Understanding ‘sound finances’

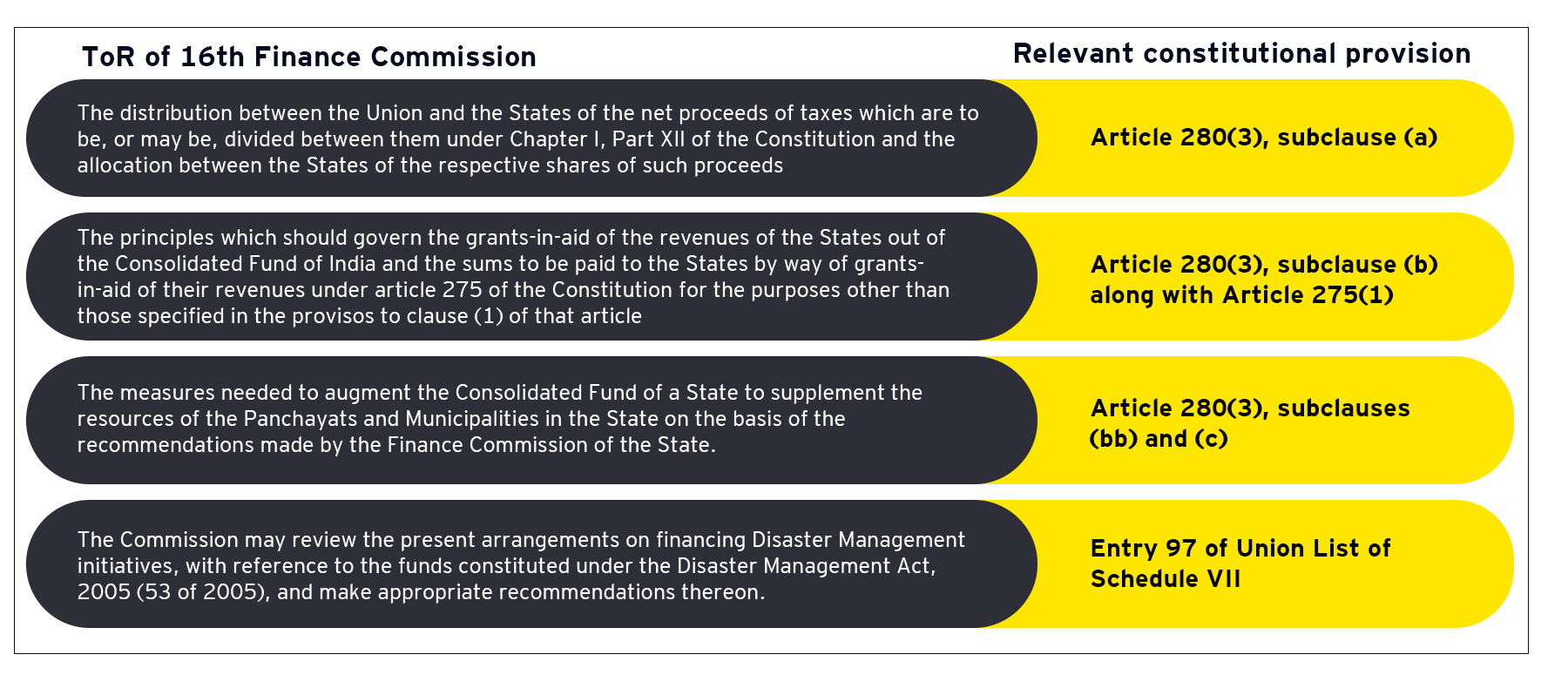

In case of earlier Finance Commissions, quite a number of other clauses were included in the ToR, reflecting the provision under clause (d) of Article 280 of the Constitution which refers to ‘any other matter… in the interests of sound finance’. No specific matter has been referred to the 16th Finance Commission under this clause. However, since this phrase is part of the Constitution, it should be open to the Commission to consider any matter relating to central and state finances in the interest of sound finance.

