Quebec budget 2022‑23: highlights

Tax Alert 2022 No. 16, 22 March 2022

“The pandemic has also had a significant impact on public finances, which is unavoidable when many sectors of the economy are slowing down. Our strong support for the public and businesses has also led the government to significantly increase spending.

In this context, I think it is fair to say that Québec has persevered. Our people rose to the challenge of fighting the pandemic, despite all the restrictions this required.

And that same perseverance will carry us through the turbulence facing the global economy. The budget I am tabling today is being presented in a context of great uncertainty: we do not know how the pandemic may evolve, inflation is currently high, and central banks are tightening their monetary policy. Added to this is the tense geopolitical context, marked by the Russian invasion of Ukraine.”

Éric Girard, Québec’s Minister of Finance

2022-23 Québec Budget Speech

On 22 March 2022, Québec Finance Minister Éric Girard tabled the province’s fiscal 2022–23 budget. The budget contains tax measures affecting individuals and corporations. The budget contains no new taxes and no tax increases.

The minister anticipates a deficit of $7.4 billion for fiscal 2021–22 (after contributions to the Generations Fund) and $6.5 billion for fiscal 2022-23, with reduced deficits for each of the next four fiscal years. The government’s objective is to restore fiscal balance by fiscal 2027‑28.

Following are the highlights of the budget tabled by the Québec Minister of Finance. A summary of the key tax measures announced will be available in our Tax Alert No. 17 — Québec budget 2022-23.

Business tax measures

- Corporate tax rates

- No changes to the corporate tax rate are proposed.

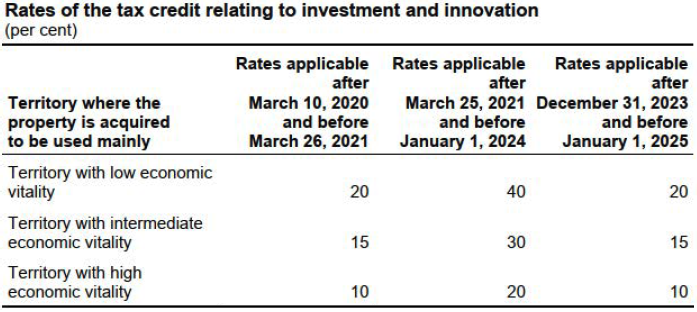

- Extension of the temporary increase in the tax credit relating to investment and innovation

- On 25 March 2021, it was announced that the tax credit rates would be temporarily doubled to encourage Québec businesses to carry out their investment projects and to accelerate Québec’s economic recovery. It was then planned that this temporary increase would end on 31 December 2022.

- In order to continue the government’s support for business investment, the temporary increase in the tax credit relating to investment and innovation will be extended by one year, that is, until 31 December 2023.

- Introduction of the refundable tax credit for the production of biofuel in Québec

- In summary, a qualified corporation will be able to claim this tax credit in respect of eligible biofuels that it produces in Québec for sale and use in Québec, up to a maximum of 300 million litres per year. The tax credit will be available from 1 April 2023 to 31 March 2033.

- In order to benefit from the tax credit in respect of a biofuel that the corporation produces in a taxation year, the corporation will be required to obtain, for that taxation year, a qualification certificate issued by the Minister of Energy and Natural Resources certifying that the biofuel is an eligible biofuel for the purposes of the tax credit.

- The rate of the tax credit will be determined according to various factors so that the level of tax assistance applicable to an eligible biofuel produced by a qualified corporation will increase according to the decrease in carbon intensity observed for that biofuel compared to the gasoline or diesel fuel that it replaces.

- The refundable tax credit for the production of ethanol in Québec, the refundable tax credit for cellulosic ethanol production in Québec, and the refundable tax credit for the production of biodiesel fuel in Québec, expiring on 31 March 2023, will not be renewed.

- Extension of and changes to the refundable tax credit for the production of pyrolysis oil in Québec

- In order to maintain the government’s support for efforts to reduce greenhouse gas (GHG) emissions, the refundable tax credit for the production of pyrolysis oil in Québec will be extended for a period of ten years, that is, until 31 March 2033.

