Northwest Territories budget 2021‑22

Tax Alert 2021 No. 02, 5 February 2021

“Mr. Speaker, I present Budget 2021 as a stability budget that builds on the foundations we have set over the past year and allows further opportunity to advance many important projects. In this time of uncertainty, we propose to carry on with $2 billion in expenditures and no spending reductions.”

“The Northwest Territories economy in 2021 will likely remain smaller than it was in 2019 and the risks and challenges remain the same as before the pandemic’s economic shock.“

“Until the global health crisis is under control, a full recovery of the territorial economy will be slow and uneven.”

Northwest Territories Finance Minister Caroline Wawzonek

2021–22 budget speech

On 4 February 2021, Northwest Territories Finance Minister Caroline Wawzonek tabled the territory’s fiscal 2021–22 budget. The budget contains no new taxes and no income tax increases.

The minister anticipates an operating deficit of $31 million for 2020–21 and projects an operating surplus of $69 million for 2021–22, $84 million for 2022-23 and declining surpluses for each of the next two years.

Following is a brief summary of the key tax measures.

Business tax measures

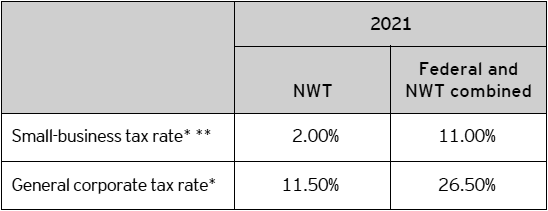

Corporate tax rates

No changes are proposed to the corporate tax rates or the $500,000 small-business limit.

The Northwest Territories 2021 corporate tax rates are summarized in Table A.

Table A – 2021 Northwest Territories corporate tax rates

* The rates represent calendar year-end rates unless otherwise indicated.

** Northwest Territories reduced its small-business income tax rate from 4.00% to 2.00%, effective 1 January 2021.

Personal tax

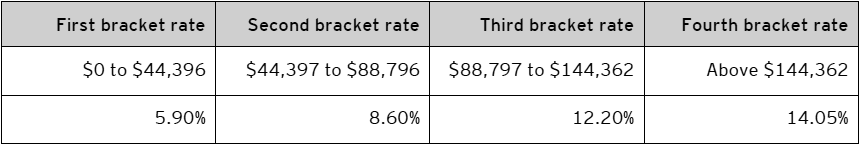

Personal income tax rates

The budget does not include any changes to personal income tax rates.

The 2021 Northwest Territories personal tax rates are summarized in Table B.

Table B – 2021 Northwest Territories personal tax rates

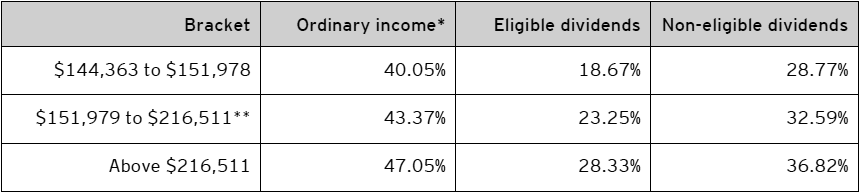

For taxable income in excess of $144,362, the 2021 combined federal–Northwest Territories personal income tax rates are outlined in Table C.

Table C – Combined federal and Northwest Territories 2021 personal tax rates

* The rate on capital gains is one-half the ordinary income tax rate.

** The federal basic personal amount comprises two elements: the base amount ($12,421 for 2021) and an additional amount ($1,387 for 2021). The additional amount is reduced for individuals with net income in excess of $151,978 and is fully eliminated for individuals with net income in excess of $216,511. Consequently, the additional amount is clawed back on net income in excess of $151,978 until the additional tax credit of $208 is eliminated; this results in additional federal income tax (e.g., 0.32% on ordinary income) on net income between $151,979 and $216,511.

Other tax measures

Property tax

In keeping with the existing indexation policy, property mill rates will be adjusted for inflation, effective 1 April 2021.

Carbon pricing

Given the upcoming federally mandated carbon tax rate increase to $40 per carbon-equivalent tonne of greenhouse gas emissions effective 1 July 2021, the budget proposes to increase the Northwest Territories cost of living offset benefit to $208 per year for an individual and to $240 per year for a child, effective 1 July 2021.

Learn more

For more information, please contact your EY or EY Law advisor.

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.