Chapter 1

Expectations are changing

According to EY research¹, SMBs represent about 90% of businesses and over 50% of worldwide employment, and contribute to over 40% of national GDP in emerging economies. This segment is a significant market opportunity for financial institutions.

And this matters to society too. Allianz analysis estimates that, in mature markets such as Europe, there is a 3% of GDP gap that could be closed if SMBs received the banking services they need.2

For years, traditional financial institutions have acted as a one-stop shop for SMBs’ financial needs. This client segment’s expectations were set by the FI’s offerings in terms of products, services and distribution strategy. Traditional financial providers were driving the show. Simply put, financial institutions served SMBs by answering a very simple question: what products can we sell you?

Today, there is a new market reality, where dynamics and expectations are being driven directly by customers. Although their needs differ from large commercial enterprises, SMBs now expect the same level of service from their financial institution that large organizations are accustomed to.

Furthermore, they expect a more personalized set of services aligned to their specific needs. For instance, SMBs expect their FI to provide services 24/7, making “bankers’ hours” a thing of the past. Next, mobile-friendly services are a must, given that SMBs do much of their business on the go. Further, banking platforms need to be easy to use and offer tailored services. As a Forbes study3 suggests, financial institutions will achieve a potential breakthrough when they will anticipate the needs of their SMB customers and tailor advice and experiences accordingly.

SMB customers are increasingly using mobile solutions for their finance-related needs. In 2019, according to a J.D. Power study4, 61% of SMBs use banks’ mobile apps vs. 53% the year before.

Given these new expectations, an appetite has emerged to use non-traditional players, namely FinTechs, which meet the new product and service standards better. This means approaching the market with a client centric lens and asking what do SMBs need to run their businesses and make their lives easier?

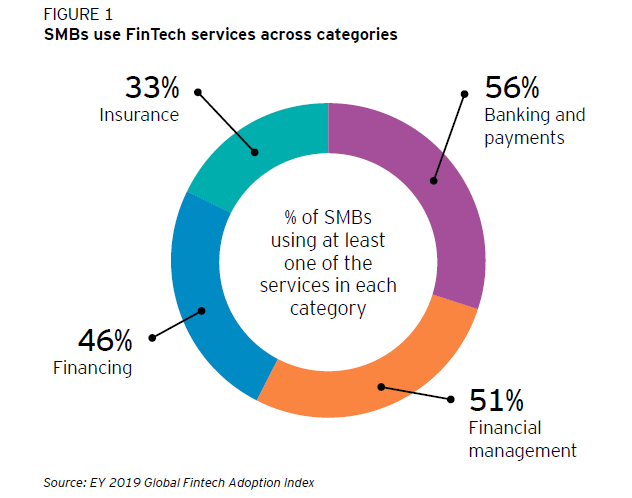

According to the EY 2019 Global Fintech Adoption Index, 53% of SMBs have used products and services from FinTechs in at least one category in the last six months. Furthermore, a quarter of SMBs worldwide have leveraged products and services from FinTechs in the past six months in all of these four categories: banking and payments, financial management, financing and insurance.

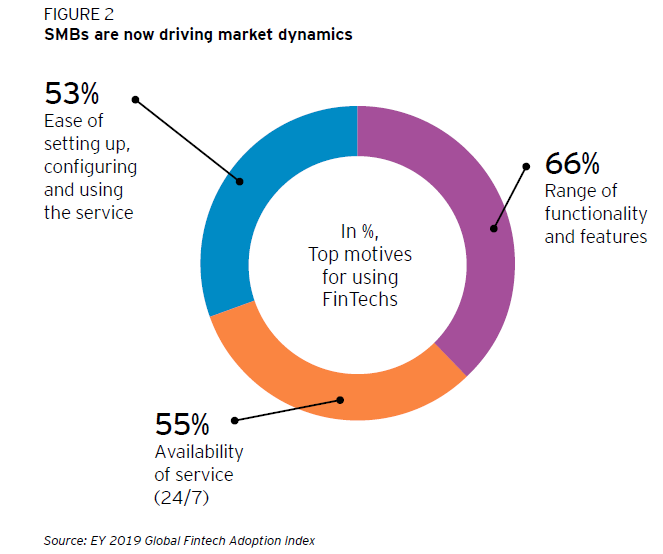

According to the same EY report5, the core motives behind using FinTechs products and services included ease of setting up, configuring and using the service, availability of service (24/7) and range of functionality and features.

