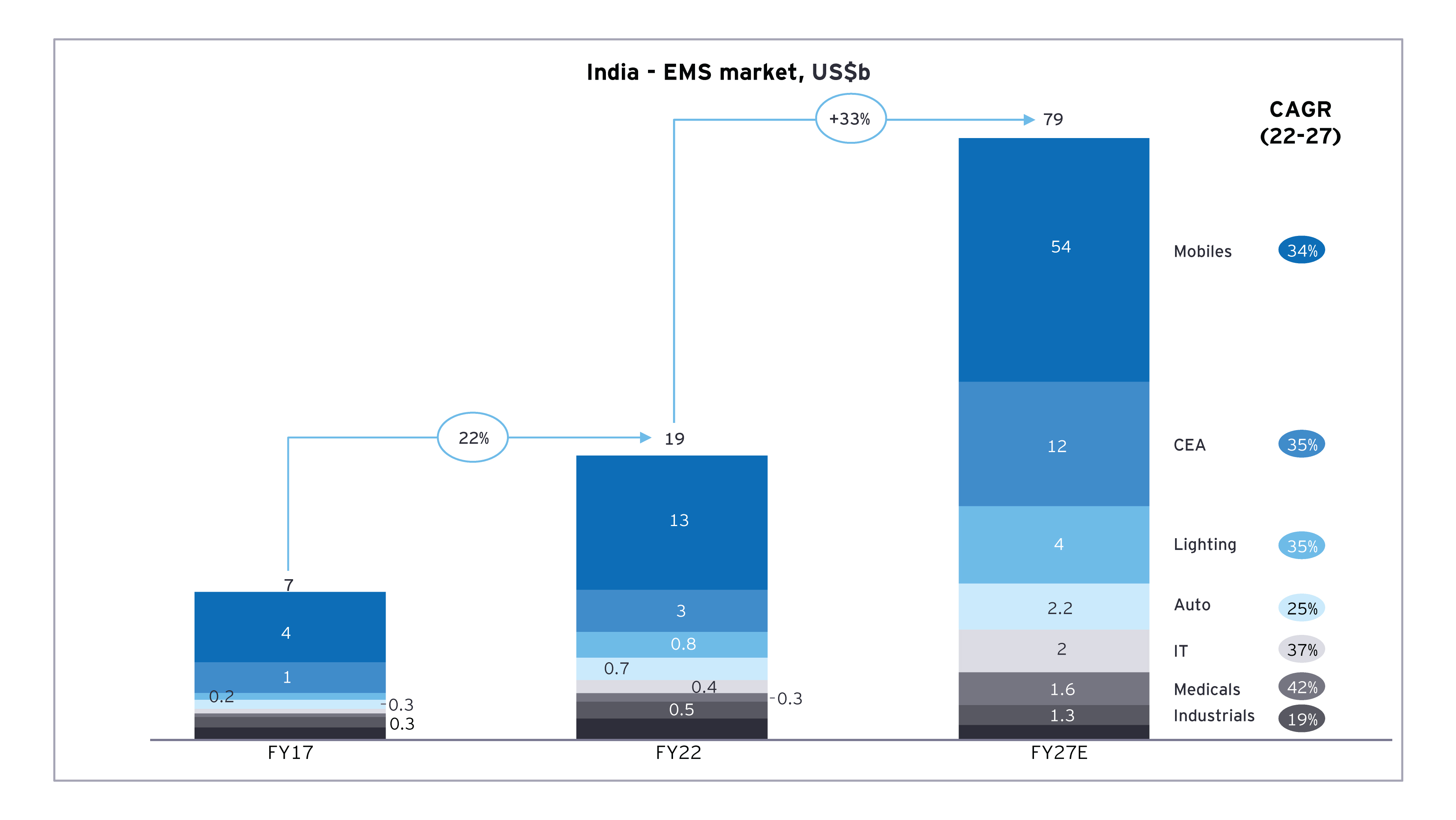

Growth drivers for India’s EMS market: Increased outsourcing to EMS players, China plus one strategy and domestic electronics ecosystem development are the key demand drivers.

Over the next five years, the EMS market in India is expected to reach US$80 billion, providing growth opportunities to strategic and financial investors. A large chunk of this growth will be seen in mobiles and consumer electronics and appliances, followed by lighting, auto, and others.

In addition to increasing domestic demand, many global electronics manufacturers are moving their outsourced manufacturing operations from geographies such as China to India to ensure that supply chains remain uninterrupted. Other factors such as rising cost of manufacturing in China, trade disputes, and the Indian government's efforts to attract foreign investment in the electronics sector are in favor of the Indian EMS sector.

Several OEMs in the country are outsourcing a larger share of their manufacturing to domestic EMS providers due to reasons such as increasing complexity of electronic products, the need to reduce costs, and their desire to focus on core competencies.

Focus is shifting from traditional contract manufacturing to ODMs

In response to the changing demand, the EMS landscape has been evolving rapidly, with a noticeable shift from traditional contract manufacturing to ODM. These two approaches are distinct as each caters to specific OEM needs.

