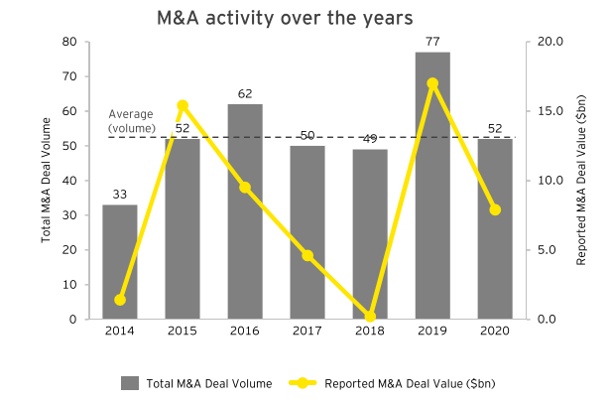

M&A activity showed signs of quick recovery after a slowdown in Q2; diversified and skincare categories continued to attract interest from strategic and financial buyers alike.

Key deals during the period include KKR’s $2.58b acquisition of Coty's professional and retail hair beauty business and Ipsy’s $500m acquisition of Boxy Charm. Also, L'Oréal acquired Thayers Natural Remedies for $400m to expand its skin care business and strengthen its portfolio.

Canada-based KIK Custom Products sold its personal care business to Voyant Beauty, a portolio company of Wind Point Partners, to focus on its core consumer business. KDC received a co-investment from Churchill Asset Management and Cornell Capital Partners, enabling it to enhance its capabilities through accretive acquisitions and support its growth strategy.

Source: S&P Capital IQ, Mergermarket, Secondary research

Online sales, at-home solutions, green products, technological innovation and personalization are among the key trends shaping the North American personal care market.

1. Growth in online sales - While in-store purchases have historically been a major driver of sales in the industry, the pandemic expedited e-commerce sales. In 2020, personal care sales were expected to contribute 32.4%1 (vs. 16.6% in 2019) of overall e-commerce sales in the US. Some industry specialists predict that the shift to e-commerce will be permanent. L'Oréal's global chief digital officer estimates that 50% of the company’s sales will come frome-commerceby2023.

2. Rise in popularity of do-it-yourself (DIY) solutions - Lockdowns and social distancing norms resulted in a temporary shutdown of beauty stores and salons, inducing consumers to purchase DIY kits. While in-store sales declined, industry segments such as skin care and hair care experienced heightened demand for DIY products owing to improved focus of self-care.

Madison Reed, a US-based hair care expert, experienced a 750% increase in at-home hair coloring kits in Q2, exceeding itsprojectedsubscribercountformid-2021.

Although outlets have reopened with capacity restrictions, DIY kits have remained popular, with consumers forgoing salon vis its and beauty treatments to avoid contact.

3. Increased focus on health and wellness - With the market shifting towards clean products and consumers increasingly linking health and beauty, the demand for natural and organic personal care products has been further accelerated. Beauty ingestibles and CBD beauty products are among the categories that have become popular among consumers, retailers and now M&A suitors.

Grove Collaborative acquired Sundaily, an ingestible skin care brand. Ulta announced its first foray into the clean beauty category through a strategic partnership with Credo Beauty, a clean beauty retailer.

4. Growing demand for contract manufacturing services - Contract manufacturers have specialized R&D and custom formulation capabilities to meet consumer preferences. Further, with an increased focus on natural and customized products, contract manufacturing is likely to be expedited.

Concurrently, supply chain restrictions due to the pandemic have driven personal care providers to re-evaluate the resilience of their manufacturing facilities. This has led to increased consolidation efforts in this space. KDC/ONE strengthened its capabilities through the acquisition of Cosmetic Laboratories of America. Voyant Beauty agreed to acquire the personal care business of KIK Custom Products, and Palladium Equity Partners acquired Accupac.

5. Technological innovation and personalization - Innovation has been the cornerstone of personal care, with an increased focus on personalization and at-home solutions. Coty filed a patent on a method to personalize perfumes by blending scent additives into existing products or building customized blends. L'Oréal's Perso device and Neutrogena’s Skin360 App provide AI-powered at-home skin care solutions.

New technologies such as automated tools for product testing are revolutionizing the retail sector. In 2020, Orlandi unveiled MultiScent 20, a tool that enables consumers to test perfumes by controlling a diffuser from their mobile phones, while guaranteeing sanitary safety.

Selected transactions in 2020

- December 31, 2020: PureK Holdings Corp. announced the acquisition of No B.S. Skincare. The transaction positions PureK Holdings Corp. to capitalize on what is expected to be strong growth in the skin care, beauty markets and CBD consumer products market. The acquisition is valued at $5.5m.

- December 31, 2020: THG holdings announced the acquisition of DermStore. The transaction will enable THG to increase the scale of its beauty box business. It will also help accelerate the growth of THG’s own beauty brands via a new and large US customer base. The acquisition is valued at $350m and represents an enterprise value of 1.8x revenues.