Traditional FIs are generally not tailoring their service offerings to small businesses’ needs. SMBs are willing to go to multiple, non-traditional financial service providers and have grown increasingly happy with financial unbundling (i.e., using multiple providers) to best meet their needs.

Just as important, the ubiquitous technology ecosystem players (GAAFA) outside of traditional FIs, which have a high degree of trust and high volume of customer data, have identified an opportunity to proactively expand their offerings to address SMBs’ needs.

In summary, market dynamics have changed. Not only have SMBs’ expectations changed, but they are also adopting new entrants’ services in the FI market to meet these expectations. This threat requires a fast and powerful transformational response from incumbent financial institutions.

Chapter 2

SMBs’ new needs

New entrants to the FI market have been successful by bringing a broader client-centric lens and meeting needs, rather than selling products. What are these needs? Where are the “blind spots” for banks?

These needs fall into two categories:

- Addressing traditional banking and financing needs better: SMBs need fast access to credit with non-traditional scoring (over 20% of the market in the UK and the US is covered by online financing6) and services around cash flow management. According to an Intuit study7, “69% of small business owners are kept up at night with concerns about cash flow.” This is clearly a pressing issue for SMBs, yet is not being adequately addressed by traditional banking providers.

- Addressing broader needs of business owners: SMBs are looking for services around managing the business, such as: payroll, expense management, accounting, invoicing, financial planning, legal and contracts, procurement and taxes. While these services do not map neatly to banks’ traditional product categories, they are of high value to SMBs given that they spend a significant amount of time on these activities. On bookkeeping alone, SMBs spend 1/6 of their time8. This is an area where banks could be helpful given the data and scale available to them, and since these activities are closely linked to cashflow and viability implications for the business.

Chapter 3

New entrants are already here

This shift in market dynamics has already brought new players to this market to tap into these unaddressed needs.

Addressing traditional banking and financing needs better

FinTechs are taking advantage of the opportunity by applying laser focus on the services they offer to SMBs and being nimble to address issues around cash flow and fast access to credit. The following are examples of a few new FinTech players that are disrupting the financing landscape.

- One FinTech offers credit decisions in minutes for SMBs. First, customers share basic information about their company. Then, they connect their accounting software and/or bank account to the FinTech to get a credit decision.

- Another FinTech is a crowdfunding platform for SMBs that offers rewards-based and equity-based campaigns for small businesses with $570m in funding to date. Customers create their profile, select if they prefer reward or equity for their funding needs and then start their funding campaign by sharing and telling the world about their fundraising.

- A third FinTech example is one that allows companies to apply for a business loan in just 15 minutes without fees or obligations. Once the application is complete, the SMB customer can choose from over 75 leading US lenders.

Tech-driven ecosystem players are moving into the same space, taking advantage of the data generated by their core business activities to provide solutions to credit needs. For example, a ride-sharing company entered the financial services space by launching an application that allows drivers to get paid sooner (e.g., after each ride), creating a win-win scenario for the company and its drivers; however, effectively eliminating the traditional intermediary.

Another example is of an e-commerce giant that is now offering point-of-sale financing, a solution that provides business loans to Amazon sellers. The magnitude of data collected by Amazon on its sellers allows the company to enter the financing market and offer loans that are usually disbursed in less than five business days, without any origination, application fee or prepayment penalty.

Finally, a hospitality disruptor launched a program in collaboration with a mortgage financing company to help their platform users refinance their mortgages. Selected lenders have adapted to new market realities by recognizing these users’ income earned through the platform in their application for mortgage refinancing. For better refinancing terms (e.g., lower borrowing costs9), these clients can leverage new solutions offered by traditional banks.

