Empower your people by focusing on their readiness now

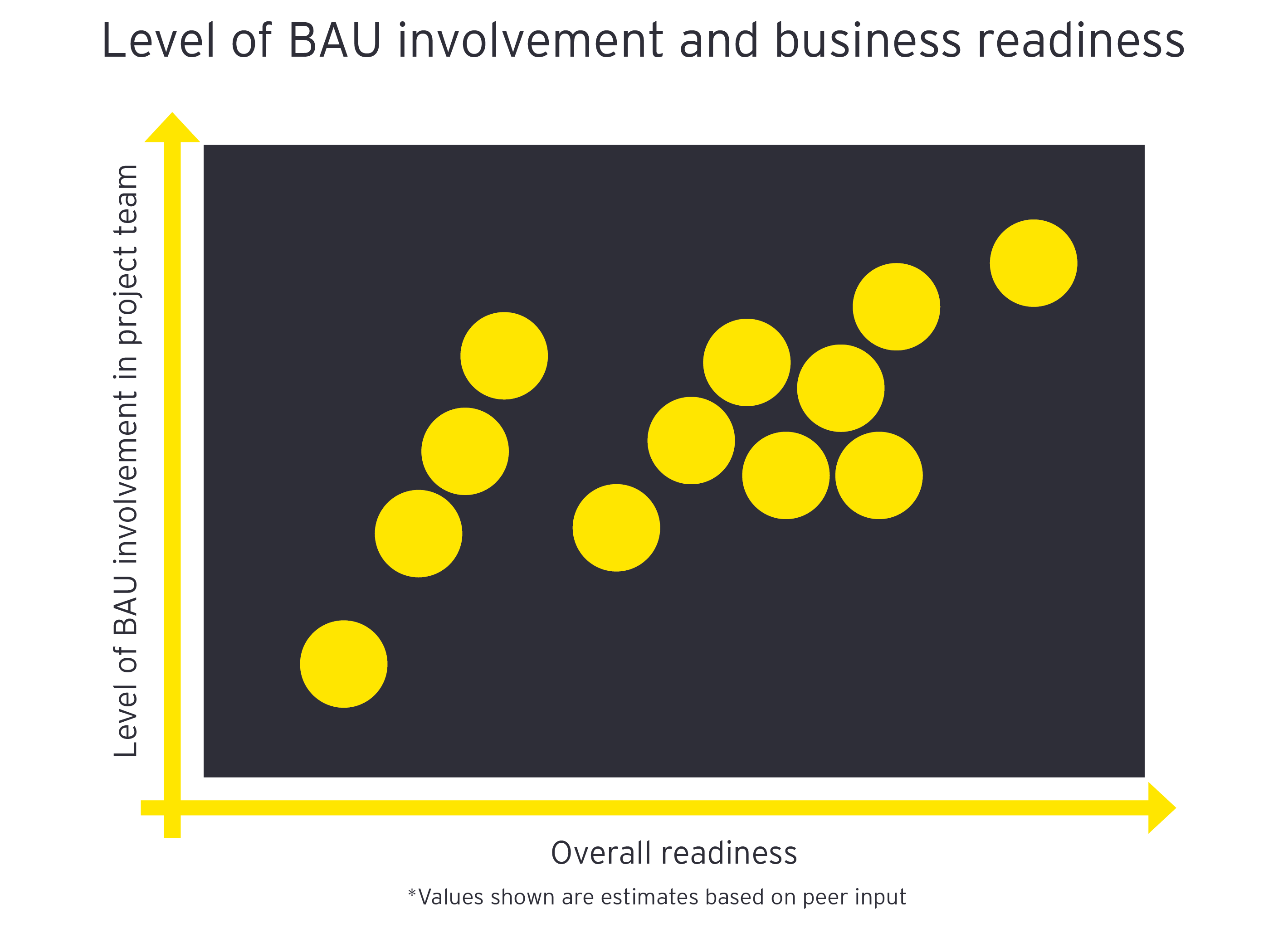

Ramping up for IFRS 17 BAU requires solid understanding and quantification of the IFRS 17 impacts on performance KPIs in various areas of the business. Our survey underscored that while training plans are well in hand, absorption remains a struggle, due to the protracted duration of the IFRS 17 transition. A lack of understanding of results and KPI impacts was another contributing factor.

