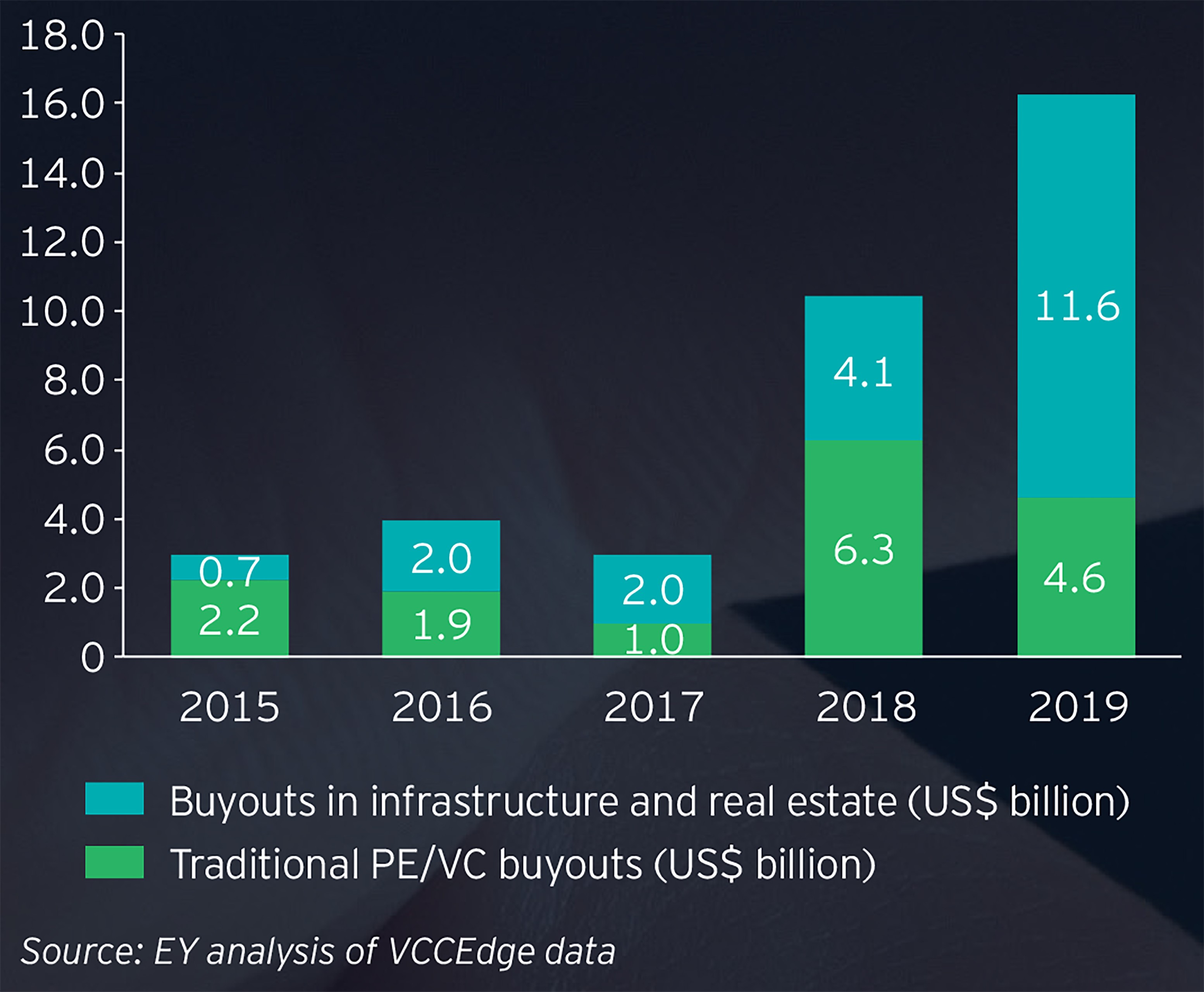

Another major standout trend that emerged in 2019 was the rise of PE/VC interest in the infrastructure sector which accounted for 30% of all PE/VC investments during the year and grew approximately three times over the previous year. Of this US$14.5 billion invested in the infrastructure asset class in 2019, ~US$7.1 billion came by way of investment into InvITs, the tax efficient structure that seems to have won the acceptance of global pension funds and sovereign wealth funds, that continue to hunt for predictable, long-term yield.