Addressing broader needs of business owners

FinTechs are also tapping into other business and finance-related needs that SMBs tend to have, such as accounting services:

- An accounting software company helps SMBs with an online accounting software that simplifies invoicing and accounting. The software allows its users to collect payments and pay invoices entirely online and keep track of their finances with automated reports and insights.

- A tax services FinTech simplifies tax compliance through automation. Through APIs (application program interface), the software allows for integration with other platforms such as Microsoft Dynamics, Salesforce and ShopifyPlus to help businesses meet their tax obligations (e.g., sales tax, excise tax, lodging tax).

- A UK business finance lender, with a niche in invoice processing, business loans and corporate finance solutions, was the first to allow SMBs to borrow against individual outstanding invoices.

Another example of how FinTechs are successfully serving the SMB segment by offering business management solutions includes offering an accounting software that helps SMBs manage their cashflows by sending online invoices and reconciling their books. The software allows the SMB client to connect to their bank account to the cloud ledger and, every morning, data flows to the software without the need for manual data entry.

Payment solutions such as Square are disrupting merchant services with easy-to-use payment solutions. Moreover, they are now offering capital through business loans, full-service payroll, invoicing solutions and dashboard and analytics. SMBs only need to select the amount they would like to borrow, and the repayment terms appear as a percentage of their daily sales.

Chapter 4

Addressing broader needs of business owners

The challenge is around both addressing traditional banking and financing needs better, while also addressing the broader needs of the business owner. How have FIs responded?

Doubling down on improving existing offerings

Canada’s banking market leader, with close to 20% market share, looks to solidify its position through continued investment in innovation. These investments have included the rollout of new SMB-focused features on the bank’s mobile app, a financial snapshot dashboard, quick access to Interac e-Transfer and NOMI Insights to gain financial insights on how small business owners are spending and saving.

A major European bank offers a more tailored financing solution for SMBs, which combines two tranches under one contractual arrangement (e.g., a traditional medium-term bank loan repayable over some five years plus a long-term loan of 7 to 10 years provided via the debt fund), reimbursable in full at the date of maturity.

And in 2018, a US bank launched a new service for small businesses that enables online loans and lines of credit of up to US$100,000 through a simple online application. The bank also provides financial advice through relationship managers, going beyond the traditional scope of services SMBs have grown to expect from their bank.

Launching new offerings

In Australia, a large bank launched a separate platform (integrating to their platform) that acts as a hub for SMB business management tools, Wiise. Wiise empowers SMEs to take control of their business by combining accounting, payroll and banking, and operational functions like HR, inventory and manufacturing.

A Canadian bank has created a standalone banking start-up for SMBs to challenge app-based competitors. On this B2B platform, SMBs can connect with each other via their trusted networks. Primarily focused on the clothing and garment industry, the app helps SMBs build supply networks and connect buyers and sellers. This is a true evolution from the bank’s traditional business model, i.e. providing financing and deposit solutions.

A national Canadian bank, which is exclusively devoted to entrepreneurs, offers a broad range of complimentary advisory services for the country’s entrepreneurs. This financial crown corporation is providing tailored advice on how its SMB clients can better manage their businesses (e.g., strategic planning advice, human resource advice or even post-merger advice). They also advise Canadian SMBs on finding ways to increase their revenues and optimize their operations. This level of service goes beyond what traditional banks typically offer this client segment.

Partnering with FinTechs

We also see examples of traditional players joining forces with FinTechs to accelerate the development of new offerings to the SMB segment.

In Canada, the country’s largest credit union, partnered with a FinTech in 2019 to launch digital account opening. This allows potential members to open accounts in less than five minutes.

In early 2020, a major bank in the UK announced that it was partnering with a FinTech to offer single-invoice insurance, which helps SMBs protect themselves from insolvency and late payments. This partnership resulted in exponential growth for the FinTech partner, as a result of the bank’s accelerator.

According to a Barclays study, 58% of SMBs turn away new business opportunities due to an inability to offer credit terms10. Banks should seize this opportunity and partner with FinTechs to close this gap.

