Nunavut budget 2022‑23

Tax Alert 2022 No. 32, 27 May 2022

“With this budget, we are laying a new foundation for the future in Nunavut – one that improves the quality of life in all communities and that diversifies our economy to ensure that the abundance of our land and water is shared by all.”

Nunavut Finance Minister Lorne Kusugak

2022–23 budget speech

On 26 May 2022, Nunavut Finance Minister Lorne Kusugak tabled the territory’s fiscal

2022–23 budget. The budget contains no new taxes and no tax increases.

The minister anticipates an operating deficit of $31.0 million for 2021–22 and projects an operating surplus of $40.3 million for 2022–23.

Following is a brief summary of the key tax measures.

Business tax measures

Corporate income tax rates

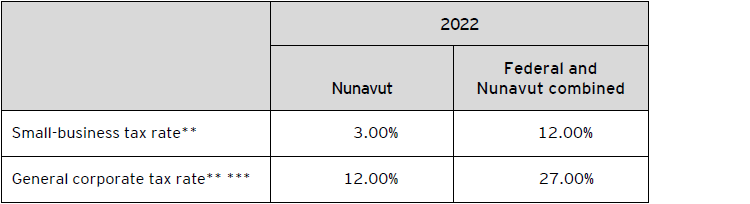

No changes are proposed to the corporate income tax rates or the $500,000 small-business limit.

Nunavut’s 2022 corporate income tax rates are summarized in Table A.

Table A – 2022 Nunavut corporate income tax rates*

* Rates represent calendar-year rates.

** The 2021 federal budget proposed to temporarily reduce the federal corporate income tax rate for qualifying zero-emission technology manufacturers by 50% (i.e., to 7.5% for eligible income otherwise subject to the 15% general corporate income tax rate or 4.5% for eligible income otherwise subject to the 9% small-business corporate income tax rate), applicable for taxation years beginning after 2021. The reduced tax rates are proposed to be gradually phased out for taxation years beginning in 2029 and fully phased out for taxation years beginning after 2031.

*** The 2022 federal budget proposed an additional tax on banks and life insurers. See EY Tax Alert 2022 Issue No. 23 for details.

Personal tax

Personal income tax rates

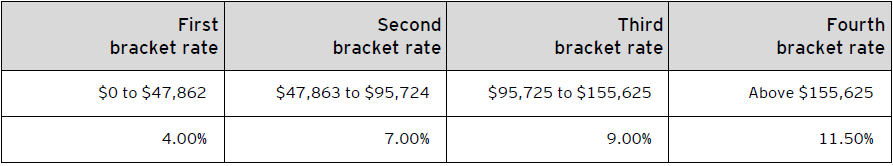

The budget does not include any changes to personal income tax rates.

The 2022 Nunavut personal income tax rates are summarized in Table B.

Table B – 2022 Nunavut personal income tax rates

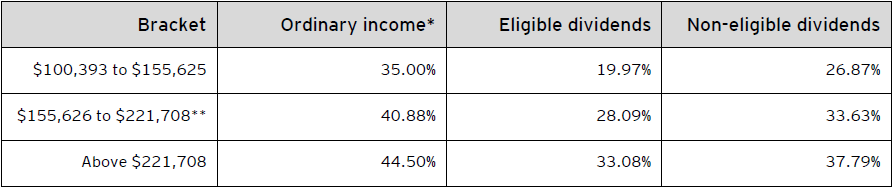

For taxable income in excess of $100,392, the 2022 combined federal-Nunavut personal income tax rates are outlined in Table C.

Table C – Combined 2022 federal and Nunavut personal income tax rates

* The rate on capital gains is one-half the ordinary income tax rate.

** The federal basic personal amount comprises two elements: the base amount ($12,719 for 2022) and an additional amount ($1,679 for 2022). The additional amount is reduced for individuals with taxable income in excess of $155,625 and is fully eliminated for individuals with taxable income in excess of $221,708. Consequently, the additional amount is clawed back on taxable income in excess of $155,625 until the additional tax credit of $252 is eliminated; this results in additional federal income tax (e.g., 0.38% on ordinary income) on net income between $155,626 and $221,708.

Learn more

For more information, please contact your EY or EY Law advisor.

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.