New Brunswick budget 2021‑22

Tax Alert 2021 No. 08, 17 March 2021

“Today’s budget continues to provide the important supports needed to deal with the public health challenge of our time. However, it is also a budget that supports a strong and resilient recovery.”

“Furthermore, today’s budget also positions the province for a lasting recovery that is built on providing value to our citizens in a fiscally responsible manner.”

New Brunswick Minister of Finance and Treasury Board Ernie Steeves

2021–22 budget speech

On 16 March 2021, New Brunswick Minister of Finance and Treasury Board Ernie Steeves tabled the province’s fiscal 2021–22 budget. The budget contains no significant tax measures affecting individuals and corporations.

The minister anticipates a deficit of $244.8 million for 2021–22 and projects deficits for each of the next two years.

Following is a brief summary of the key tax measures.

Business tax measures

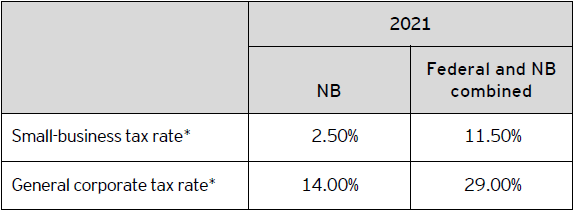

Corporate tax rates

No changes are proposed to the corporate tax rates or the $500,000 small-business limit.

New Brunswick’s 2021 corporate tax rates are summarized in Table A.

Table A – 2021 New Brunswick corporate tax rates

* Rates represent calendar-year rates unless otherwise indicated.

Personal tax

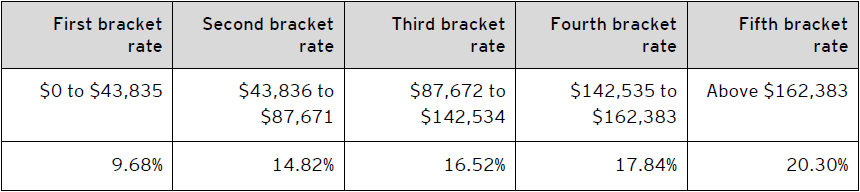

Personal income tax rates

The budget does not include any changes to personal income tax rates.

The 2021 New Brunswick personal tax rates are summarized in Table B.

Table B – 2021 New Brunswick personal tax rates

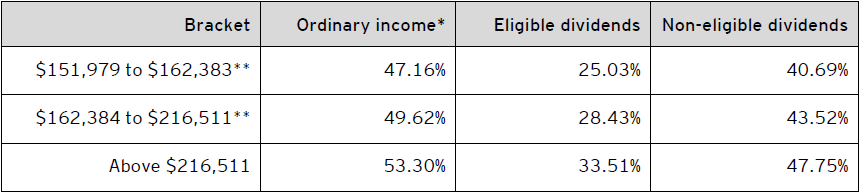

For taxable income in excess of $151,978, the 2021 combined federal-New Brunswick personal income tax rates are outlined in Table C.

Table C – Combined federal and New Brunswick 2021 personal tax rates

* The rate on capital gains is one-half the ordinary income tax rate.

** The federal basic personal amount comprises two elements: the base amount ($12,421 for 2021) and an additional amount ($1,387 for 2021). The additional amount is reduced for individuals with net income in excess of $151,978 and is fully eliminated for individuals with net income in excess of $216,511. Consequently, the additional amount is clawed back on net income in excess of $151,978 until the additional tax credit of $208 is eliminated; this results in additional federal income tax (e.g., 0.32% on ordinary income) on net income between $151,979 and $216,511.

Other tax measures

Carbon tax

Effective 1 April 2021, the province will increase its tax on carbon-emitting products from $30 per tonne to $40 per tonne, with a result of increasing its carbon tax by 2.21¢ per litre for gasoline and by 2.68¢ per litre for diesel.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Dieppe

Dan LeBlanc

+1 506 388 7728 | dan.leblanc@ca.ey.com

Pauline Vautour

+1 506 388 7724 | pauline.vautour@ca.ey.com

Marc Léger

+1 506 388 7746 | marc.d.leger@ca.ey.com

Natacha Poirier

+1 506 388 7719 | natacha.poirier@ca.ey.com

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.