EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

UK retains its lead as Europe’s most attractive destination for financial services investment

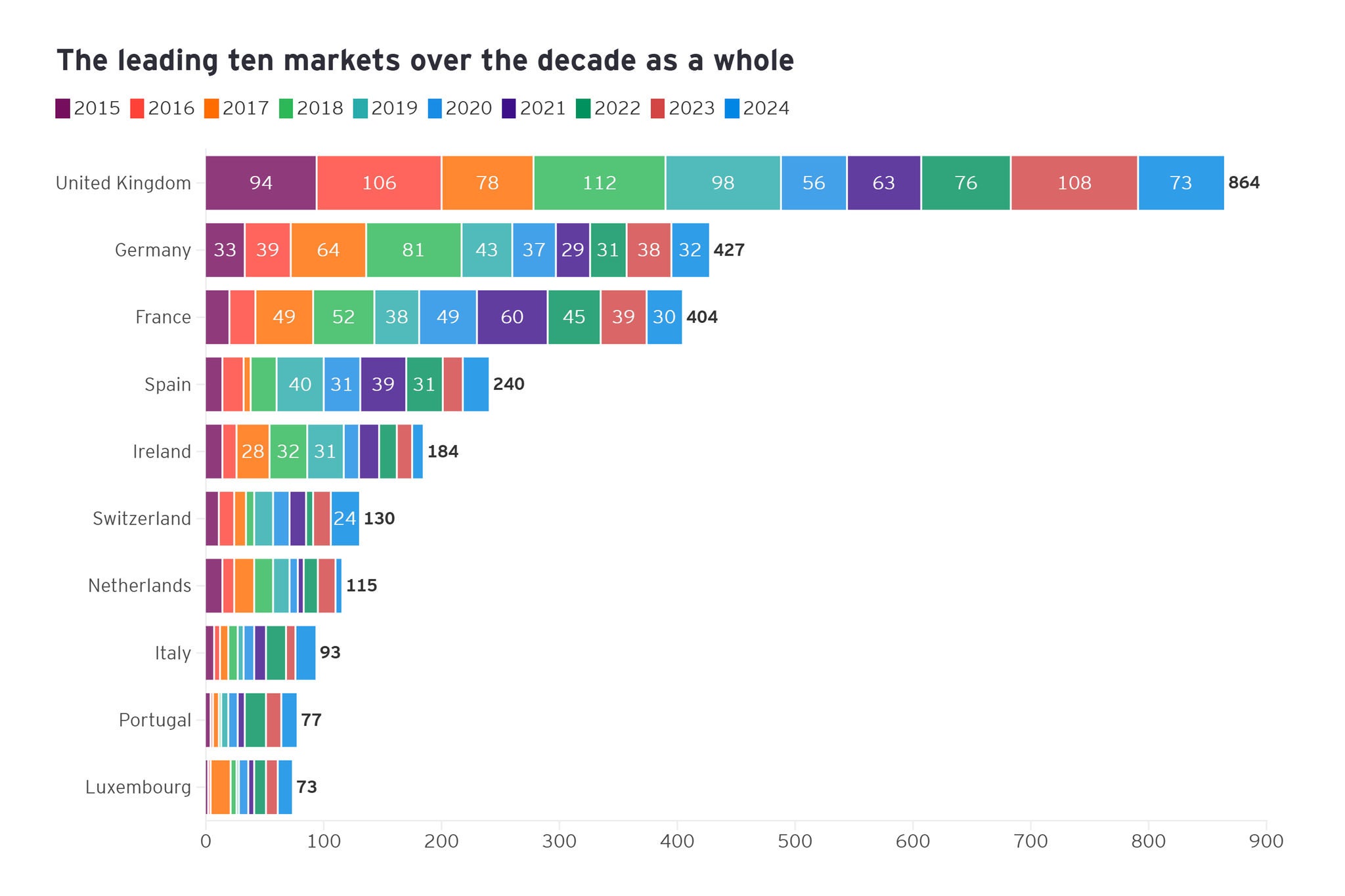

- Despite a 32% annual drop, the UK attracted the most foreign direct investment (FDI) in Europe again in 2024, recording 73 projects

