New Brunswick budget 2022‑23

Tax Alert 2022 No. 15, 22 March 2022

“Today’s budget is about maintaining this momentum and positioning the province for ongoing sustainable growth.

With a projected surplus of $35.2 million for 2022–2023, New Brunswickers will see a fiscal plan that considers our current economic and fiscal environment, continues the important work from previous government decisions, addresses budget pressures, and provides much-needed tax relief. Furthermore, today’s budget also positions the province for sustainable growth and to deliver services to our citizens in a fiscally responsible manner.”

New Brunswick Minister of Finance and Treasury Board Ernie Steeves

2022–23 budget speech

On 22 March 2022, New Brunswick Minister of Finance and Treasury Board Ernie Steeves tabled the province’s fiscal 2022–23 budget. The budget contains no new taxes and no tax increases other than carbon-tax-related measures described below.

The minister anticipates a surplus of $35.2 million for 2022–23.

Following is a brief summary of the key tax measures.

Business tax measures

Corporate income tax rates

No changes are proposed to the corporate income tax rates or the $500,000 small-business limit.

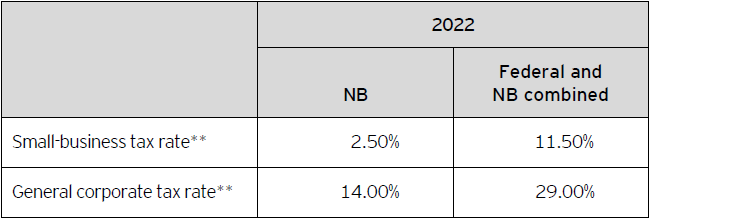

New Brunswick’s 2022 corporate income tax rates are summarized in Table A.

Table A – 2022 New Brunswick corporate income tax rates*

* Rates represent calendar-year rates.

** The 2021 federal budget proposed to temporarily reduce the federal corporate income tax rate for qualifying zero-emission technology manufacturers by 50% (i.e., to 7.5% for eligible income otherwise subject to the 15% general corporate income tax rate or 4.5% for eligible income otherwise subject to the 9% small-business corporate income tax rate), applicable for taxation years beginning after 2021. The reduced tax rates are proposed to be gradually phased out for taxation years beginning in 2029 and fully phased out for taxation years beginning after 2031.

Personal tax

Personal income tax rates

The budget does not include any changes to personal income tax rates.

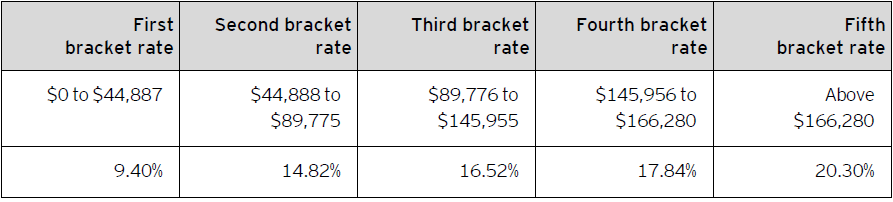

The 2022 New Brunswick personal income tax rates are summarized in Table B.

Table B – 2022 New Brunswick personal income tax rates

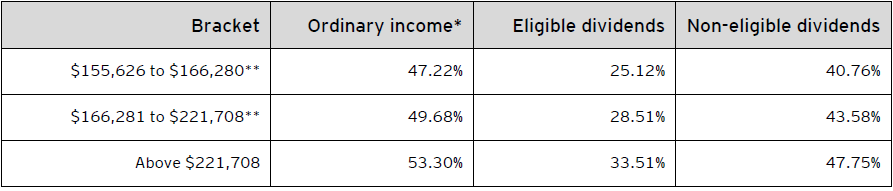

For taxable income in excess of $155,625, the 2022 combined federal-New Brunswick personal income tax rates are outlined in Table C.

Table C – Combined 2022 federal and New Brunswick personal income tax rates

* The rate on capital gains is one-half the ordinary income tax rate.

** The federal basic personal amount comprises two elements: the base amount ($12,719 for 2022) and an additional amount ($1,679 for 2022). The additional amount is reduced for individuals with net income in excess of $155,625 and is fully eliminated for individuals with net income in excess of $221,708. Consequently, the additional amount is clawed back on net income in excess of $155,625 until the additional tax credit of $252 is eliminated; this results in additional federal income tax (e.g., 0.38% on ordinary income) on net income between $155,626 and $221,708.

Personal tax credits

This budget proposes changes to the following personal credits/amounts effective for the 2022 taxation year:

- Increase in the basic personal amount from $10,817 to $11,720; and

- Increase in the Low-Income Tax Reduction threshold from $18,268 to $19,177.

Other tax measures

Property tax

Previously announced measures from the 2020–2021 budget that were put on hold as a result of the global pandemic will move forward as part of this budget.

The budget proposes the following three phased-in rate reductions:

- A 50% reduction of property tax rates on non-owner-occupied residential properties;

- A 15% reduction of property tax rates on other residential properties, including nursing homes; and

- A 15% reduction of property taxes on non-residential properties.

These measures will be phased in over a three-year period. It is expected that property tax bills for the 2022 taxation year will be issued 1 April and will reflect the first phase of tax rate reductions.

Other measures

- Minimum wage will increase by $1 per hour on 1 April 2022 to $12.75 per hour and by October 2022 is expected to be $13.75 per hour. The minimum wage is currently $11.75 per hour.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Dan LeBlanc

+1 506 388 7728 | dan.leblanc@ca.ey.com

Pauline Vautour

+1 506 388 7724 | pauline.vautour@ca.ey.com

Marc Léger

+1 506 388 7746 | marc.d.leger@ca.ey.com

Natacha Poirier

+1 506 388 7719 | natacha.poirier@ca.ey.com

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.