The ToR of the 16th Finance Commission can be considered as a fresh and welcome departure from the earlier practice of giving a detailed set of considerations. This implies that the Commission is free to determine scope of its work, approach and methodology. The Commission would be free to choose the Census year for state-wise population without any direction from GoI through the ToR. It may be noted, however, that the 2021 Census has not been carried out and the latest available Census data pertains to 2011.

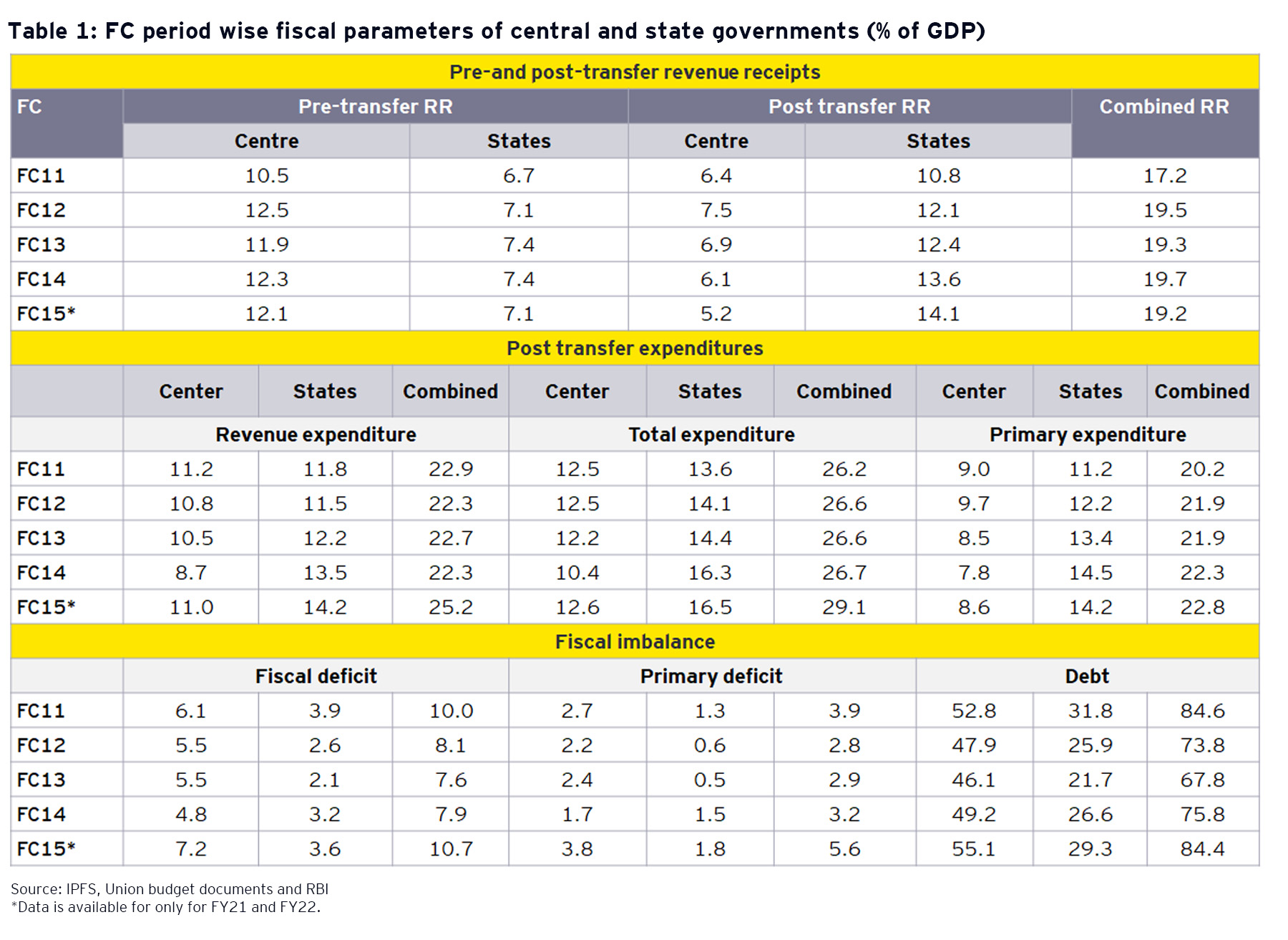

Linking vertical and horizontal imbalance to fiscal imbalance

The subject of determination of grants and tax devolution in India requires consideration of three types of imbalances namely, vertical, horizontal, and fiscal. Fiscal imbalance deals with the borrowing undertaken by central and state governments to fill up part of the resource gap, which is not met by the availability of resources after transfers from the GoI.