- Germany took second place with 32 financial services projects in 2024 (a 16% annual decline), and France was third with 30 projects (a 23% annual decline)

- Total financial services FDI projects across Europe fell from 329 in 2023 to 293 in 2024 – a year-on-year decrease of 11%

The UK continues to be Europe’s most attractive location for foreign direct investment (FDI) into financial services, according to EY’s latest Attractiveness Survey for Financial Services, despite total project numbers across Europe falling 11% year-on-year (from 329 projects in 2023 to 293 projects in 2024).

Although the UK recorded a 32% year-on-year decline in project numbers (from 108 in 2023), it attracted 73 financial services projects in 2024, which is more than double second-placed Germany, which recorded 32 projects – a 16% decline from 38 in 2023. France fell to third position with 30 projects in 2024 – a 23% decline from 39 projects in 2023.

As a result, the UK secured a quarter (25%) of all European financial services FDI projects in 2024, though this was down from 33% in 2023. By comparison, Germany secured 11% and France secured 10% of Europe’s financial services FDI projects – both unchanged from 2023.

The leading 10 markets for financial services FDI over the last 10 years

Martina Keane, EY UK and Ireland Financial Services Managing Partner, comments: “The UK has retained its position as Europe’s most attractive destination for financial services investment, despite investment falling across the region. The strength and depth of the UK’s financial services sector continues to capture global investor confidence – particularly as they navigate challenging market conditions. But competition is fierce, and while the UK industry is a clear leader, we cannot ignore the fact that investment levels have declined over the last year.

“Both industry and Government are taking positive action to prioritise growth and innovation in UK financial services, and this collaboration must continue. Future success rests on not just maintaining, but growing the attractiveness of the UK’s financial services sector on the global stage. To do this, we must build on our inherent strengths and prioritise progressive regulation, innovation and the continued establishment of key international trade relationships.”

New financial services projects rose marginally across Europe and the UK, but fell in most major markets

Alongside the expansion of existing projects, the number of ‘new’ financial services projects across Europe and the UK rose only marginally, from 233 projects in 2023 to 234 in 2024. Of the 73 UK financial services projects recorded in 2024, 53 were new – down from 85 in 2023. Similarly, new financial services projects in Germany fell - from 32 in 2023 to 28 in 2024 - and in France they declined from 22 in 2023 to 17 in 2024.

In contrast, new financial services projects in Spain increased from 14 in 2023 to 21 in 2024, and in Switzerland project numbers climbed from 11 in 2023 to 21 in 2024.

Employment fell across Europe following three years of successive growth

Employment arising from financial services projects across Europe declined in 2024, following three successive years of growth. Where available, publicly disclosed job figures showed employment from UK financial services projects more than halved (52%) from 5,019 in 2023 to 2,408 in 2024, and in the EU publicly disclosed employment linked to financial services FDI was down a third (33%) year-on-year.

London remains leading European city for FDI, but gap with Paris closes

London remains the leading European city for attracting financial services FDI, despite falling from 81 projects in 2023 to 39 in 2024. Paris placed second, with 23 projects, down from 31 in 2023. Madrid and Zurich in joint third place saw uplifts in their project numbers, securing 14 projects each in 2024; for Madrid this was up from 11 the previous year and for Zurich this was up from 9 projects in 2023. Milan followed in fifth place, with 13 projects in 2024, up from 7 in 2023.

In terms of securing ‘new’ financial services projects, London attracted the highest number in 2024 (34 projects down from 69 in 2023), followed by Madrid (14 projects up from 10 in 2023), then Milan (13 projects up from 3 in 2023), Zurich (12 projects up from 7 in 2023)), Munich (11 projects up from 5 in 2023) and Paris (11 projects down from 18 in 2023).

UK remains leading recipient of US investment

The largest source of financial services investment into Europe was again the US, although projects were down from 91 in 2023 to 72 in 2024 (a decrease of 21%). Overall, the US backed a quarter (25%) of all financial projects into Europe in 2024.

