Chapter 1

Identify value creation opportunities

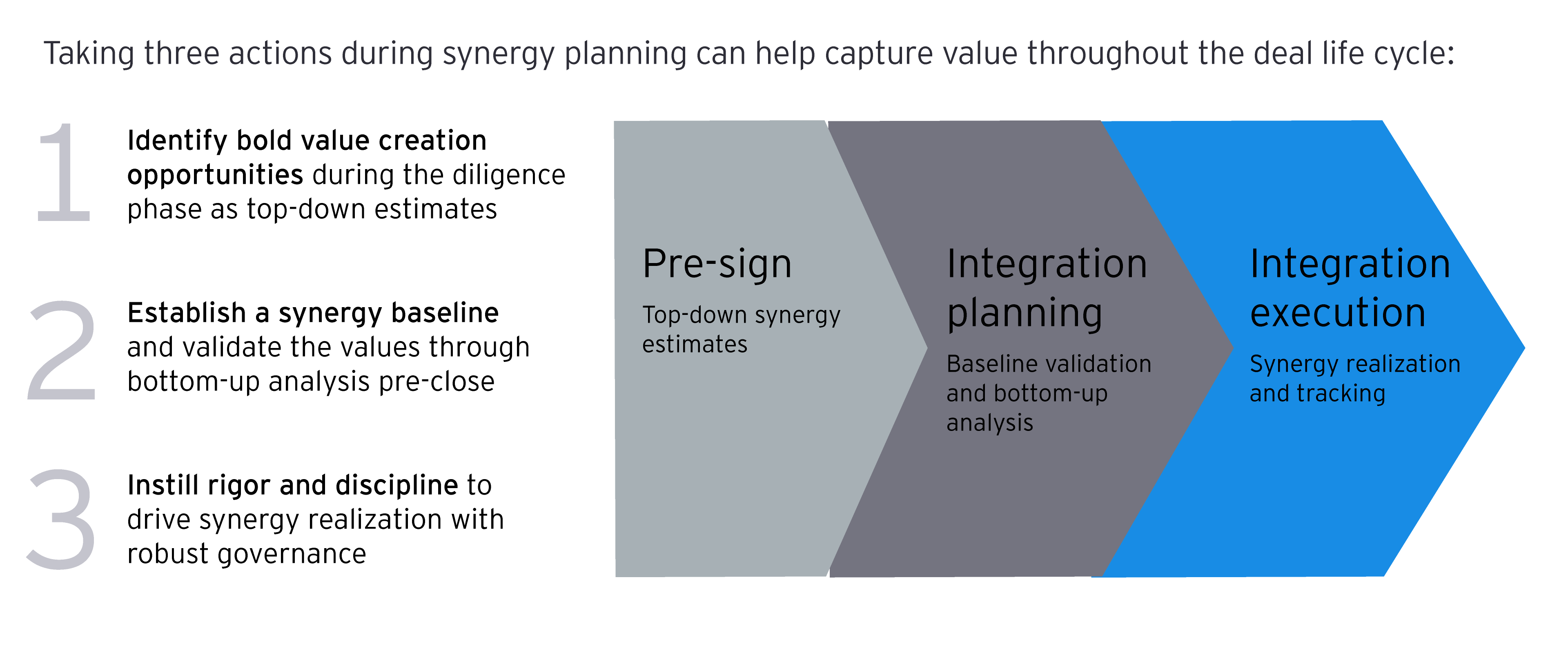

Plan for cost and revenue synergy during the diligence period, and link to the integration strategy.

In the survey of 300 CEOs, CFOs and CDOs, 49% of tech respondents say they consider synergy identification to be the most important step in due diligence to achieve deal value. Tech companies can start both cost and revenue synergy planning during the diligence period and link it to the integration strategy.