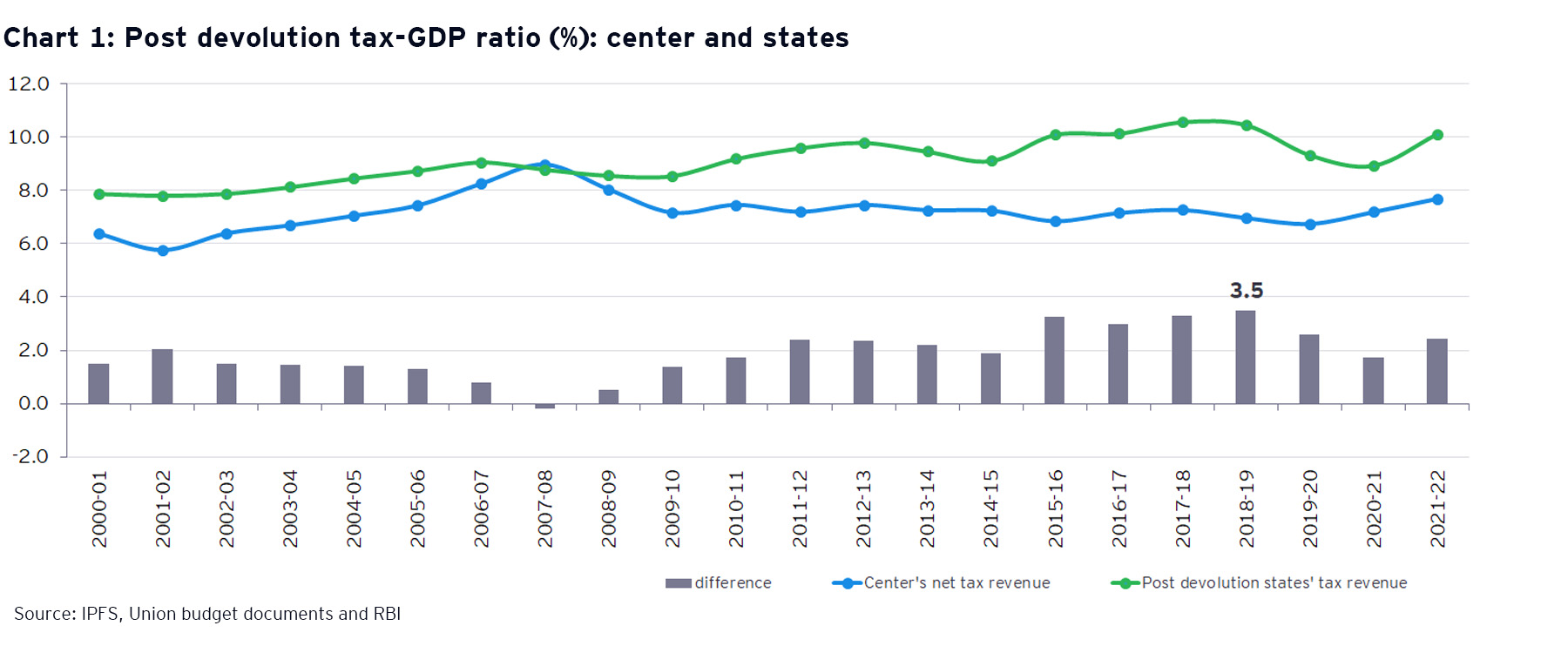

In the context of vertical imbalance, Chart 1 shows a convergence between the center’s net tax revenue and states’ tax revenues post tax devolution during FY01 to FY08. These years were covered largely by the recommendations of 11th and 12th Finance Commissions. After FY10, the gap between the two started to increase with states’ post devolution tax-GDP ratio exceeding that of the center by a wide margin, resulting in a squeezing of fiscal space for the center.