Ontario budget 2022‑23

Tax Alert 2022 No. 27, 28 April 2022

“And now, I am proud to put forward the next step in Ontario’s Plan to Build. ...A plan to keep costs down and put more money into the pockets of families and seniors so they can invest in themselves, their communities, their families and in their futures.“

“Our government is supporting our vision with a fiscal plan that is prudent, responsible and sustainable.“

Ontario Finance Minister Peter Bethlenfalvy

2022–23 budget speech

On 28 April 2022, Ontario Finance Minister Peter Bethlenfalvy tabled the province’s fiscal 2022–23 budget. The budget contains several tax measures affecting individuals and corporations.

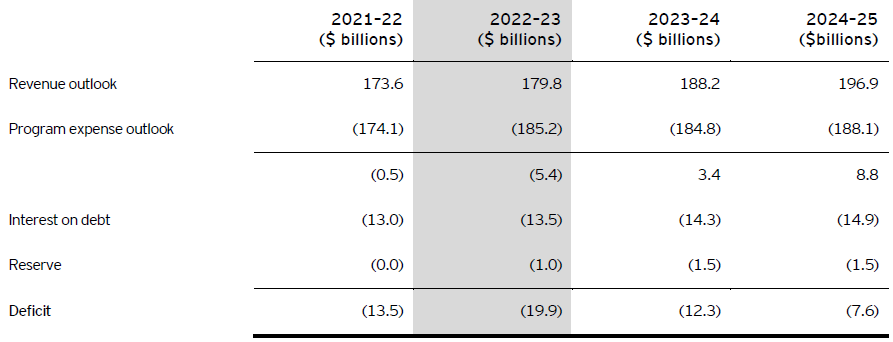

As set out in Table A, the minister anticipates a deficit of $19.9 billion for 2022–23 and projects deficits for each of the next four years, with a return to balance by 2027–28.

Table A – Projections of Ontario budgetary deficit

Numbers may not add due to rounding.

Following is a brief summary of the key tax measures.

Business tax measures

Corporate income tax rates

No changes are proposed to the corporate income tax rates or the $500,000 small-business limit.

Ontario’s 2022 corporate income tax rates are summarized in Table B.

Table B – 2022 Ontario corporate income tax rates*

* Rates represent calendar-year rates.

** The 2021 federal budget proposed to temporarily reduce the federal corporate income tax rate for qualifying zero-emission technology manufacturers by 50% (i.e., to 7.5% for eligible income otherwise subject to the 15% general corporate income tax rate or 4.5% for eligible income otherwise subject to the 9% small-business corporate income tax rate), applicable for taxation years beginning after 2021. The reduced tax rates are proposed to be gradually phased out for taxation years beginning in 2029 and fully phased out for taxation years beginning after 2031.

*** The 2022 federal budget proposed an additional tax on banks and life insurers. See EY Tax Alert 2022 Issue No. 23 for details.

Other business tax measures

The minister also proposed the following business tax measures:

- Extension of enhancement of regional opportunities investment tax credit – The budget is proposing to extend the temporary enhancement of this credit by one year, to the end of 2023. The 2021 budget temporarily doubled the credit rate to 20% from 10%, for eligible expenditures in excess of $50,000 and up to $500,000 for assets that become available for use in the period beginning on 24 March 2021 and ending before 1 January 2023. The 2022 budget proposes to extend this period to 31 December 2023.

This refundable credit is available to Canadian-controlled private corporations that make qualifying investments in eligible geographic areas of Ontario.

Qualifying investments include expenditures for constructing, renovating or acquiring eligible commercial and industrial buildings and other assets, generally capital property included in Class 1 and Class 6 for the purposes of calculating a corporation's capital cost allowance.

- Extension of film and television tax credits to online productions – The budget is proposing to make regulatory amendments to the Ontario film and television and the Ontario production services tax credits to extend eligibility to professional film and television productions that are distributed exclusively online.

Additional eligibility requirements for the Ontario film and television tax credit will apply for these types of productions to ensure the credit only supports professional productions. Examples of these additional requirements include:

- Meeting a minimum budget threshold of $250,000;

- Having an agreement in writing with an eligible exhibitor service for consideration at fair market value to have the production shown on the internet in Ontario within two years of completion; and

- Not including certain content (e.g., opinion, advice or how-to instructions).

Productions distributed exclusively online that become eligible for these credits will also be eligible for the Ontario computer animation and special effects tax credit if they meet all other eligibility requirements. Additional information on these proposals and their effective date will be made available in the fall.

- Review of Ontario’s film and television and production services tax credits –The government has announced that it will review the regional bonus under the Ontario film and television tax credit to ensure the credit is providing effective and appropriate incentives and support for film and television productions in all regions of Ontario. In addition, the government will review the eligibility of location fees for the Ontario production services tax credit.

