Chapter 1

Current focus of silver mining companies

Miners are growing production and reserves and focusing on improving sustainability.

Most silver is produced as a by-product, with only 27% coming from primary silver mines. In 2020, zinc-lead mines produced the highest share, 32%, of total silver production.² However, over the past few years, the average price of base metals, including zinc-lead, gold and copper, declined, pushing marginal mines to cease operations. Silver production that relied heavily on base metals production faced increased pressure to maintain profitability.

Primary silver production was also moderate, due to lower prices over the last few years. Between 2014-19, overall mine production decreased by 1.12% to reach 833.2moz. Lower silver prices than the usual incentive price for new project developments impacted exploration budgets, leading to flat reserve growth over past decade. After a short uptrend during 2011-12 when silver prices surged, investment activities remained subdued as the average price fell from $34/oz to $18/oz.

However, COVID-19 has resulted in renewed focus toward silver production. Elevated silver prices and improving the balance sheet for all non-ferrous miners is indicating an opportunity to allocate higher risk capital toward exploration budgets and work toward adding new reserves for mining companies. In line, companies are looking for M&A activities, more prominently for early-stage assets as higher prices have inflated the valuation of assets. Traditionally, the focus has been on base metal to determine deal value, but now miners are increasingly considering silver as a co-product in determining valuations to gauge intrinsic value of assets in a mine.

Miners are also considering deals of ceased assets with a potential for further economic viability in the overall reserve area. For instance, GR Silver Mining completed the acquisition of Marlin Gold Mining from Mako Mining, including La Trinidad Mine and 12 concessions totaling 107,393 hectares adjacent to existing portfolio. It now owns two past-producing mines (Plomosas and La Trinidad) that are fully permitted for future production. The company has begun drilling activities at Plomosas and reported silver mineralization at shallow depths in areas never drilled before.³

