Flexible cost structures and income protection

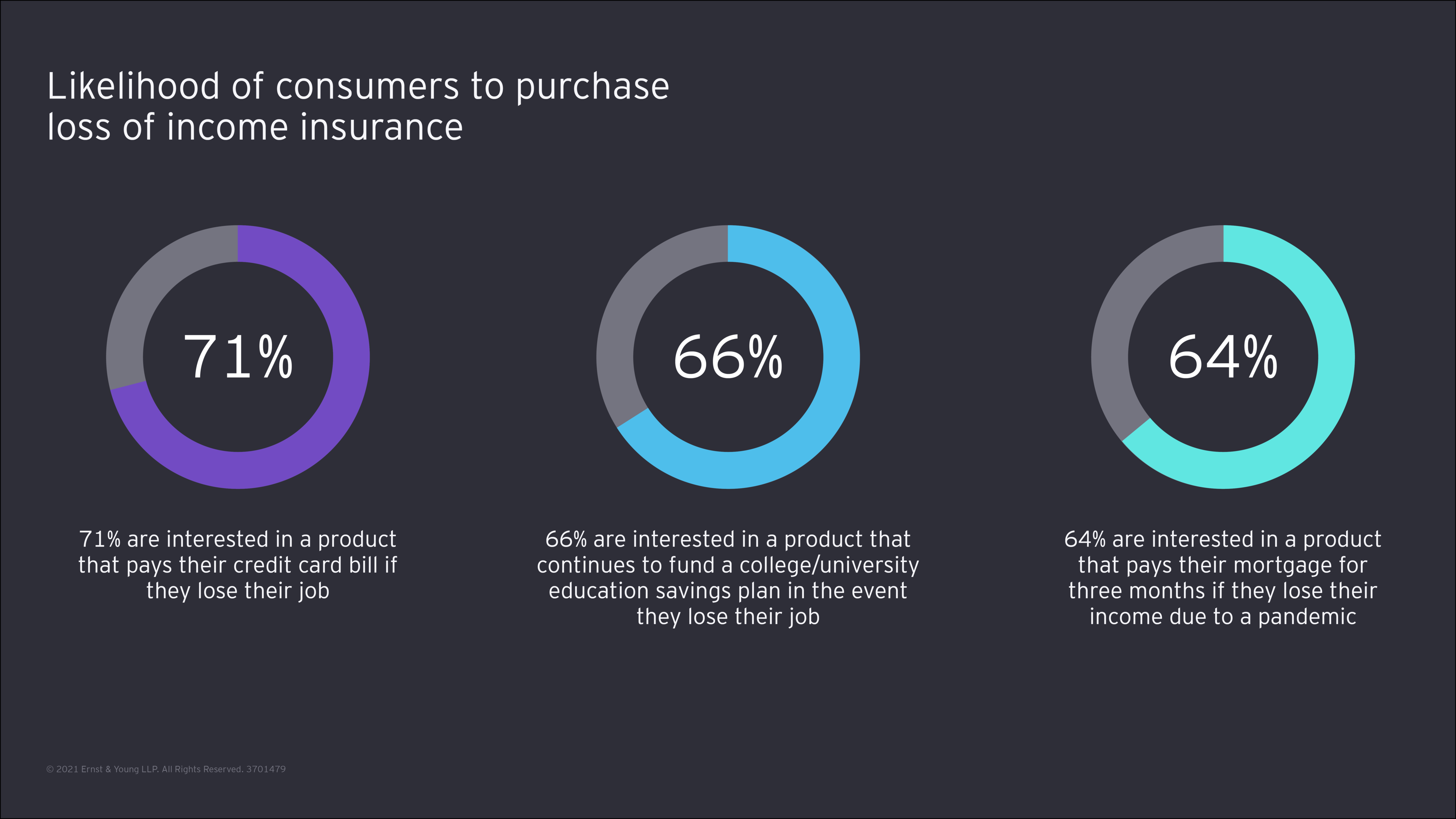

With many focused on their financial security, there is appetite for insurers to reduce the cost of insurance. Seventy percent of consumers said they would exchange personal data for lower premiums, and 67% said they would install smart sensors in their home and share real-time data in exchange for a discount. In addition, demand for insurance policies that cover loss of income is high, including those that pay mortgage costs for three months or cover other existing financial commitments (e.g., credit card bills).