Chapter 5

Response so far from traditional financial institutions

From increased competitive pressure to new client expectations, traditional financial institutions are faced with an opportunity to better serve the SMB market.

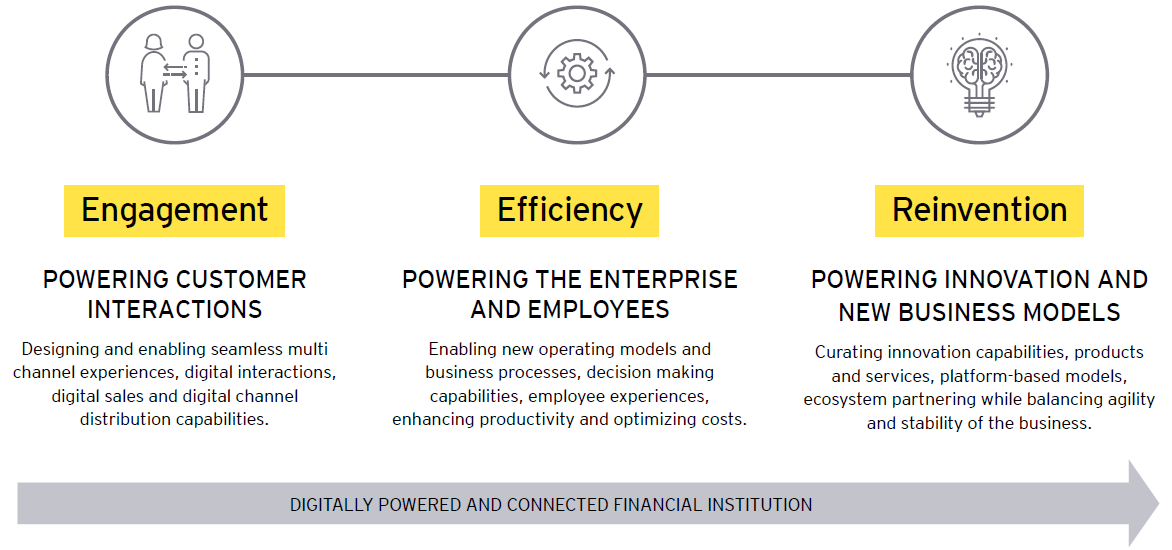

We believe that by being digitally powered and connected, financial institutions can create the right SMB customer interactions, power their enterprise and their employees to provide the right experiences and solutions to their SMB customers. It is through engagement, efficiency and reinvention, that FIs will foster innovation and new business models, which the SMB market needs.

FIs have significant advantages to play to — the broadest existing relationships and level of trust with clients, knowledgeable employees, strong distribution footprints and customer data to fuel engagement and reinvention.

Financial institutions can take advantage of their strong position with SMBs by owning more of the relationship. While others may have single products, FIs are still more likely (for now) to meet SMBs’ multiple needs and have the most frequent touchpoints as a result of checking/savings type products, and often through a mobile device. They can capitalize on their range of service offerings, and perhaps more importantly, on their rich client insight, to create greater loyalty through more integrated and personalized interactions around the SMB’s life stages – start, grow, thrive and retire.

At a basic level, this means that everyone in the bank should have a clear view of all holdings, statuses, requests, issues and potential needs when interacting with the customer, and have prompts to guide the interaction. This means being proactive and showing that the FI is on the client’s side by reaching out at the right time and in the right way. For example, the FI could connect with their client through text to offer reminders or tips. Taking a customer journey-led approach is often a good first step to structure the right end-to-end experience, which may combine both financial and non-financial products and services.