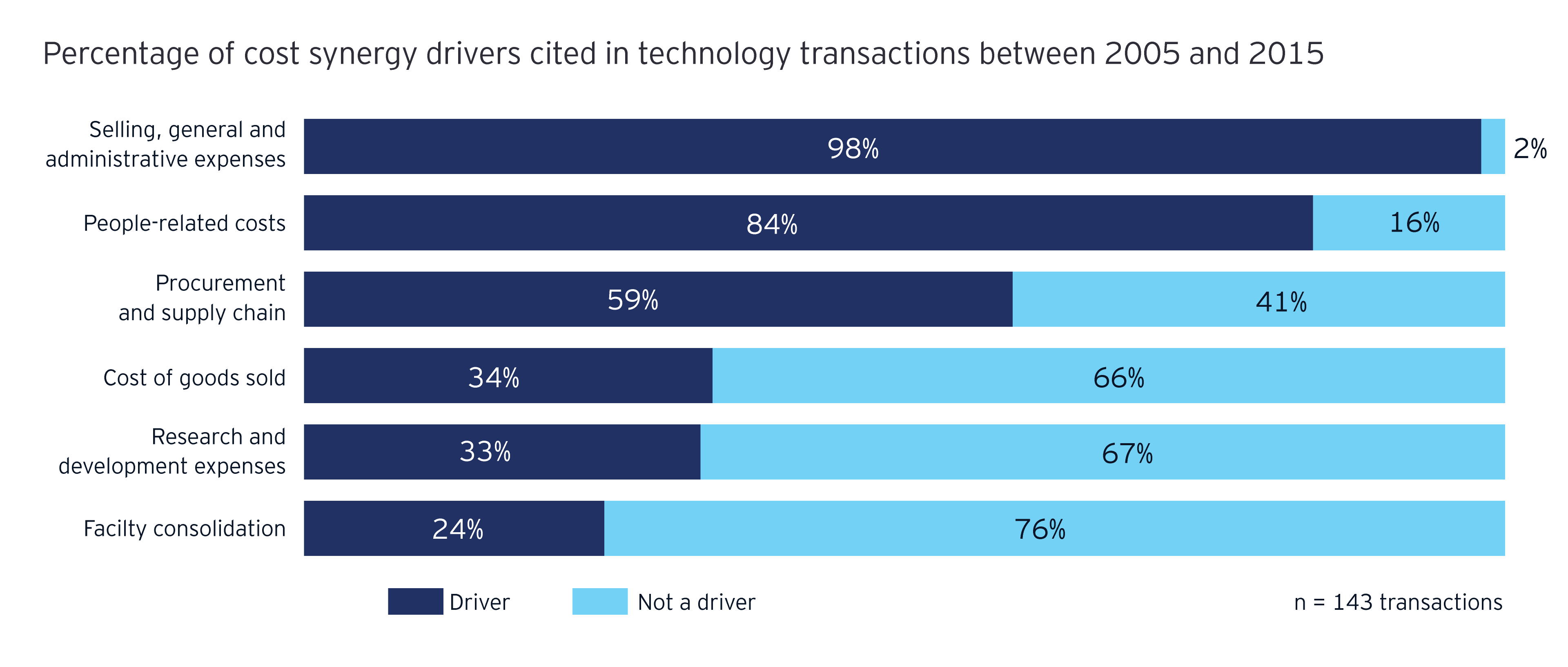

EY analysis of 178 technology deals from 2005 through 2015, each valued at over US$500 million, shows that the majority announced their target publicly and that approximately 80% (143) of the deals identified the synergy drivers. The following chart summarizes findings where companies cite selling, general and administrative (SG&A) expenses, people-related costs, and procurement and supply chain as key value drivers.

Where to find hidden cost synergies

We have identified four often overlooked cost-savings opportunities which, if addressed early on, can help technology companies reap significant long-term rewards.

Working capital

Often overlooked because it does not directly improve earnings before interest, taxes, depreciation and amortization (EBITDA), this synergy is critical, because it releases cash from payables, receivables and inventory.

On average, tech companies may derive cash benefits in a magnitude of 5%-7% of revenue through working capital levers. It also enables companies to use the free cash flows for other business purposes, such as a liquidity cushion, share buyback, and additional research and development (R&D) funding.

Legal entity rationalization (LER)

Technology companies that grow through acquisitions often have a complex legal entity structure, which may hinder long-term business performance. We found that companies, on average, report annual carrying costs of US$25,000 to US$50,000 per legal entity, which indicates a potential savings of US$2.5 million to US$5.0 million annually for every 100 entities eliminated.

This does not account for the potential savings from finance, accounting, information technology, human resources and intellectual property-related implications. LER savings require a cross-functional view with tax professionals to guide the right legal entity structure to streamline operations.

Real estate optimization

Consolidation of a company’s real estate portfolio is a common synergy item with acquisition integrations. This category is related to the real estate footprint optimization, accomplished through consolidations or simply finding and eliminating vacancies.