- Changes will also be made to the tax credit, particularly with respect to the tax credit rate, so that the level of assistance granted to a qualified corporation, with respect to its eligible production of pyrolysis oil, will take into account the reduction in carbon intensity induced by this biofuel, compared to the fuel it replaces, over its life cycle. In addition, the maximum number of litres for which a qualified corporation may benefit from the tax credit will be increased to 300 million litres per year.

- In order to benefit from the tax credit in respect of a pyrolysis oil it produces in a taxation year, a corporation will be required to obtain, for that taxation year, a qualification certificate issued by the Minister of Energy and Natural Resources certifying that the pyrolysis oil is an eligible pyrolysis oil for the purposes of the tax credit.

- These changes will apply as at 1 April 2023.

Personal tax

- Personal tax rates

- No changes to personal income tax rates.

- Introduction of the refundable tax credit granting a one-time amount to mitigate the increase in the cost of living

- In summary, an eligible individual will be entitled, in the 2022 calendar year, to the payment of an amount of up to $500 in respect of a refundable tax credit granting a one-time amount to mitigate the increase in the cost of living.

- This amount will be reducible on individual net income in excess of $100,000 for the 2021 calendar year.

- This lump-sum assistance will be provided to all eligible adults who have filed their income tax return for the 2021 calendar year with Revenu Québec.

- Perpetuation of the tax credit for a major cultural gift

- In order to increase major donations in the cultural sector, the additional tax credit of 25% for a major cultural gift was introduced with the publication of Information Bulletin 2013-6.

- With a view to perpetuate this support for the financing of the cultural sector, the tax legislation will be amended to remove the deadline for making a donation so that it can be recognized as a major cultural gift, thereby making the tax credit for a major cultural gift permanent.

- Extension of the refundable tax credit for the upgrading of residential waste water treatment systems

- In order to encourage a greater number of owners to undertake repair work on their septic systems, the period during which a service agreement may be entered into with a qualified contractor, for the application of the refundable tax credit for the upgrading of residential waste water treatment systems, will be extended by five years, that is, until 31 March 2027.

Other tax measures

- Amendment to the rules governing the interruption of the prescription period

- Under the Tax Administration Act, the recovery of an amount owed under a fiscal law is prescribed by 10 years after the day on which the notice of assessment was sent or, in the case of charges or fees, from the time the charges or fees are applied.

- It only takes one allocation of a refund against a non-prescribed tax debt to lose the benefit of the time that has elapsed to extinguish the debt through the 10-year prescription period, since the period resets to zero due to the allocation.

- Consequently, with a view to making the tax system more fair and equitable for all Québec taxpayers with a non-prescribed tax debt, the Tax Administration Act will be amended to remove compensation as a reason for interrupting the prescription period when a taxpayer entitled to a refund under a fiscal law is also a debtor under such a law or is about to be, and the Minister of Revenue applies the refund to pay the tax debt of that taxpayer.

- This measure will apply to allocations of refunds made on or after a date to be determined by the government after the bill giving effect to this measure is assented to.

Other measures

- Extension of the Roulez vert program and Revision of the maximum rebate according to the evolution of the market

- The maximum rebate granted for the acquisition of electric vehicles under the Roulez vert program will be, as of 1 April 2022:

- $7,000 for new fully electric vehicles;

- $5,000 for new plug-in hybrid vehicles;

- $3,500 for used fully electric vehicles.

- The maximum rebate granted for the acquisition of electric vehicles under the Roulez vert program will be, as of 1 April 2022:

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Jonathan Bicher, Montréal

514 731 7902 | jonathan.bicher@ca.ey.com

Philippe Dunlavey, Montréal

514 879 2662 | philippe.dunlavey@ca.ey.com

Stéphanie Jean, Montréal

514 879 8047 | stephanie.jean@ca.ey.com

Stéphane Leblanc, Montréal

514 879 2660 | stephane.leblanc@ca.ey.com

Sandy Maag, Montréal

514 874 4377 | sandy.maag@ca.ey.com

Benoît Millette, Montréal

514 879 3562 | benoit.millette@ca.ey.com

Nancy Avoine, Québec

418 640 5129 | nancy.avoine@ca.ey.com

Sylvain Paquet, Québec

418 640 5138 | sylvain.paquet@ca.ey.com

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.