Focus on improving sustainability

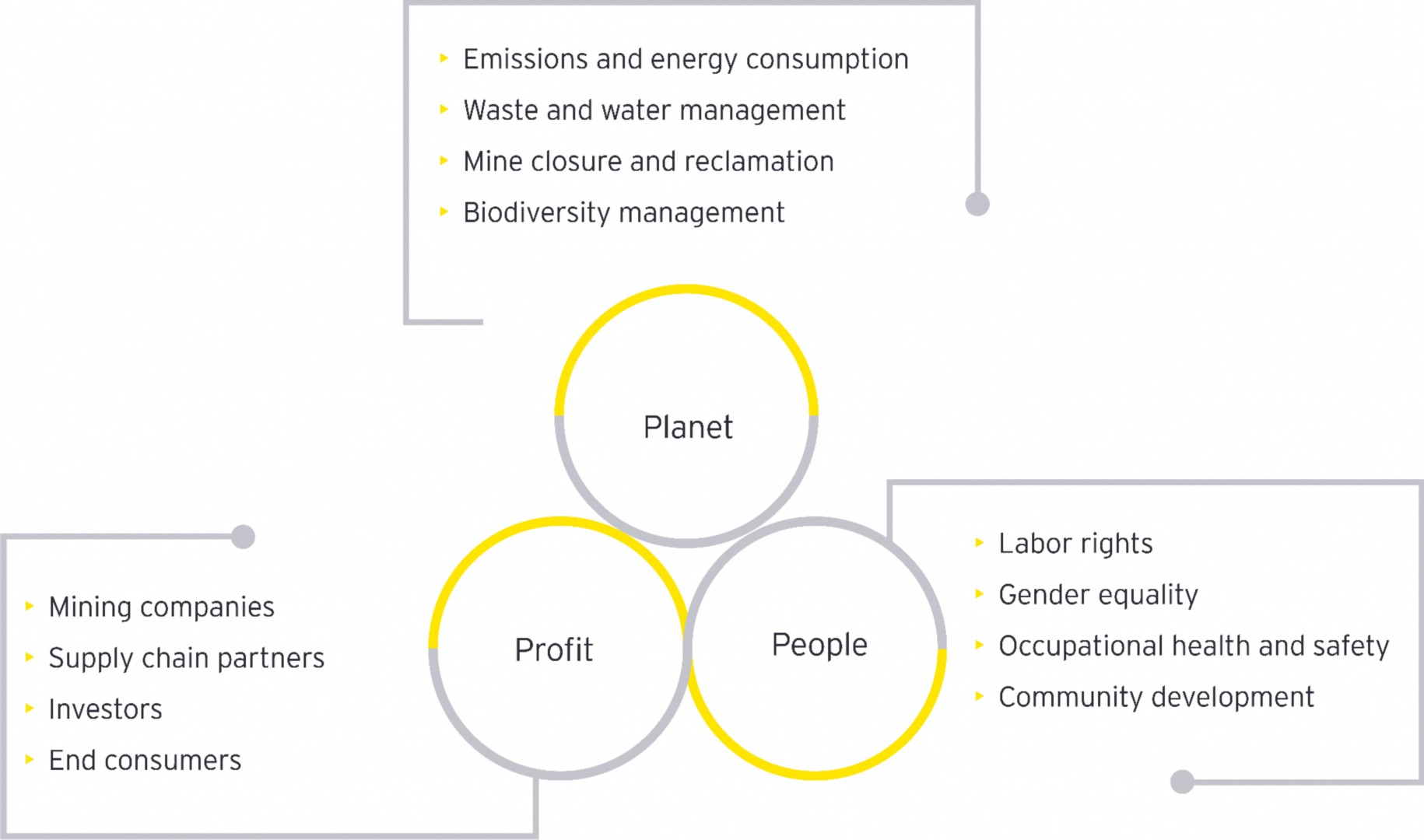

Sustainability of operations is likely to become more prominent with increasing stakeholder focus across the value chain. Ambitious climate targets have forced governments across regions to intervene and enforce carbon abatement strategies. Moreover, investors are more vigilant now to hold a sustainable portfolio through ESG-based investing, pushing companies to factor in ESG compliance.

Increased usage of recycled silver: Silver scrap usage is on the rise due to heightened metal prices. Global silver recycling increased for a second straight year in 2020, rising by 7% year-over-year to a seven-year high of 182moz with industrial scrap having 56% share.⁴ Due to tighter environmental regulations, demand for scrap will further increase as it reduced both emissions and the need for new produced metals.

Renewed focus on improving sustainability metrics: Companies are currently focusing across multiple areas. Among these, climate change and sustainability, community development, waste and water management, and health and safety emerged as the key areas in which miners’ investments have increased during 2020.

Source: Company reports

Note: Size of words is proportional to frequency of ESG initiatives by miners.

Chapter 2

Next steps for miners to steer the transition

Rethinking business models and leveraging green financing alternatives are next on miners’ lists.

Mining and refining member companies of the Silver Institute have taken several initiatives aligned with the United Nations Sustainable Development Goals (SDGs) to address sustainability issues. Member companies have aligned to comprehensive environmental management programs to meet regulatory standards and address risk management. Major miners have collaborated with the Silver Institute to guide sustainable mining and cover the following key areas:

People: Focus on providing health, safety, competitive wages, benefits, and training and professional development for employees and contractors.

Community: Contribute to economic growth by providing local jobs, internships, education and scholarships, investing in infrastructure, supporting community organizations and local businesses.

Environment: Follow and aim higher than minimum legal standards while utilizing innovation through leading modern mining practices to control impact, including reducing emissions and energy intensity, preserving biodiversity, and optimizing waste and water management.

