2. The right mix of products and services may set you apart.

Canadian investors value products and services above all other aspects of their provider’s approach. That means different things on each side of the equation.

On the one hand, investors here are increasingly interested in accessing a greater range of products. Today, Canadians use an average of 4.1 investment products. But they expect to see themselves embrace an average of 5.5 products by 2024.

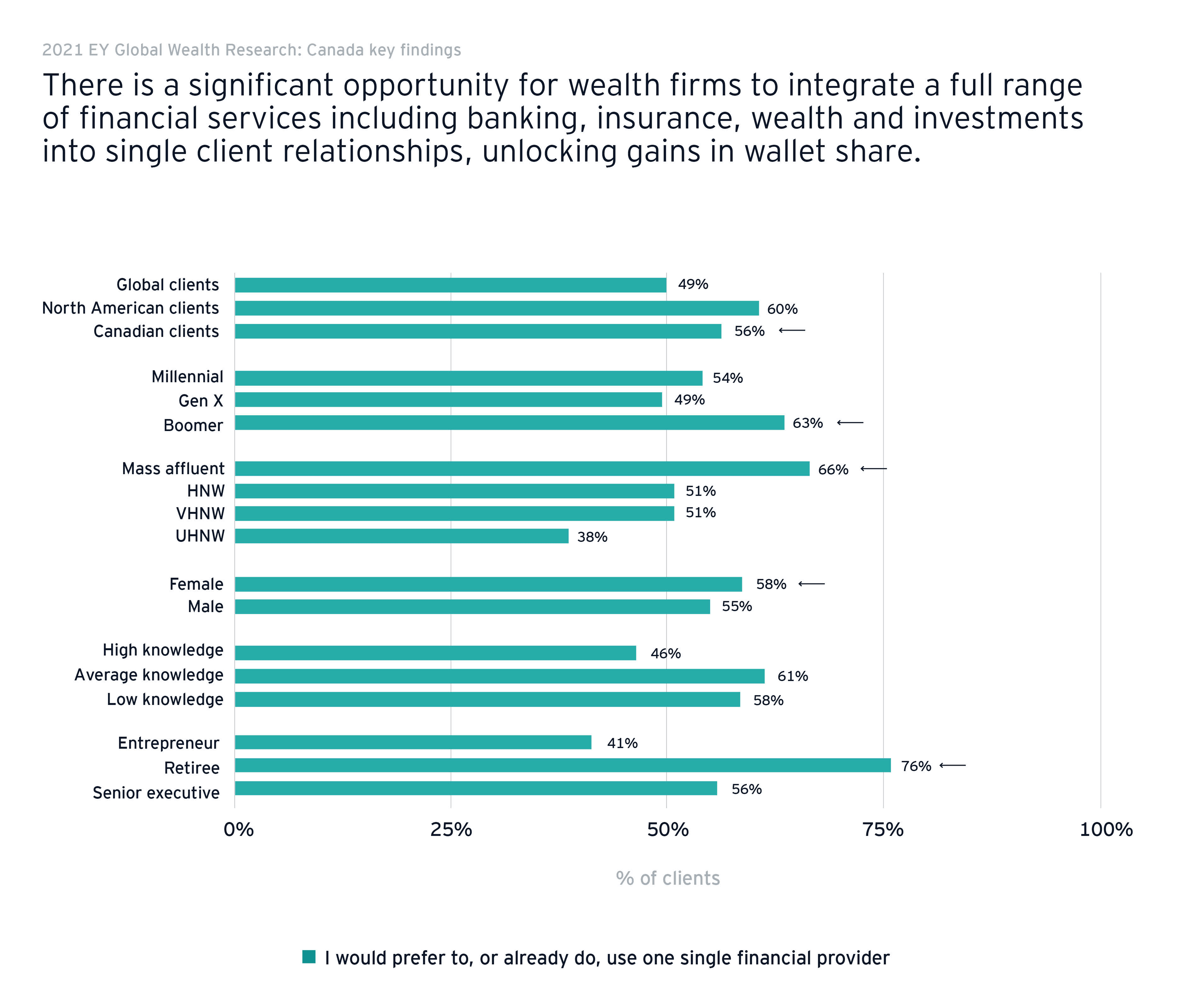

On the other hand, about half of investors prefer to use a single-source financial services provider. While we saw an appetite for that kind of consolidation globally, it was particularly prevalent among Canadians. Conservative investors — and those with low to medium investment knowledge — are most likely to opt for a single provider. As they gain sophistication in terms of risk profile and investment knowledge, investors become more willing to use multiple providers.

Both here and globally, this dynamic reflects opportunities for any financial services provider capable of offering more products through a single relationship. What could that look like?

Larger institutions can work to provide more product versatility in a single spot, consolidating clients’ financial lives into a single relationship using the right capabilities.

Independent advisors with one key product can explore partnerships, filling this white space through co-opetition. The right alliance can empower an existing single-product provider to quarterback a much broader network of client offerings.

New entrants and non-traditional players can capitalize on the other 50% of the investing population’s willingness to use multiple providers by developing niche products that help even the most traditional investor flesh out their portfolio with innovative options.

Because these preferences change across demographics, providers can also segment strategies, addressing core tranches with a customized approach to products and services. For example, consolidation becomes more important to investors in their later years as they transition from wealth accumulation to using their wealth as their primary source of income. Demographically, baby boomers are most likely to prefer using one provider; 76% of retirees fall into this category. Some 10% of all investors who plan to switch providers say they’ll do so to consolidate their financial services relationships, including 18% of boomers. The sooner they consolidate, the easier it is to manage that wealth from one central location. Addressing these sentiments strategically may strengthen relationships with specific client groups.