PE/VC exits: taking a breather after a stellar 2018

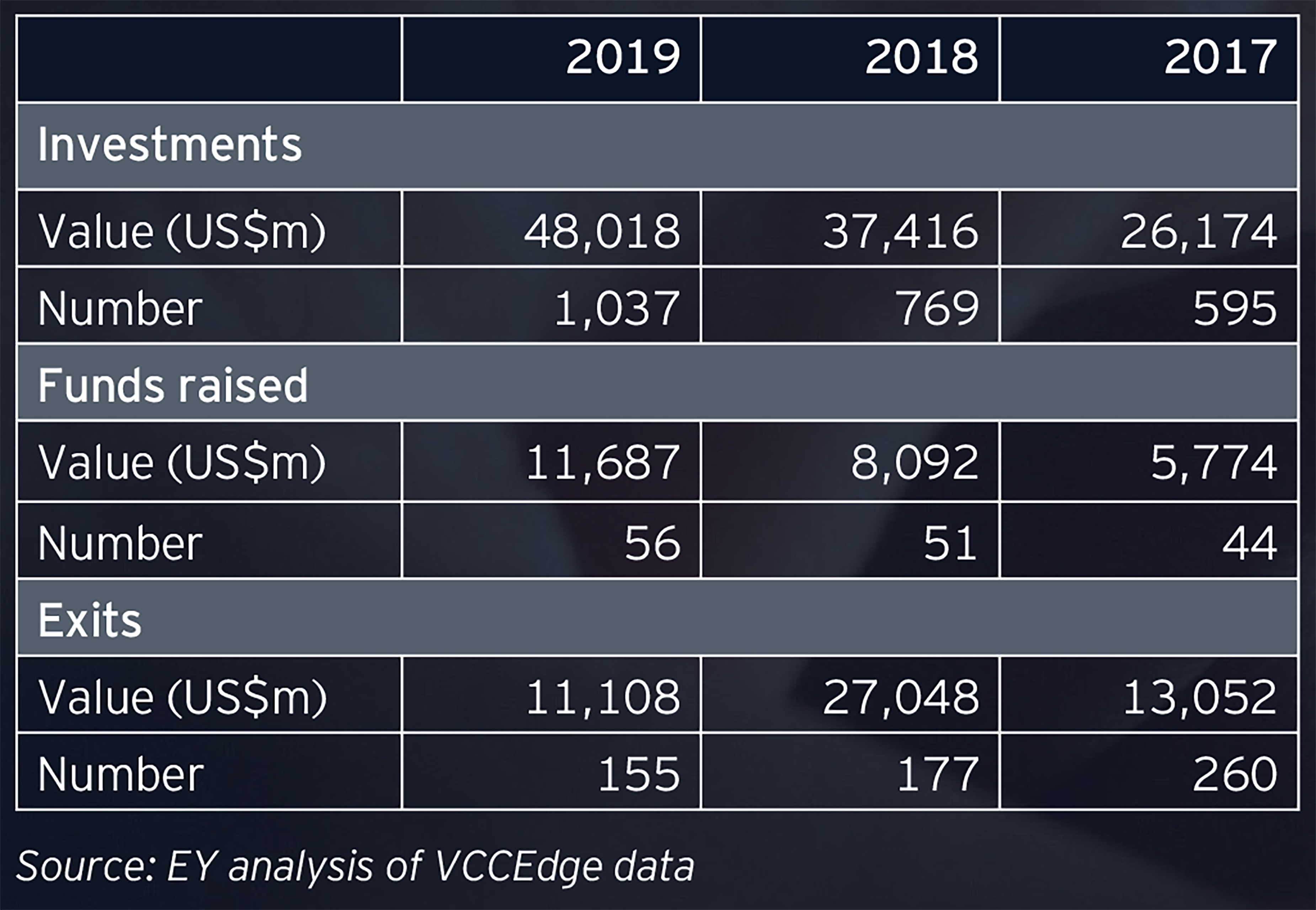

In 2019, PE/VC exits were comparatively muted, climbing down ~59% from last year. By volume, the deals have also gone down by 12% on a y-o-y basis. Adjusting for the one-off US$16 billion Walmart-Flipkart deal, India’s largest ever PE/VC exit, PE/VC exits in 2019 were at par with 2018.