Another portion of real estate savings often involves hidden facility management costs. One software company learned during a divestiture that they were paying 5x fees for common work orders such as changing a light bulb. This was due to the conflicting terms related to the lease and facility management contracts (the company was paying both the landlord, and their outsourced facility provider). While the example may seem insignificant, the potential operating expense savings can be sizeable. In our experience, a tech company can typically save ½ to 1% of revenue on real estate expenses, achieved through assessing and planning real estate and related costs proactively.

Tax

Pre-signing, it is important to identify historic tax liabilities and model out the value of any tax attributes that the buyer will inherit post-closing so that purchase price adjustments or specific indemnification provisions can be incorporated into the purchase agreement.

It is also helpful to consider an efficient acquisition structure from a tax perspective and understand associated taxes that may arise from the acquisition itself.

Another aspect that arises during an acquisition is ensuring proper tax treatment of retention components in the deal, such as holdbacks. This includes determining whether the acquirer can claim a tax deduction for some payments and whether such amounts are taxable to shareholders or employees. Often, the structure of the retention mechanism in legal documents impacts the ultimate tax treatment. Developing an efficient post-acquisition integration plan requires understanding the target company structure and operations well ahead of closing. Evaluating post-acquisition integration structures should start as early as possible.

Chapter 2

Establish a synergy baseline and validate values

Work through deal complexities while refining synergy plans between deal sign and close.

An EY analysis of technology acquisitions shows companies have an average of 100 days between deal sign and close. This is a good time for organizations to work through deal complexities while refining synergy plans. During this time, companies have more access to information about the target to validate the initial synergy estimates. Often, the initial total estimate remains the same while the contributions by business units and functions are likely to change.

Three leading approaches to validate top-down synergies

Clean room approach

When there is a long deal approval time that involves multiple regulatory bodies, acquirers can use the clean room to facilitate the exchange of confidential customer and contract data relevant to integration planning. They can also begin validating assumptions for a synergy plan and be ready for execution on day one. For example, semiconductor acquisitions with complex regulatory approvals and a highly competitive market require a clean room approach to validate synergy assumptions during pre-close. This is critical to jump-start integration planning and, at the same time, mitigate potential risks of not being able to close the deal due to regulatory challenges and exposing their confidential data to competitors.

Baseline operating model

The second approach involves comparing operating models of the acquirer and target to confirm the baseline for synergy calculation and identify limitations to the initial estimate. Major differences in how the target runs the business may limit initial synergies from systems, processes and organizational consolidation. Knowing this limitation allows acquirers to explore other sources of synergies to offset the difference.

One software as a service (SaaS) enterprise digital marketing company acquired a digital marketing software company with a focus on small and mid-market customers. Through a baselining exercise, the buyer identified that the initial savings from go-to-market activities had been reduced. This was due to the need to invest more in scaling the sales force and IT platform to handle the order management process for small to midsized businesses. This resulted in changes to go-to-market integration and the need to find additional sources of savings to compensate for the reduction of the initial synergy estimate.

Internal benchmark

A detailed comparison of the acquirer’s pre- and post-acquisition performance metrics often reveals additional opportunities to bring cost performance back in line with expectations. This objective assessment often has the most stakeholder buy-in because it is based on actual internal data.

These validation approaches yield a confirmed baseline and refined target synergy by function. They are supported by a business case and a list of synergy initiatives committed by the business with a set of milestones to execute post-close. It is important to have this level of detailed planning to drive rigorous synergy realization.

Chapter 3

Instill rigor and discipline to drive synergy realization

The IMO measures, tracks and reports on synergy progress to help achieve business accountability.

According to the EY-Parthenon survey of technology, media and telecommunications corporate development executives in January 2020, 60% of companies conduct their first post-acquisition review within a month of deal close. The review typically centers around planned synergy progress and deal value realization.

The integration management office (IMO) plays a critical role in orchestrating the measurement, tracking and reporting of synergy progress, while the accountability of realizing synergies sits with the business. Typically, the IMO reports synergy progress to an integration executive steering committee, a monthly business review panel and the board of directors on a regular basis to achieve business accountability.

Toyyab Murtaza, Brian Salsberg, Tiffany Lee, Ken Chadash, Joe Roohan, Ahana Sarkar, Rahul Agrawal and Banipreet Kaur from EY-Parthenon contributed to this article.

Összefoglalás

Synergy management is complex. Even in a time of disruption, such as the COVID-19 pandemic, a successful deal requires timely achievement of synergies that are driven by rigorous process and discipline. The execution principles set forth in this article may help organizations capture the most value from their acquisitions and increase the likelihood of dealmakers rising as “winners,” even in turbulent times.