2. What critical innovations can create new market opportunities for us?

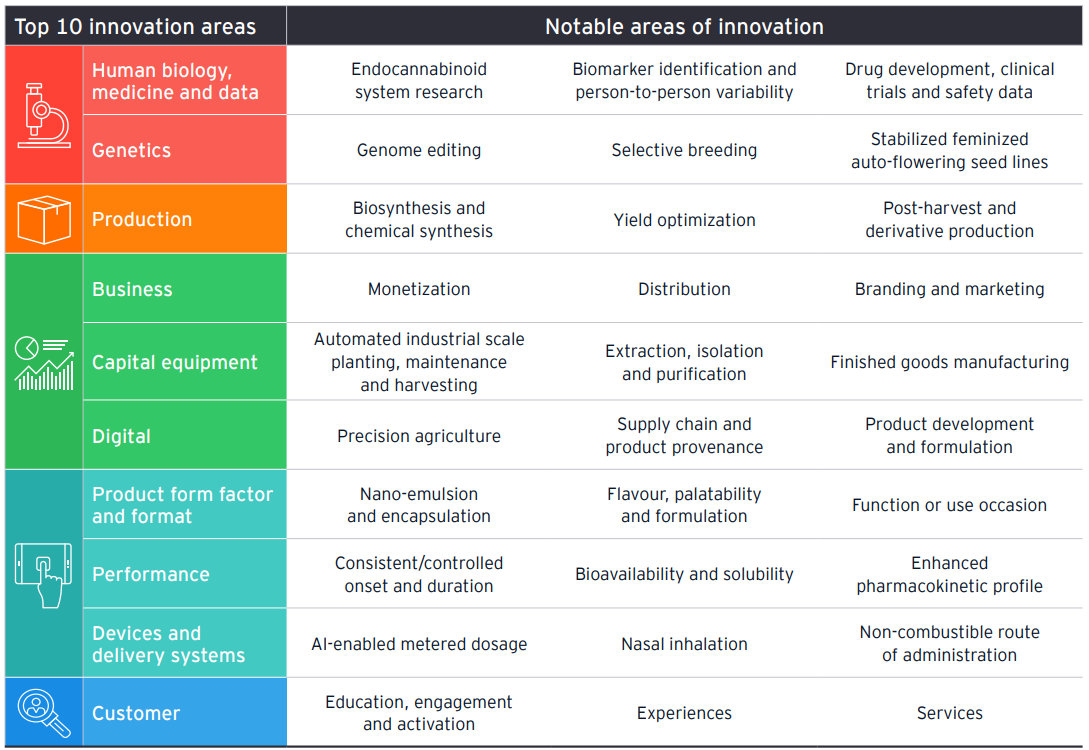

Those already shaking up the cannabis industry are taking a holistic view of the sector and using innovation to accelerate research, product development and consumer understanding. On the one hand, dried cannabis flower has been the dominant cannabis format to date and will continue to be an important category.

Down the road, individuals may consume cannabis as a supplement with their morning breakfast for a boost of energy, apply cannabis-infused topicals to soothe localized pain from a round of golf, or drink a beverage before bed to promote relaxation. Creating such substitutes and investing in resources to develop these new markets are attractive propositions for adjacent industries already making their way into the space.

To capitalize on new innovation, consider:

- Taking down organizational silos that impede innovation can accelerate the speed and impact of your progress. Innovation thrives when it’s deeply embedded in organizational culture.

- Creating a collaborative innovation ecosystem through incubators, accelerators and co-innovation spaces. This can provide high-growth potential companies with access to resources, infrastructure, product development and commercialization expertise.

3. How can we proactively build optionality into our strategy?

So much of the market opportunity ahead will only accelerate as major regulatory breakthroughs and scientific milestones are met. Valuation premiums for good operators, additional investments and industry participation are likely to increase as additional countries, like the US, embrace federal legalization. Waiting for the industry to cement itself can mean missing out on the opportunities already proliferating across the global industry.

Early entrance into this emerging industry typically requires significant infrastructure investments. However, late entrants may miss out on opportunities that are accessible only through established and trusted partnerships. Optionality can be built into strategy by taking an iterative approach to scanning the market, developing adaptive commercial strategies, conducting scenario analysis and engaging in pilots that are structured in a way that reduces risk while enabling active participation.

Create greater optionality by:

- Using flexible and innovative investment and partnership structures to mitigate risks and compete effectively over the long term. Given the many unknowns and dynamic changes in the industry’s future, the traditional “build, buy or joint venture” market entry framework may need rethinking.

- Decreasing risk through structuring contingencies into minority investments with the option to convert to majority / controlling interest upon certain market conditions, economic milestones or regulatory reform.

Summary

Where do we go from here?

With the right alignment, just about any company competing in a mature adjacent industry can uncover a route into the sector, tapping into new growth. Right now, the industry represents a wealth of possibilities to explore. Making smart investments today can secure optionality as legalization expands, regulations evolve and innovation unlocks new product, market and customer opportunities. Exploring what investments, partnerships, joint ventures or transactions could make the most sense for you now means building agility and alignment with your longer-term strategy. With an industry moving this rapidly, that’s critical.