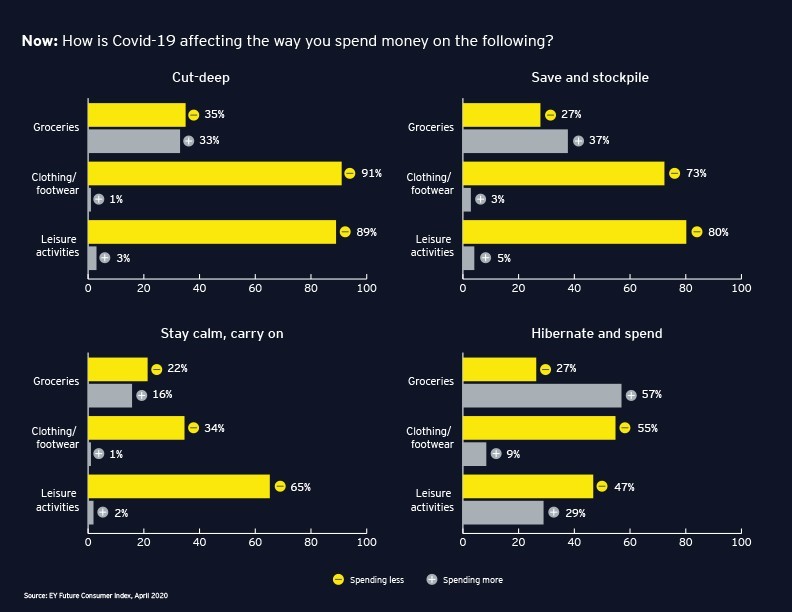

Meanwhile, 27% of Canadian consumers fall into the cut deep segment. These individuals have been hardest hit by the outbreak and anticipate a recession, pushing them to make drastic changes to their financial habits. In some cases, this has meant a decrease in spending on clothing and leisure by nearly 90% due to either temporary or permanent job losses. Rather than spend money on physical items, 33% of this segment are choosing to spend more on groceries to meet their basic needs.

On the flip side, a quarter of consumers fall into the stay calm and carry on segment. They don’t feel as threated by the pandemic and have continued shopping as normal. What’s changed for these consumers is a shift from shopping in store to online.

That’s opened doors to more options and suppliers. Customers are considering a wider variety of retailers, and this is having an especially big impact on small-to-medium-sized businesses that traditionally lean on local support. To meet consumers’ rapidly evolving needs and invest in the future, retailers will need to build out their online capabilities.

Millennials and Gen Z are translating optimism into more spending. They make up the remaining 12% of consumers in the hibernate and spend segment. Despite strong concerns over the pandemic, they’re spending the most across the board.

In light of the situation, sustainable options and product brand are climbing up the ranks of their purchase criteria. Companies that are rewarding and protecting staff at risk of infection, for example, are building stronger brand integrity among consumers — particularly younger generations. Purpose and authenticity will continue to play important roles in this segment’s buying patterns over the long term, and companies should recalibrate purpose towards current and emerging consumer values.

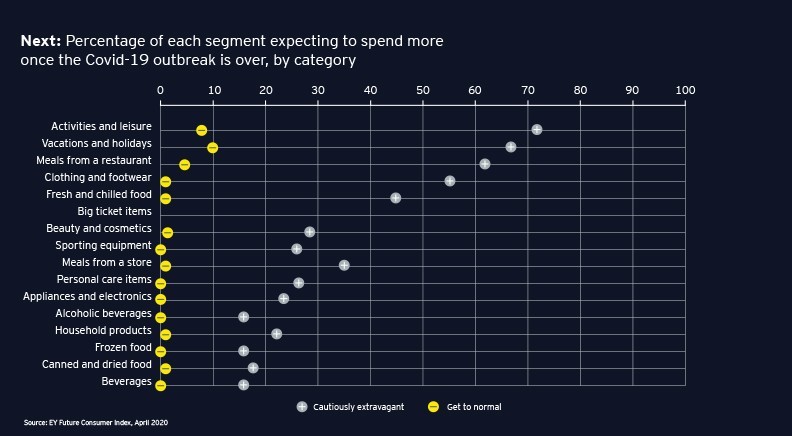

Looking beyond the immediate impact of the pandemic, the Index finds that 42% of Canadian consumers expect they won’t go back to their old shopping behaviours any time soon. With this in mind, it’s more important than ever for organizations to take a business-to-human (B2H) approach to services and experiences. Focusing on customer empathy can help companies understand unique consumer sentiments, preferences and challenges. This can lead to improved innovation and the production of more relevant products — in turn, unlocking consumer trust and long-term value.

By understanding where the most significant changes are and, more important, which ones will stick, companies can actively pivot their business strategies to be better prepared for what comes next.

Summary

Consumer behaviours are quickly shifting as the world navigates new territory amid COVID-19. The pandemic is changing what people buy and consume, and how they do it.