Newfoundland and Labrador budget 2021‑22

Tax Alert 2021 No. 22, 31 May 2021

“This budget sets the course to achieve fiscal stability by ensuring we spend within our means. It reins in and tightens control of the public purse; it ensures a return to fiscal balance within five years; it makes strategic economic investments; it supports those that need a hand up.”

Newfoundland and Labrador Finance Minister Siobhan Coady

2021–22 budget press release

On 31 May 2021, Newfoundland and Labrador Finance Minister Siobhan Coady tabled the province’s fiscal 2021–22 budget. The budget contains several tax measures affecting individuals and no changes affecting corporations.

The minister anticipates a deficit of $826 million for 2021–22 and projects deficits for each of the next four years.

Following is a brief summary of the key tax measures.

Business tax measures

Corporate tax rates

No changes are proposed to the corporate tax rates or the $500,000 small-business limit.

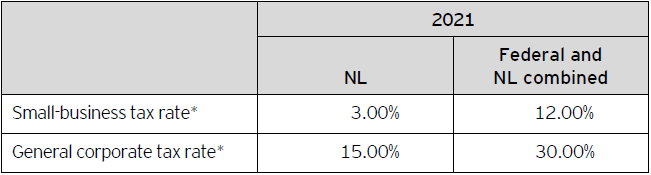

Newfoundland and Labrador’s (NL) 2021 corporate tax rates are summarized in Table A.

Table A – 2021 corporate tax rates

* Rates represent calendar-year rates unless otherwise indicated.

Personal tax

Personal income tax rates

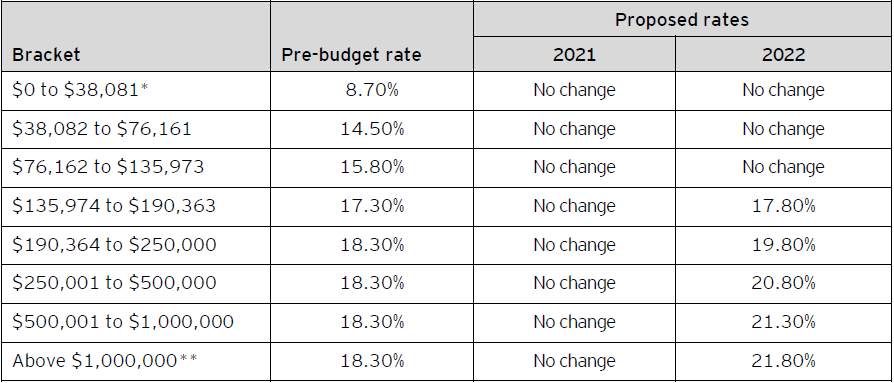

The minister proposes to increase personal tax rates for individuals earning more than $135,974 beginning on 1 January 2022. The minister also proposes to add new tax brackets, which will impact individuals that earn in excess of $250,000. The new rates and tax brackets are outlined in Table B.

Table B – 2021 and 2022 Newfoundland and Labrador personal tax rates

* Individuals resident in Newfoundland and Labrador on 31 December 2021 with taxable income up to $19,444 pay no provincial income tax as a result of a low-income tax reduction. The low-income tax reduction is clawed back for income in excess of $20,619 until the reduction is eliminated, resulting in an additional 16% of provincial tax on income between $20,620 and $26,007.

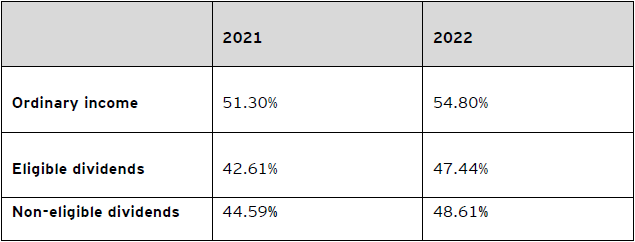

** Accordingly, the proposed combined federal and Newfoundland and Labrador 2021 and 2022 top marginal personal tax rates on income above $1,000,000 are as follows:

Personal tax credits

This budget proposes changes to the following personal credits/amounts:

- A new Physical Activity Tax Credit, which will provide a refundable tax credit up to $2,000 (value of up to $174) per family. No further details were provided.

Other budget measures

- Provincial tax on tobacco products has increased by 3 cents per cigarette and 6 cents per gram of fine-cut tobacco.

- A new Sugar Sweetened Beverage Tax of 20 cents per litre. This tax is effective 1 April 2022.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Troy Stanley, Partner

+1 709 570 8290 | troy.a.stanley@ca.ey.com

Scott Howell, Senior Manager

+1 709 570 8267 | scott.r.howell@ca.ey.com

Norman Byrne, Senior Manager

+1 709 570 8285 | norman.j.byrne@ca.ey.com

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.