While 92% finance leaders across 89 corporates have started their journey to introduce digital interventions in the finance function, only 11% believe they are at an advanced stage according to EY Report ‘Digital disruption in finance” - insights from survey conducted by global professional services organization, EY.

Digital Transformation in finance is now a realistic goal due to the widespread availability of business data; teams’ ability to process large sets of data using now-accessible algorithms and analytic methods; and improvements in connectivity tools and platforms, such as sensors and cloud computing.

The finance function being the gatekeepers of critical data are required to generate forecasts and support strategic plans and decisions—among them, data relating to sales, order fulfilment, supply chains, customer demand, regulatory requirement and business performance as well as managing real-time statistics.

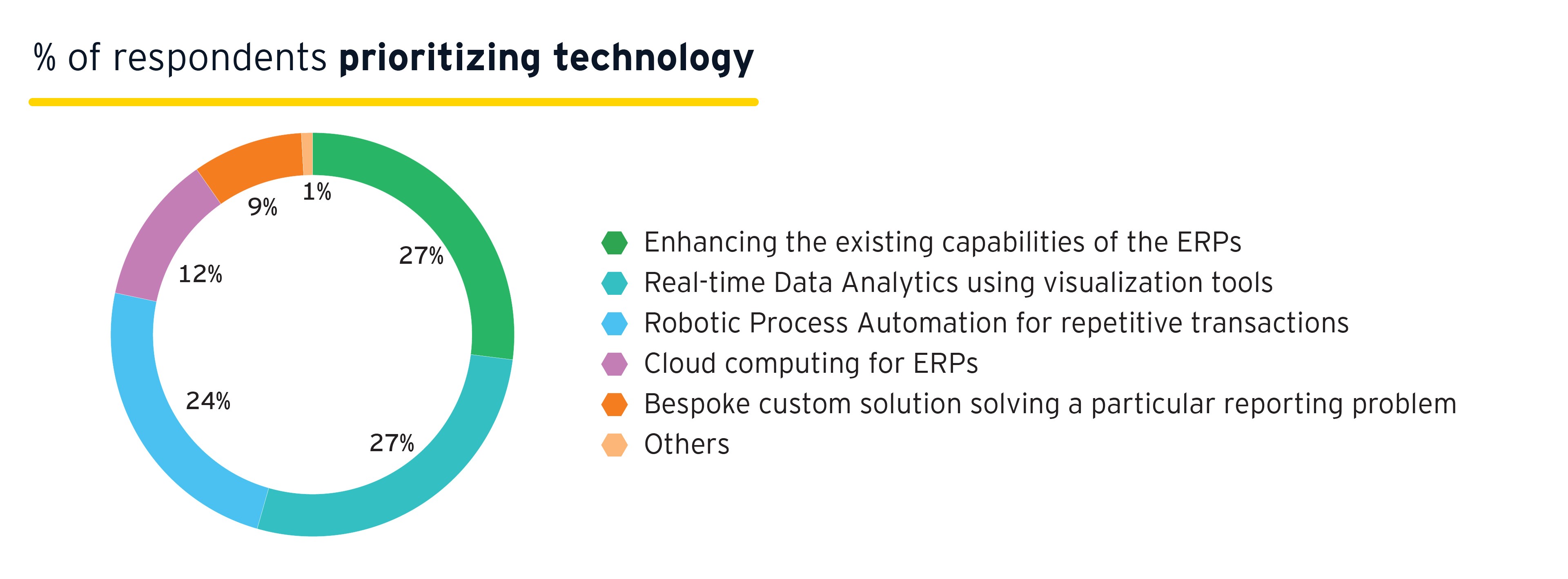

The survey insights revealed that while 56% participants demonstrate confidence on completeness and accuracy of data generated by finance function, only 22% are able to achieve this without significant manual intervention and only 33% are able to do this on a timely basis. It means finance teams undertake a lot of manual effort to compensate sub-par automation and generate timely information with reasonable completeness and accuracy. In times when emerging technologies can play a significant role in reducing manual mundane tasks, companies should be thinking about relieving finance teams from the deadline pressures through the optimal intervention of technology.