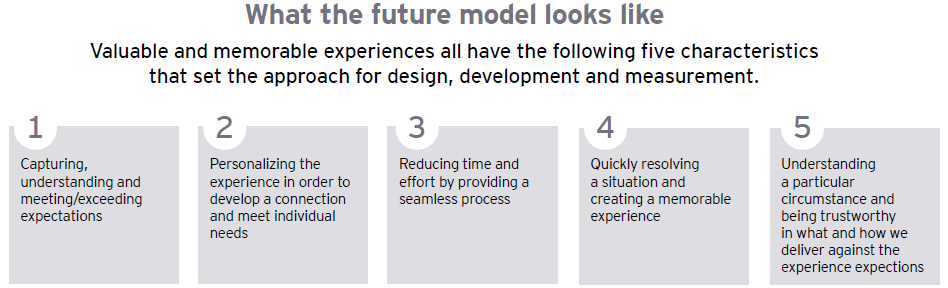

Financial institutions can design and develop seamless multi-channel experiences for their SMB clients. EY research shows that 68%11 of customers want more proactive service. SMB customers expect the same level of service online as they would receive in a traditional branch. To enable this level of experience, traditional FIs should focus on every level of digital interaction, enable digital sales and service activities, and review their distribution channel strategy. The experiences that will bring the most value to SMB customers will need to have five characteristics, noted in the diagram below, that set the approach for design, development and measurement.

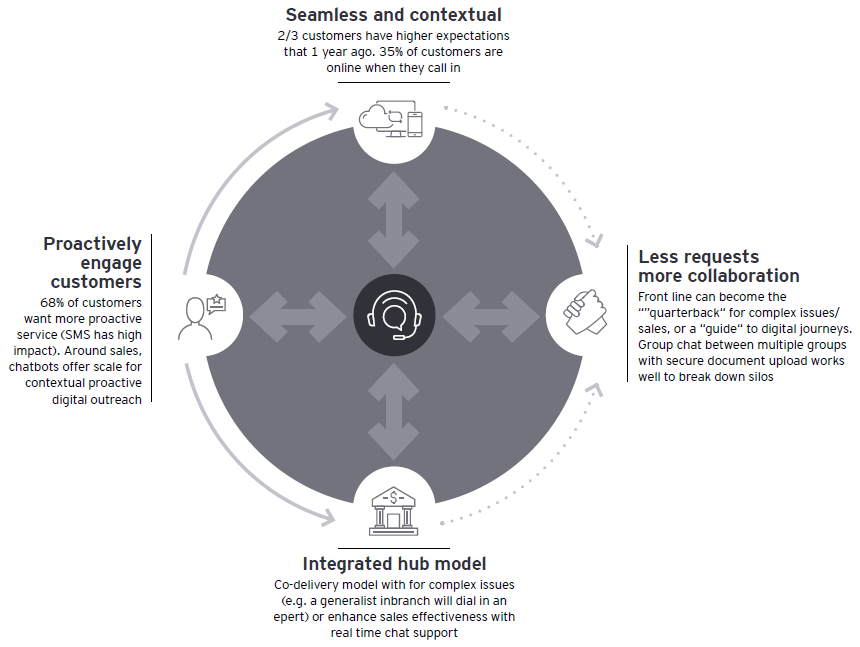

An EY study shows that approximately 66%12 of customers have greater expectations today in the way their banking providers serve them than they had one year ago. So how can financial instutions adapt their business model to foster client engagement in the SMB market? We believe that FIs should shift their current models to become oriented towards proactive engagement, seamless service, personalization, and collaboration, as well as by offering an integrated hub for all small business financial and non-financial needs.

Digital engagement is merely the first step to capture the SMB market opportunity. SMBs want their financial institutions to serve them faster and adapt more quickly to their evolving needs. So how could FIs achieve greater efficiency in serving their clients?

