Most efficient alkaline electrolyzers today consume ~50 kWh of electricity and 10 liters of fresh water to produce 1 kg of hydrogen. Therefore, if all the ~5 million tons of green hydrogen production target by 2030 were to be achieved via alkaline electrolysis, India would require ~50 billion liters of fresh water and 250 billion kWh of electricity supply from renewable sources of energy, primarily wind and solar PV. This translates to ~115 GW of installed renewable power generation capacity @ 25% CUF (for hybrid round-the -clock supply). To get a sense of this scale, the current all India installed capacity of renewable power generation is ~106 GW as of Feb 20221.

India’s green hydrogen market is currently in the nascent stages of development. The supply chain for green hydrogen needs sufficient economies of scale and innovation to achieve competitiveness through 2030. More importantly, robust and predictable demand for green hydrogen through 2030 is fundamental for accelerating investments to expand the supply chain. By leveraging low–cost domestic renewable electricity produced at scale, India could become a regional hub for exporting green hydrogen at competitive prices and command a reasonable share in the global hydrogen demand of 200 million tonnes2 by 2030.

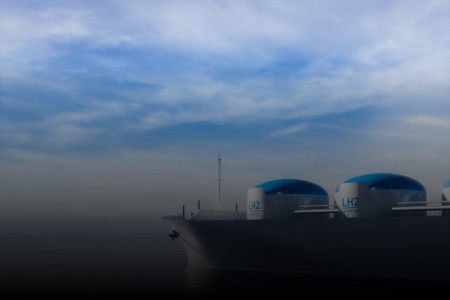

The supply chain of GH2 is complex, like any other fossil fuel commodity, and includes production from renewable energy sources, storage, transportation, distribution, and handling. Beyond this, the physical properties of hydrogen warrant additional infrastructure for safe handling and operations. Many potential end–use applications may need technology and infrastructure to support energy transformations such as H2 to electricity and vice versa, H2 to ammonia, H2 to methanol etc. GH2 production, storage, and supply needs to meet the purity, pressure, and volume requirements of specific industries and applications.