Fairness opinion

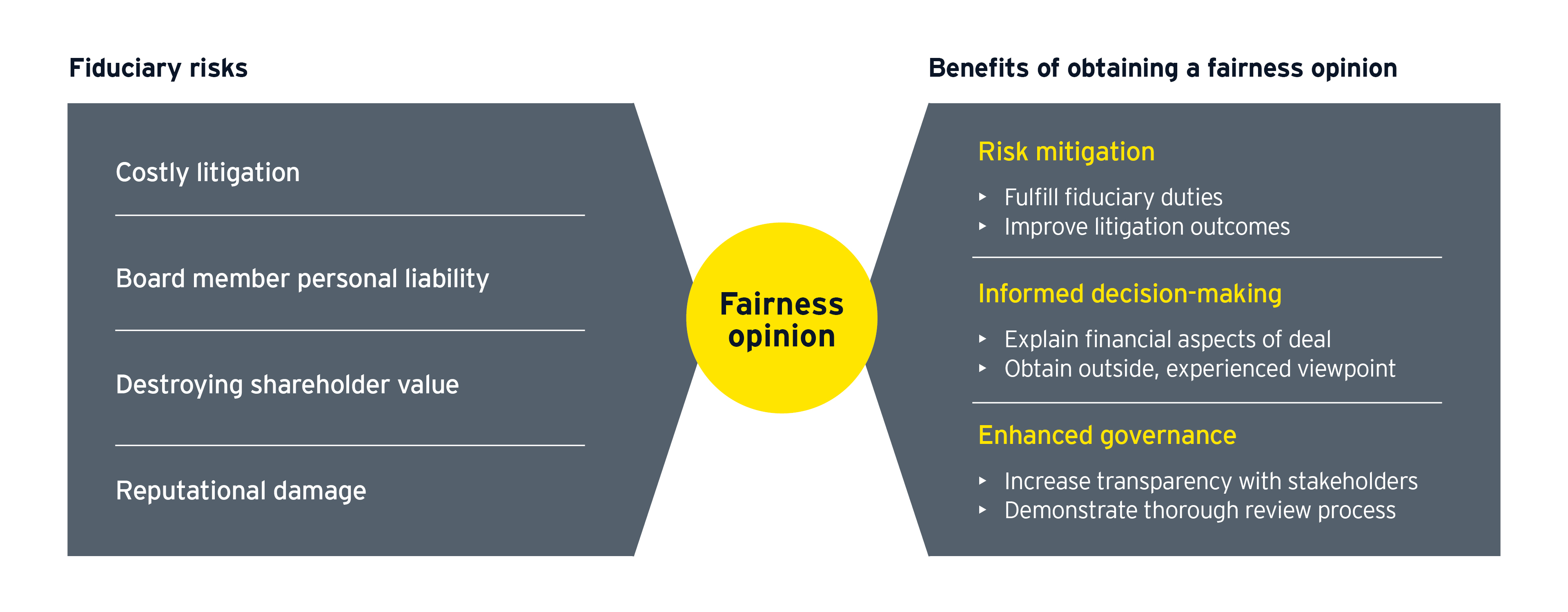

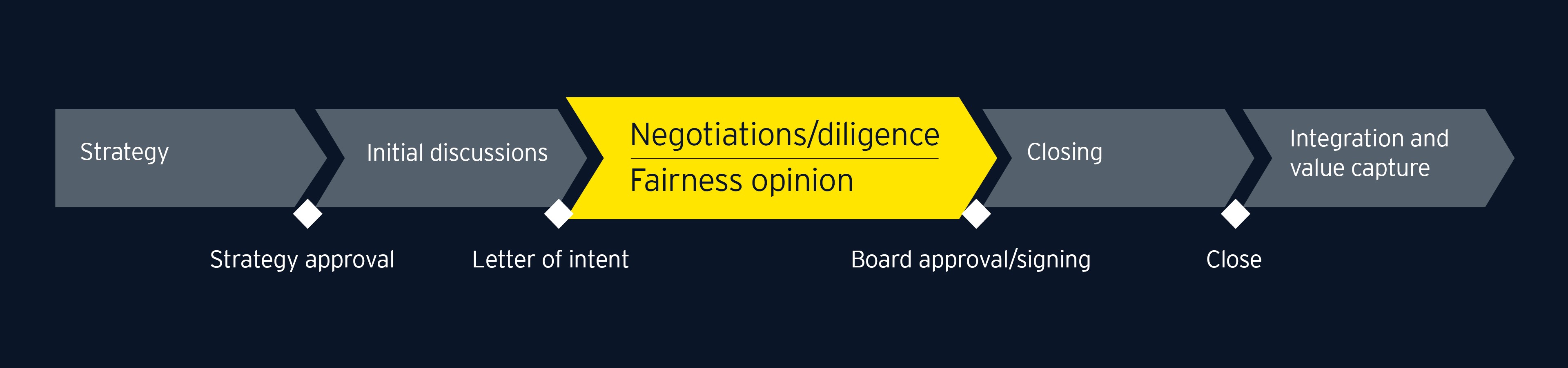

EY fairness opinion team provides fairness opinions to boards of directors, special committees and other fiduciaries in connection with mergers, acquisitions, divestitures and other material transactions. By analyzing the financial aspects of a transaction, we help our clients fulfill their fiduciary duties and make better decisions.

What EY can do for you

EY teams can provide you with an independent fairness opinion as to whether the price to be paid or received in a transaction is fair from a financial point of view. In doing so, EY professionals can help you address the following important questions:

- Will the transaction create or destroy shareholder value as part of the merger or acquisition?

- What is the value of the target assets or equity interests?

- How does non-cash consideration such as equity, seller notes, earnouts, options and other complex financial instruments affect the transaction value?

- How do risks, synergies and other growth opportunities impact the transaction economics?

- Is the transaction accretive or dilutive?

- How do the transaction structure, tax attributes and contingencies impact deal value?

How EY professionals are different

- Insightful, rigorous and independent analysis: An EY fairness opinion provides a thorough analysis of the target, as well as the value of any noncash consideration such as seller notes, equity interests, earnouts and other complex financial instruments.

- Dedicated fairness opinion team: Knowledgeable professionals who concentrate on fairness opinions, including senior partners and thought leaders who are at the forefront of legal developments and governance trends.

- Transaction advisors recognized across the globe with dedicated sector professionals: 18,000+ EY transaction professionals, including 3,500+ valuation professionals, around the world combining local market knowledge with sector experience to provide exceptional client service.

- Broad suite of transaction capabilities: EY professionals can leverage the findings and skill sets of strategy, financial, tax, commercial, cyber, human resources and other diligence teams that are advising on the transaction.

Frequently asked questions

Our latest thinking

Explore our solutions and technology

The team

Contact us

Like what you’ve seen? Get in touch to learn more.