Ontario budget 2021‑22

Tax Alert 2021 No. 09, 24 March 2021

“As the pandemic has continued to unfold, people have been very clear that they expect us to focus on two vital priorities: first and foremost, they expect us to protect people’s health, and second, they expect us to protect our economy. That is exactly what this Budget does.

There is no doubt that our return to fiscal sustainability will take many, many years.

Some may say we must rely on tax hikes or cuts to public services to restore fiscal sustainability. We are choosing a different path, because anyone who claims higher taxes or fewer public services are inevitable is forcing a false choice. Growth is the third path, one that our government intends to pursue.”

Ontario Finance Minister Peter Bethlenfalvy

2021–22 Budget Speech, Foreword and Introduction

On 24 March 2021, Ontario Finance Minister Peter Bethlenfalvy tabled the province’s fiscal 2021–22 budget. The budget contains some tax measures affecting individuals and corporations but contains no new taxes and no tax increases.

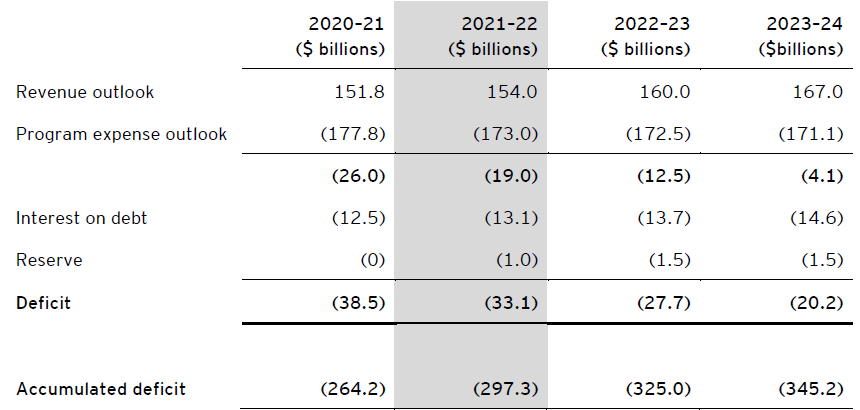

As set out in Table A, the minister anticipates a deficit of $33.1 billion for 2021–22 and projects deficits for each of the next seven years.

Table A – Projections of Ontario budgetary deficit

Numbers may not add due to rounding.

Following is a brief summary of the key tax measures.

Business tax measures

Corporate tax rates

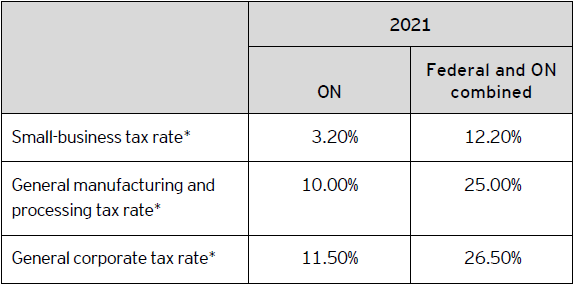

No changes are proposed to the corporate tax rates or the $500,000 small-business limit.

Ontario’s 2021 corporate tax rates are summarized in Table B.

Table B – 2021 Ontario corporate tax rates

* Rates represent calendar-year rates unless otherwise indicated.

Other business tax measures

The minister proposed the following business tax measure:

- Enhancement of regional opportunities investment tax credit – The budget is proposing to temporarily double the regional opportunities investment tax credit rate to 20% from 10%.

This refundable credit is available to Canadian-controlled private corporations that make qualifying investments in eligible geographic areas of Ontario. The 10% tax credit is available for eligible expenditures in excess of $50,000 and up to $500,000 in a year, for property that becomes available for use on or after 25 March 2020.

The proposed enhanced 20% tax credit will be available for eligible expenditures in excess of $50,000 and up to $500,000 for property that becomes available for use in the corporation’s taxation year, for the period beginning on 24 March 2021 and ending before 1 January 2023.

