Nova Scotia budget 2021‑22

Tax Alert 2021 No. 12, 26 March 2021

“Budget 2021–22 builds upon the strong fiscal foundation achieved over the past several years. This fiscal health helped the province weather the COVID-19 pandemic. The province will continue to exercise strong financial management and get back to balance as quickly as possible. We will create an environment where businesses can thrive again, and create the economic activity that will allow us to invest in healthcare, the environment and in people, especially those who have not had the same historic opportunities as other Nova Scotians.”

Nova Scotia Minister of Finance and Treasury Board Labi Kousoulis

2021–22 budget introduction

On 25 March 2021, Nova Scotia Minister of Finance and Treasury Board Labi Kousoulis tabled the province’s fiscal 2021–22 budget. The budget contains no new taxes and no tax increases.

The minister anticipates a deficit of $584.9 million for 2021–22 and projects deficits for each of the next two years.

Following is a brief summary of the key tax measures.

Business tax measures

Corporate tax rates

No changes are proposed to the corporate tax rates or the $500,000 small-business limit.

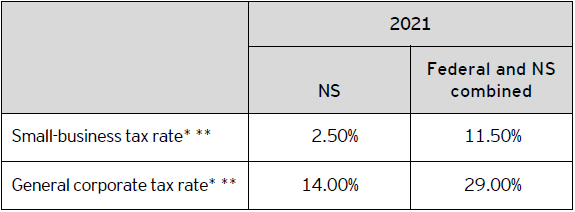

Nova Scotia’s 2021 corporate tax rates are summarized in Table A.

Table A – 2021 corporate tax rates

** Nova Scotia reduced its general corporate income tax rate from 16.00% to 14.00% and its small-business tax rate from 3.00% to 2.50%, effective 1 April 2020.

Personal tax

Personal income tax rates

The budget does not include any changes to personal income tax rates.

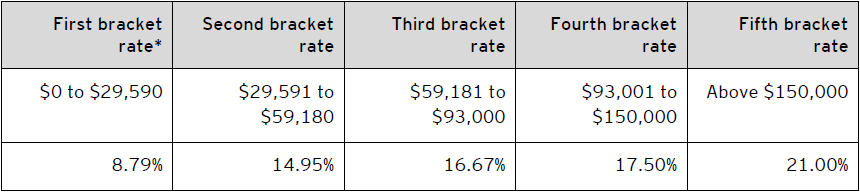

The 2021 Nova Scotia personal tax rates are summarized in Table B.

Table B – 2021 Nova Scotia personal tax rates

* Individuals resident in Nova Scotia on 31 December 2021 with taxable income up to $11,894 pay no provincial income tax as a result of a low-income tax reduction. The low-income tax reduction is clawed back for income in excess of $15,000 until the reduction is eliminated, resulting in an additional 5% of provincial tax on income between $15,001 and $21,000.

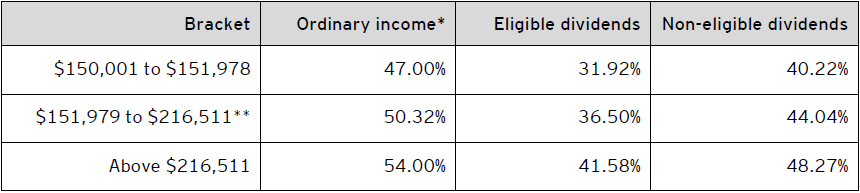

For taxable income in excess of $150,000, the 2021 combined federal-Nova Scotia personal income tax rates are outlined in Table C.

Table C – Combined 2021 federal and Nova Scotia personal tax rates

* The rate on capital gains is one-half the ordinary income tax rate.

** The federal basic personal amount comprises two elements: the base amount ($12,421 for 2021) and an additional amount ($1,387 for 2021). The additional amount is reduced for individuals with net income in excess of $151,978 and is fully eliminated for individuals with net income in excess of $216,511. Consequently, the additional amount is clawed back on net income in excess of $151,978 until the additional tax credit of $208 is eliminated; this results in additional federal income tax (e.g., 0.32% on ordinary income) on net income between $151,979 and $216,511.

Other tax measures

Extension of Equity Tax Credit for CEDIFS

The Equity Tax Credit, which was introduced in 1999 and provides a non-refundable credit for investments in shares of an eligible business, was phased out as of 31 December 2019, with the exception of investments in Community Economic Development Investment Funds (CEDIFs). The budget proposes that the tax credit for these investments, previously scheduled to expire on 28 February 2022, will now be extended for a 10-year period.

The tax credit for CEDIFs provides a 35% tax credit for individuals who invest up to $50,000 and hold their shares for a five-year period. Rollover tax credits provide an additional 20% when individuals retain their shares for an additional five years (10 years in total) and a further 10% when individuals retain their shares for a period of 15 years.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Dana Birch

+1 902 470 2073 | dana.birch@ca.ey.com

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.