It has taken two years for the Indian economy to get close to the normal growth levels. While in FY21, it suffered a major contraction, FY22 allowed only enough recovery to enable the economy to reach a real GDP magnitude marginally above its pre-pandemic FY20 level. Even as policymakers have been looking forward to the prospects of a normalized Indian economy, another layer of challenges has gathered momentum in the form of surging prices of global crude and primary products along with an accentuation of supply-side bottlenecks. These issues in fact, pre-date the recent geopolitical developments.

Estimating adverse impact of crude price upsurges

Global crude prices averaged at a 16-year low of US$43.8/bbl. in FY21 due to a comprehensive demand slowdown in the wake of the pandemic. In FY22, prices increased, averaging close to US$75/bbl. during April-February FY22 with the overall global economic recovery. In FY23, crude prices have come under pressure due to significant supply-side issues. Already, average brent crude price has increased to US$115.1/bbl. during the first two weeks of March 2022. In tandem, there are visible increasing trends in some critical input prices such as coal, iron ore, and potassium chloride. These are important commodities in the WPI basket which has a relatively larger weight in the implicit price deflator (IPD).

A review of India’s growth history indicates that two periods of recent slowdowns coincided with upsurges in global crude prices. In the first period from FY11 to FY13, real GDP growth fell from 8.5% to 5.5%, a fall of 3% points. Correspondingly, global crude price increased from an average of US$70/bbl. in FY10 to US$107.2/bbl. in FY12. In the second period spanning from FY17 to FY20, growth fell from 8.3% to 3.7%, a fall of 4.5% points. Alongside, global crude prices showed an increase from US$46/bbl. in FY16 to US$67.3/bbl. in FY19. In explaining the fall in growth in these periods, we recognize the adverse role of an increase in global crude prices although there might have been other contributing factors that led to the slowdown.