Silver Institute sustainable mining initiatives practiced by member companies

Source: The Silver Institute

Rethink business model to meet increasing demand

Energy transition is pushing silver demand in nontraditional sectors, such as e-mobility and renewable power generation. From an industrial standpoint, silver has prominent usage in electrical and electronic applications, and in the production of solar panels as a key component in photovoltaic cells and photography. A growing appetite for commodity investments is also expected to continue contributing to demand. In 2019, 45% of silver demand was for investment purposes, split between jewelry (20%), silverware (6%), and bars or coins (19%). Compared to gold, silver’s strong dual hold as an investment instrument and as a metal with industrial applications is expected to strengthen its demand further.⁵

However, miners need to seriously consider the impact of green initiatives to reduce emissions at every stage of the value chain. As end consumers are facing increased pressure to report and reduce scope 3 emissions, there is a growing expectation of low-carbon supplies. Increased demand for sustainable products from end consumers is pushing miners toward greater adoption of sustainable production techniques, including improving process efficiencies and electrification of mining operations. In line, silver miners need to re-orient the existing and upcoming business toward more sustainable product portfolios.

Leverage green financing alternatives

Increased ESG initiatives will increase capital requirements initially, but they also have long-term value. Moreover, these actions are likely to open a window for miners to model financing activities to raise funds earmarked for greener initiatives. For instance, Polymetal raised a green loan worth $125m from Société Générale to finance projects aimed at transitioning to sustainable operations.⁶ Atlantic Copper raised a green loan to finance six sustainable projects for $21m, in a transaction supported by Spanish bank BBVA.⁷

The global sustainable bond market is growing aggressively and is likely to account for 8%-10% of total bond issuance in 2021, compared to 5.5% in 2020.⁸ Minerals such as silver, which are critical for energy transition, will see an increased traction in bond markets. Miners need to restructure capital strategies to provide a transition to sustainable mining by utilizing green capital available. Increase in sustainable capital usage in zinc-lead, copper and gold production will directly impact the production and quality of silver products.

Chapter 3

What will drive business resilience beyond?

Digitalization and electrification have the potential to unlock long-term value.

Digitalization has the potential to unlock greater long-term value in mining operations. As mines are getting deeper and remote with a decline in average grade, digitalization will help in monitoring and analyzing data to develop integrated solutions and improve productivity of low-grade assets. Miners are increasingly collaborating with mining equipment, technology and services ( METS) companies to incorporate digitalization to develop integrated solutions by addressing challenges from construction to capital spending.

Electrified mines critical in future technology road map: Electrification of mines is an enabler toward green energy consumption as miners seek to reduce costs, increase energy efficiency and maintain licenses to operate. By 2028, market value of electric vehicles in global mining operations is expected to reach $9b.⁹ Adopting a phased implementation approach to advance progressively will aid in developing competitive solutions and limit up-front capital investment for silver miners.

Disruptions in base metals industry to impact silver output

Fortunes of silver depend on gold, zinc-lead and copper mining industries. Business risks related to geopolitical changes, local community disputes and changes in government regulations in areas of mine operations will significantly impact competitiveness. Illegal mining activities have grown exponentially in recent times, especially in the Latin American region. In 2016, it was estimated that about 28% of gold mined in Peru, 31% in Bolivia, 77% in Ecuador, 80% in Colombia and 91% in Venezuela was produced illegally, which has only increased with rising prices.¹⁰ This resulted in frequent outrages, damage to environmental and human capital, and temporary or permanent cease of operations in the region.

The proposed royalties bill in Chile could impact the long-term investment plans in copper. The royalties bill proposes to impose a base rate royalty of 3% on copper sales, which could go as high as 75% as prices rise.¹¹ This will not only impact cash flows in the short to medium term, but will also impact future pipelines for silver, both for domestic and foreign players.

Summary

The silver industry will remain critical as the world shifts toward a low-carbon economy and silver gains more traction as an investment instrument to hedge against economic uncertainties. As miners increase reserve base with strong demand outlook, pivoting business strategies around sustainability will provide increased ESG compliance for maintaining operations. A digital road map is critical to develop cost-efficient solutions and improve productivity in mines where silver is not a dominant metal. Collaborative efforts to develop and deploy new technologies will drive a gradual transition to more sustainable operations while maintaining profitability and long-term competitiveness.