- Eligibility of remote work for Ontario’s computer animation and special effects and interactive digital media tax credits – The budget clarifies that eligible labour expenditures for purposes of these credits may include remote work done by employees, provided the work is undertaken in Ontario by an Ontario resident who reports to and is under the direction of an eligible tax credit applicant with a permanent establishment in Ontario.

- Simplifying the Ontario computer animation and special effects tax credit – Currently, a film or television production must receive either the Ontario film and television tax credit or the Ontario production services tax credit to be eligible for the Ontario computer animation and special effects tax credit. The budget announced that the government will examine ways to untether the Ontario computer animation and special effects tax credit from the Ontario film and television and production services tax credits, while ensuring the tax credit remains targeted to professional productions with significant cultural or economic impact.

- Ontario book publishing tax credit – Generally, a minimum of 500 copies of a literary work in a bound edition must be published to be eligible for this credit. Ontario temporarily waived this requirement for the 2020 and 2021 taxation years. The 2022 budget proposes to permanently remove this requirement, effective for the 2022 and later taxation years.

Personal tax

Personal income tax rates

The budget does not include any changes to personal income tax rates.

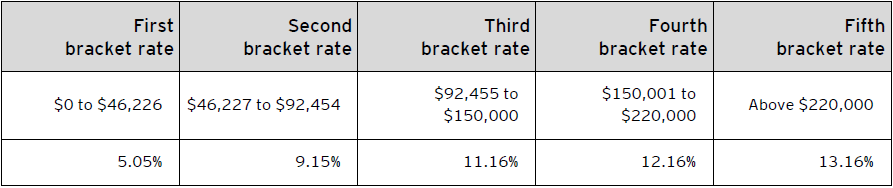

The 2022 Ontario personal tax rates are summarized in Table C.

Table C – 2022 Ontario personal income tax rates

In addition, for 2022, a 20% surtax applies to basic Ontario tax in excess of $4,991, and an additional 36% surtax applies to basic Ontario tax in excess of $6,387.

Individuals resident in Ontario on 31 December 2022 with taxable income in excess of $20,000 must pay the Ontario Health Premium. The premium ranges from nil to $900 depending on the individual’s taxable income, with the top premium being payable by individuals with taxable income in excess of $200,599.

Individuals resident in Ontario on 31 December 2022 with taxable income up to $16,230 pay no provincial income tax as a result of a low-income tax reduction. The low-income tax reduction ($257 of Ontario tax) is clawed back for income in excess of $16,230 until the reduction is eliminated, resulting in an additional 5.05% of provincial tax on income between $16,231 and $21,319.

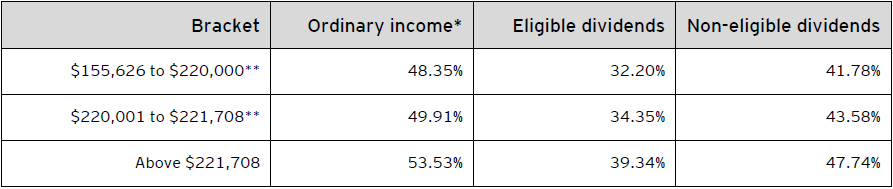

For taxable income in excess of $155,625, the 2022 combined federal-Ontario personal income tax rates are outlined in Table D.

Table D – Combined 2022 federal and Ontario personal income tax rates

* The rate on capital gains is one-half the ordinary income tax rate.

** The federal basic personal amount comprises two elements: the base amount ($12,719 for 2022) and an additional amount ($1,679 for 2022). The additional amount is reduced for individuals with net income in excess of $155,625 and is fully eliminated for individuals with net income in excess of $221,708. Consequently, the additional amount is clawed back on net income in excess of $155,625 until the additional tax credit of $252 is eliminated; this results in additional federal income tax (e.g., 0.38% on ordinary income) on net income between $155,626 and $221,708.

Personal tax credits

This budget proposes the following personal tax credit changes:

- Low-income individuals and families (LIFT) tax credit – The LIFT tax credit, which was introduced in 2019, is a non-refundable tax credit aimed at reducing or eliminating Ontario personal income tax for low-income taxpayers who have employment income. The budget proposes to enhance the LIFT tax credit for 2022 and later years by increasing the maximum benefit amount and increasing the income range over which the credit is reduced. Specifically, starting in 2022, the enhanced LIFT credit will be calculated as the lesser of $875 (up from the current cap of $850) and 5.05% of employment income, and the amount of the credit will be reduced by 5% (down from the current 10%) of the greater of the individual’s:

- Adjusted individual net income in excess of $32,500 (up from the current threshold of $30,000); and

- Adjusted family net income in excess of $65,000 (up from the current threshold of $60,000).

