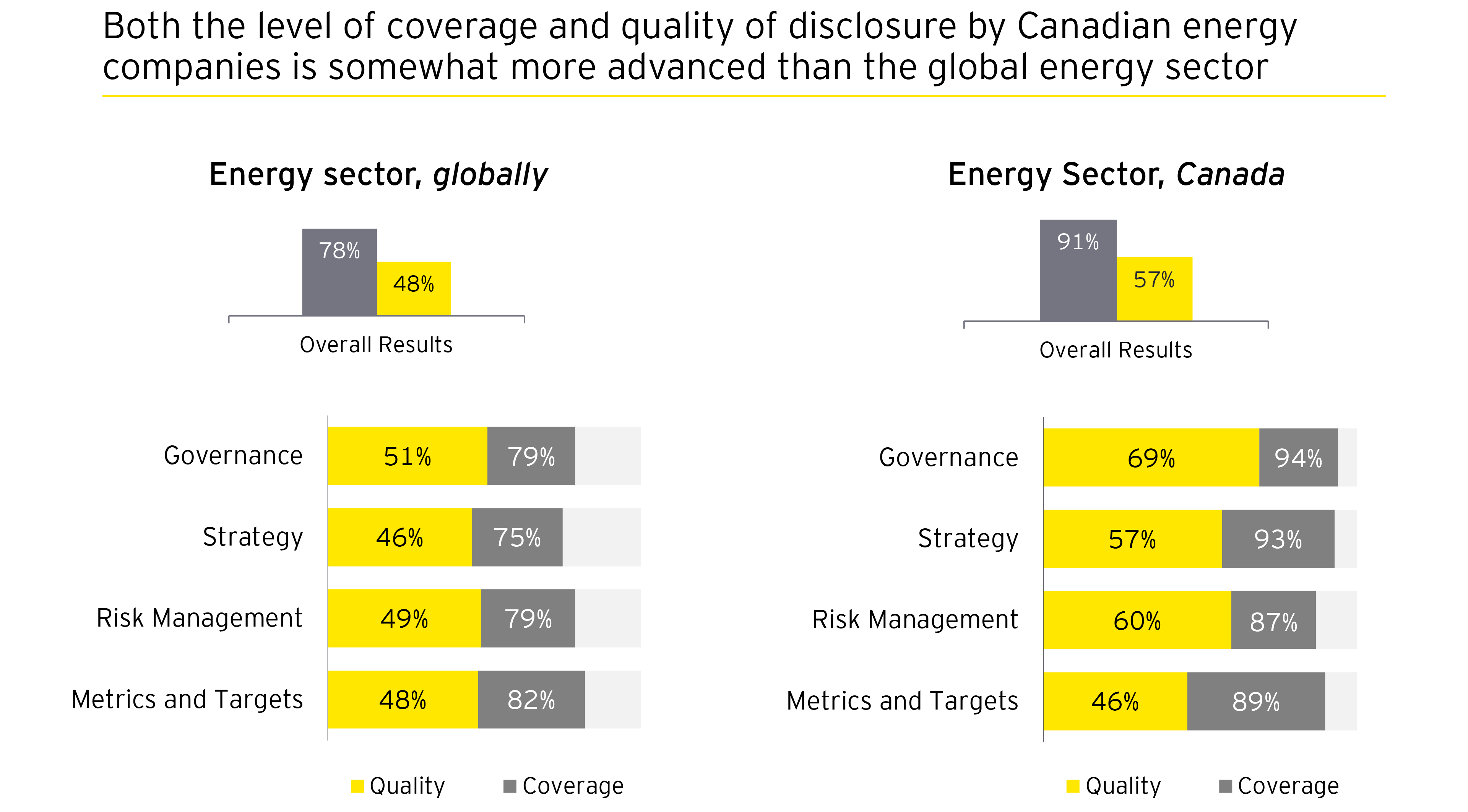

Two-thirds of Canadian companies had reached full coverage of the recommended disclosures, higher than the 50% of their global peers that had reached full coverage.

What’s more, Canada’s energy sector coverage of the TCFD recommendations increased an impressive 27% over 2019, and its quality increased by 20%, while coverage and quality in other countries increased just 12% and 13%, respectively.

Despite Canada showing some bright improvements, there’s still considerable work to do. First, we look at the forces behind the enhanced disclosures and then address where there are gaps.

What’s driving Canadian energy’s enhanced disclosure

Oil and gas companies are a significant contributor to Canada’s total greenhouse gas (GHG) emissions, with their activities making up approximately 26% of the country’s total emissions. As such, they’ve faced mounting stakeholder pressure across a range of environmental issues, including climate change.

Many of today’s investors are focused on responsible investment, where environmental, social and governance (ESG) factors are incorporated into the selection and management of their assets. They want to know how energy companies are preparing to build business resilience and manage transition risk. Transition risks are the risks companies face as they transition to a low-carbon economy, including carbon pricing or other policy changes, evolving consumer preferences and reputational risks.

More than ever before, energy companies’ access to capital depends on their climate strategy and sound management and mitigation plan for risks — both of which begin with shared understanding and transparency.

