If consumers hold the key to a greener future, how can energy companies unlock it?

Sustainability has gone mainstream, accelerated by COVID-19

Attitudes impacted by the pandemic

Any beliefs that UK energy consumers are unwilling or unable to engage with sustainability are dispelled by our survey. Nearly two-fifths (38%) stated that their everyday decisions are being influenced by sustainability issues, with 62% stating that they were more likely to purchase a product or service that is sustainable.

These attitudes have been deepened by the pandemic, with 44% of consumers saying that COVID-19 has made them more aware of sustainability and environmental issues. While this clearly represents an opportunity for energy companies, it also brings risks. Almost a third of respondents (32%) said they had stopped using a product or service because it was non-sustainable. In addition, a small but significant proportion of energy consumers (12%) switched supplier in the past five years for sustainability-related reasons, three times more than for customer services-related issues (4%).

Impact of COVID-19

44%of consumers said COVID-19 has made them more aware of sustainability and environmental issues.

Purchasing propensity

62%of consumers are more likely to purchase a product or service that is sustainable.

If consumers hold the key to a greener future, how can energy companies unlock it?

Consumers are aware of their impact on the environment but want to know more

Consumer awareness does not easily translate into action

Consumers are aware that their behaviours within the home impact sustainability and plan to take greater action in the future. Nearly 9 in 10 (87%) consumers said that they feel it is important to reduce waste and recycle more at home over the next five years. In addition, 68% of consumers said that they want to use less energy for heating and appliances in their home over the next five years.

Consumer awareness of environmental impacts does not always easily translate into action. One key reason is a lack of information, with 49% of respondents saying that they lack relevant information when purchasing sustainable home appliances and 33% have the same problem when it comes to choosing an electricity or gas supplier. More specifically, consumers want a better way to gauge the impact of their behaviours, with 55% stating that they would like to understand their individual carbon footprint.

Sustainable purchasing decisions

68%of consumers want to use less energy for heating and appliances over the next five years.

Sustainable purchasing decisions

49%of respondents lack relevant information when purchasing sustainable home appliances.

If consumers hold the key to a greener future, how can energy companies unlock it?

Many consumers are willing to pay a ‘green premium’, with younger generations leading the way

Sustainability is influencing customers’ purchasing behaviour

Sustainability is now a vital factor influencing customers’ purchasing behaviour. 50% of under 35s said that they were likely to pay more for sustainable products, with the figure falling to 33% for over 35s.

When asked if consumers would be willing to pay a small premium for a sustainable home energy supplier, the same trend was evident. Over two in five (42%) of under 35s were willing to pay a premium, falling to 26% for over 35s. These green-conscious younger consumers are likely to play an increasingly important role within the home and influence older generations’ purchase behaviour by, for example, asking probing questions on environmental issues.

Energy companies are in a strong position to benefit from consumers making sustainable choices, with 42% of survey respondents saying that they would like to buy sustainable products and services from an energy supplier, ahead of providers from other sectors such as technology companies and retailers.

Attitudes towards paying a green premium

42%of under 35s likely to pay a premium for sustainable home energy.

Attitudes towards paying a green premium

50%of under 35s are likely to pay more for sustainable products.

For more information on the insights, please refer to the detailed report.

If consumers hold the key to a greener future, how can energy companies unlock it?

Community is crucial as consumers think local

Consumers prefer products and services from local suppliers

With both climate change and sustainable energy production being very much global concerns, it is easy to overlook the local focus of many households. Nearly two-thirds (64%) of consumers prefer to purchase products and services from local suppliers rather than global brands and 63% of consumers indicated that COVID-19 has made them more aware of the benefits of supporting local communities.

More specifically, 76% of respondents indicated they would rather buy and use sustainable energy generated in their community. This trend looks set to continue, with 62% indicating that they will consume more local services and products over the next 12 months.

Attitudes towards local suppliers

76%of consumers would rather use sustainable energy generated in their community.

Attitudes towards local suppliers

62%of respondents are likely to consume more local services and products over the next 12 months.

If consumers hold the key to a greener future, how can energy companies unlock it?

