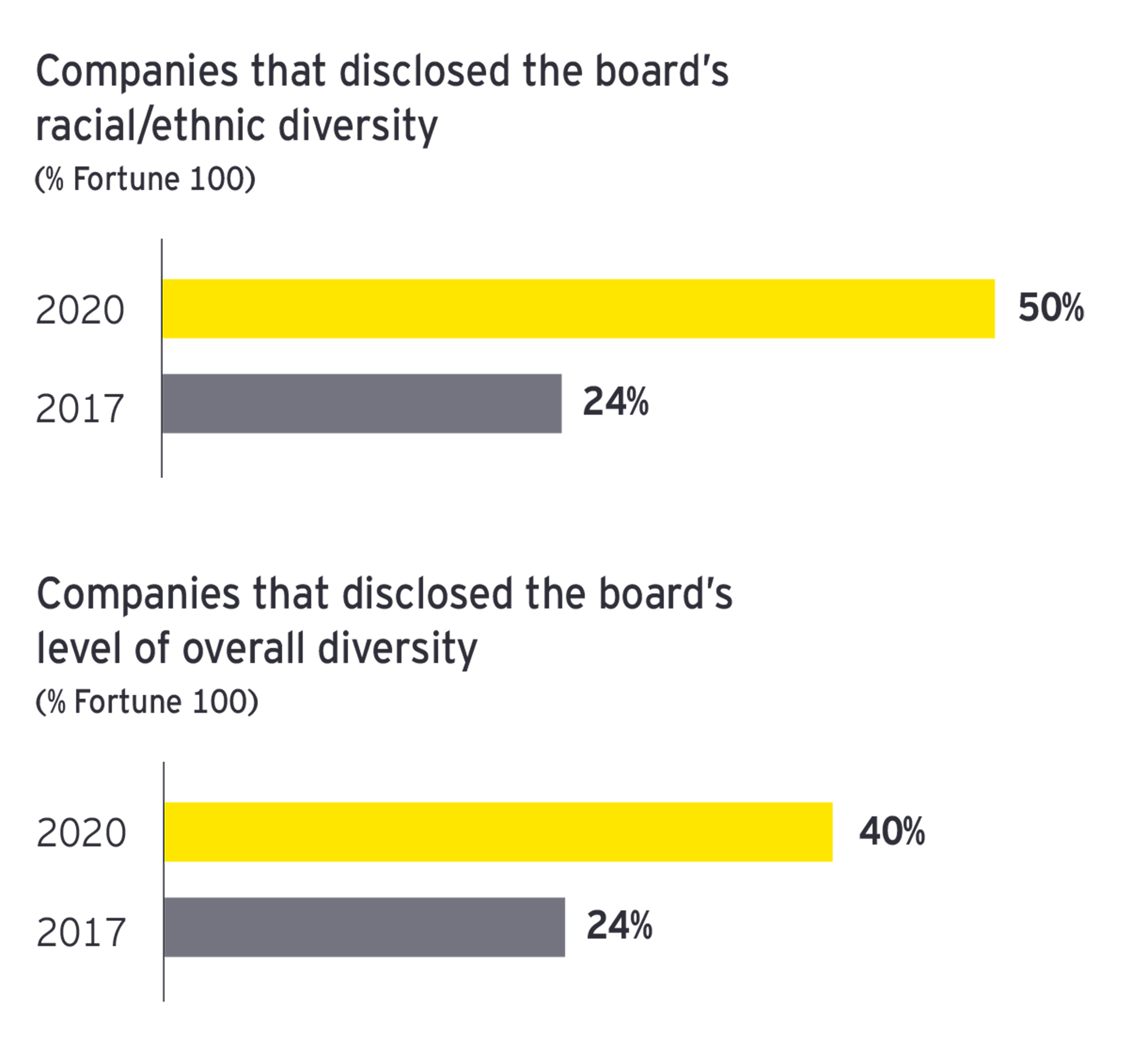

Racial/ethnic board diversity disclosures continue to climb, but unclear if such diversity is advancing

More companies are voluntarily disclosing the board’s racial/ethnic diversity, with half of Fortune 100 companies doing so this year, up from 24% in 2017. More boards are also disclosing their aggregated diversity, combining diversity across gender, race, ethnicity and sometimes other identity categories to provide an overall percentage of “diverse” directors. This year, 40% of the Fortune 100 disclosed the level of overall diversity on the board, up from 24% in 2017.

Enhanced racial/ethnic diversity disclosures largely hinge on director willingness to self-identify,3 and some directors may choose not to do so for personal reasons. Without these disclosures, it is unclear if racial diversity is advancing. Among Fortune 100 companies that voluntarily disclosed the board’s racial/ethnic diversity this year, that level of diversity averaged 25%, which is the same level of racial/ethnic diversity for Fortune 100 companies making those disclosures in 2017.

Chapter 4

Virtual annual meetings surge

COVID-19 catapulted virtual meetings into the mainstream.

From a governance perspective, a key development of the 2020 proxy season was the surge in virtual-only shareholder meetings. While the number of companies having such meetings has increased in recent years, COVID-19 catapulted this minority practice into the mainstream. More than 2,200 virtual meetings were held in the US market this year, up from 286 for all of calendar 2019. A vast majority of these companies were holding virtual meetings for the first time.4

Investors have raised concerns about some of their experiences in the 2020 meeting season. Reported problems include challenges logging into meetings, inability to ask or get answers to questions and a lack of transparency on questions asked by shareholders. Some governance practitioners have assessed this year’s virtual meeting results and are suggesting enhanced approaches that optimize technology to enhance shareholder attendance and engagement and aspire to replicate an in-person meeting5.

Proxy season 2020 unfolded as the COVID-19 pandemic locked down people and economies globally and wrapped up amid civil unrest related to the recent and ongoing injustice against the Black community. These events, on the heels of other macro developments — such as shifts away from globalization, sustainable investing going mainstream and climate change becoming a dominant business and political issue — are reshaping the global business environment.

A number of key business trends are accelerating, including digitization and the transition to virtual working environments, the diversification of supply chains, and stakeholder capitalism as the pandemic underscores the interdependence of long‑term financial value and social and environmental factors. The growing global focus on racial and economic justice and equality is already further sharpening the spotlight on companies’ societal role and how, and for whom, capitalism creates value.

In this environment, long-term stakeholder value — inclusive of ESG factors — is more clearly emerging as a critical lens through which to assess a company’s resilience and competitive differentiation. Through this lens a number of topics are emerging as key areas of focus for investors and company engagement over the coming year, including risk management and resilience, supply chain, human capital, executive pay, capital allocation, environmental risks, stakeholder commitments and long-term value.

Summary

To help boards navigate this new normal and meet evolving stakeholder expectations, this report examines four ESG developments from the 2020 season and considers how investor and corporate perspectives and priorities are changing in the wake of the pandemic, the growing push to eradicate systemic racism, and other macro developments.