Rise in uncertainty and business risk premium on account of global factors like friction in global trade, Brexit as well as domestic concerns like slowing growth, liquidity and credit expansion weighed on the valuation expectations, dampening the velocity of both secondary and strategic deals which were the primary drivers of the good performance recorded last year.

While improvement in capital markets helped the pickup in open market exits, IPO activity remained lacklustre with just eight PE-backed IPOs hitting the bourses compared to 13 last year. Nonetheless, 2019 saw India’s maiden REIT IPO offering, backed by the Embassy/Blackstone consortium. This was a lighthouse event for the Indian real estate private equity sector which, over the past three-to-four years, has seen significant amounts of PE investment into portfolios of rent generating commercial properties such as office, retail malls and industrial warehousing. We remain confident that India’s first successful REIT listing will pave the way for corporates, investors and even government-controlled entities with portfolios of quality yield generating assets to follow with new REIT listings.

Outlook

The last three years have been impressive for India in both investments as well as exits. However, we are projecting some moderation in the growth of investments from about 44% in 2017-2019 to about 15%-20% in 2020 as investors have become a little circumspect and also because of the large base effect of US$48 billion invested in 2019. Notwithstanding the decline in GDP growth estimates by various sources, in the global context, India is expected to remain an important destination for PE/VC investments and as yields in OECD countries continue to decline, asset managers are expected to increase allocation to emerging markets. India is likely to be an important beneficiary of this shift. As per the estimates published by Preqin[2], globally PE/VC funds are sitting on dry powder of almost US$2.5 trillion. With India forming a major part of the investment strategy for many global funds, we are likely to see a meaningful share of the incremental dry powder for emerging markets allocation being deployed in India.

The momentum in buyout deals is expected to continue due to three factors: succession planning by family-owned businesses, divestment of divisions by conglomerates, and venture capital-backed portfolio companies where the VCs have more than 51% stake and are looking to exit. We expect most private equity investors to continue going into the same five sectors: financial services, IT, e-commerce, retail consumer finance, and healthcare. Infrastructure and real estate should continue to attract strong interest from real asset economy investors.

Spurred by the dislocation in the credit markets, we expect most fast-growing private companies to be open to doing growth equity trades with PE/VC investors. Valuations are expected to remain stable in 2020, especially for start-ups and small- to mid-cap companies.

We also expect 2020 to be a good year for exits because of the build-up of a huge stock of small- and mid-cap companies over the past 18 months, where private equity has a substantial stake. Whether or not an IPO window opens, we expect to see more secondary deals in 2020.

We believe 2020 is going to be another big year for infrastructure and real estate sectors, which accounted for almost one-third of all the private capital invested into India in 2019. More money has entered into the infrastructure sector this year than the previous seven years combined, largely because of the new InvIT structures, which allow investors seeking yield to hold assets with minimum tax leakage. We hope that international yield seekers will come to India to invest in highly-rated asset-backed cash flow opportunities as corporates, investors and even government-controlled entities owning infrastructure asset portfolio’s look to monetize their assets via InvITs.

Thanks to direct and indirect pressure created by India’s new insolvency and bankruptcy laws, we also project an increase in credit investments, including structured credit for corporates and in portfolios of loans that have gone bad or are stressed. Until now, this has involved large assets that have mostly attracted strategic players. Going forward, as the average size becomes more granular, we expect to see more interest from PE firms, which are sensing the opportunity and are setting up credit teams in India.

On the downside, substantial uncertainty on account of global factors like US-China trade issues, pandemic concerns around China-origin Coronavirus and its potential impact on global supply of goods and services are expected to act as significant headwinds. Domestic issues like slowdown in growth, lack of liquidity and credit expansion are projected to continue well into 2020. The response of the PE/VC investor community in the wake of these downside risks is likely to be influenced by pro-active steps that our government will take to ensure policy stability and continuing reforms.