The UK was again the leading recipient of US investment. Although projects fell from 38 in 2023 to 28 in 2024 (a drop of 26%), the UK recorded a higher proportion of US investment (38%) than its average for the decade (34%).

Switzerland, Spain, Italy and Luxembourg buck trend of falling FDI projects numbers

Despite most major European markets seeing an annual decline in financial services FDI, a number of markets bucked this trend and saw an increase year-on-year in investment. Switzerland, now ranked fourth in financial services FDI across Europe, recorded 24 projects in 2024 up from 15 in 2023 (a 60% increase), fifth placed Spain recorded 22 projects up from 17 (a 29% increase), sixth placed Italy recorded 17 projects up from 8 (a 113% increase), and seventh-placed Luxembourg recorded 12 projects in 2024 up from 10 in 2023 (a 20% increase).

Omar Ali, EY Global Financial Services Leader, comments: “Whilst geopolitical and macroeconomic uncertainty has weighed on investor sentiment and business confidence this past year, cross-border investment remains key for global financial services firms as they look for growth and competitive advantage. Global investors are undoubtedly still committed to Europe’s deep capital markets and highly skilled workforce and although investment fell both overall and in the region’s biggest markets in 2024, a number of financial centres bucked this trend. Switzerland, Spain, Italy and Luxembourg all recorded a rise in foreign investment, in part due to the progressive policy environment and specialist sector expertise they offer.

“Outside of Europe’s borders – notably in New York, Singapore and Hong Kong – competition is strong. With FDI levels down on previous years, it is more important than ever that Europe’s major markets find ways to outwardly demonstrate the pull factors that investors are looking for and collaborate where needed to keep investment within the region.”

Further to the European FDI data, a global financial services investor sentiment survey in May 2025 examining future investment attractiveness of Europe found that:

86% of investors think the UK will retain or improve its level of financial services attractiveness over the next three years (up from 75% in 2024).

London is seen as the most attractive European city for financial services foreign investment over the next year (54%), with Frankfurt second (45%), followed by Paris (40%), and Dublin (37%).

At a country level, Germany is seen as the most attractive European country for financial services investment (47%), followed by the UK (45%), France (38%), and Switzerland (24%).

The global cities identified as London’s biggest rivals for financial services foreign investment in the next three years are New York (59%), Paris (41%), Frankfurt (43%), Singapore (39%) and Hong Kong (39%).

Global financial services investor sentiment following the US tariff announcements in March favours the UK over the EU and US for FDI, with those surveyed more likely to invest in the UK (44%) than in the EU (39%) or the US (32%).

Conversely, market uncertainty following the UK tariff announcements has increased caution in some investors. When asked if they are less likely to invest these markets following the tariff announcements, investors indicated hesitancy towards the US (61%), followed by the EU (55%) and UK (52%).

Investors cite the key areas for future strategic investment as small and medium sized business support, tech and innovation, R&D funding and improved access to business capital.

Notes to editors:

Financial and non-financial European FDI saw a 6% year-on-year decline in projects, from 985 projects in 2023 to 853 in 2024. The UK recorded a total number of 853 projects in 2024, a 13.4% decline compared to 2023 (985 projects).

‘New’ investment projects represent a new footprint for firms and is a recognised means of assessing a country’s investment dynamism and ability to attract fresh investors.

About the EY Attractiveness Report

The EY Attractiveness Surveys analyse the attractiveness of a particular region or country as an investment destination. The surveys are designed to help businesses make investment decisions and governments remove barriers to growth. A two-step methodology analyses both the reality and perception of FDI in the country or region.

The evaluation of the reality of FDI in the UK is based on the EY European Investment Monitor (EIM), the proprietary EY database.

We define the attractiveness of a location as a combination of image, investors’ confidence and the perception of a country’s or area’s ability to provide the most competitive benefits for FDI.

Field research assessing sentiment on the UK and Europe's attractiveness was conducted by FT Longitude in May 2025 based on a representative panel of 100 international financial services decision-makers.