As affordability and value become increasingly important in the wake of COVID-19, new private label opportunities are emerging for UK retailers.

Consumer anxiety has been a key feature during and post-lockdown in the UK. But as life returns to a degree of normality, anxiety is continuing to ease, in the short term at least. Operational changes adopted by retailers both online and instore are reassuring customers that it is safe to shop. As a result, UK consumers feel more comfortable shopping and show a greater willingness to return to ‘normal’ behaviours.

But that does not mean their worries are over. Our fourth EY Future Consumer Index shows that short-term fears may be easing as consumers get more comfortable returning to old environments. However, over the long term, they are becoming increasingly worried about the economic implications of the pandemic. As a result, consumers are starting to change their buying behaviours, with an increased focus on value and price - more than two-thirds of UK consumers now say they have an interest in private label packaged food, for example.

As well as continuing operational measures to ensure UK consumers feel safe and comfortable when shopping, what opportunities and tactics should retailers now consider?

Feeling more comfortable about the ‘new normal’

Consumer behaviour has changed since April. UK consumers expect to shop less frequently but spend more when they do (56%), are mindful of store hygiene and sanitation (69%) and make informed decisions around the risks involved in everyday activities. This trend is illustrated and discussed in our previous indicies.

But they strive to return to ‘normal life’. The number of UK consumers now in the ‘get to normal’ consumer category (identified in our inaugural EY Future Consumer Index) has continued to rise. In July, it was up to almost half (49%) of consumers, compared with 28% in May.

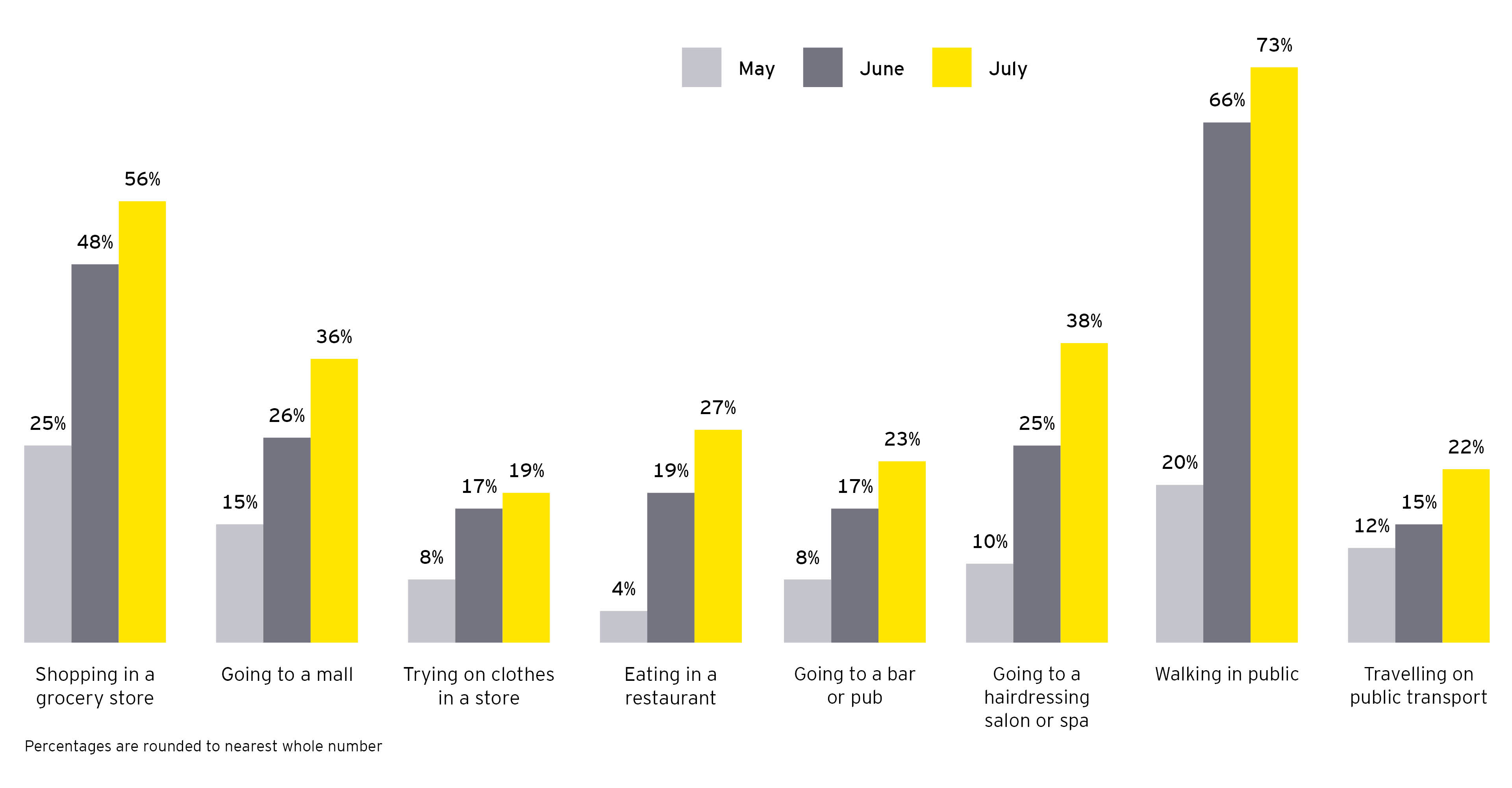

Consumers are increasingly confident doing things they did pre-COVID-19. From only 1 in 10 (10%) of UK consumers feeling comfortable going to a hairdressing salon or spa in May, the figure has now almost quadrupled to 38%. Similarly, while only 8% of UK consumers were previously comfortable with the idea of going to a bar or pub, that figure has now risen to 23%.

Within retail specifically, comfort with traditional shopping behaviours such as going to a mall (now 36% of UK consumers) and trying on clothes (now 19%) have both more than doubled since May. Similarly, in May, 25% of UK consumers said they felt comfortable shopping in a grocery store. In July, that figure rose to 56%.