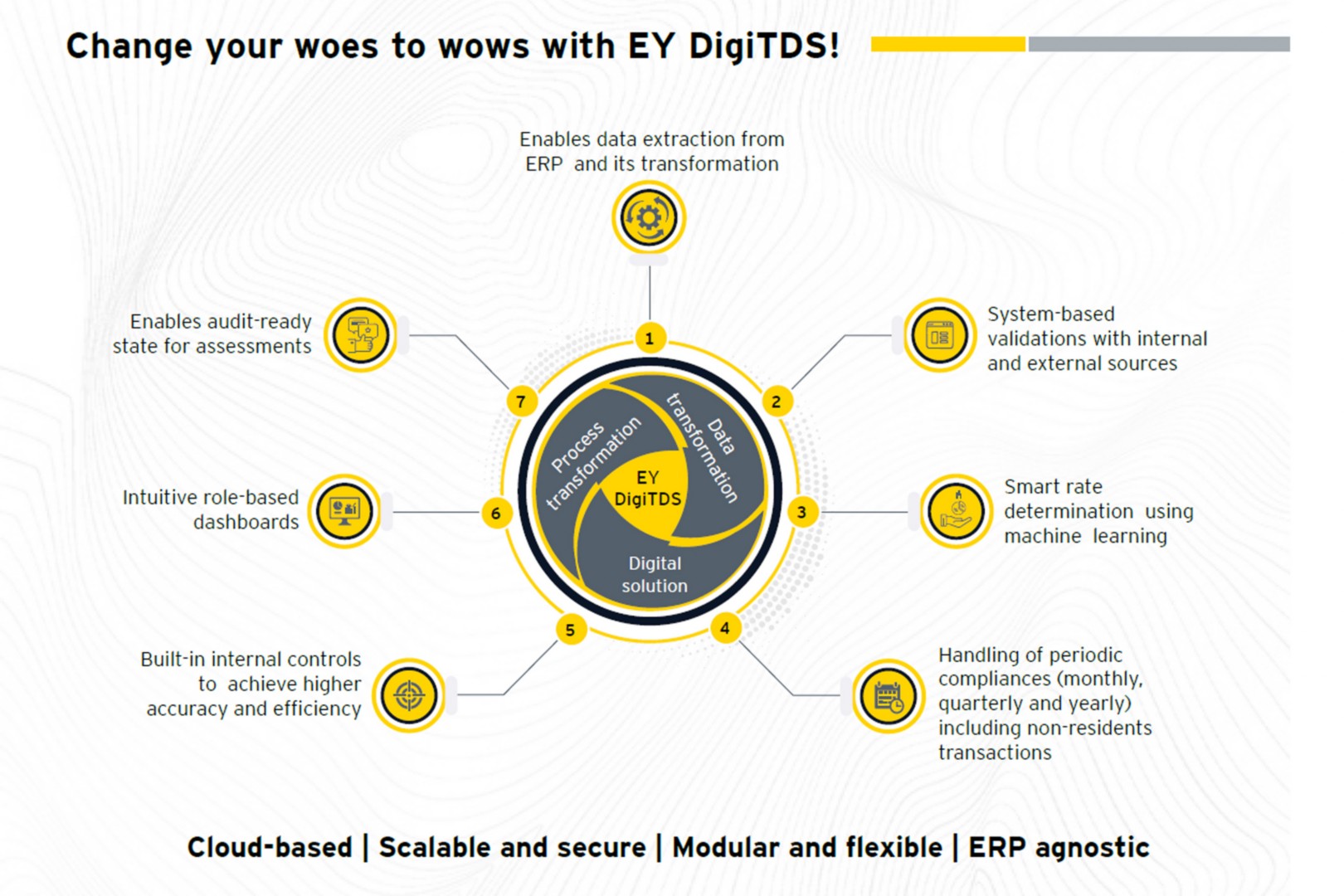

Withholding tax payable solution - EY DigiTDS

EY DigiTDS is a comprehensive cloud-based withholding tax payable solution and is equipped to handle Tax Deduction at Source (‘TDS’) on purchase of goods and verify ‘specified person’ status. Similarly, Tax Collection at Source (‘TCS’) module of DigiTDS enables transformation of the entire TCS compliance and reporting cycle and handles customer declarations.

The tax landscape is rapidly changing with “digital” at the helm of this evolution. With the continuously evolving landscape, focus of the Government has moved to using technology as a backbone to ensure tax compliances and to undertake tax risk assessments.

TDS and TCS compliances have become increasingly challenging due to:

- expanding scope (TDS on dividends, purchase of goods etc.) and increased complexity on account of interplay between TDS and TCS provisions.

- dependency on vendor and customer information (tax return filing status, amount of TDS and TCS credit etc.) to determine applicability of TDS vs TCS and corresponding rate at a transaction level.

- additional disclosures.

- technology-based tax assessments.

- increasing reputational and financial risks.

Further, challenges with respect to TDS data mapping and transformation, limited system-based controls, determination of tax filing status of vendor/customer and related applicable conditions, lack of TDS sensitized data from Enterprise Resource Planning (ERP), and sub-optimal audit readiness increasingly make TDS compliances more cumbersome and challenging for the industry.

Hence, there is a growing business need for a transformation solution for handling TDS and TCS compliances and reporting requirements.

EY DigiTDS provides a comprehensive solution for transformation of your processes dealing with:

- TDS on:

- Dividend payments (by listed companies) made to shareholders.

- Resident as well as non-resident business payments, including purchase of goods.

- TCS on sale of specified goods.

DigiTDS enables transformation of TDS and TCS function across people, processes, data and technology in an organization.