British Columbia budget 2022‑23

Tax Alert 2022 No. 07, 23 February 2022

“Budget 2022 meets today’s challenges, while always investing in a stronger British Columbia. It delivers action today with a plan for tomorrow.”

British Columbia Finance Minister Selina Robinson

2022–23 budget speech.

On 22 February 2022, British Columbia Finance Minister Selina Robinson tabled the province’s fiscal 2022–23 budget. The budget contains several tax measures affecting individuals and corporations.

The minister anticipates a deficit of $5.5 billion for 2022–23 and projects deficits for each of the next two years.

Following is a brief summary of the key tax measures.

Business tax measures

Corporate income tax rates

No changes are proposed to corporate income tax rates or the $500,000 small-business limit.

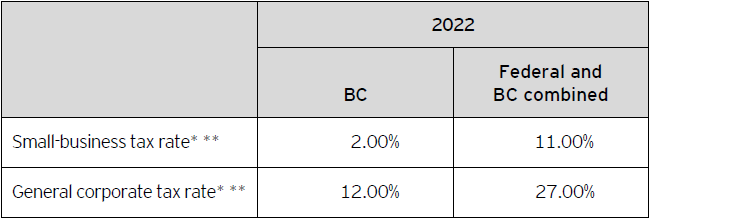

British Columbia’s 2022 corporate income tax rates are summarized in Table A.

Table A – 2022 British Columbia corporate income tax rates

* Rates represent calendar-year rates unless otherwise indicated.

** The 2021 federal budget proposed to temporarily reduce the federal corporate income tax rate for qualifying zero-emission technology manufacturers by 50% (i.e., to 7.5% for eligible income otherwise subject to the 15% general corporate income tax rate or 4.5% for eligible income otherwise subject to the 9% small business corporate income tax rate), applicable for taxation years beginning after 2021. The reduced tax rates are proposed to be gradually phased out for taxation years beginning in 2029 and fully phased out for taxation years beginning after 2031.

Other business tax measures

The minister proposed the following business tax measures:

- The scientific research and experimental development tax credit is extended for five years to 31 August 2027.

- Effective 23 February 2022, a new temporary clean buildings tax credit for retrofits that improve the energy efficiency of multi-unit residential buildings with four or more dwellings and prescribed types of commercial buildings is introduced. Taxpayers who improve the energy efficiency of the buildings to meet prescribed energy use targets after the retrofit is completed can receive a refundable tax credit of 5% of eligible expenditures paid. Eligible expenditures must be made before 1 April 2025 and under a contract entered into after 22 February 2022.

- Training tax credits are extended for two years to the end of 2024.

- The shipbuilding and ship repair industry tax credit is extended for two years to the end of 2024.

- Effective for the 2022 to 2024 years, the Equity Tax Credit Budget for Clean Technology is temporarily increased. For more details, see below.

Personal tax

Personal income income tax rates

The budget does not include any changes to personal income tax rates.

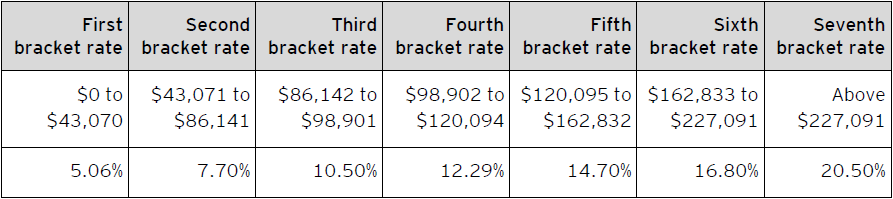

The 2022 British Columbia personal income tax rates are summarized in Table B.

Table B – 2022 British Columbia personal income tax rates*

* Individuals resident in British Columbia on 31 December 2022 with taxable income up to $21,362 generally pay no provincial income tax as a result of a low-income tax reduction. The low-income tax reduction is clawed back on income in excess of $21,362 until the reduction is eliminated, resulting in an additional 3.56% of provincial tax on income between $21,363 and $35,660.

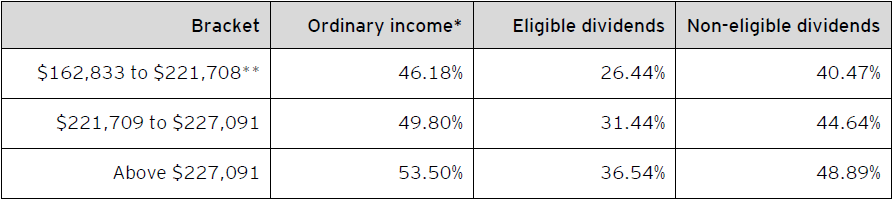

For taxable income in excess of $162,832, the 2022 combined federal-British Columbia personal income tax rates are outlined in Table C.

Table C – Combined 2022 federal and British Columbia personal income tax rates

* The rate on capital gains is one-half the ordinary income tax rate.

** The federal basic personal amount comprises two elements: the base amount ($12,719 for 2022) and an additional amount ($1,679 for 2022). The additional amount is reduced for individuals with net income in excess of $155,625 and is fully eliminated for individuals with net income in excess of $221,708. Consequently, the additional amount is clawed back on net income in excess of $155,625 until the additional tax credit of $252 is eliminated; this results in additional federal income tax (e.g., 0.38% on ordinary income) on net income between $155,626 and $221,708.

Personal tax credits

This budget proposes changes to the following personal credits/amounts:

- Effective for the 2022 to 2024 years, the Equity Tax Credit Budget for Clean Technology is temporarily increased to $41 million from $38.5 million.