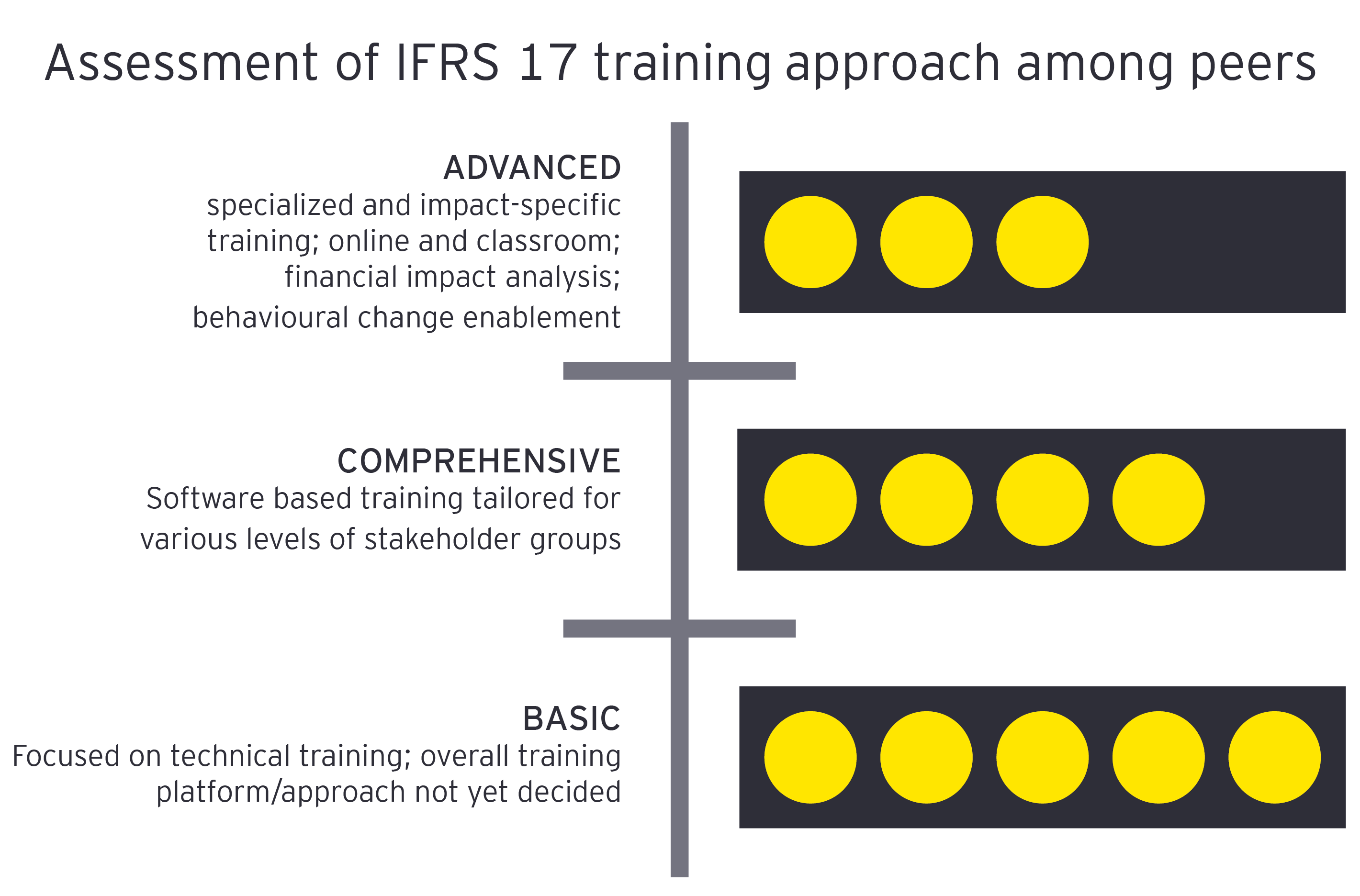

Analyzing where people stand on the basics and offering the right training or upskilling opportunities at various levels in the organization gives your team a strong start. We see that carriers with advanced training plans tie together online and facilitated training with less formal, two-way exchange sessions. Training is then supplemented with hands-on experience that brings users directly into the training plan (user acceptance testing and/or dry run).

Ask these questions internally to navigate your people’s readiness:

- Does our training plan reflect varying degrees of stakeholder understanding, from basic to advanced, and is it effectively balanced to include hands-on experience?

- How do we broaden our people’s understanding of how IFRS 17 will impact performance KPIs to enable the business? What specific learning do investor relations teams and the board require?

- How are we combatting “change saturation” across the organization, as competing priorities fight for their share of internal focus?