As a result of these changes, the maximum credit amount will be $875 for a single individual and $1,750 for couples. In addition, the enhanced credit will be phased out when an individual’s adjusted net income is $50,000 or more (up from $38,500 under the current rules) or a couple’s adjusted family net income is $82,500 or more (up from $68,500 under the current rules).

- Ontario seniors care at home tax credit – The budget introduces a new refundable tax credit intended to assist low- to moderate-income seniors (and their spouse or common-law partner) with the cost of eligible medical expenses. For 2022 and later years, an eligible senior may be able to claim an Ontario seniors care at home tax credit equal to 25% of their eligible medical expenses up to $6,000, for a maximum tax credit of $1,500. The credit amount will be reduced by 5% of family net income over $35,000 and be fully phased out when family net income is $65,000 or more. The family net income test will be the same for both single seniors and couples; in the case of couples, the incomes of both spouses (or common-law partners) are combined. Seniors eligible to claim the credit include individuals who turned 70 years of age or older in the year, or have a spouse or common-law partner who turned 70 years of age or older in the year, and are resident in Ontario at the end of the year. Eligible medical expenses include those that are currently eligible for the Ontario medical expense tax credit. The new credit can be claimed in addition to the non-refundable federal and Ontario medical expense credits on the same eligible expenses. Finally, as with the existing Ontario and federal medical expense credits, expenses can be combined with those of the claimant’s spouse, common-law partner or dependants, and the new credit will also be claimed when the senior files their personal income tax return.

Other tax measures

Gasoline and fuel tax

- On 14 April 2022, gasoline and fuel tax rate reductions were enacted for the period beginning on 1 July 2022 and ending on 31 December 2022. The gasoline tax rate is reduced from 14.7¢ per litre to 9.0¢ per litre, while the tax rate on clear fuel, which includes diesel, is reduced from 14.3¢ per litre to 9.0¢ per litre. The clear fuel rate reduction does not apply to clear fuel that is received or used to operate railway equipment operated on rails in connection with a public transportation system. As well, these changes do not affect tax rates for leaded gasoline, propane or aviation fuel. Importers, wholesalers and retailers who hold inventory purchased at the higher rates will be required to take inventory on 1 July 2022. Suppliers higher up on the supply chain will issue tax adjustments by crediting accounts in accordance with the reported inventory.

Non-resident speculation tax

- Ontario imposes a non-resident speculation tax (NRST) in accordance with the Land Transfer Tax Act. Prior to 30 March 2022, the NRST was a 15% tax that applied to purchases of residential property located in the Greater Golden Horseshoe Region of Southern Ontario, where the purchaser was a foreign national. On 30 March 2022, Ontario implemented regulatory amendments to increase the NRST tax rate to 20%, extend the tax to apply throughout the province, and eliminate NRST rebates for international students and foreign nationals working in Ontario. These measures apply to agreements of purchase and sale entered into on or after 30 March 2022, subject to transitional measures. Foreign nationals may continue to claim a rebate if they become permanent residents of Canada within four years after the tax becomes payable, provided certain additional conditions are met. Ontario is also retaining NRST exemptions for nominees under the Ontario Immigrant Nominee Program, protected persons (refugees) and spouses of individuals who are not subject to the NRST, provided certain additional conditions are met.

Supporting the use of municipal vacant home taxes

- Municipalities are currently exploring the use of vacant home taxes to increase the provincial housing supply. Ontario will work with municipalities to establish a working group to share information and best practices, as well as to explore opportunities to enhance the existing legislative framework. The government may consider amendments to the Municipal Act, 2001 in accordance with feedback from the working group. The stated purpose of this collaboration is help maximize the impact of vacant home taxes on housing supply in the province and to ensure that a coordinated and consistent approach applies to the implementation of such taxes.

Extending tax relief for the electricity distribution sector

- The Electricity Act, 1998 imposes a 33% transfer tax on the fair market value of electricity assets sold by municipal electricity utilities (MEUs) to the private sector. In accordance with its 2015 budget, Ontario reduced the transfer tax rate from 33% to 0% for MEUs with fewer than 30,000 customers. For larger MEUs, the tax rate was reduced from 33% to 22%. As well, any capital gains arising under the payments in lieu of tax (PILs) deemed disposition rules were exempted from PILs. These tax relief measures applied originally for the period from 1 January 2016 to 31 December 2018. Ontario subsequently extended the application of this relief to 31 December 2022. The 2022 Ontario budget proposes to further extend this tax relief to 31 December 2024.

Learn more

Toronto

Karen Atkinson

+1 416 943 2172 | karen.e.atkinson@ca.ey.com

London

John Sliskovic

+1 519 646 5532 | john.t.sliskovic@ca.ey.com

Waterloo

Tim Rollins

+1 519 571 3379 | tim.rollins@ca.ey.com

Ameer Abdulla

+1 519 571 3349 | ameer.abdulla@ca.ey.com

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.