Several federal regulations and policy developments are also taking shape in Canada. With the clear direction outlined in the updated Canada Climate Plan, energy companies are expected to set more aggressive reduction targets and disclose their plans to decarbonize. Canada’s 2030 target of 40% to 45% reduction of GHG emissions over 2005 levels is expected to drive, more decisive action and even higher disclosures next year and in years to come.

These domestic factors are compounded by pressure from the global economy, with a growing number of countries making pledges to attain net-zero carbon emissions. In June 2021, G7 countries called for mandatory financial disclosures around companies’ exposure to climate-related risks. Next up, the UN Climate Change Conference, COP26 in Glasgow in November 2021, is expected to accelerate further action towards Paris Agreement goals and the UN Framework Convention on Climate Change.

Factors influencing disclosure in Canada

Now

- In 2019, the Canadian Securities Administrators reiterated expectations for disclosure of material risks, including those related to climate change.

- In 2019, the CDP (formerly the Carbon Disclosure Project) aligned its questionnaire to the TCFD recommendations. Many companies already reported to the CDP — the challenge now is to provide more detailed and robust responses.

- The updated Canada Climate Plan provides direction to meet Canada’s latest ambition to be net zero by 2050.

- Canada’s carbon pricing mechanisms are leading to more detailed company emission information and a willingness to publish mitigation strategies.

In the near future

- In June 2021, the G7 announced support for moving towards mandatory climate-related financial disclosures.

- The proposed Canadian Net-Zero Emissions Accountability Act, introduced in 2020, formalizes Canada’s target to achieve net-zero emissions by 2050, with a series of emissions reduction targets at five-year milestones.

- In 2022, large Crown corporations will be required to report on climate-related financial disclosures.

Connecting disclosure to risks and opportunities

With climate risk moving up the agenda, Canadian energy companies need to be prepared for climate-related disclosures to be added to the scope of their external audits. We’re already beginning to see climate disclosures, including TCFD scenarios for publicly traded companies, fall under the enhanced scrutiny of securities regulators.

While Canadian energy company disclosures are becoming more assertive, what needs improvement is future-focused risk analysis as these companies’ progress.

When it comes to risks, we found that most energy companies focus on capital infrastructure and carbon pricing risks, leaving others poorly defined. While companies recognize climate change as a threat, they don’t explore the related risks in detail, and few can quantify their impact on the company. This means that, as the world transitions to net zero, Canada’s energy companies face climate-change-related risk exposure and risk being underprepared for opportunities that arise.

In addition to transition risks, companies also need to consider physical risks that can be material and highly unpredictable, such as climate-related heatwaves and flooding. The recently released report from the UN’s Intergovernmental Panel on Climate Change (IPCC) Working Group I Contribution to the Sixth Assessment Report clearly presents evidence of worsening risks. These occurrences affect the energy sector and other sectors of the economy and can no longer be overlooked.

Climate scenario analysis is critical to robust risk assessment

As we examined Canadian energy company disclosures, the missing element was clear: identified risks and opportunities are not tied to scenario analysis.

Within the TCFD framework, scenario analysis is the critical planning stage that turns theory into tangible, actionable strategies. Scenario analysis is vital for leading-class reporting because climate change risks are inherently longer, longer-term, and more complex than traditional business risks.

As reporting becomes commonplace, regulators and capital markets will increasingly look to see whether companies have performed robust risk assessments that include scenario analysis.

So far, only 41% of companies globally conduct scenario analysis, and only 15% feature potential implications of climate change in their financial statements.

Then there are various forms of scenario analysis that help companies see the path forward and update their business models accordingly. Examples include detailing what becoming net-zero looks like for different economic sectors and compensation plans and offsetting. By assessing and managing various scenarios — from most likely to worst-case — companies can enhance their preparedness and satisfy stakeholders.

Moving to a net-zero future

As the scientific evidence grows, more compelling and climate change projections come to life, the requirement for immediate and more robust action is clear.

Canada’s energy companies have heeded the warnings, which has become clear as their decarbonization strategies have begun to take shape. While climate change may be their biggest long-term challenge, it also brings economic opportunity.

Energy companies that are openly sharing their progress have an opportunity to attract investors and green financing. What’s more, the sector is demonstrating a willingness to adapt and innovate, supported by technological developments in carbon capture, utilization, and storage or CCUS, hydrogen, grid modernization and small modular nuclear reactors.

Canada is working hard to position itself as a leader among global economies, but we must consider that we’re also among those with the farthest to go. Our hard-to-abate sectors are still essential to the global economy, at least short to medium term. Enhanced disclosures from energy companies mean we’re headed in the right direction. Still, to move the needle in any meaningful way, those disclosures need to lead to concerted action involving multiple players in the value chain.

As the transition to net-zero continues to gather pace, climate-related risks and opportunities should be front and centre for all Canadian organizations as they plan their futures.

Related articles

Summary

Canadian energy companies are gaining ground on climate risk disclosures – satisfying investors and complying with evolving policy regulations – however, there’s still significant work to be done to protect against growing climate risks and align their business strategies with a net-zero economy. We’re helping energy companies, and other sectors understand the physical, economic and policy connections between future climate change and its impacts and their business and supply chain activities.