Prioritize time for multiple dry-runs

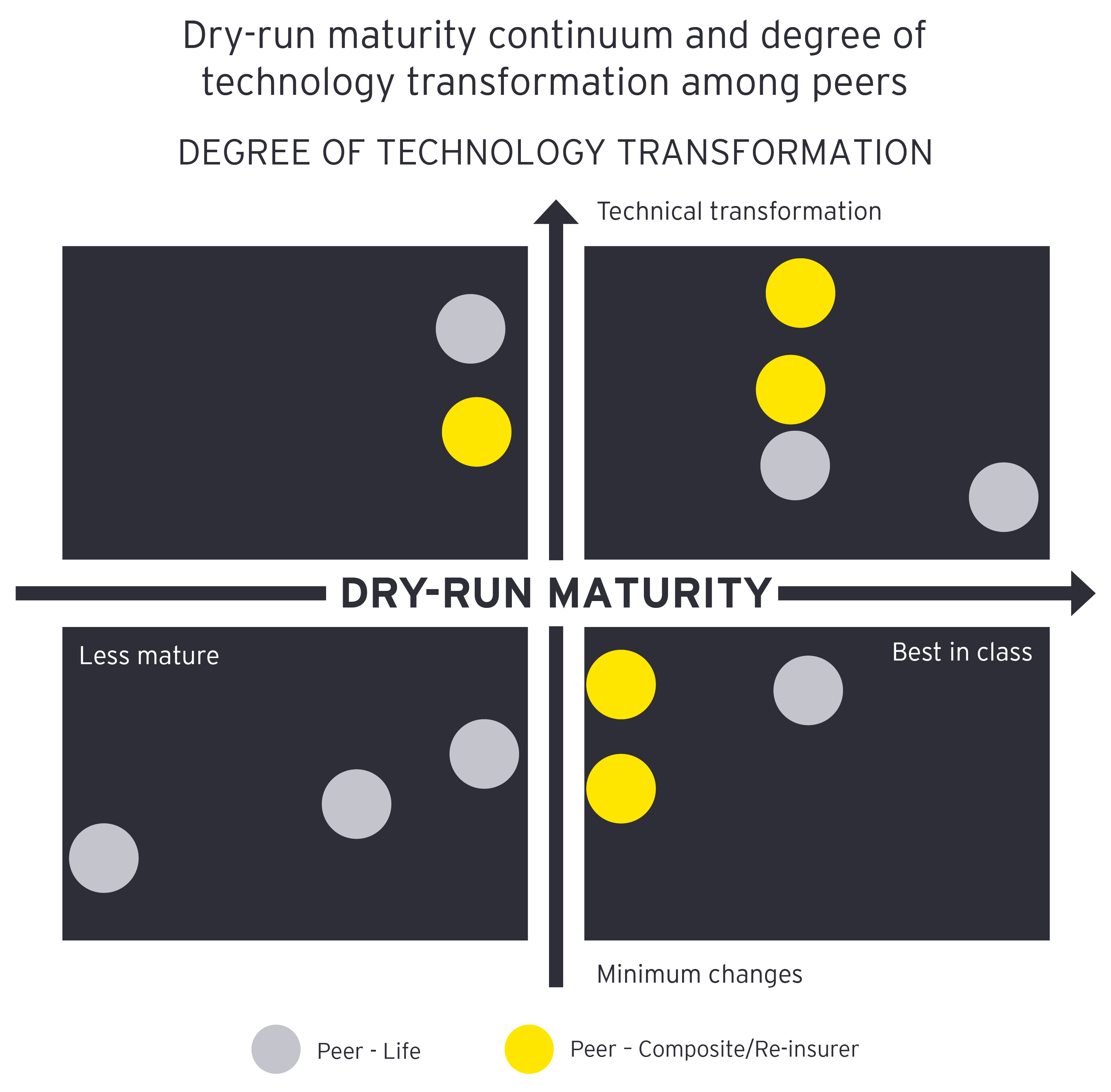

For many insurers, the IFRS 17 implementation has necessitated a broader — and necessary — technology transformation. With that comes the need to test, test, test the model at every opportunity. Still, regardless of the scope of technology transformation, testing must extend beyond technology alone to assess target-state processes, controls, roles and operating models.

That should include building in ample time to identify bugs or bottlenecks with the potential to impact the time-sensitive financial close process. The dry run is an ideal chance to proactively spot any potential barriers that could get in the way of closing the books effectively. It’s also an opportunity. The transformation itself is likely to surface a wealth of new data, reports and insight that cross-functional business leaders can use to understand the absolute and relative impact of IFRS 17 for each quarter. But they can’t benefit from the full lift of that new information without enough time to fully assess and analyze it.

Our survey revealed that dry runs are being used to identify gaps in BAU readiness, and the point at which the BAU community assumes greater ownership and engagement with the IFRS 17 changes. Dry runs using production (or production-like) data create interpretable financial results that fuel simulations, cultivate deeper understanding of policy decisions and illustrate implications, helping to inform the people readiness activities.

Ask these questions internally to make the most of dry runs:

- How can we use our dry runs to produce financially interpretable results that simulate the impacts of policy decisions? Is the broader business — including investment, finance and actuarial stakeholders at a minimum — sufficiently involved in ongoing test and dry-run cycles?

- How are we aligning the accountabilities in the dry run to the new target operating model?

- Can we use QIS III to determine where to focus our dry runs?