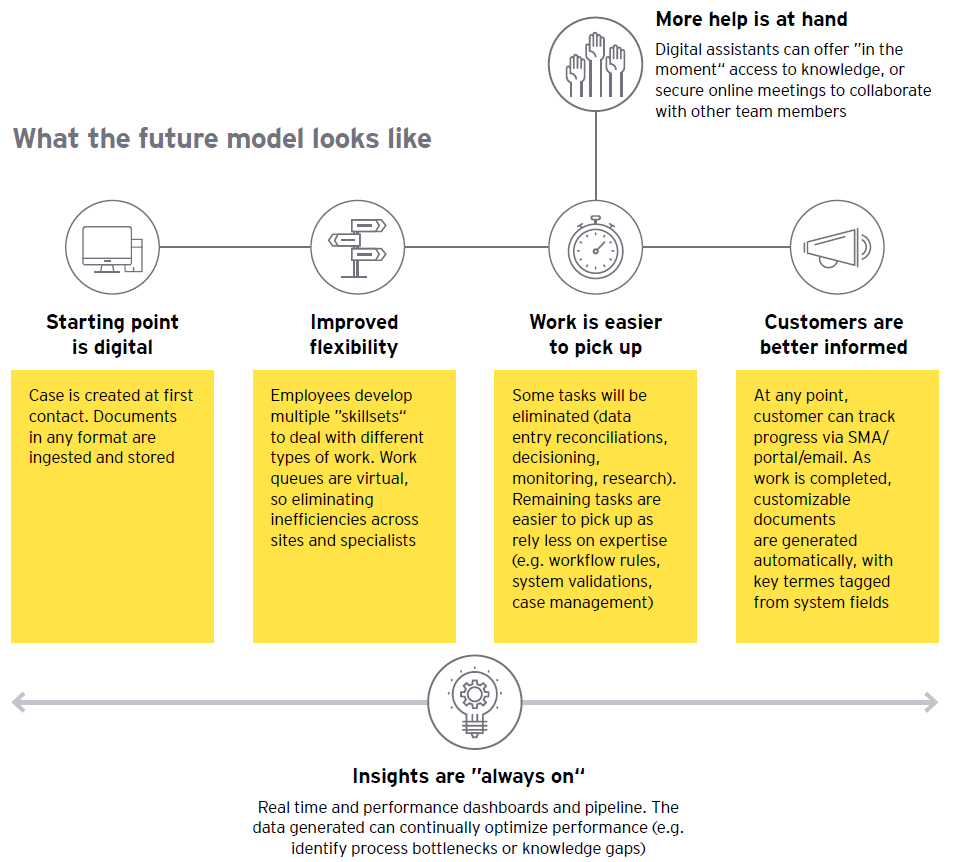

FIs should take advantage of the most important resources they have – their people. It’s through their people that banks have a deep understanding of customers’ behaviours, often at the individual level. Through new ways of working and targeted implementation of digital levers, banks can improve their efficiency and effectiveness to become more nimble and future ready.

Managers should encourage front-line employees to identify efficiency opportunities in the way the bank functions and how clients are served. A digital organization listens and acts at both the individual client and big-picture level, with feedback clearly impacting the change agenda. A digital organization also empowers employees on a daily basis, with fewer silos and more support, through more integrated processes (e.g., workflow through a case management system) and/or more readily available knowledge (e.g., providing digital assistants or formalized use of internal instant messaging for in-the-moment support).

Managers have an important role to play in augmenting their people. Digital enablers such as intelligent automation – including robotic process automation, machine learning and artificial intelligence – can quickly automate processes, as well as decision-making, while reducing manual effort of repetitive tasks. Furthermore, digital agents/virtual assistant/chatbots can help guide inquiries. Optical character recognition can likewise be used for an end-to-end digital flow, removing paper.

Increasingly, advanced analytics can extract insights from less structured data sources. And as technologies move to the cloud, the barrier to adoption is less and less about time, and more about understanding how the bank’s future operations with respect to risk management will work.