Contract manufacturing, historically the dominant model, involves EMS players sourcing components, manufacturing, assembling, and supplying finished products to OEMs based on the latter’s specifications. The ODM model represents a more comprehensive approach as, in addition to contract manufacturing services, ODM companies take on the responsibility of designing products according to OEMs’ specifications. This includes product conceptualization, prototyping, and design iterations, all carried out in close collaboration with the OEM. Furthermore, ODMs’ services encompass logistics, and after-sales support, thereby offering a holistic solution to OEMs.

Large global MNCs and large Indian firms seek ODM services as they require a higher degree of product innovation, customization, and end-to-end support. ODMs enable OEMs to bring unique products to market swiftly and efficiently, often tapping into the latest technological advancements and market trends.

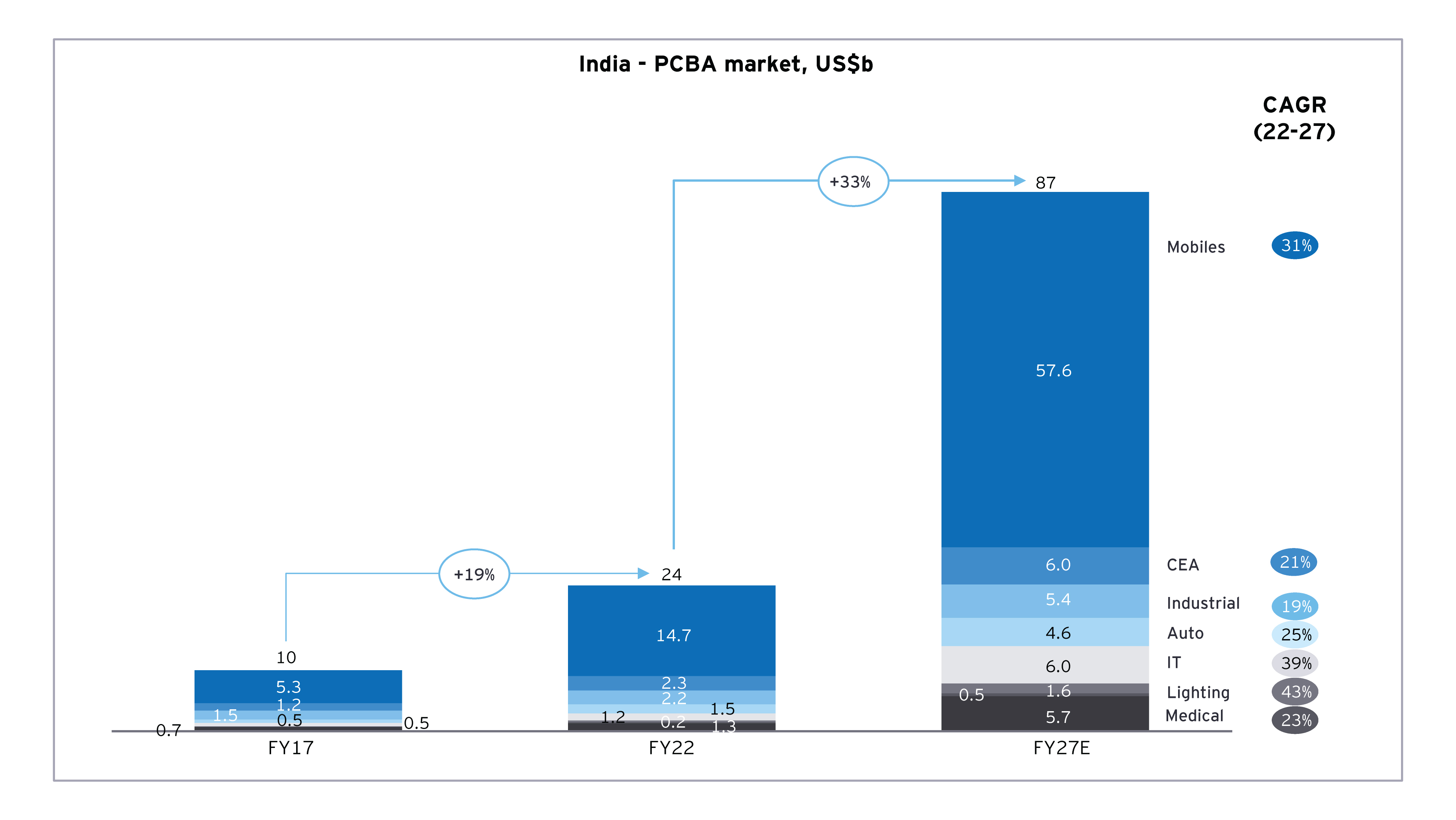

The printed circuit board assembly (PCBA) market in India is expected to provide larger opportunity, growing at a CAGR of 30% in the next five years due to its supply to both in-house OEMS and EMS players.