Qualifying investments include expenditures for constructing, renovating or acquiring eligible commercial and industrial buildings and other assets, generally capital property included in Class 1 and Class 6 for the purposes of calculating a corporation’s capital cost allowance.

Personal tax

Personal income tax rates

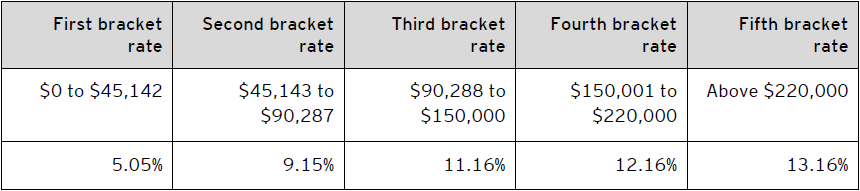

The budget does not include any changes to personal income tax rates.

The 2021 Ontario personal tax rates are summarized in Table C.

Table C – 2021 Ontario personal tax rates

In addition, for 2021, a 20% surtax applies to basic Ontario tax in excess of $4,874, and an additional 36% surtax applies to basic Ontario tax in excess of $6,237.

Individuals resident in Ontario on 31 December 2021 with taxable income in excess of $20,000 must pay the Ontario Health Premium. The premium ranges from nil to $900 depending on the individual’s taxable income, with the top premium being payable by individuals with taxable income in excess of $200,600.

Individuals resident in Ontario on 31 December 2021 with taxable income up to $15,850 pay no provincial income tax as a result of a low-income tax reduction. The low-income tax reduction ($251 of Ontario tax) is clawed back for income in excess of $15,850 until the reduction is eliminated, resulting in an additional 5.05% of provincial tax on income between $15,851 and $20,821.

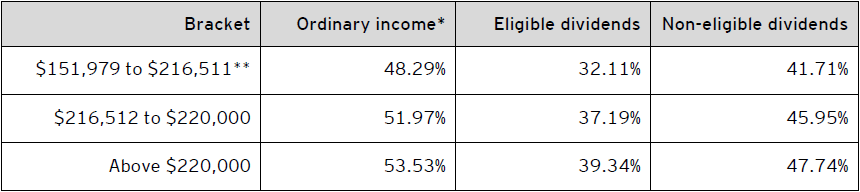

For taxable income in excess of $151,978, the 2021 combined federal-Ontario personal income tax rates are outlined in Table D.

Table D – Combined 2021 federal and Ontario personal tax rates

* The rate on capital gains is one-half the ordinary income tax rate.

** The federal basic personal amount comprises two elements: the base amount ($12,421 for 2021) and an additional amount ($1,387 for 2021). The additional amount is reduced for individuals with net income in excess of $151,978 and is fully eliminated for individuals with net income in excess of $216,511. Consequently, the additional amount is clawed back on net income in excess of $151,978 until the additional tax credit of $208 is eliminated; this results in additional federal income tax (e.g., 0.32% on ordinary income) on net income between $151,979 and $216,511.

Personal tax credits

This budget proposes changes to the following personal credits/amounts:

Temporary Ontario jobs training tax credit – Ontario is introducing a temporary Ontario jobs training tax credit for the 2021 taxation year. This refundable credit, which is modelled after the Canada training credit provided under the Income Tax Act (Canada), would be calculated as 50% of eligible expenses for 2021 and the maximum credit would be $2,000.

Individuals may claim the credit on their 2021 personal income tax return if:

- They are resident in Ontario on 31 December 2021;

- They are at least 26 years of age and not older than 65 at the end of 2021; and

- They have a Canada training credit limit for 2021 greater than zero.

An individual’s Canada training limit for 2021 may be found on their latest notice of assessment or reassessment for 2020 provided by the Canada Revenue Agency. In general, this limit is a running balance that builds up over time and is reduced by any training tax credit claims made. An individual will have a positive Canada training limit for 2021 if they have met age and income conditions, among other requirements set out in the federal Act, for 2019 and 2020.

