Not just the icing on the cake, ESG needs to be baked in

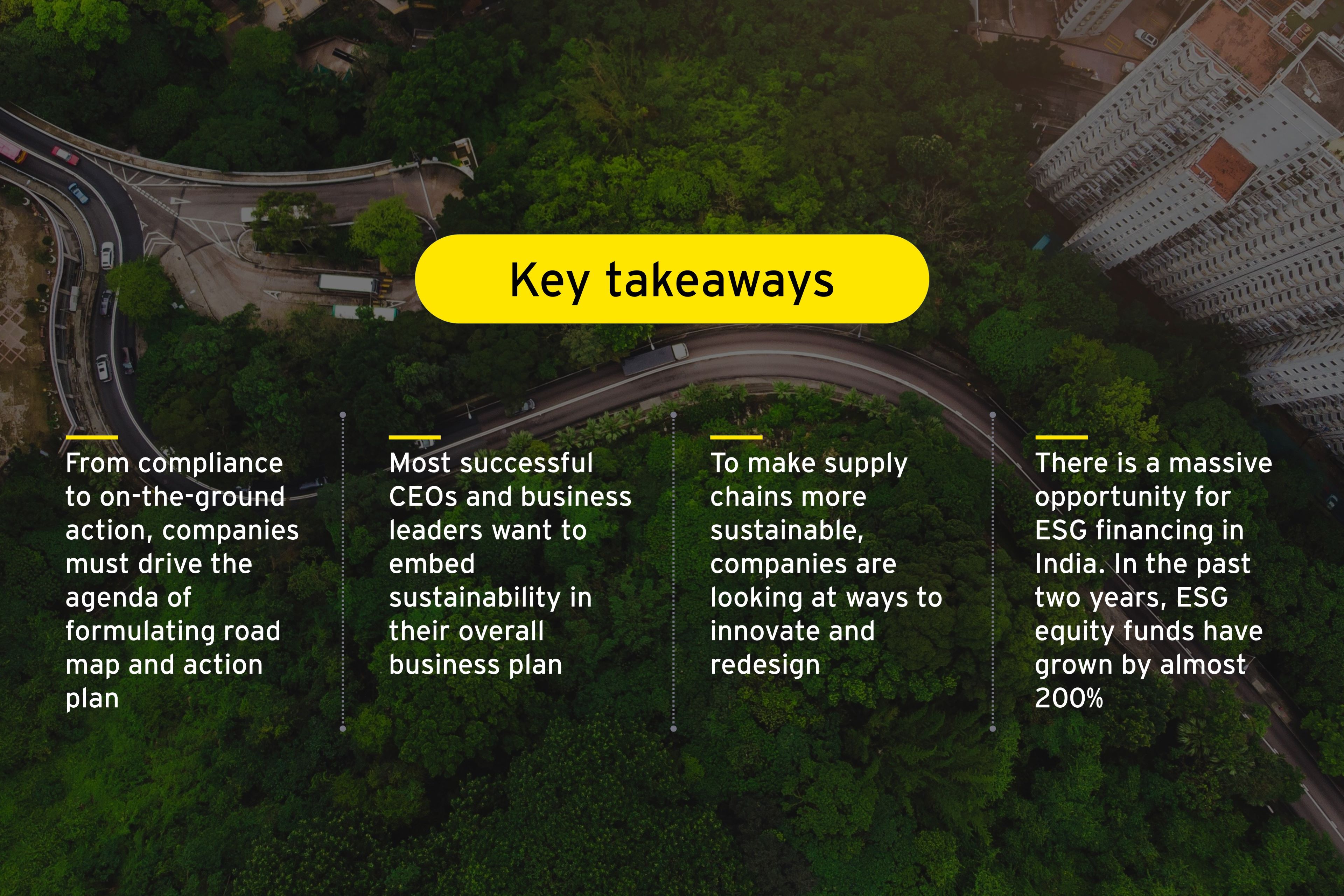

ESG regulations are at different levels of implementation in various geographies. There is a rising need for the ESG agenda to be made an integral part of business strategy. Commenting on the surge of ESG reporting, Julie Teigland said, “In the past 12 months, most companies have met their ESG compliance requirements. Now they understand that sustainability is not just the icing on the cake. It must be baked into their strategy and supported at the board level.”

Purpose-driven approach for creating impact-driven value

Regulators, customers, and other stakeholders are influencing business decisions with ESG considerations in their mind. However, the success of this agenda will hinge on the implementation of the actions and driving changes on the ground in how business is being conducted, keeping in mind not just environmental considerations but also being community and ecosystem centric.

Tata Chemicals, for instance, is focusing on three key areas — climate control, circular economy, and nature and biodiversity, shared Zarir Langrana. He added, “Our sites are in coastal areas. We have planted 150,000 mangroves in the past few years and rescued nearly 1,000 whale sharks. We focus on livelihoods, self-empowerment, and employability as community engagement. Thousands of families are covered under our food and clean water programs.”

“ESG is not just a cost and should not be seen as lost profits. It plays an integral role in creating and sustaining long-term value. To start with, businesses can deploy existing systems to meet their ESG goals. The Indian government is deliberating carbon tax and approaching businesses to gather inputs.” said Nadir Godrej.

Technology: an enabler of sustainability

Technology is one of the most significant enablers of sustainability, and several companies are leveraging it to drive their ESG agenda. Grasim Industries has developed a circular system to recycle cotton waste. Creating this system was crucial as the textile industry is the second biggest consumer of water, explained Kalyan Ram. “Most of our units are low water-intensive. We have also tied up with Nagar Palikas (city municipal authorities) to reuse the water from sewage treatment plants,” he added.

Textile waste management is another key part of the industry’s sustainability efforts. Every second, the textile industry ends up either burning or throwing one truckload of its manufactured clothing in a landfill. Not just that, the industry hardly recycles 1% of its entire textile waste. Therefore, the company has invested US$200 billion to focus on digitization and installing process systems to ensure the EU emission and waste management guidelines.

Young investors are the driving force behind the ESG revolution

Capital markets are starting to factor in ESG considerations in investments. There is a huge opportunity for ESG financing in India, as it is the second largest green bond market after China. “In the past two years, ESG equity funds have grown almost 200%. Young investors are looking at not only returns but also the impact on the planet’s future. They are also driving a change in investing behavior,” said Navneet Munot.