It is obvious that channels have already shifted, and this Christmas the trend will be further highlighted as consumers turn to the convenience and relative safety of shopping online over the in-store experience.

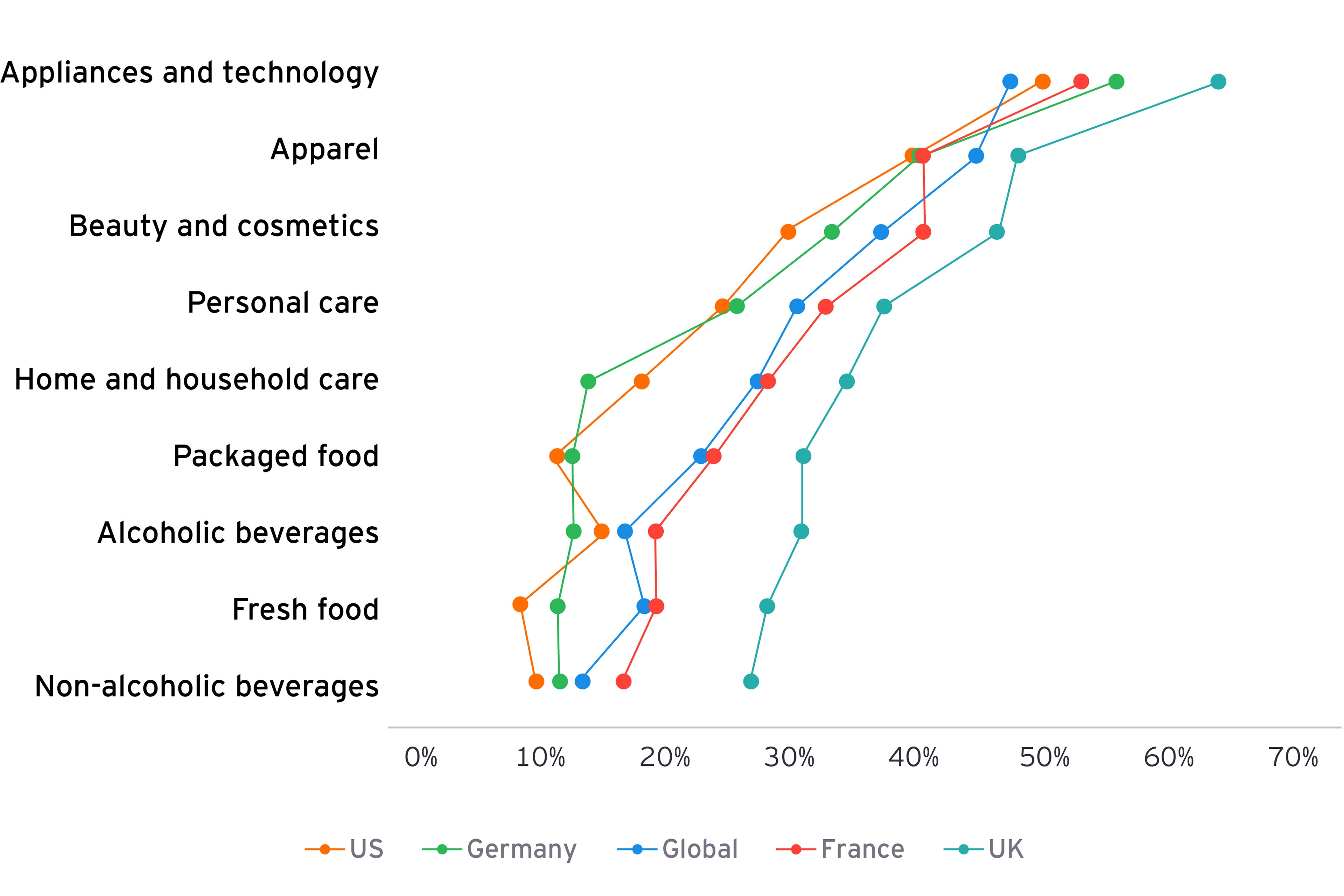

Across the board, UK consumers are far more likely to shop online for both essential and discretionary categories than those in the US, Germany, France and across the globe. Again, this could be because the market is more established and so the shift for consumers is more natural. However, the willingness to do so varies dramatically across different categories. In technology, 64% of UK consumers see online as their primary purchasing channel. In grocery, 30% of UK consumers are currently ordering groceries online more frequently and 44% are spending more (than before the pandemic) on delivery services.

Read the latest global EY Future Consumer Index for regional insights.

Consumers in the UK are far more likely to shop online for both essential and discretionary categories than those elsewhere

% of UK consumers that will shop primarily online for each product category in the future

But the product categories where consumers are looking to go online, are also the categories where consumers are most demanding of service, and to touch and feel products. This offers huge opportunities for those retailers that can embrace such needs and get the experience right for their customers. Our Index found that 48% of UK technology consumers are looking for feedback or advice from sales staff before they buy - a similar number (49%) want to touch and feel the product before purchasing. Meanwhile, in clothing, shoes and accessories, customers prioritise touching and feeling a product, with 67% of UK customers wanting to handle a product but only 28% wanting sales advice before buying.

Retailers cannot ignore this behaviour. If they fail to address this need through true omnichannel capabilities, they risk losing customers to showrooming - where their stores are used to view a product that the customer then buys elsewhere because of improved convenience or price.

Now is the time to reinvent retail

As we go into this holiday period, the mood of UK consumers is subdued. They are cautious and considered, reducing wasteful spend and preferring value over big sales events. What does this mean for UK retailers?

In the short-term, retailers need to review their marketing strategies to ensure they can maximise the opportunities of what could be a dramatic reduction in spending. Online campaigns and capacity need to be maximised; and the technological and fulfilment infrastructure necessary to manage a dramatic increase in online purchasing needs to be reinforced.

In the longer term, the online experience needs to be enriched with easy access to expert advice so that retailers can replicate the in-store benefits of physical engagement with both products and staff. Fashion retailers, for example, have started to respond to this trend with online stylist advice. Categories such as technology have an even greater opportunity to engage their customers through tactics such as video calls with consumers to help them choose the right product.

To ensure the customer is not lost to a slicker experience elsewhere, physical retailers need to ensure they have: a well-thought-out product range; the option of expert, instore advice (perhaps with appointment bookings); and the ability to convert and seamlessly fulfil demand that best suits the customer - either through immediate pick up in store, same day collection, or delivery to home.

Retailers must also focus on building the organisational agility to pivot their offer and channel mix to the changing consumer. Are they reacting to customer needs? Have they taken cost and complexity from stores and truly simplified to focus on what the customer wants? Have they maximised their capabilities online?

Retailers cannot afford to stay still in this constantly changing consumer market. What would have been a 10-year transition has happened in less than a year, and retailers need to act now with agility and focus. Doing so now will maximise their chances of thriving into Black Friday and Christmas and taking advantage of future growth opportunities as we head into 2021.

Summary

As the end of the year approaches, the latest EY Future Consumer Index illustrates how UK consumers continue to feel cautious about spending. With the move to a considered Christmas likely, we identify the key areas retailers must address to make the most of a peak period unlike anything seen before.