Eligible expenses would be the same as those that can be claimed for the Canada training credit for 2021, which include:

- Fees for occupational skills courses that are paid to a university, college or certain other educational institutions, if the student is enrolled at the institution to obtain or improve their skills in an occupation;

- Fees for an occupational, trade, or professional examination required to obtain professional status, or to be licensed or certified as a tradesperson, and that are paid to a university, college or other educational institution, a professional association, provincial ministry, or similar institution; and

- Fees for one or more courses at the postsecondary level, if the courses provide credit towards a degree, diploma or certificate.

Enhancement of Ontario child care access and relief from expenses (CARE) tax credit in 2021 – The budget proposes a one-time top-up of the CARE tax credit equal to 20% of the calculated CARE tax credit entitlement for 2021. The top-up will be delivered when CARE tax credit recipients file their 2021 personal income tax returns.

The CARE tax credit is a refundable tax credit providing eligible low- and moderate-income families with flexible child care support of up to 75% of eligible child care expenses. The CARE tax credit is available in addition to the child care expense deduction. The maximum credit each year is $6,000 per child under the age of 7, $3,750 per child between the ages of 7 and 16, and $8,250 for each child with a severe disability.

For purposes of the CARE tax credit, “eligible child care expenses” is defined as the taxpayer’s total entitlement under the child care expense deduction. The applicable credit rate is determined by the amount of family income, as determined for purposes of the child care expense deduction. The maximum rate of 75% applies to recipients with family income not exceeding $20,000 for the year and is nil when family income exceeds $150,000.

Ontario tourism tax credit – The 2020 budget announced a proposal to promote tourism within Ontario by providing Ontario residents with up to 20% support for eligible Ontario tourism expenses in 2021. The government intends to proceed with this proposal by introducing legislation for a tax credit to encourage residents to explore Ontario when public health experts advise that it is safe to travel.

Other tax measures

Unregulated tobacco

In February 2021, Ontario initiated a consultation with First Nations with a view to address the issue of unregulated tobacco and develop a made-in-Ontario tobacco strategy. While the consultation is ongoing, Ontario will enhance and expand existing programs for tackling unregulated tobacco, including the following:

- Collaborating with federal partners on strengthening border enforcement and addressing tobacco smuggling;

- Enhancing the Ontario Ministry of Finance’s oversight of raw leaf tobacco by using more innovative digital technologies; and

- Consulting with cigar wholesalers to clarify and strengthen guidance relating to on-reserve sales.

Other technical amendments

Anti-avoidance

Ontario indicated it supports the federal government’s plan to consult on the modernization of Canada’s anti-avoidance rules and the general anti-avoidance rule in particular. As part of these efforts, the province is encouraging the federal government to consider ways to combat artificial income shifting, such as through the use of trusts or corporate continuances.

Administration and enforcement

Ontario may propose amendments to various statutes administered by the Ontario Minister of Finance to:

- Improve administrative effectiveness and enforcement;

- Maintain the integrity and equity of Ontario’s tax and revenue collections system; and

- Preserve policy intent by enhancing legislative clarity or regulatory flexibility.

As well, Ontario may propose similar amendments to other statutes, including the Electricity Act, 1998.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Toronto

Karen Atkinson

+1 416 943 2172 | karen.e.atkinson@ca.ey.com

Neil Moore

+1 416 932 6239 | neil.moore@ca.ey.com

Ottawa

Ian Sherman

+1 613 598 4335 | ian.m.sherman@ca.ey.com

London

John Sliskovic

+1 519 646 5532 | john.t.sliskovic@ca.ey.com

Waterloo

Tim Rollins

+1 519 571 3379 | tim.rollins@ca.ey.com

Ameer Abdulla

+1 519 571 3349 | ameer.abdulla@ca.ey.com

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.