Build a solid plan to effectively tackle dual reporting

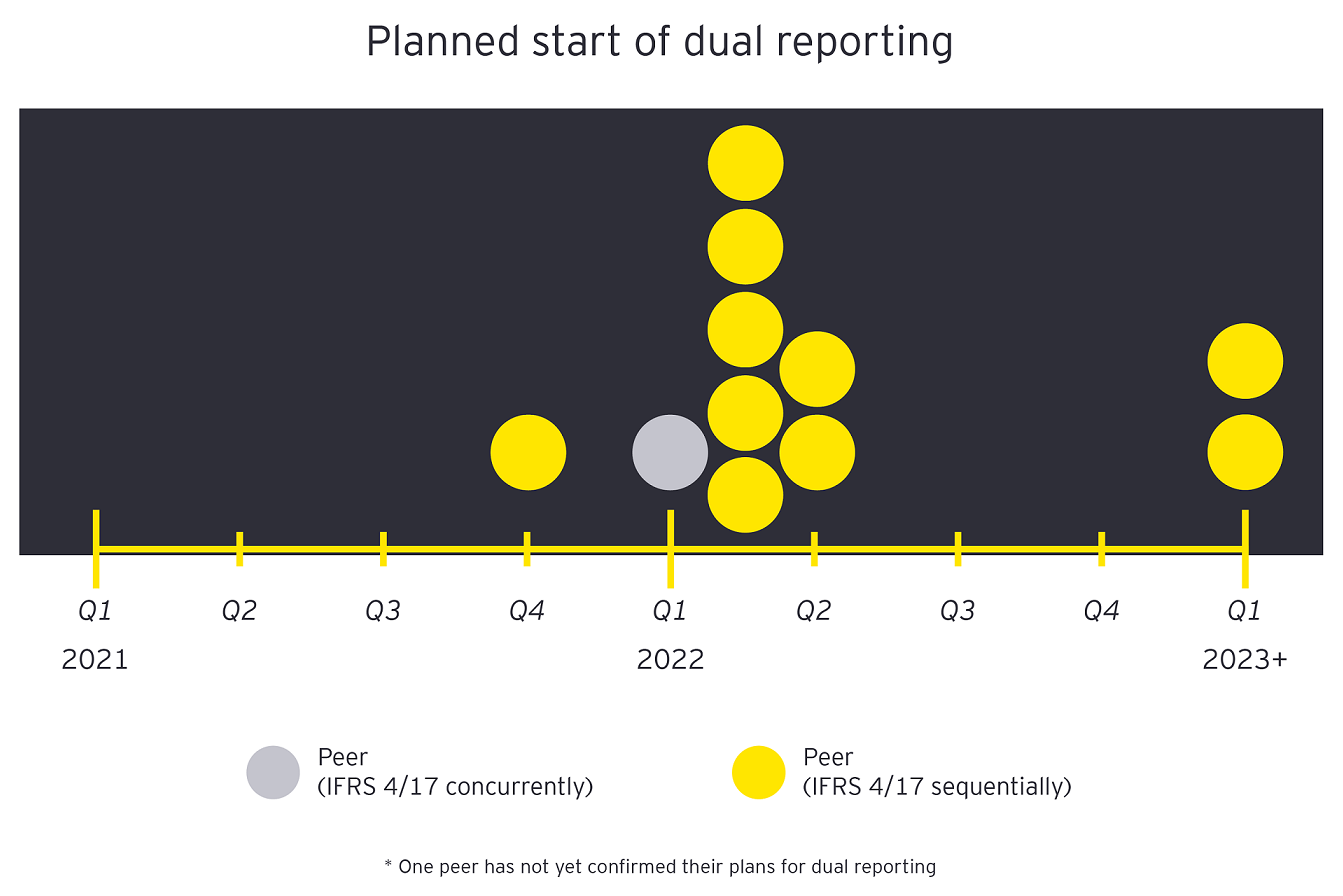

From the way you engage external auditors to the way you communicate with industry analysts, dual reporting entails a host of dynamics to consider. Planning an earlier start to dual reporting allows more runway to understand those implications, address them and adjust your approach accordingly.

Our survey showed most peers are planning for dual reporting with the intent of running IFRS 4 and IFRS 17 sequentially. Further, none of the organizations canvassed expect to disclose the IFRS 17 impacts earlier than the second or third quarters of 2022.

Ask these questions internally to support dual reporting success:

- How will we balance any delayed disclosures against industry trends and shifting stakeholder demands?

- How will we maintain overall effectiveness if dual reporting drives an uptick in workload, staff burnout or requests for time off?

- Are we doing enough to socialize systems, data architecture, end-to-end testing and financial close processes with external auditors?

What’s the bottom line?

Getting the IFRS 17 BAU change management piece right takes renewed energy and continued investments across this final critical stage of adoption. Addressing these four key areas now can make all the difference in determining the ultimate success of your IFRS 17 implementation and BAU program.

How can EY help?

Key IFRS 17 offerings - An array of specialized IFRS 17 services to facilitate the implementation program — including model build, system implementation, test planning and execution — and BAU support, such as CSM validation, Moody’s RiskIntegrity™ assessment and upgrades, and actuarial modelling on AXIS and Prophet.

Target operating model and model office/dry run - Designing an IFRS 17 operating model that translates strategic direction into operational capabilities by defining “what” an organization needs to do to achieve its objectives: the key target operating model components include people, data, systems, process and governance. Supporting planning and execution of a model office/dry run to validate the components of the operating model as the solution comes together and prior to the transition into dual reporting.

