The automotive value chain must ensure resilience today, whilst innovating for future growth.

Before the COVID-19 pandemic, many automotive businesses were struggling. Now they are in peril. Government furlough payments and soft loans helped in the short term but falling volumes, cancelled projects and difficulty refinancing debt are a grave concern for original equipment manufacturers (OEMs) and suppliers already battling to revive output, recover profitability and manage the transition to zero emission technologies.

According to the Society of Motor Manufacturers and Traders (SMMT), UK automotive manufacturing employed 168,000 people in 2019, with a further 655,000 jobs in the rest of the automotive value chain. 1 The SMMT now says one in six posts is under threat and is calling for sector-wide support. 2

COVID-19 lockdowns compounded vulnerabilities in globalised automotive supply chains exposed by recent trade disputes. National efforts to reduce job losses and maintain competitiveness will be hindered if policy responds more slowly than the pace of change in the industrial landscape. Both demand-side and supply-side might benefit from stimulus.

How can players and affected stakeholders across the value chain emerge stronger than before?

The last straw, not the root cause

Long before anyone had heard of COVID-19, several OEMs and suppliers were shrinking their European operations. 3,4,5,6 Vehicle manufacturers are responding to the crisis by further reducing capacity and cancelling or deferring new models. 7,8,9,10,11,12 In general, suppliers have less cash in hand and greater regional exposure than OEMs and are at higher risk. Some made layoffs during the lockdown, some became insolvent before they could restart. 13,14

Restart? Yes. Back to normal? No.

Factories have reopened but weeks of sales have been lost. The European Automobile Manufacturers’ Association (ACEA) forecasts European vehicle sales in 2020 will be 25% lower than 2019. 15 Preparing for the restart with additional protective measures and redesigned workflows cost money and reduced efficiency. Working capital has been hit as sales have stopped but vendors received payment for previous deliveries. Suppliers are less optimistic than OEMs that output will return to pre-crisis levels until social distancing ends. 13,16,17,18,19

Events are moving quickly

Large OEMs already have departments to manage supplier distress but what if the scale and speed of restructuring is too over whelming? Supplier failures in the financial crisis played out over several years; what if this time it is just a few months? Orders are weak and furlough subsidies are being withdrawn, squeezing cash reserves. Financing is available but at increasing cost. 20 Existing debt must also be refinanced. Requests for early or upfront payments are rising and OEMs are already nudging multinational suppliers to absorb weaker rivals. 16,21,22

Troubling times for global supply chains

Whilst OEMs react to financial turmoil amongst their suppliers, they must re-examine global supply chain vulnerabilities exposed by trade stresses - the UK’s future relationship with its biggest trading partners remains unclear - and rolling regional lockdowns. Some will be tempted to avoid such shocks in future by sourcing regionally rather than globally. Good for supply chain resilience but bad for the factories that lose customers.

There are few easy options

Supplier distress is usually managed reactively with limited risk forecasting. Financial health monitoring mostly relies on data that is published weeks after the fact. Faltering deliveries or counterparties reporting payment problems are often a surprise.

The customer’s options for resolving supplier failure often have downsides:

- Help them using quicker payments or higher prices?

- Stabilise them by taking on liabilities via loan guarantees, capital injection or acquisition?

- Build inventory to sidestep potential interruptions?

- Encourage consolidation and grant pricing power to the survivors?

What about moving to a new source? Customer-owned tooling at direct suppliers is generally more effective for protecting intellectual property than production continuity. Physical access can be troublesome and tooling often requires modification to fit a new factory. Resourcing therefore frequently turns into dual sourcing; requiring financial investment and upfront planning.

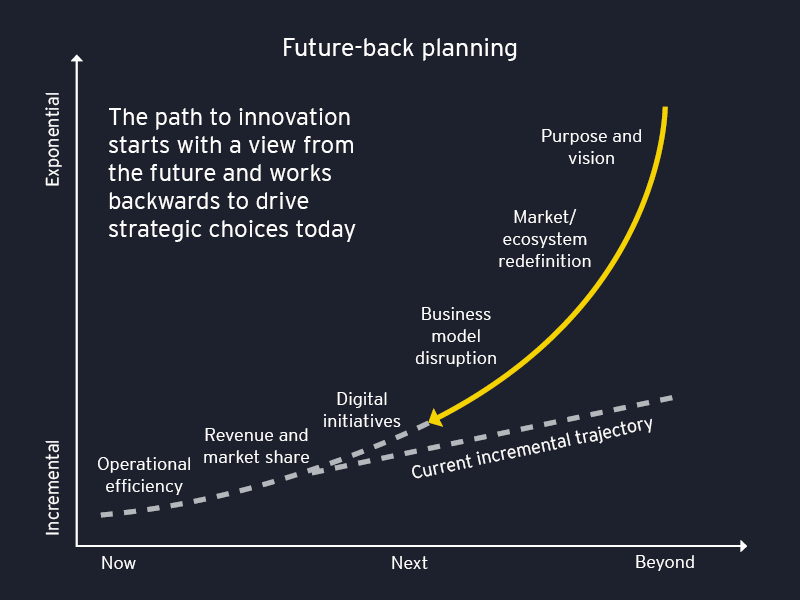

Companies are already thinking about how to repay huge sums borrowed to weather the lockdown. 23,24,25 They have no appetite for cost increases and wish to thrive in the longer term. Greater proactivity and agility can identify and resolve problems before the threat to current output overshadows wider concerns. Technology is increasingly important as vehicles transition from traditional combustion engines to zero emissions. How will companies preserve gains in sustainability and traceability? A futureproof sourcing footprint considers demand, technology, the final assembly location and supply chain vulnerabilities. The analysis should focus on long-term value and identify actions to take today through future-back planning.