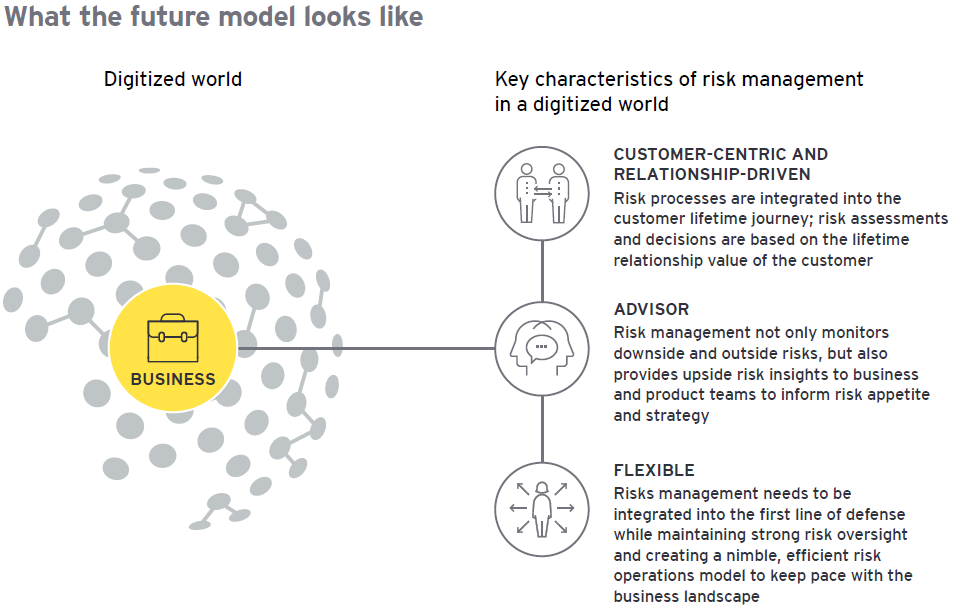

Risk management activities also should be digitized to adapt to new market realities. This can bring efficiency and help FIs serve their SMB customers more quickly. FIs should ensure that their risk management processes are integrated into the customer lifetime journey. By adopting a holistic perspective in their risk assessment processes, banks can foster long-term relationships with their customers. Further, with efficient back-end risk processes, front-line bank employees can be more flexible and spend more time advising their SMB clients. By gaining visibility to both downside risks and to potential upside risks, the salesforce can better inform their clients, thereby improving the way they serve them.

How EY can help

Digital strategy and transformation

We help companies thrive in the Transformative Age by refreshing themselves constantly, experimenting with new ideas and scaling successes.

Read more

Financial institutions could take advantage of the data they have on their SMB clients, such as their financial habits interacting with the bank, and leverage these insights and trends from the data to fuel innovation and reinvention.

Transformation is no longer a periodic exercise (e.g., a big multi-year project that comes and goes) — it’s ongoing, flexible and happens much faster than it did in the past given how quickly the market changes. Transforming engagement or efficiency on a continuous basis requires a new mindset and approach around innovation.

To create entirely new business models (e.g., platform-based models and ecosystems) or revenue streams and products (e.g., monetizing insights from data), a new approach is needed – to identify, accelerate and de-risk these initiatives.

- This new approach of industrialized innovation relies on building blocks that can be thought of as modular, but that come together to apply disruptive technologies in a scalable way, help develop innovative ecosystems or contribute to new platforms.

- Financial institutions can leverage our proposed digital approach (discover, define and ideate) on their business model. Specifically, FIs that serve SMBs should address the deficits in both what products and services they offer and how they offer those products and services. They should develop data-centric offerings, meaning increasing tailored interactions around tips on reducing spend, or perhaps provide guidance around the “best location for your next medical office”, where they are able to link aggregate geographic, payments and demographic data. This is where banks can begin to meet a wider range of SMBs’ needs.

- Even with the right ideas, bringing multiple ideas to market simultaneously can lead to bottlenecks and barriers. To achieve rapid speed to market, FIs should consider engaging increasingly in partnerships and alliances, and not assume they need to build everything in-house. While some might look to white label, all financial institutions should create ecosystems that meet SMBs’ needs. With the increasing standardization of interfaces, this is becoming more feasible.

The opportunity to offer better banking services to SMBs is here. Financial institutions can seize this opportunity by developing their digital capabilities oriented towards fostering engagement, focusing on efficiency of service and driving reinvention.

Summary

Market dynamics have changed. Small Medium Businesses’ expectations have changed, and they are adopting new entrants’ services in the financial institution market to better meet these expectations. This shift in market dynamics has already brought new players to tap into these unaddressed needs. This threat requires a fast and powerful transformational response from incumbent financial institutions – one where innovation is key.