- December 9, 2020: Vesper Healthcare Acquisition Corp. announced the acquisition of Edge Systems (dba HydraFacial). The SPAC enables HydraFacial to be publicly listed on the NASDAQ. The acquisition is valued at $1b and represents an enterprise value of 6.3x revenues and 37.5x* EBITDA.

- October 30, 2020: Personalized Beauty Discovery (dba ipsy) announced the acquisition of Boxy Charm. The transaction is expected to result in more than $1b in combined revenues in 2020. The acquisition is valued at $500m.

- October 1, 2020: Oaktree Acquisition Corp. announced the acquisition of Hims, inc. The SPAC deal enables Hims, Inc. to trade on the New York Stock Exchange. It will also enable the company to reinvest in geographic growth and new product lines. The acquisition is valued at $1.6b and represents an enterprise value of 19.3x* revenues.

- September 30, 2020: THG Holdings announced the acquisition of NV Perricone. The transaction enables THG to further strengthen its position as a leading pure-play specialty beauty brand owner and retailer. Perricone will benefit from the powerful and sustainable infrastructure of THG Ingenuity platform. The acquisition is valued at $60m and represents an enterprise value of 1.0x revenues.

- September 24, 2020: CURE Pharmaceutical Holding Corp. announced the acquisition of Sera Labs. The transaction will enable CURE to leverage Sera Labs' brand marketing and multi-channel distribution platform and give its consumers greater access to the dosage forms and drug delivery technologies. The acquisition is valued at $20m.

- September 17, 2020: Churchill Asset Management, Cornell Capital announced the acquisition of Knowlton Development Corporation (KDC). The transaction will support KDC's next phase of growth and innovation, enabling it to expand its capabilities through accretive acquisitions. The financial terms of the transaction were not disclosed.

- September 2, 2020: PLZ Aeroscience Corp. announced the acquisition of Mansfield-King. The transaction is in line with PLZ's strategy to expand its liquid production capabilities and customer network in the personal care sector. The financial terms of the transaction were not disclosed.

- September 1, 2020: Traub Capital announced the acquisition of MANA Products. The transaction allows Traub Capital to leverage MANA's innovation, research and development and contract manufacturing capabilities as part of its vision. It will also enable MANA to use Traub Capital's strategic, operational and financial expertise. The financial terms of the transaction were not disclosed.

- August 24, 2020: Present Life announced the acquisition of One Ocean Labs Beauty. The acquisition will give One Ocean Beauty resources and capital to expand its footprint. The financial terms of the transaction were not disclosed.

- August 6, 2020: Medline Industries announced the acquisition of Aloe Vesta and SensiCare Skin Care product lines of Convatec Group. The transaction enables Medline Industries to market its products outside North America. The acquisition is valued at $29m and represents an enterprise value of 1.0x revenues.

- August 4, 2020: Edgewell Personal Care announced the acquisition of Cremo. The acquisition complements Edgewell’s portfolio of insurgent brands by serving specific consumer profiles and increasing its penetration in growth categories in men’s grooming. The acquisition is valued at $234.5m.

- July 29, 2020: Anthony Murira (director of Alami Beauty Corporation) announced the acquisition of Alami Beauty Corporation (51% stake). The acquisition gives Anthony Murira ownership of a majority stake in the company. The acquisition is valued at $20k.

- June 29, 2020: Coty announced the acquisition of KKW Beauty. The transaction is another step in Coty’s renewed emphasis on its beauty business and ongoing transformation into a more agile, focused company. The acquisition is valued at $200m.

- June 18, 2020: L’Oreal annouced the acquisition of Thayers Natural Remedies. The acquisition is part of L’Oreal’s strategy to develop its skincare business and complements its North American skincare brand portfolio. The acquisition is valued at $400m and represents an enterprise value of 7.0X revenues.

- June 1, 2020: Kohlberg Kravis Roberts & Co announced the acquisition of Professional and retail hair beauty business of Coty (60% stake). Coty expects to utilize approximately $2 billion of proceeds to pay down its Term Loans, with the remainder used for general corporate purposes, including initially paying down its revolver. The acquisition is valued at $2.58b and represents an enterprise value of 1.8X** and 12.3x EBITDA.

- April 16, 2020: Omya announced the acquisition of Formulae Development. The acquisition will expand Omya’s R&D capabilities in the Americas. The financial terms of the transaction were not disclosed.

- April 2, 2020: Perrigo Company announced the acquisition of Oral Care Assets of High Ridge Brands. The acquisition will strengthen Perrigo’s leadership position in children’s oral care segment and is expected to add more than $100m in net sales. The acquisition is valued at $113m.

- March 3, 2020: Knowlton Development Corporation announced the acquisition of Cosmetic Laboratories of America. This acquisition strengthens KDC’s leadership on the west coast in delivering creative design, innovation-driven research, custom development and manufacturing to the prestige beauty segment. The financial terms of the transaction were not disclosed.