The case for a diversified distribution strategy

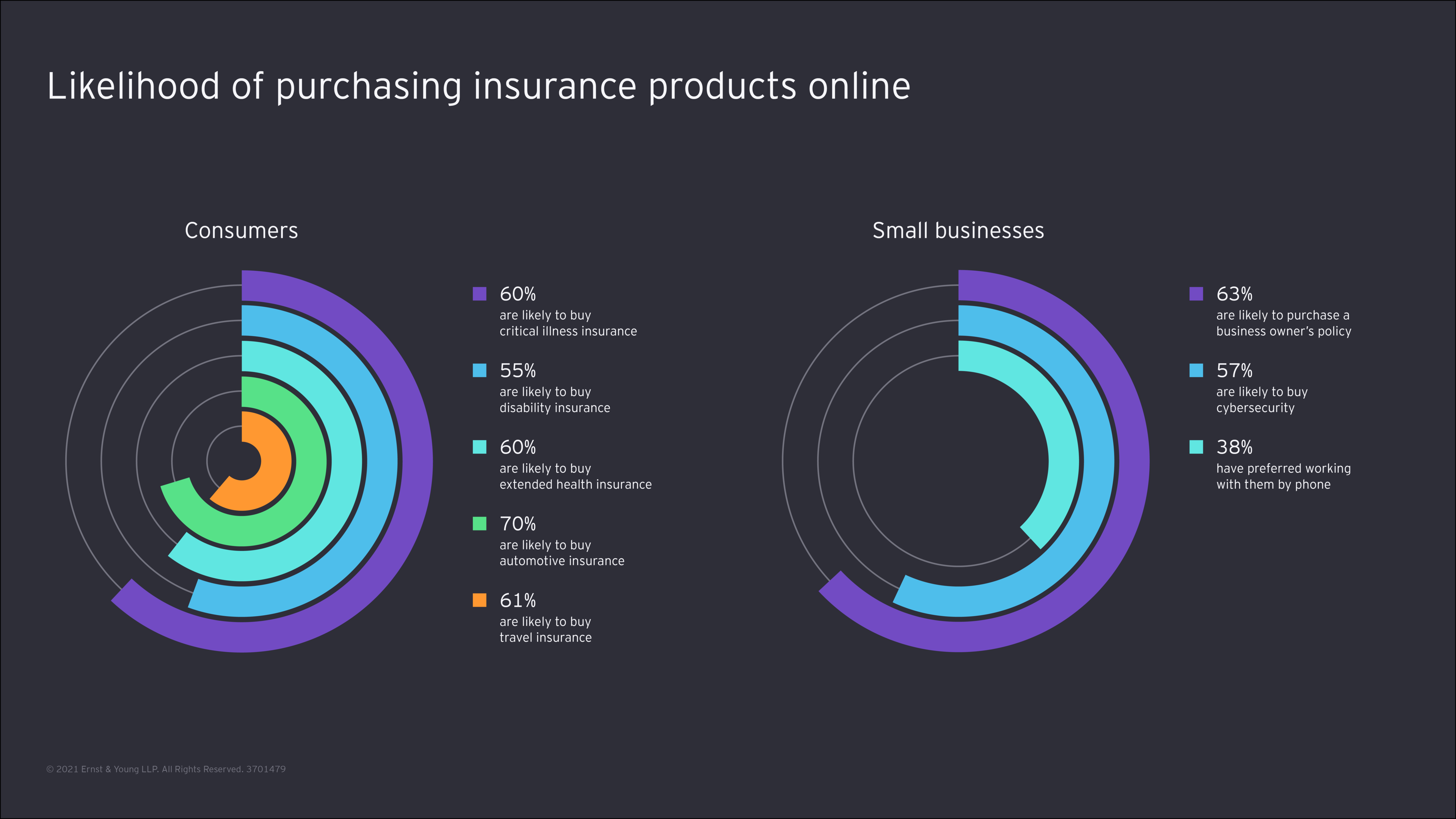

Significant shifts toward online purchasing behaviors reinforce the need for Canadian insurers to focus their digital strategy around future innovation. Our findings suggest significant appetite for digital insurance channels, with both consumers and small businesses expressing greater interest for dealing with insurance brokers online.

Small business owners’ solution needs

Similar to consumers, Canadian small business owners are interested in products that lower costs while protecting against new risks.

Three-quarters are interested in a product that pays their fixed business expenses for three months in the event of a pandemic-related shutdown or insurance that covers them from the liability of employees or customers catching disease in their place of business.

There is appetite for insurers to innovate around the new behaviors developed as a result of the pandemic: 78% are interested in commercial vehicle insurance that only charges them for miles driven, 81% are interested in cyber insurance to cover additional exposure from employees working offsite and 55% of small businesses are also interested in insurance that assists them with adjusting to the new business environment (e.g., online delivery).