Human-centric solutions - A part of organizational change management that focuses on addressing people needs. This includes organization and workforce transformation (e.g., workforce planning), platform-based learning services, HR transformation, coaching and training (e.g., board training services on IFRS 17 and technology capabilities).

IFRS 17 valuation tool - A tool tailored to perform independent validation of the results generated by Moody’s RiskIntegrity (i.e., CSM roll-forward, LRC, LIC, loss component). We also provide version upgrades based on each new RiskIntegrity/AXIS release.

Intelligent metrics navigator - An accelerator to support the process of identifying, designing and implementing KPIs and metrics tailored to various levels of management in an interactive, visualized dashboard.

What’s shaping BAU for small and medium-sized carriers?

In Canada, based on our experience working with several small and medium-sized insurance carriers, we learned the following about how their implementation aligns with their peers’ approach at the global level:

- Capacity management remains a sticking point. Most insurers have recruited skilled individuals who are dedicated full time to the IFRS 17 implementation and BAU rollout. Even so, not many have carried out thorough resource planning for BAU. Most have planned a minimal compliance implementation, relying heavily on manual processes. That creates risk, including a potential failure to comply as BAU ramps up.

- People readiness is still taking shape. The majority of insurers haven’t finalized BAU operating models or processes. Instead, they’re wrapping up the implementation and testing of core data, systems, policies and methodologies. Basic training and knowledge transfer seem to focus largely on the adoption of new components (think accounting policies, data solutions and calculation management). That means folks may lack the big-picture BAU understanding they’ll need to drive a seamlessly smooth IFRS 17 transition.

- Testing strategies require additional investment. For the most part, insurance companies haven’t explored dry-run or model office approaches for IFRS 17 BAU. Very few have completed their strategy, even though testing is targeted for early 2022. That could deprive insurers of the learning opportunities dry runs provide and eliminate chances to course correct.

- Dual reporting could be a challenge. Many of the insurers we consulted have yet to confirm how they’ll handle dual reporting. That gap could widen as BAU takes shape, causing teams to struggle under the strain of dual reporting and competing tasks, requirements and responsibilities.

How will you juggle key BAU activities with your software release management strategy?

As target architectures stabilize while they continue to evolve, and while software vendors narrow in on critical final “MVP” features, insurers have to learn to balance the risk introduced by a changing software landscape with the need for critically required features to satisfy the standard:

- Develop a “release management” strategy. Understand how, when and why new releases are introduced. It’s leading practice to schedule and synchronize across data, actuarial, CSM and subledger for internally and externally developed releases. Don’t forget to look at how the version and security updates required by your general ledger and other vendor-provided solutions will impact this strategy.

- Assess a vendor’s new version release. It’s not enough to blindly take a vendor’s new version. You should understand the impact and criticality of data model changes it will inevitably require. Stay current by planning to take all major releases and strategically take minor releases where needed. Understand the vendor’s support model for releases and work with the vendor to understand timing and impact.

- Own the software roadmap. For vendor solutions — including CSM calculators, subledgers and actuarial platforms — participate in user groups to be part of the discussion on new features and strategic direction. Offer to be a beta test client for new features you’re particularly interested in. Understand the roadmap and map it to your internal “wish list.” Be able to prioritize new and requested features according to factors including risk and control, operational efficiency, evolving standard requirements and internal customizations.

- Automate regression testing covering core scenarios. A good regression testing strategy should include all core test scenarios using automation to quickly verify that key functionality remains unchanged where expected when introducing fixes, patches and other required changes. A regression plan should be ready for execution during end-to-end testing cycles and should be executed as part of your test strategy and plan. This approach can help further galvanize your “release management” strategy.

Summary

Get insight on IFRS 17 and how insurers are navigating the profound and rapid market shifts, regulatory headwinds, and how they rethink and transform their legacy operating approaches.