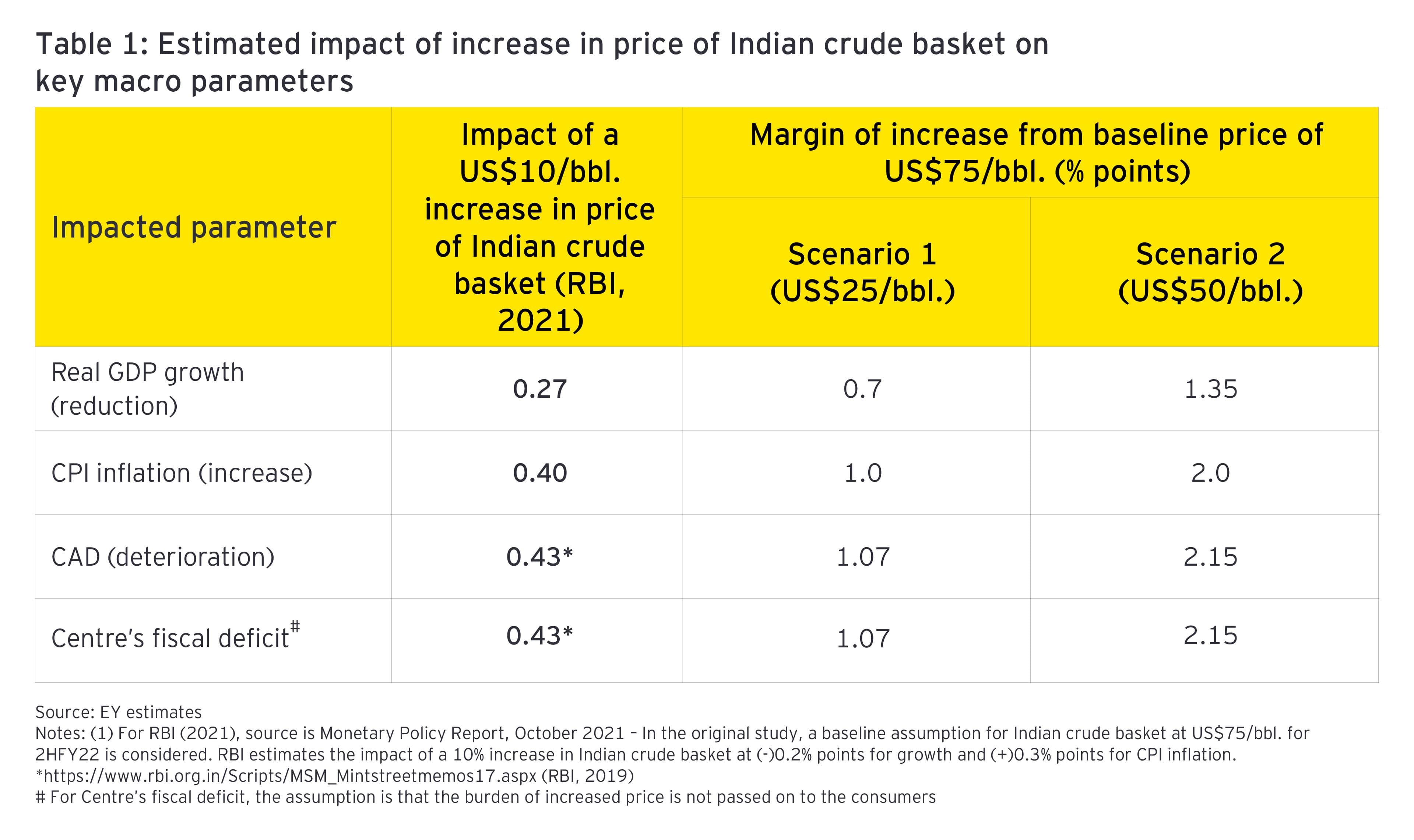

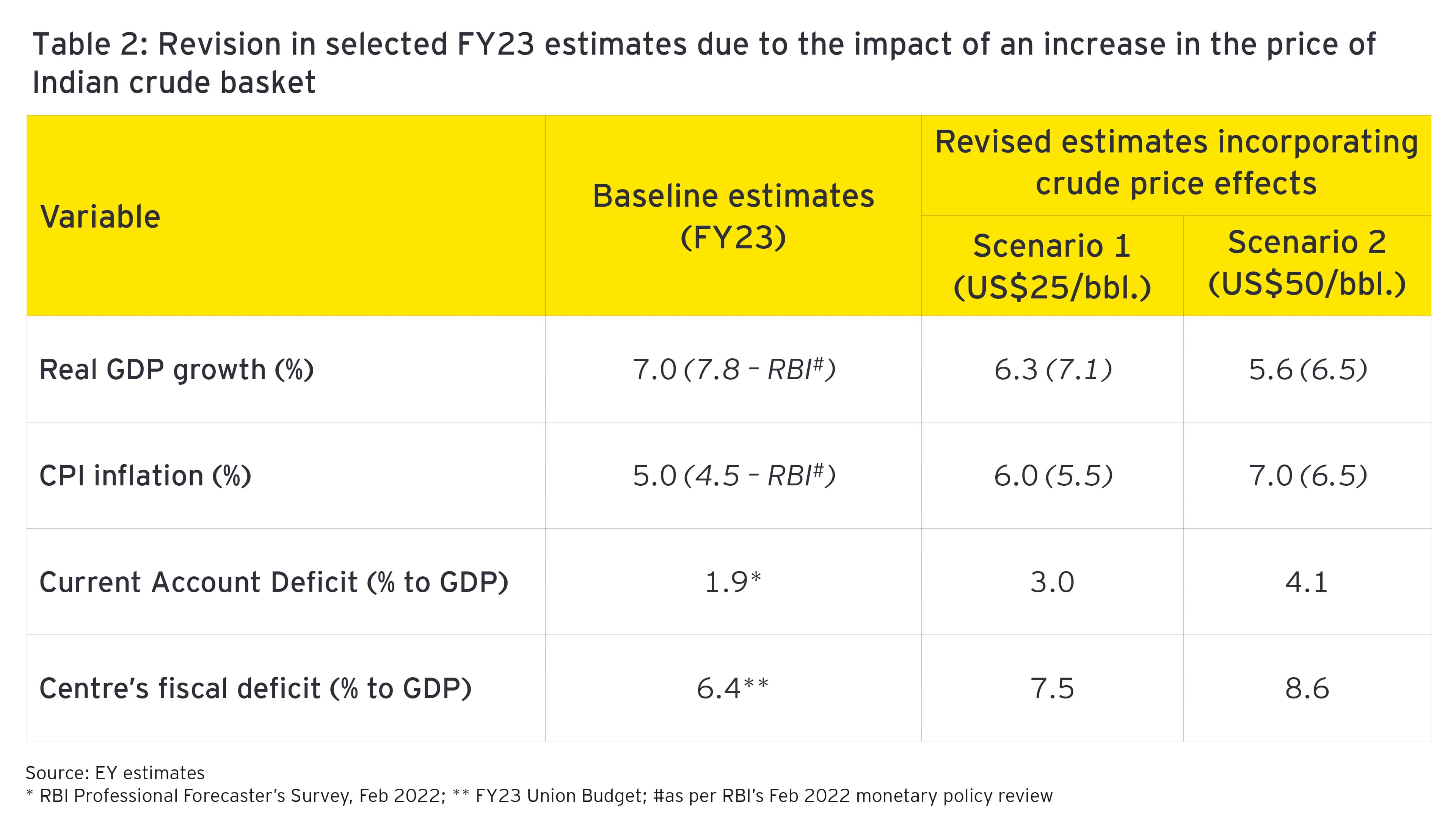

While recent growth history confirms the deleterious growth effects of global oil price increases, there are empirical studies also highlighting the magnitude of impact of an increase in global crude price on key macroeconomic parameters. Table 1 shows that the estimated impact of a US$10/bbl. increase in the price of Indian crude basket is a reduction in real GDP growth by 27 basis points and an increase in CPI inflation by 40 basis points. An earlier RBI (2019) study had estimated the impact on current account deficit and Center’s fiscal deficit relative to GDP of a US$10/bbl. increase in the Indian crude basket. The adverse impact for both cases is of the order of 43 basis points. For Center’s fiscal deficit, it is assumed that the burden of increased price is not passed on to the consumers. The RBI (2021) study had assumed a baseline price of Indian crude basket at US$75/bbl. Using this as the baseline, we may consider two benchmarks relating to the average price of the Indian crude basket in FY23 at US$100/bbl. (scenario 1) and at US$125/bbl. (scenario 2). Thus, the increase from the baseline price would be US$25/bbl. (scenario 1) and US$50/bbl. (scenario 2).