Provincial sales tax

Zero-emission vehicles

- Effective 23 February 2022, used zero-emission vehicles purchased from motor vehicle dealers or private sales of used zero-emission vehicles driven for at least 6,000 kilometres are exempt from provincial sales tax. The exemption applies for five years and is scheduled to end on 22 February 2027.

- Effective 23 February 2022, the passenger vehicle surtax threshold for zero-emission vehicles is increased to $75,000 from $55,000. The exemption applies for five years and is scheduled to end on 22 February 2027.

Heat pumps and fossil fuel combustion systems

- Effective 1 April 2022, heat pumps are exempt from provincial sales tax. A person who purchased a heat pump prior to 1 April 2022 to fulfil a contract where the heat pump is affixed or installed into real property on or after 1 April 2022 will be eligible to apply for refund of the provincial sales tax paid on the heat pump.

- Effective 1 April 2022, the provincial sales tax rate on fossil fuel combustion systems that heat or cool buildings or water is increased from 7% to 12%. Contracts entered into on or after 23 February 2022 to affix or install fossil fuel combustion systems into real property on or after 1 April 2022 will be subject to the 12% tax rate.

Provincial sales tax on tobacco

- Effective 1 July 2022, provincial sales tax is applied to tobacco, in addition to existing tax obligations under the Tobacco Tax Act.

Purchase price of private vehicle sales

- Effective 1 October 2022, tax on private sales of motor vehicles will be based on the greater of the reported purchase price and the average wholesale value of the vehicle. The measure will not apply for motor vehicles involved in a trade-in.

Marketplace facilitator collection, remittance and reporting obligations

- Effective 1 July 2022, businesses that facilitate sales or leases of certain goods, services or software for third parties through their online platforms, including accepting payment from consumers (marketplace facilitators), will be required to collect and remit tax on sales and leases made in BC. This obligation will apply to sales of taxable goods shipped from within Canada, taxable services (including short-term rentals and taxable accommodations, but not legal services), software and lease of goods made through marketplace facilitators. Sellers will be relieved of their obligation to collect and remit tax on sales and leases made through a marketplace facilitator.

- Effective 1 July 2022, marketplace facilitators will be required to charge provincial sales tax on marketplace facilitation services they provide to sellers.

Other tax measures

Motor fuel tax

Effective 23 February 2022, hydrogen fuel is classified as a Category 1 alternative fuel and is exempt from motor fuel tax provided that:

- The hydrogen is purchased for use in an internal combustion engine vehicle; and

- The hydrogen is not produced by electrolysis using coal-generated electricity, unless the carbon dioxide emitted from the process is captured and stored or captured and sequestered.

Speculation and Vacancy Tax Act

The exemption for strata accommodation properties that was set to expire at the end of the 2021 tax year is now made permanent.

Effective for the 2021 tax year only, the exemption for hazardous or damaged residential property is expanded to apply to homeowners whose principal residence or tenancy exemption was affected by the Fraser Valley flooding in late 2021.

Other technical amendments

Budget 2022 introduces a number of technical amendments to various tax acts including the Carbon Tax Act, Income Tax Act, Land Tax Deferment Act, Motor Fuel Tax Act, Property Transfer Tax Act, Provincial Sales Tax Act and the Speculation and Vacancy Tax Act for clarity and certainty:

- Effective 23 February 2022, the Carbon Tax Act and Motor Fuel Tax Act are amended to authorize the director to establish an annual period for tax reporting.

- Effective 22 February 2022, the production services tax credit is amended to extend the pre-certification filing deadline from 60 days to 120 days.

- Effective on Royal Assent, the Income Tax Act is amended to clarify the authority to disclose taxpayer information for the purposes of administering the Employee Investment Act and Small Business Venture Capital Act.

- The Land Tax Deferment Act is amended, effective on Royal Assent, to allow the minster to delegate authority to a class of persons and, effective 1 April 2022, to create a statutory appropriation for concessionary grant expenses.

- Effective on Royal Assent, the Motor Fuel Tax Act is amended to authorize the director to specify the form to be used as an application for a carrier licence under the International Fuel Tax Agreement.

- Effective 1 April 2022, the Property Transfer Tax Act is amended to clarify the authority of the administrator to make payments out of the consolidated revenue fund for refunds determined under the regulations.

- The Provincial Sales Tax Act is amended:

- Effective 23 February 2022, to clarify that gift cards and gift certificates are not subject to provincial sales tax when acquired;

- Effective 1 April 2013, to clarify the evidentiary requirements for real property contracts where the customer and the contractor agree that the customer is responsible for paying the provincial sales tax; and

- Effective on a date to be specified by regulation, to make minor changes to provisions related to tax payment agreements.

- Effective 27 November 2018, the Speculation and Vacancy Tax Act is amended to extend the deadlines to apply for a tax credit for eligible taxpayers by 90 days when a notice of assessment or a minister’s notice of decision is given after the end of the normal application period.

- Effective 1 October 2022, the Carbon Tax Act, Employer Health Tax Act, Homeowner Grant Act, Insurance Premium Tax Act, Logging Tax Act, Mineral Tax Act, Motor Fuel Tax Act, Net Profit Royalty Regulation, Petroleum and Natural Gas Royalty and Freehold Production Tax Regulation, Property Transfer Tax Act, Provincial Sales Tax Act, Speculation and Vacancy Tax Act and Tobacco Tax Act are amended to standardize and clarify rules on filing appeals to the Minister of Finance.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Lokesh Chaudhry

+1 604 899 3532 | lokesh.chaudhry@ca.ey.com

Carla Marchant

+1 604 899 3565 | carla.marchant@ca.ey.com

Rodger So

+1 604 891 8210 | rodger.so@ca.ey.com

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.