- February 24, 2020: e.l.f Beauty announced the acquisition of W3ll People. The acquisition is in line with e.l.f. Beauty’s strategic expansion plan and will enable it to achieve synergies in cost and distribution. Further, it is expected to add $7m in net sales and $0.01 to its adjusted earnings per share on a fully diluted basis in 2021. The acquisition is valued at $27m and represents an enterprise value of 3.9x**.

- January 29, 2020: An undisclosed buyer announced the acquisition of New Avon Company. The acquisition is valued at $121.8m and represents an enterprise value of 0.2X revenues.

- January 23, 2020: Knowlton Development Corporation announced the acquisition of HCT Group. The acquisition will give HCT Group and KDC an expanded suite of manufacturing and packaging solutions. The financial terms of the transaction were not disclosed.

- January 23, 2020: Colgate-Palmolive Company announced the acquisition of Hello Products. Hello Products’ distinct on-trend lifestyle positioning and strong appeal among younger consumers complements the Colgate and Tom’s of Maine brands. The acquisition is valued at $351m.

* Indicates outliers - excluded from mean and median calculations.

** Implied forward revenue multiple.

All $ values are in US$, unless otherwise stated.

Source: S&P Capital IQ, MergerMarket, Secondary research.

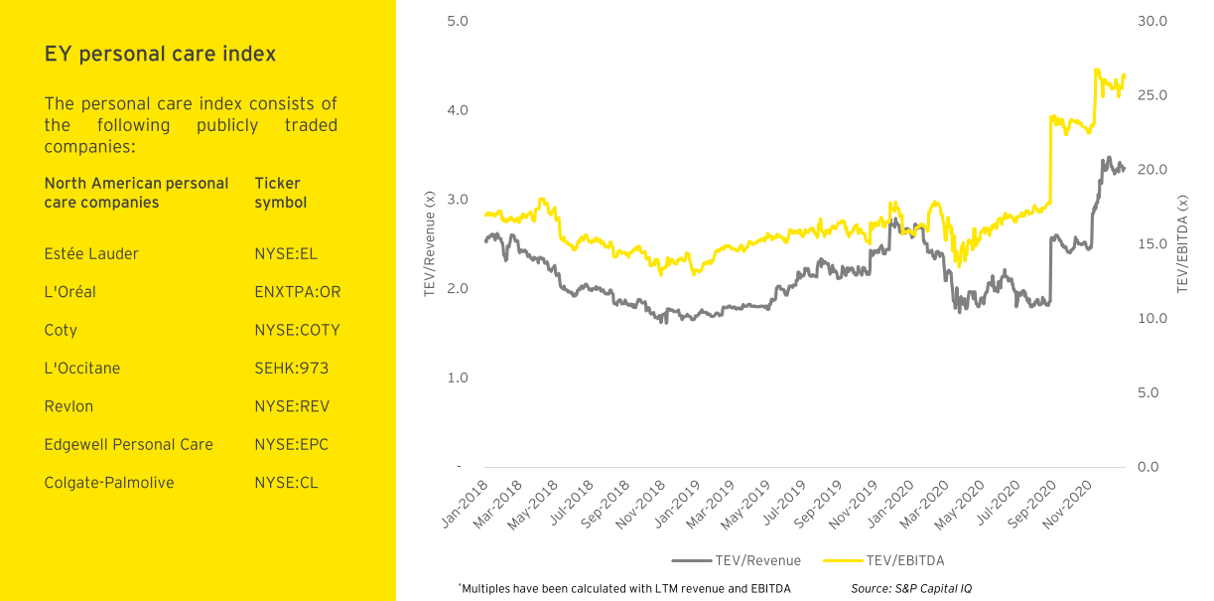

Revenue and EBITDA trading multiples (2018-20)

Summary

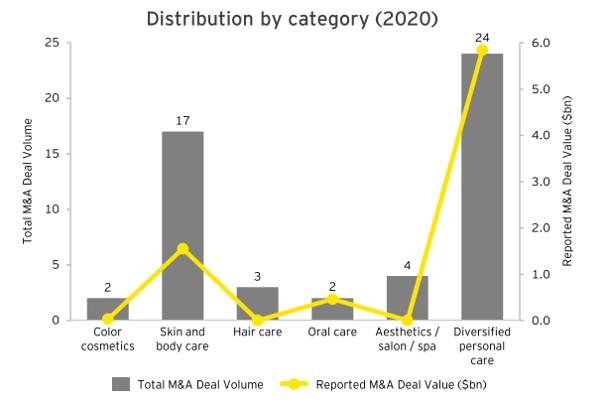

The sector witnessed an estimated total deal value of $7.9b in 2020. The diversified personal care segment led the market in terms of M&A, accounting for approximately 46.2% of the overall deal count, followed by skin and body care at 32.7%.