Consumers want to change behaviours but aren’t clear how to do it

Barriers that cause this gap include price, complexity and lack of options

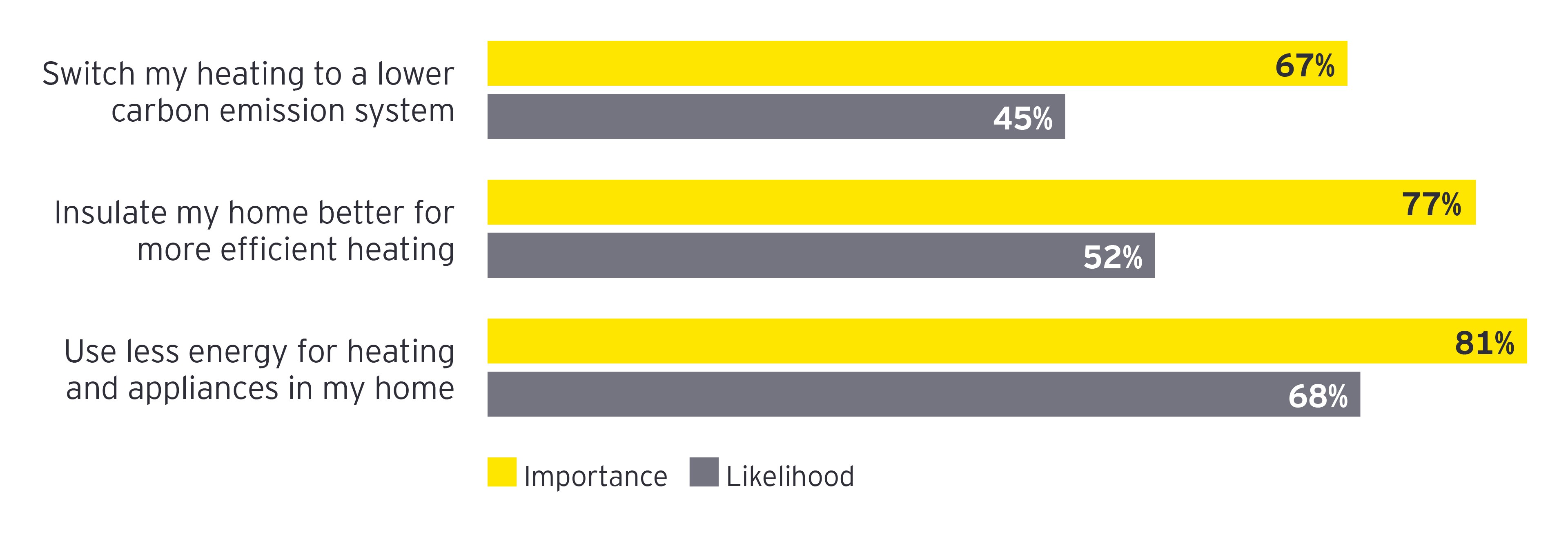

Our survey reveals that, while the consumer intent is clearly there, the link with action is often missing. To explore this gap between theory and practice, we asked survey respondents how important the 12 sustainable behaviours will be to them over the next five years and also how likely they will be to actually act upon them. Our data reveals that, over the 12 sustainable behaviours, the average gap between the perceived importance and the likelihood of taking action was 13%.

Within this average importance-likelihood gap, there were major differences. While there was only a small gap between the 87% agreeing that recycling more was important and the 84% who said they are likely to do it, the gap was far bigger when it came to sustainable energy: two-thirds (66%) of consumers thought it was important for them to switch to a lower carbon heating system, yet only 45% said they were likely to do so.

Sustainable heating behaviours: importance and likelihood over next five years

The barriers that cause this gap include price, complexity and lack of available options in the marketplace. Over half (51%) of consumers said they would switch to a sustainable energy companies if suppliers made the process simpler and easier to understand. Just under half (47%) indicated they would like to live a more environmentally friendly life, but that it seems too complicated and requires too much effort.

Energy consumers’ switching propensity

51%of consumers would switch to a sustainable energy companies if it was a simpler and easier process.

Energy companies to evaluate barriers

47%of consumers would like to live more sustainably but seems too complicated.

What does this mean for energy providers?

Energy providers are in an acute period of transformation as they seek to become leaders in a net zero world, while simultaneously experiencing cost and margin pressures. Momentum for climate change, which was already building at pace, has now been accelerated by the COVID-19 pandemic.

The good news is that persuading consumers to adopt sustainable behaviours may not be as big a task as anticipated. As our research shows, consumers are ready and willing but not always able – because energy companies do not yet have the right products, services and strategies in place. The challenge here is to make it easier for consumers to turn awareness into action with simple and attractive options.

Energy consumers want more detailed, holistic data on their household energy management and carbon footprint. By meeting this need – for example, through an easy-to-use carbon footprint app – energy companies can both build trust and create powerful nudges to change consumers’ behaviour.

Localisation of products and services may also be a key factor in persuading customers to adopt new behaviours. Energy companies could see this as an opportunity to offer community energy schemes and demonstrate their local presence.

The willingness of many consumers – particularly younger generations – to pay a premium for sustainable services offers energy companies a potential route to success. Energy companies must respond by providing younger customers with carefully-targeted sustainable products and services that will satisfy demand and generate greater customer lifetime value.

Summary

Powering a sustainable future – what lies ahead?

UK energy customers are ready to flick the switch to more sustainable suppliers but green tariffs alone aren’t enough to stand out.

“Investment in more sustainable offerings can, rather than merely adding costs, actually generate returns through higher margins. Being able to differentiate themselves in an increasingly commoditised market offers energy suppliers a powerful opportunity to distinguish themselves from their competitors.” Rob Doepel EY UK&I Energy Market Leader.

To explore the key drivers and obstacles for households as they look to convert awareness of sustainability to actions, read the full report here.