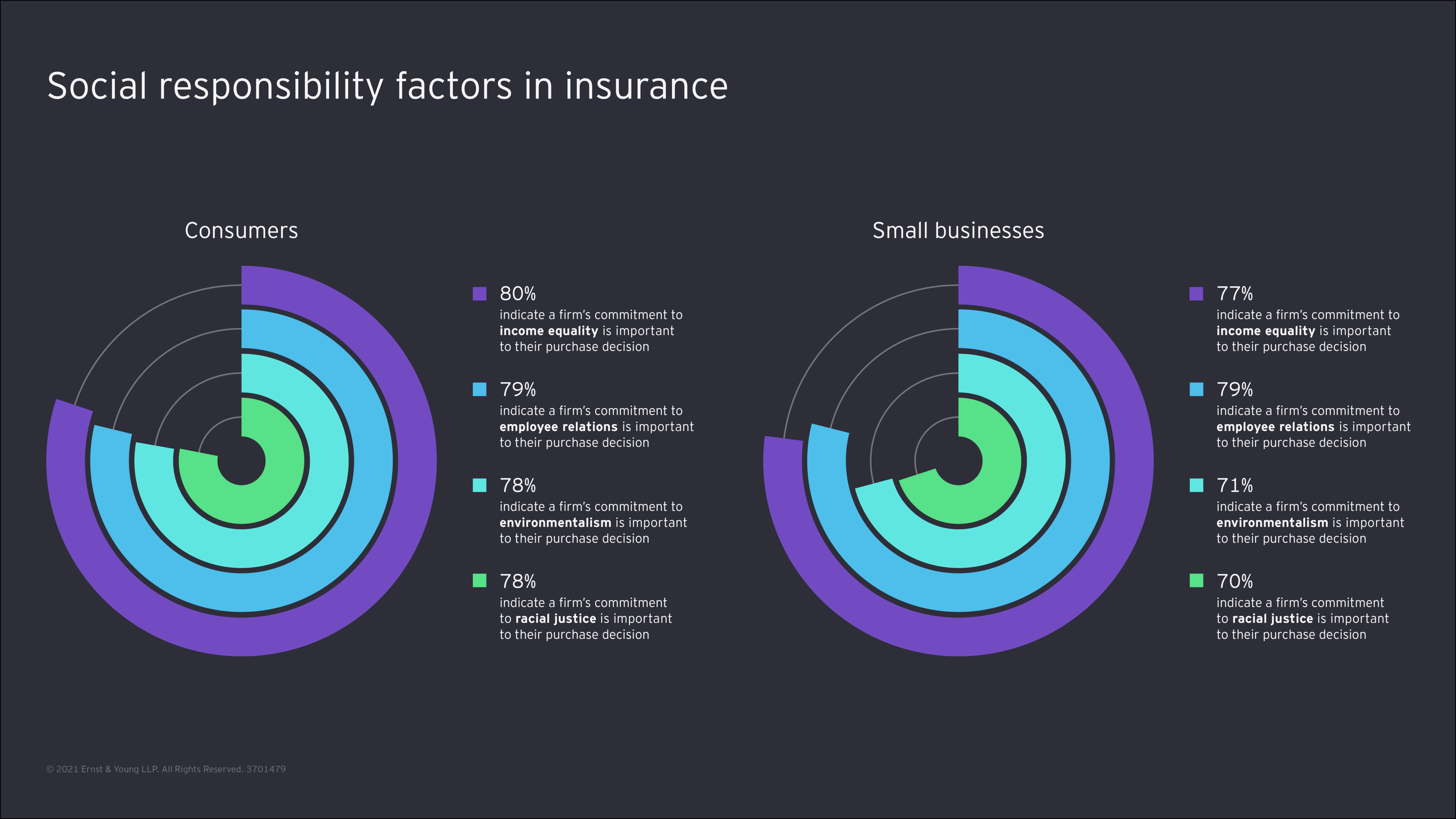

Interest in social responsibility

Our survey revealed that consumers place value on products and services that meet social responsibility criteria. Both respondent groups were asked about the extent to which an insurer’s response to environmental issues and growing inequalities would influence their purchasing decisions. Their response was emphatic, with a majority claiming that an insurer’s response would impact their decision when selecting a provider.

The way forward for insurers

The pandemic environment presents critical opportunities for insurers to reengage with customers and support them in a time of need. The challenge for insurers is to create truly customer-centric products tailored to evolving customer needs and budgets.

Delivering traditional insurance products through digital channels is no longer a viable approach for insurers to succeed in the long term. Carriers need to develop new solutions that reflect consumers’ changing priorities and help them achieve financial security.

We believe there are three core customer needs insurers should focus on providing to both consumers and small businesses:

- Use technology to offer more personalized products, services and experiences

- Diversify distribution channels to accommodate different consumer needs, with a special focus on digital

- Focus on creating long-term value that reflects your customers’ values — and effectively communicate your efforts to them

The pandemic speaks to the very purpose of insurance: to protect individuals, families, business and communities against disasters and unforeseen events. Insurers must be bold in living their purpose and demonstrate tangible value from their products and solutions. We believe those insurers who commit to strategic change during and after a crisis will emerge as winners.

Please reach out to Janice Deganis, EY Canada Insurance Leader, if you are interested in learning more about the Canadian findings.

Our latest thinking

Summary

The distress caused by the pandemic will be felt by Canadian consumers and small businesses for years to come. To meet customers’ evolving needs and restore their financial well-being, insurers must reimagine their products and solutions.